3 European Stocks Estimated To Be Up To 48.1% Below Intrinsic Value

As the pan-European STOXX Europe 600 Index edges higher, nearing record levels amid optimism about future earnings and economic prospects, investors are keenly eyeing opportunities in the market. In this environment, identifying stocks that may be undervalued relative to their intrinsic value can offer potential benefits, as these investments could provide a buffer against market fluctuations while potentially offering long-term growth.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Streamwide (ENXTPA:ALSTW) | €72.60 | €142.33 | 49% |

| Sanoma Oyj (HLSE:SANOMA) | €9.21 | €18.39 | 49.9% |

| Redelfi (BIT:RDF) | €11.70 | €23.29 | 49.8% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.278 | €8.48 | 49.6% |

| LINK Mobility Group Holding (OB:LINK) | NOK32.95 | NOK65.86 | 50% |

| Hemnet Group (OM:HEM) | SEK170.90 | SEK337.28 | 49.3% |

| cyan (XTRA:CYR) | €2.26 | €4.51 | 49.8% |

| Artifex Mundi (WSE:ART) | PLN12.20 | PLN24.33 | 49.9% |

| Allegro.eu (WSE:ALE) | PLN30.625 | PLN60.14 | 49.1% |

| Allcore (BIT:CORE) | €1.345 | €2.66 | 49.4% |

Let's uncover some gems from our specialized screener.

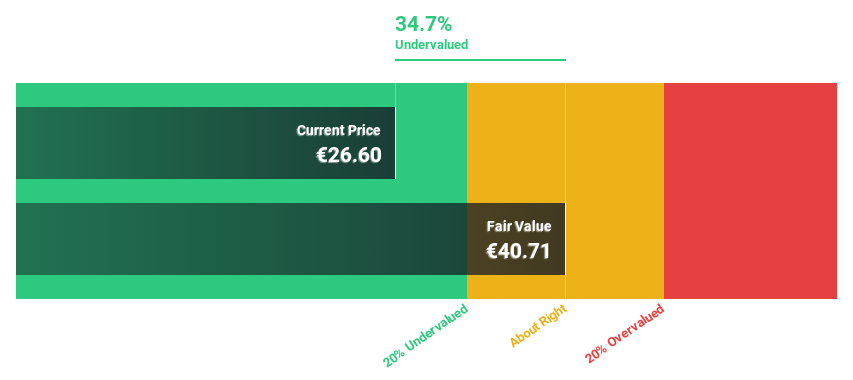

A.L.A. società per azioni (BIT:ALA)

Overview: A.L.A. società per azioni is a supply chain solutions provider serving the aerospace and defense, rail, and high-tech sectors with a market cap of €325.08 million.

Operations: The company's revenue is primarily derived from its Distribution segment at €141.74 million, followed by Service Providers at €144.00 million, Production at €28.40 million, and On Site Assembly at €3.14 million.

Estimated Discount To Fair Value: 31.9%

A.L.A. società per azioni is trading at €36, significantly below its estimated fair value of €52.83, suggesting it may be undervalued based on cash flows. The company's earnings grew 95.4% last year and are forecast to grow 18.37% annually, outpacing the Italian market's growth rate of 9.9%. However, its debt coverage by operating cash flow is weak and dividends are not well covered by free cash flows. Recent M&A activity includes H.I.G Capital's acquisition of a significant stake in A.L.A., potentially leading to delisting plans.

- Upon reviewing our latest growth report, A.L.A. società per azioni's projected financial performance appears quite optimistic.

- Take a closer look at A.L.A. società per azioni's balance sheet health here in our report.

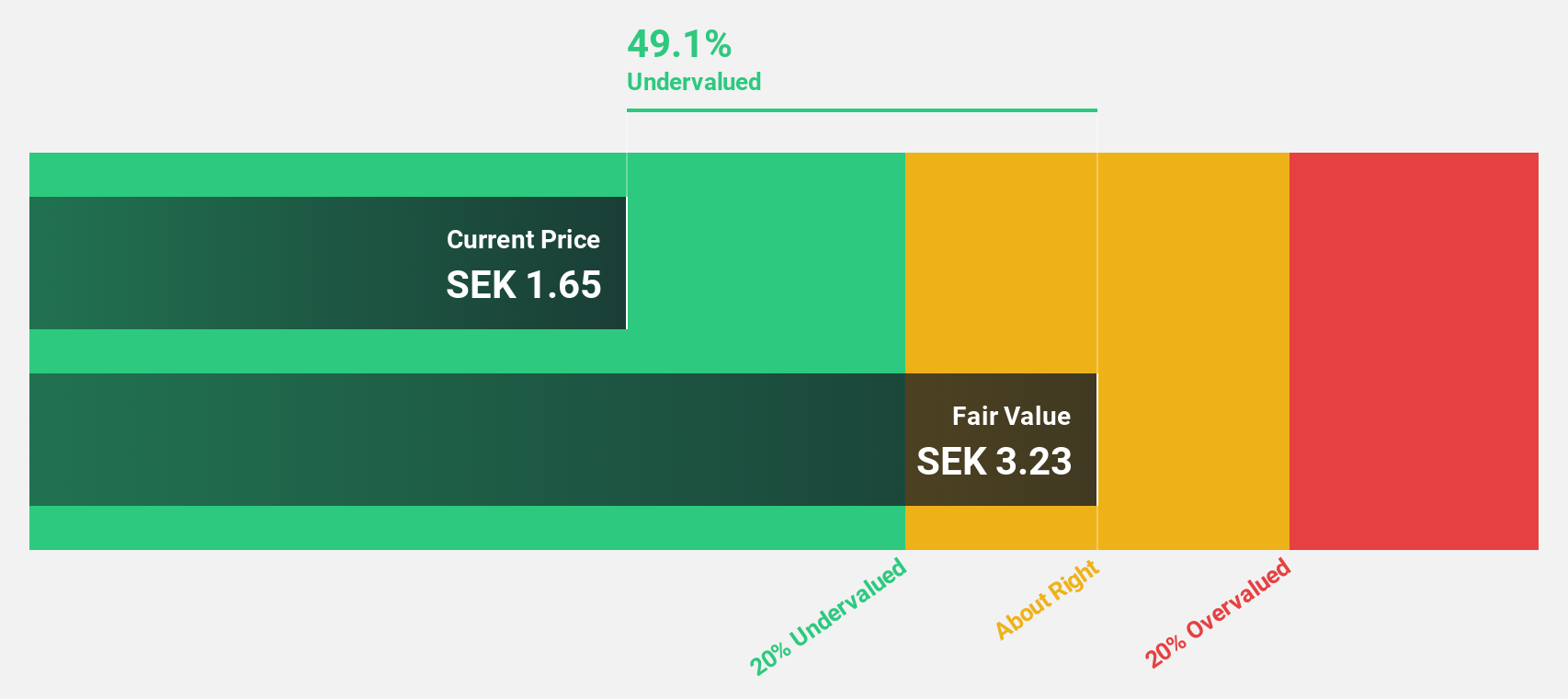

Dustin Group (OM:DUST)

Overview: Dustin Group AB (publ) operates an online information technology business across Sweden, Finland, Denmark, the Netherlands, Norway, and Belgium with a market cap of approximately SEK2.37 billion.

Operations: The company's revenue is derived from two main segments: Large Corporate and Public Sector (LCP), which contributes SEK14.74 billion, and Small and Medium-Sized Businesses (SMB), accounting for SEK5.67 billion.

Estimated Discount To Fair Value: 48.1%

Dustin Group is trading at SEK1.75, below its estimated fair value of SEK3.37, indicating potential undervaluation based on cash flows. Despite a challenging year with a net loss of SEK2.63 billion, the company is expected to become profitable within three years, outpacing average market growth. Recent leadership changes include Samuel Skott as CEO, which could influence strategic direction positively amid ongoing board adjustments and shareholder engagement efforts.

- The analysis detailed in our Dustin Group growth report hints at robust future financial performance.

- Dive into the specifics of Dustin Group here with our thorough financial health report.

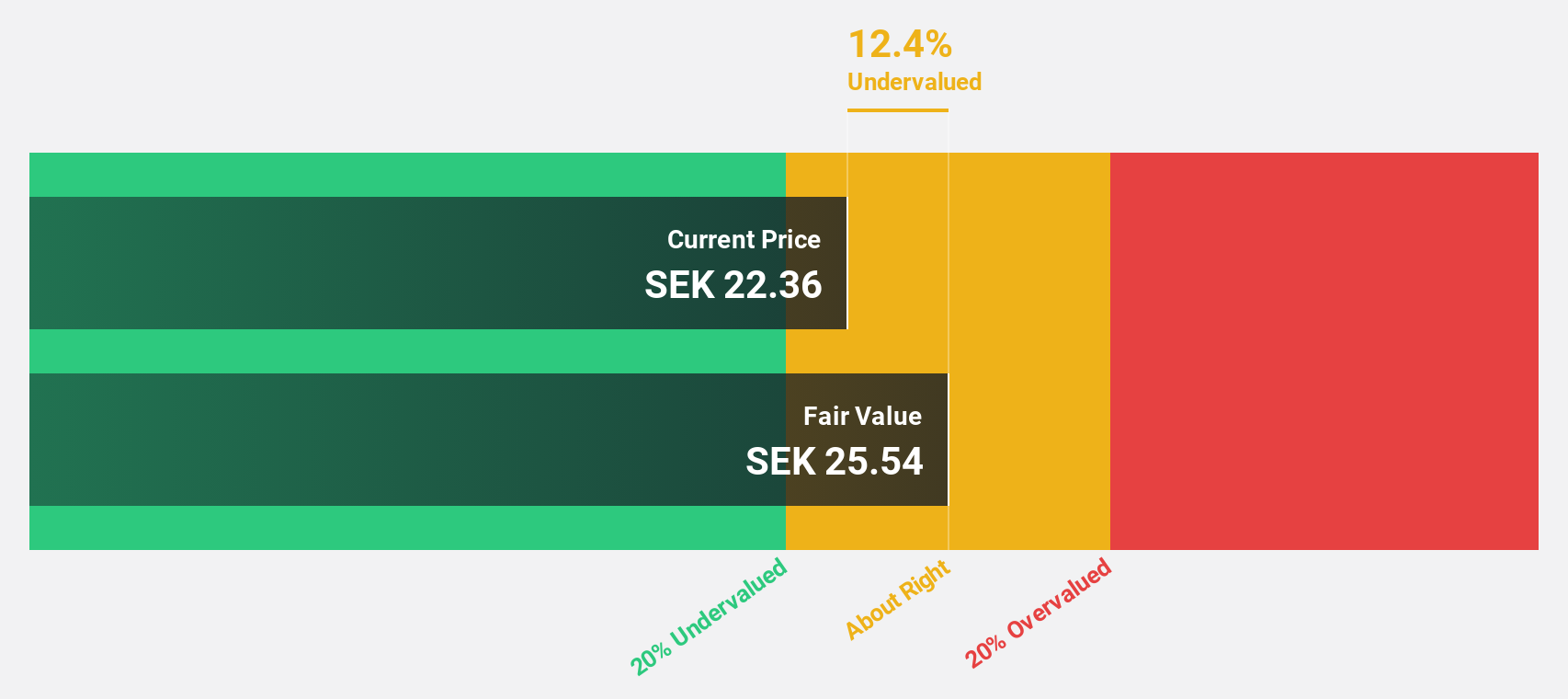

Hexatronic Group (OM:HTRO)

Overview: Hexatronic Group AB (publ) is a company that develops, manufactures, markets, and sells fiber communication solutions across Sweden, the United States, Germany, the United Kingdom, and internationally with a market cap of SEK4.65 billion.

Operations: Hexatronic Group AB (publ) generates revenue through the development, manufacturing, marketing, and sales of fiber communication solutions across various regions including Sweden, the United States, Germany, and the United Kingdom.

Estimated Discount To Fair Value: 13.9%

Hexatronic Group is trading at SEK22.61, slightly below its fair value estimate of SEK26.27, suggesting some undervaluation based on cash flows. Despite a recent net loss of SEK122 million in Q3 2025 and declining profit margins, earnings are projected to grow significantly at 48.6% annually over the next three years, surpassing Swedish market averages. The company is actively seeking acquisitions to achieve its 2028 sales targets, potentially enhancing long-term growth prospects.

- Our growth report here indicates Hexatronic Group may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Hexatronic Group stock in this financial health report.

Summing It All Up

- Access the full spectrum of 191 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal