European Dividend Stocks Yielding Up To 5.3%

As the pan-European STOXX Europe 600 Index edges closer to record highs amid positive sentiment about future earnings and economic prospects, investors are increasingly looking toward dividend stocks as a source of steady income in a potentially volatile market. In this context, selecting dividend stocks with robust fundamentals and attractive yields can be an effective strategy for those seeking to balance growth with income stability.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.07% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.51% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.37% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.00% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| Evolution (OM:EVO) | 4.85% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.14% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.30% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.22% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 4.87% | ★★★★★☆ |

Click here to see the full list of 195 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Toyota Caetano Portugal (ENXTLS:SCT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyota Caetano Portugal, S.A. imports, assembles, and commercializes light and heavy vehicles with a market cap of €227.50 million.

Operations: Toyota Caetano Portugal, S.A.'s revenue segments include €821.91 million from Domestic Motor Vehicles Commercialization, €55.77 million from External Motor Vehicles Industry, €41.44 million from External Motor Vehicles Commercialization, and various domestic and foreign contributions such as €38.16 million from Domestic Motor Vehicles Rental and €17.62 million from Domestic Motor Vehicles Services, among others in the industrial equipment sector.

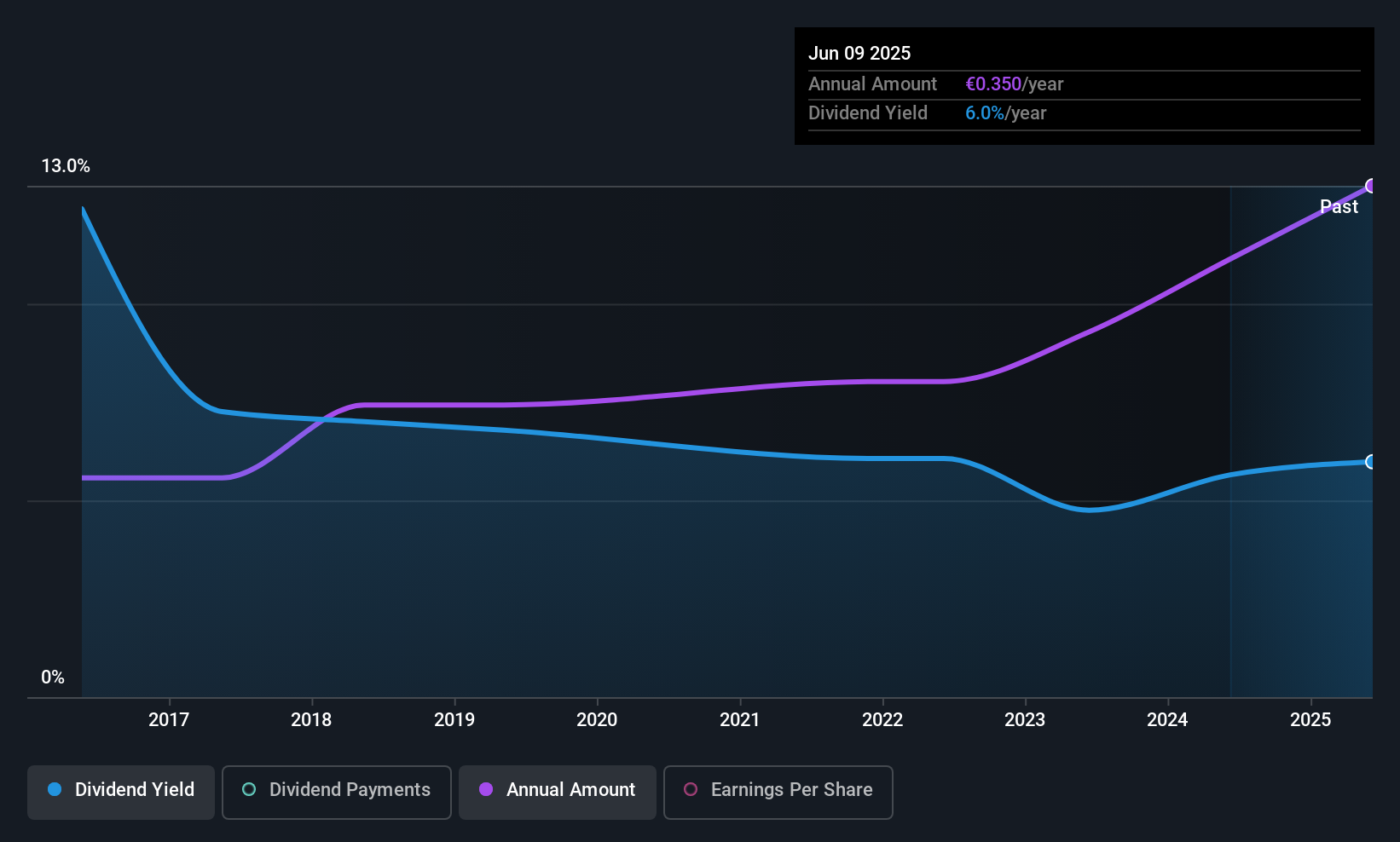

Dividend Yield: 5.4%

Toyota Caetano Portugal's dividend yield of 5.38% ranks among the top 25% in the Portuguese market, with a payout ratio of 50.5%, indicating coverage by earnings and cash flows. However, dividends have been volatile over the past decade despite recent growth. The company’s P/E ratio of 9.4x suggests it is undervalued compared to the broader market average of 13.2x. Recent expansion efforts with AutoWallis into Central Europe may bolster future revenue streams, potentially impacting dividend stability positively in the long term.

- Click to explore a detailed breakdown of our findings in Toyota Caetano Portugal's dividend report.

- Upon reviewing our latest valuation report, Toyota Caetano Portugal's share price might be too optimistic.

Neurones (ENXTPA:NRO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Neurones S.A. offers infrastructure, application, and consulting services in France with a market cap of €1.04 billion.

Operations: Neurones S.A. generates its revenue from three main segments: €50.08 million from council services, €271.70 million from application services, and €510.40 million from infrastructure services in France.

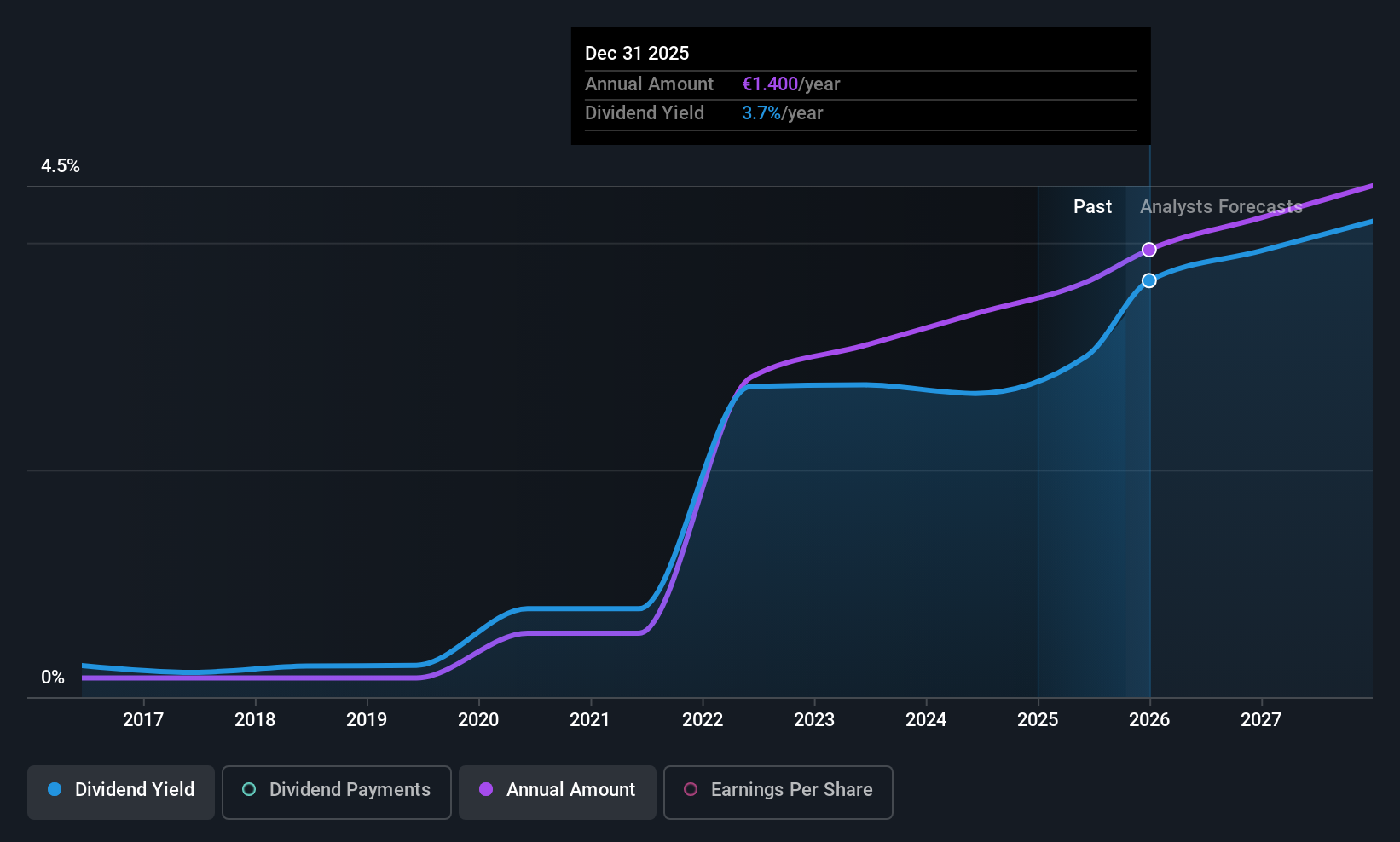

Dividend Yield: 3.1%

Neurones' dividend payments have been consistently reliable over the past decade, supported by a stable payout ratio of 62.2% and a cash payout ratio of 47.6%, indicating sustainability from both earnings and cash flows. Recent revenue growth, with third-quarter figures at €207.9 million, supports this stability. However, its dividend yield of 3.05% is below the top tier in France's market. The company targets annual revenues exceeding €850 million for 2025, which may bolster future dividends if achieved.

- Dive into the specifics of Neurones here with our thorough dividend report.

- Our valuation report here indicates Neurones may be overvalued.

Marimekko Oyj (HLSE:MEKKO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marimekko Oyj is a lifestyle design company that designs, manufactures, and sells clothing, bags and accessories, and interior decoration products globally, with a market cap of €517.69 million.

Operations: Marimekko Oyj generates revenue primarily through its Marimekko Business segment, which reported €188.80 million.

Dividend Yield: 3.1%

Marimekko Oyj's dividend yield of 3.13% is below Finland's top-tier payers, yet it maintains strong coverage with a payout ratio of 65.8% and cash payout at 68.3%. Over the past decade, dividends have been stable and growing, reflecting reliability. Recent earnings for Q3 show sales at €50.8 million, up from €47.2 million last year, supporting its dividend sustainability amidst potential global market uncertainties affecting future growth projections for net sales and profit margins in 2025.

- Click here to discover the nuances of Marimekko Oyj with our detailed analytical dividend report.

- The analysis detailed in our Marimekko Oyj valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Take a closer look at our Top European Dividend Stocks list of 195 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal