Exploring Global's Undervalued Small Caps With Insider Buying In December 2025

As we close out 2025, the global markets have been marked by a mix of optimism and caution. While major indices like the S&P 500 and Dow Jones Industrial Average reached record highs amid AI enthusiasm, small-cap stocks as represented by the Russell 2000 Index saw more modest gains, reflecting a nuanced investor sentiment. In this context, identifying promising small-cap opportunities often involves looking for companies with strong fundamentals that may not yet be fully appreciated by the market.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| A.G. BARR | 14.3x | 1.6x | 48.80% | ★★★★★☆ |

| East West Banking | 3.1x | 0.7x | 20.75% | ★★★★★☆ |

| Tokmanni Group Oyj | 12.5x | 0.3x | 40.62% | ★★★★★☆ |

| Paragon Care | 17.3x | 0.1x | 22.42% | ★★★★★☆ |

| Nexus Industrial REIT | 7.2x | 3.2x | 9.71% | ★★★★☆☆ |

| Eastnine | 12.2x | 7.7x | 48.64% | ★★★★☆☆ |

| BWP Trust | 11.0x | 14.3x | 11.38% | ★★★★☆☆ |

| Dicker Data | 22.2x | 0.8x | -45.87% | ★★★☆☆☆ |

| Nickel Asia | 13.1x | 2.0x | 7.47% | ★★★☆☆☆ |

| Sagicor Financial | 7.0x | 0.5x | -65.10% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

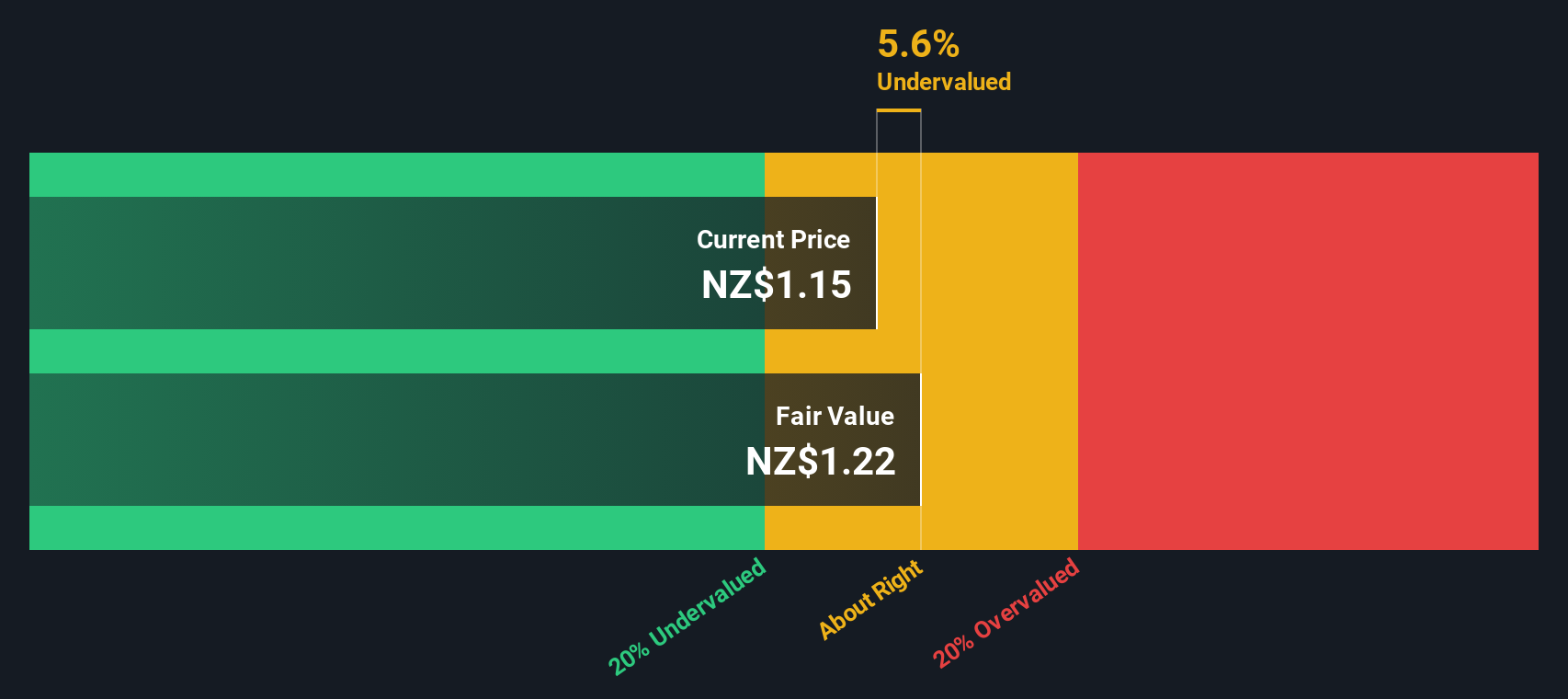

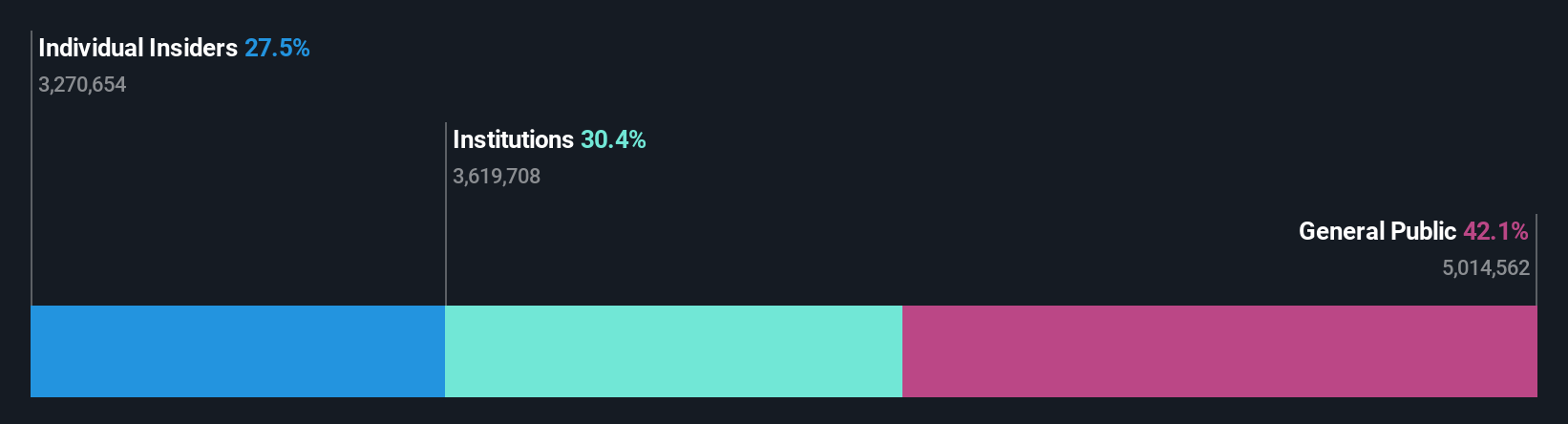

Investore Property (NZSE:IPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Investore Property focuses on owning and managing large format retail properties, with a market cap of approximately NZ$0.8 billion.

Operations: The primary revenue stream for the company is derived from its large format retail properties, with a recent revenue figure of NZ$76.72 million. The cost of goods sold stands at NZ$19.27 million, leading to a gross profit of NZ$57.46 million and a gross profit margin of 74.89%. Operating expenses are reported at NZ$2.61 million, while non-operating expenses amount to NZ$13.37 million, affecting net income outcomes over various periods.

PE: 10.5x

Investore Property, a smaller company in the property sector, reported half-year sales of NZ$38.86 million and net income of NZ$12.79 million, reflecting growth from the previous year. Insider confidence is evident with recent share purchases, suggesting potential value recognition by those familiar with the company. Despite relying solely on external borrowing for funding, its earnings show a positive trajectory with expected annual growth of 5.69%. Recent dividends add appeal for income-focused investors looking at this segment.

- Get an in-depth perspective on Investore Property's performance by reading our valuation report here.

Evaluate Investore Property's historical performance by accessing our past performance report.

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hammond Power Solutions is a company focused on the manufacture and sale of transformers, with operations contributing to a market capitalization of CA$0.54 billion.

Operations: Hammond Power Solutions generates revenue primarily from the manufacture and sale of transformers, with a recent revenue figure of CA$852.64 million. The company's cost structure includes significant costs of goods sold (COGS) at CA$586.54 million, impacting its gross profit margin, which was 31.21%. Operating expenses are also a substantial component, totaling CA$154.05 million in recent data points.

PE: 23.7x

Hammond Power Solutions, a small cap company, exhibits potential as an undervalued investment. Earnings are projected to grow 15.43% annually, though the firm relies on higher-risk external borrowing for funding. Recent financials show Q3 sales of C$218 million and net income of C$17 million, reflecting solid performance compared to last year. Insider confidence is evident with recent share purchases, suggesting belief in future growth prospects amid ongoing acquisition pursuits and capital expansion plans driven by increasing data and electricity demand.

- Take a closer look at Hammond Power Solutions' potential here in our valuation report.

Learn about Hammond Power Solutions' historical performance.

Russel Metals (TSX:RUS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Russel Metals operates as a leading metals distribution company, with key segments in metals service centers, energy field stores, and steel distribution, and has a market capitalization of approximately CA$2.38 billion.

Operations: The company's revenue primarily comes from Metals Service Centers, Energy Field Stores, and Steel Distributors. The cost of goods sold (COGS) significantly impacts its gross profit margin, which has shown variability over the years, with a recent figure of 20.72% as of June 2025. Operating expenses have been substantial but relatively stable in relation to revenue growth.

PE: 14.7x

Russel Metals, a player in the metals distribution sector, recently showcased its performance at The BancAnalysts Association of Boston Conference. For Q3 2025, sales reached C$1.17 billion with net income at C$35 million, slightly up from last year. Despite no recent insider purchases signaling confidence, the company repurchased 330,200 shares for C$13.7 million between July and August 2025. With earnings projected to grow annually by over 10%, Russel Metals offers potential growth despite relying solely on external borrowing for funding.

- Dive into the specifics of Russel Metals here with our thorough valuation report.

Gain insights into Russel Metals' historical performance by reviewing our past performance report.

Next Steps

- Reveal the 145 hidden gems among our Undervalued Global Small Caps With Insider Buying screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal