Global Penny Stocks To Watch In December 2025

As global markets continue to show resilience, highlighted by the U.S. economy's robust growth and record highs in major indices, investors are exploring diverse opportunities. Penny stocks, though an older term, remain relevant as they often represent smaller or emerging companies that can offer unique value propositions. By focusing on those with strong financials and potential for growth, investors may uncover promising opportunities among these lesser-known entities.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.255 | £488.65M | ✅ 5 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$3.00 | A$461.07M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.57 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.45 | SGD13.58B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.70 | $406.93M | ✅ 4 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ✅ 5 ⚠️ 0 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.145 | £184.26M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,604 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

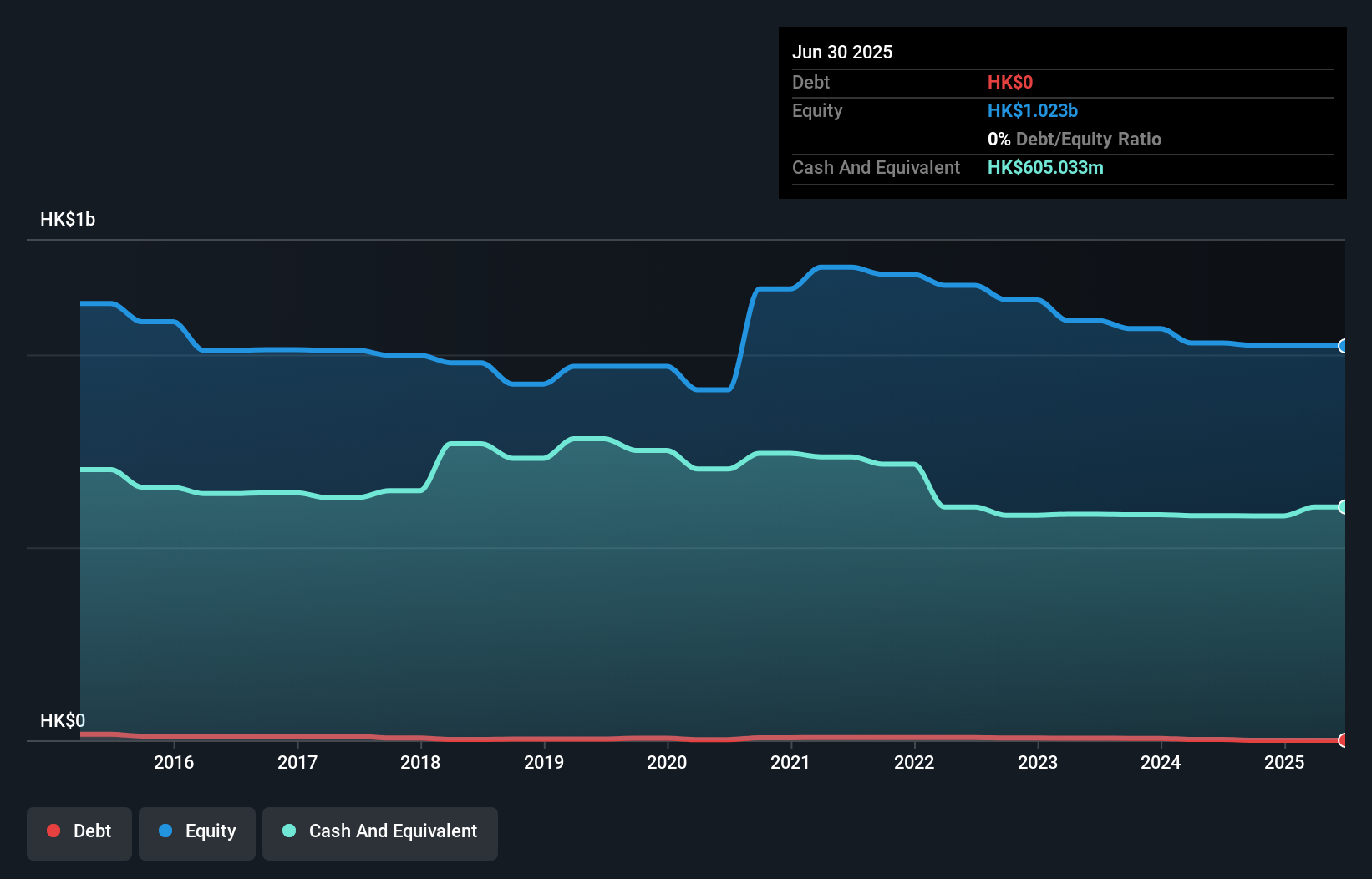

ENM Holdings (SEHK:128)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ENM Holdings Limited is an investment holding company involved in the retail of fashion wear and accessories across Hong Kong, the Americas, Europe, and other Asia Pacific regions, with a market capitalization of HK$585.98 million.

Operations: The company's revenue is derived from investments amounting to HK$19.88 million and the retail of fashion wear and accessories totaling HK$28.94 million.

Market Cap: HK$585.98M

ENM Holdings, with a market cap of HK$585.98 million, has recently shifted its focus away from its struggling fashion retail business due to ongoing economic challenges and weak tourist spending in Hong Kong. The company is now poised for a significant turnaround, reporting an expected profit of approximately HK$21 million for the nine months ending September 2025, driven by reduced operating costs and gains from its investment portfolio. With no debt and strong short-term assets exceeding liabilities, ENM Holdings presents a financially stable profile amidst the volatility typical of penny stocks.

- Unlock comprehensive insights into our analysis of ENM Holdings stock in this financial health report.

- Explore historical data to track ENM Holdings' performance over time in our past results report.

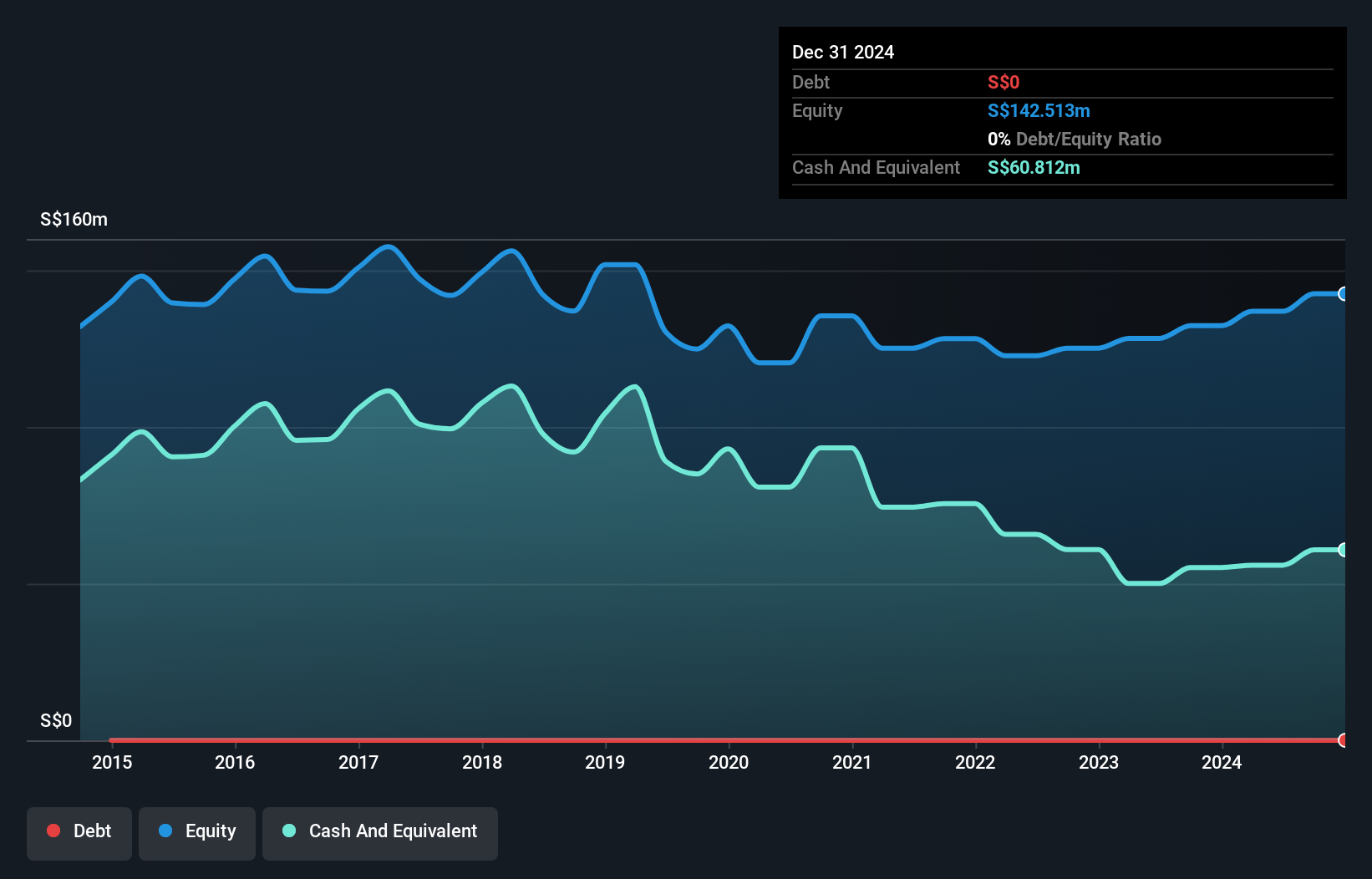

VICOM (SGX:WJP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VICOM Ltd, with a market cap of SGD581.49 million, operates as an investment holding company offering motor vehicle inspection and non-vehicle testing, inspection, and consultancy services in Singapore.

Operations: The company generates revenue of SGD133.03 million from its vehicle inspection and non-vehicle testing services.

Market Cap: SGD581.49M

VICOM Ltd, with a market cap of SGD581.49 million, is financially robust with no debt and strong short-term assets (SGD75.8M) exceeding both its short-term (SGD35.3M) and long-term liabilities (SGD35.9M). The company reported revenue of SGD133.03 million from vehicle inspection and testing services, reflecting stable operations in Singapore's commercial services sector where it outpaced industry earnings growth last year by achieving 10.6% growth compared to the industry's 5.5%. Despite a slight decline in net profit margins to 23.1%, VICOM maintains high-quality earnings and offers potential value trading below estimated fair value by nearly 40%.

- Jump into the full analysis health report here for a deeper understanding of VICOM.

- Understand VICOM's track record by examining our performance history report.

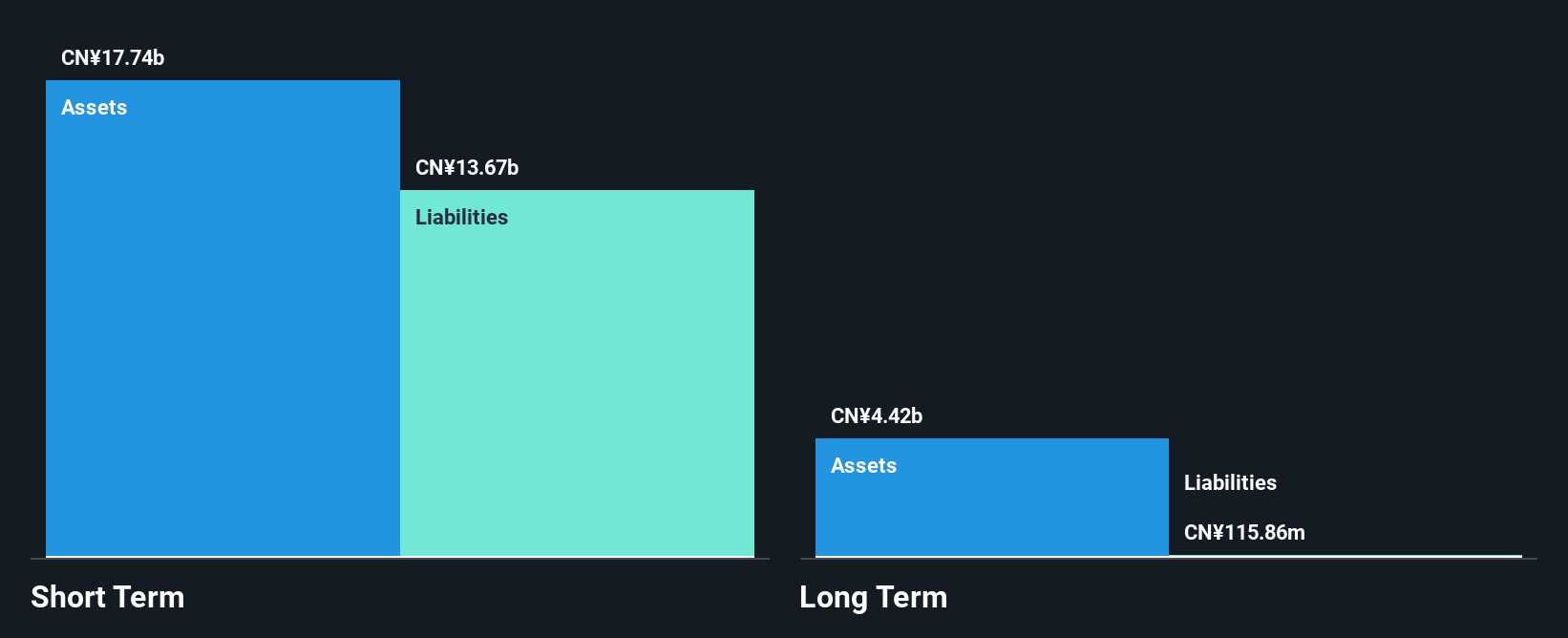

Zhejiang Yasha DecorationLtd (SZSE:002375)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Yasha Decoration Co., Ltd operates in building and curtain wall decoration, as well as intelligent system integration in China, with a market cap of CN¥5.03 billion.

Operations: There are no specific revenue segments reported for the company.

Market Cap: CN¥5.03B

Zhejiang Yasha Decoration Co., Ltd, with a market cap of CN¥5.03 billion, has demonstrated resilience in the building and curtain wall decoration sector despite a decline in sales to CN¥6.87 billion for the nine months ending September 2025. The company achieved earnings growth of 23.7% over the past year, surpassing industry averages and improving its net profit margin to 2.9%. With short-term assets exceeding both short- and long-term liabilities significantly, its financial health appears robust. However, challenges remain with an inexperienced board and unstable dividend history impacting investor confidence despite trading below estimated fair value by nearly half.

- Get an in-depth perspective on Zhejiang Yasha DecorationLtd's performance by reading our balance sheet health report here.

- Gain insights into Zhejiang Yasha DecorationLtd's past trends and performance with our report on the company's historical track record.

Next Steps

- Click through to start exploring the rest of the 3,601 Global Penny Stocks now.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal