The surge in demand for hedging sends a key signal Has the “good days” of yen arbitrage trading come to an end?

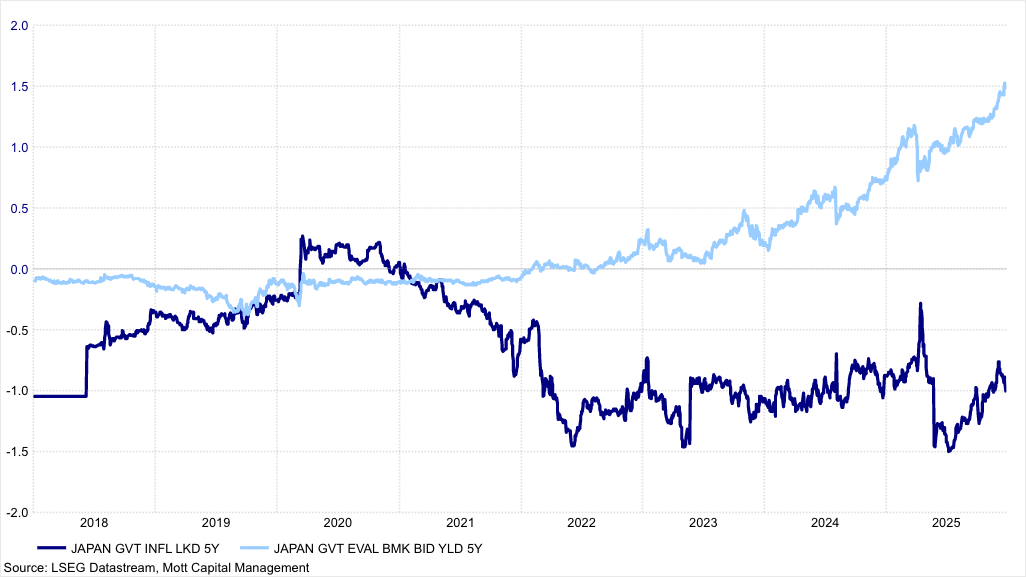

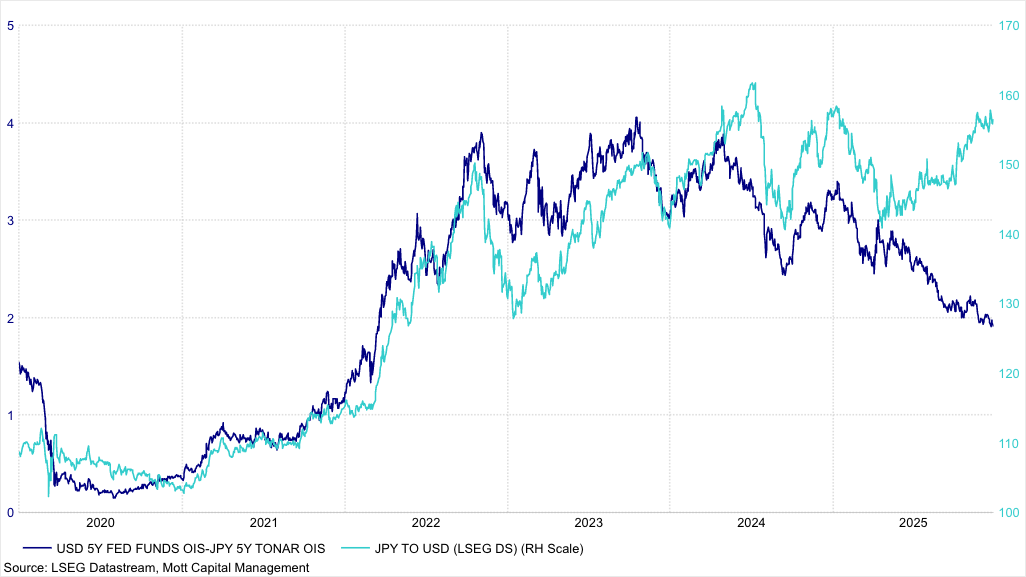

The Zhitong Finance App learned that demand to hedge against the risk of the yen's exchange rate against the US dollar is rising. This is probably the first sign that rising interest rates in Japan are beginning to affect arbitrage trading. After the Bank of Japan raised interest rates in December and hinted that monetary policy might be tightened further in the future, interest rates in Japan have risen to a decades-high level — the yield on Japan's five-year treasury bonds rose to about 1.5%, a level not seen since 2008. Although nominal interest rates have risen, break-even inflation expectations are rising at the same time, which means that Japan's real interest rates are still in a deep negative range.

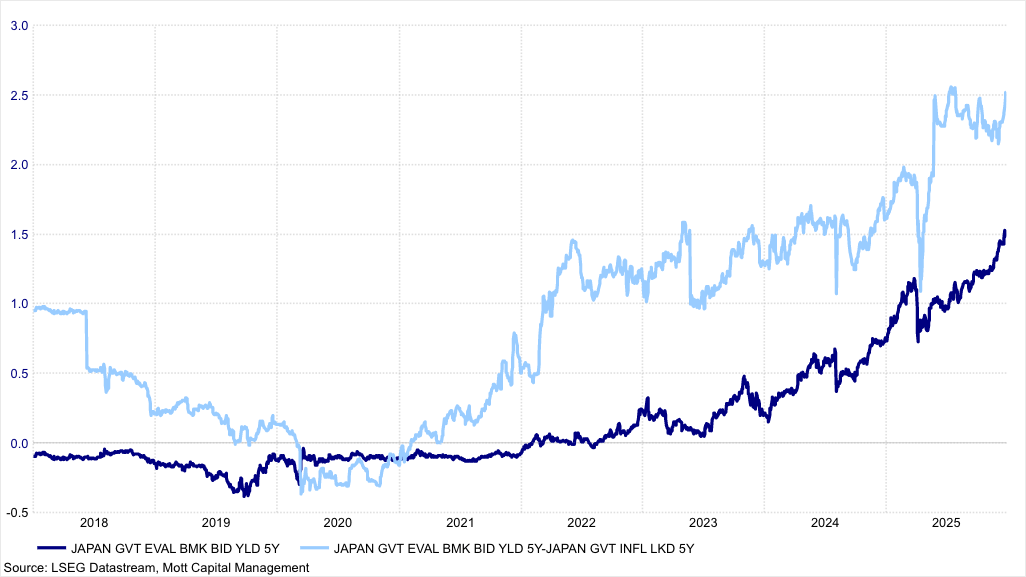

Overall, in order for Japan's real interest rate to become positive, the five-year nominal interest rate would need to rise above 2.5%. This level is equivalent to the hypothetical break-even inflation rate, and is also the current difference between nominal interest rates and real interest rates. This means that if the Bank of Japan's ultimate goal is to push interest rates to a positive range, Japan's five-year interest rate may still need to rise significantly in the next few months.

Higher five-year interest rates in Japan will mean that the spread between the US and Japan will narrow significantly, unless US interest rates rise at the same time as Japanese interest rates, or even faster. However, given the market's expectation that the Federal Reserve will cut interest rates in 2026, it seems unlikely that US interest rates will rise faster than in Japan.

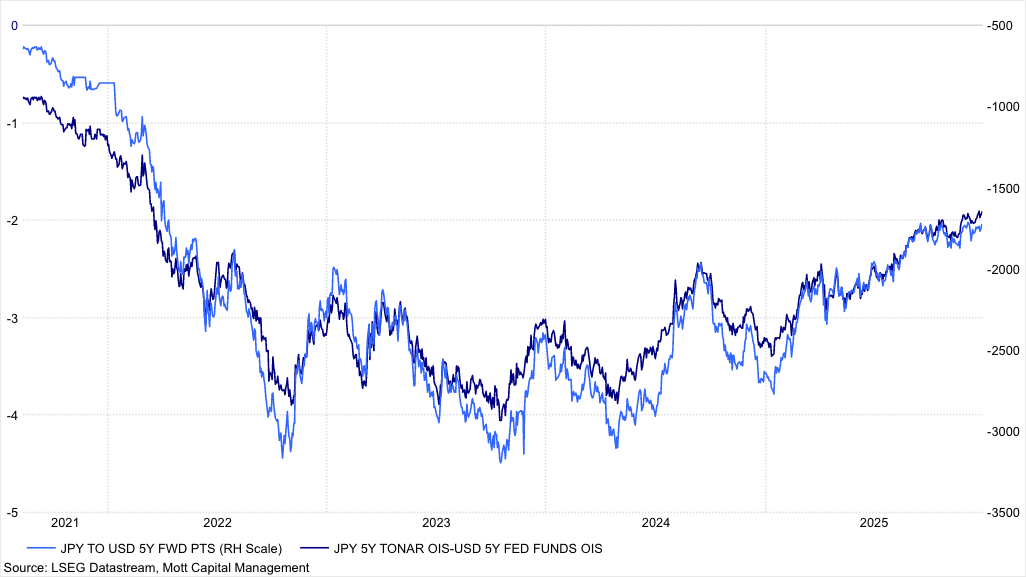

Forward interest rate

The five-year yen forward interest rate is still at a critical level, suggesting that a breakthrough may be imminent. If the spread between overnight interest rates continues to narrow, it may put more pressure on forward interest rates and push them to be further compressed.

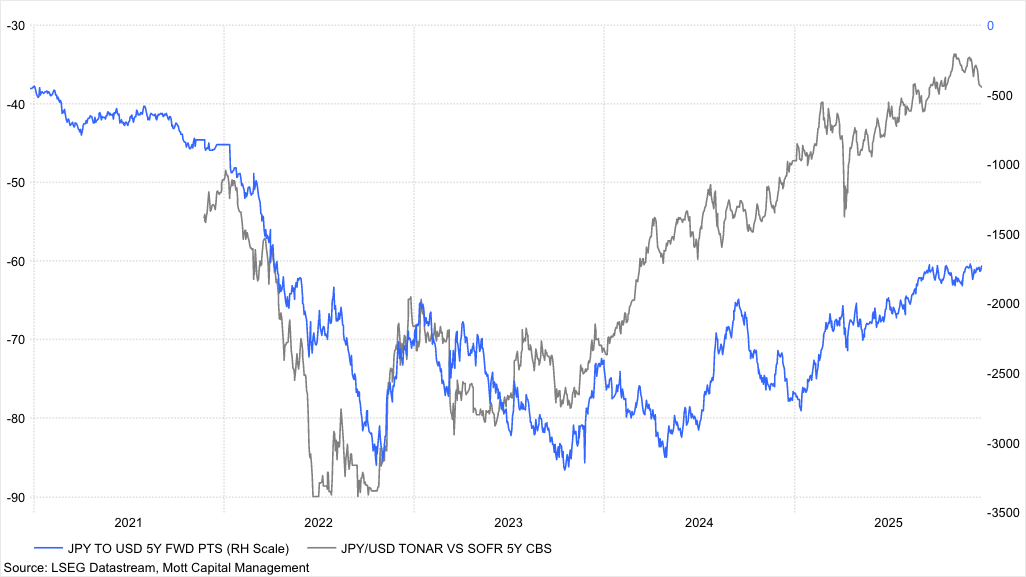

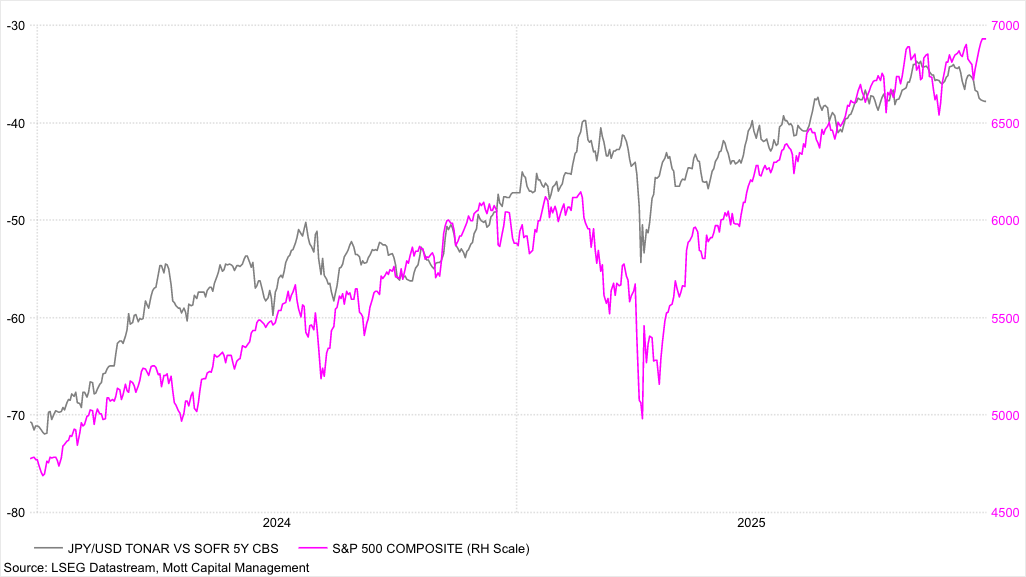

A rise in forward interest rates means that the yen may strengthen in the future, and expectations of a stronger yen may be a driving force for increased hedging activity, thereby increasing demand for dollar financing. Currently, the five-year cross-currency basis swap has stopped rising and turned even more negative. This is a sign that dollar hedging activity may increase.

Ultimately, whether this trend continues depends largely on whether the yen can strengthen against the US dollar. Despite recent increases in interest rates and narrowing spreads, the yen is actually weakening. Since 2020, this divergence between interest rates and exchange rates has been quite rare.

Increased demand for hedging

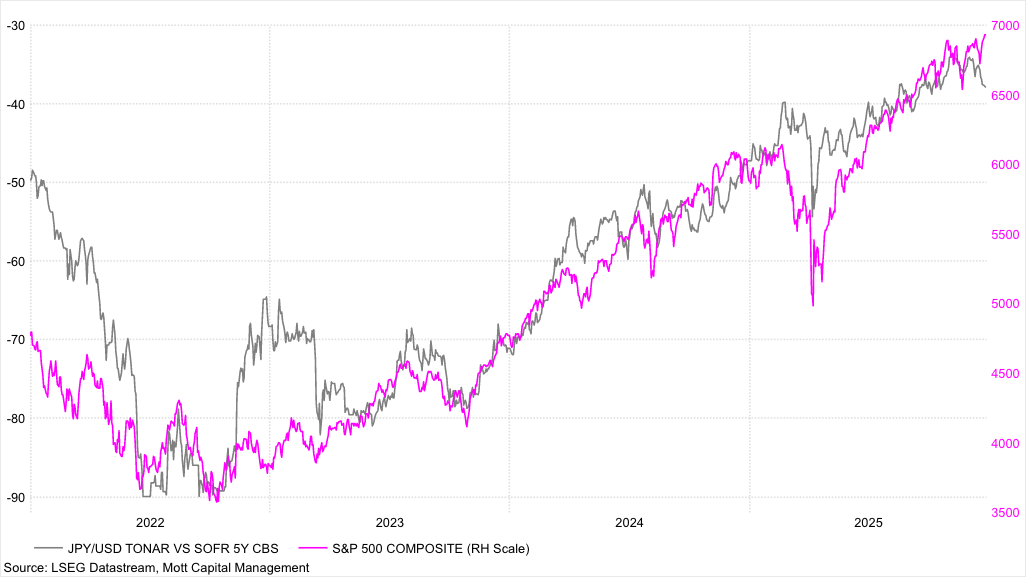

One reason for the weakening of the yen may be that investors are increasing their allocation of dollar-denominated assets and are not hedging these positions with exchange rates. However, as long as investors can still get additional returns from US stocks, arbitrage trading is likely to continue. Over the past four years, five-year cross-currency base swaps have been highly correlated with the S&P 500 index, and yen arbitrage trading also seems to have boosted the US stock market. Against the backdrop of the yen's continued weakening over the past four years, hedging was unnecessary, so the cost of US dollar financing continued to fall.

However, since the end of October, the cost of US dollar financing has risen, leading to a clear divergence between the recent rebound in the S&P 500 index and cross-currency base swaps. Similar situations have occurred before, and it is still too early to determine whether the downward trend of cross-currency base swaps will continue or reverse.

However, if Japanese interest rates continue to rise, the yen will eventually begin to strengthen, and hedging activity will increase as well. This may mark the beginning of the end of arbitrage trading — at least the kind that has been popular for the past few years.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal