High Growth Tech Stocks To Watch In Europe December 2025

As European markets close out a holiday-shortened week, the pan-European STOXX Europe 600 Index edged slightly higher, buoyed by positive sentiment around future earnings and economic prospects. In this environment, identifying promising tech stocks involves looking for companies that can leverage emerging technologies and navigate market challenges effectively to sustain growth.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Bonesupport Holding | 27.76% | 49.60% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Pharma Mar | 19.32% | 41.01% | ★★★★★☆ |

| Kitron | 21.22% | 32.49% | ★★★★★★ |

| Aelis Farma | 108.74% | 130.33% | ★★★★★☆ |

| Gapwaves | 32.48% | 72.52% | ★★★★★☆ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Waystream Holding | 17.38% | 66.50% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Smartoptics Group (OB:SMOP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Smartoptics Group ASA offers optical networking solutions and devices across various regions including the Americas, Europe, the Middle East, Africa, and the Asia-Pacific, with a market capitalization of NOK2.85 billion.

Operations: Smartoptics generates revenue by providing advanced optical networking solutions and devices across multiple global regions. The company focuses on delivering high-performance products tailored to meet the demands of telecommunications operators, internet service providers, and enterprises.

Smartoptics Group, a European tech innovator, has demonstrated robust growth with a 19.5% annual increase in revenue and an impressive 55.5% surge in earnings per year. Recent strategic moves include joining the IOWN Global Forum to enhance next-generation optical networks and deploying advanced IP over DWDM systems with Glesys, streamlining operations across Scandinavia. These initiatives not only expand Smartoptics' technological footprint but also align with industry shifts towards more efficient and high-capacity optical solutions, positioning the company well for sustained growth amidst evolving market demands.

Paradox Interactive (OM:PDX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Paradox Interactive AB (publ) is a company that develops and publishes strategy and management games for PC and consoles, serving markets in the United States, Europe, Sweden, and internationally, with a market cap of approximately SEK16.85 billion.

Operations: The company generates revenue primarily from its Computer Graphics segment, which contributed SEK2.03 billion. It focuses on developing and publishing strategy and management games for various platforms across multiple international markets.

Paradox Interactive, a leader in grand strategy games, has recently demonstrated its capacity for innovation and market adaptation with the launch of several themed expansions. Notably, their financial performance reveals an 11.6% annual revenue growth and a significant 24.1% increase in earnings per year. They have strategically invested in research and development to enhance game depth and historical accuracy, ensuring their offerings resonate well with their dedicated fan base. This approach not only strengthens their market position but also aligns with current trends towards immersive and expansive gaming experiences, setting the stage for continued growth in a competitive industry.

- Click here and access our complete health analysis report to understand the dynamics of Paradox Interactive.

Gain insights into Paradox Interactive's past trends and performance with our Past report.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: RaySearch Laboratories AB (publ) is a medical technology company that develops software solutions for cancer treatment globally, with a market capitalization of SEK7.70 billion.

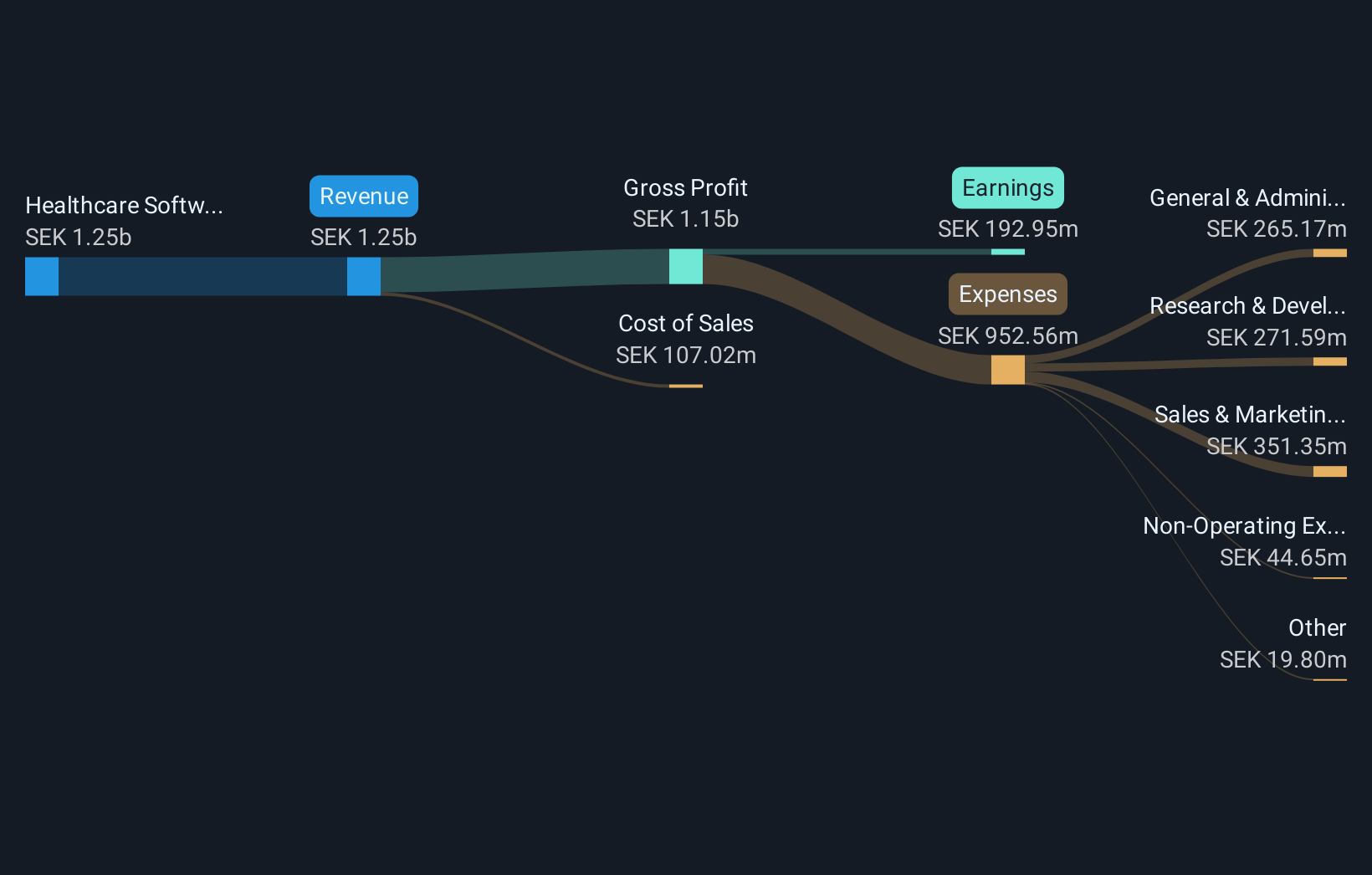

Operations: RaySearch Laboratories generates revenue primarily from its healthcare software segment, amounting to SEK1.29 billion. The company focuses on developing innovative software solutions for cancer treatment worldwide.

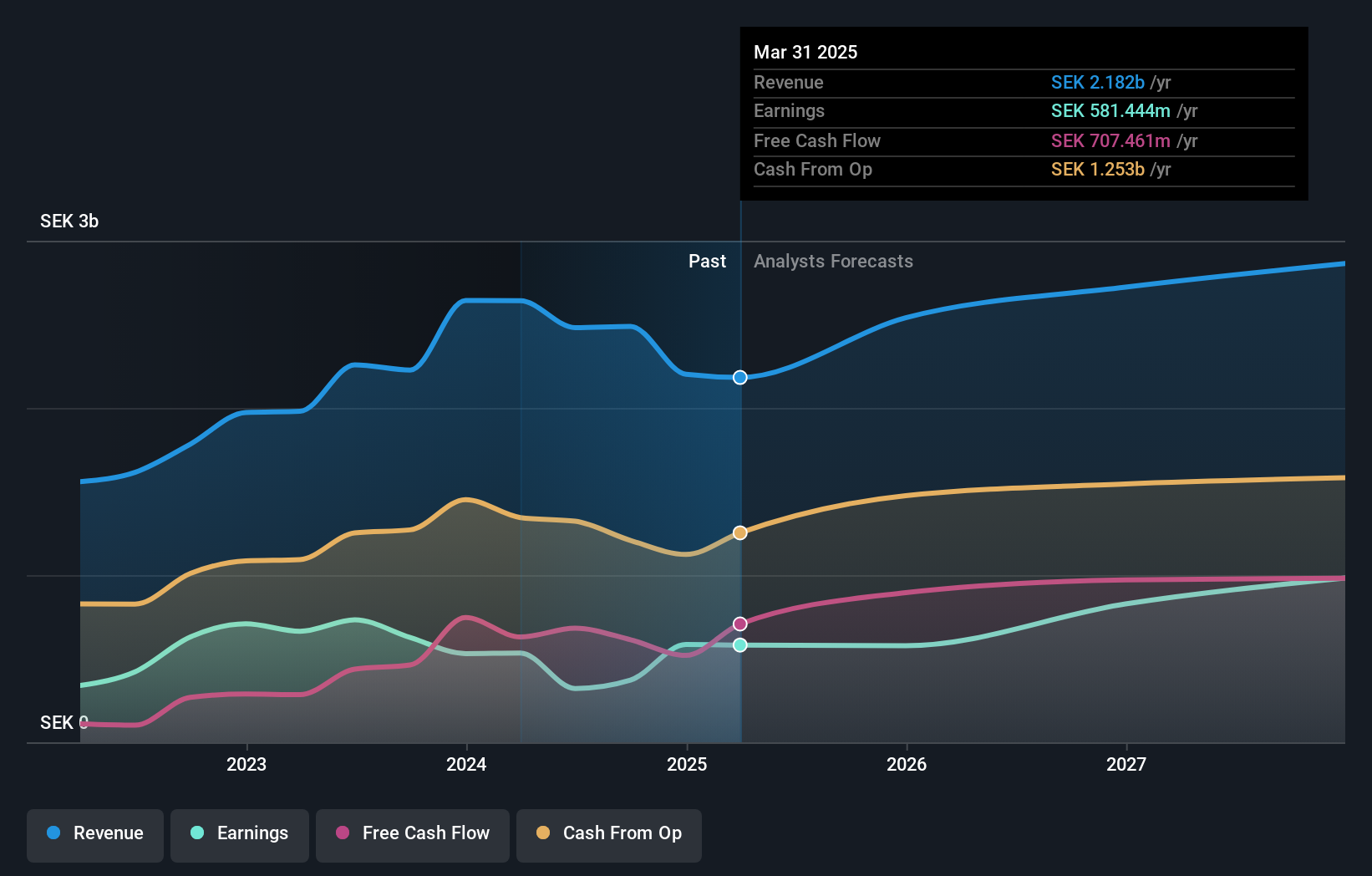

RaySearch Laboratories is shaping the future of oncology with its cutting-edge RayStation® treatment planning system, recently expanding its reach through a significant partnership with Wielkopolskie Centrum Onkologii. This collaboration not only enhances cancer care capabilities but also underscores RaySearch's commitment to integrating advanced technologies, as evidenced by their 13.9% annual revenue growth and impressive 24.3% earnings growth rate. With R&D investments sharply focused on evolving radiation therapy and diagnostic tools, demonstrated at RSNA 2025, the company is well-positioned to lead in high-tech medical solutions, leveraging strategic hires like Jenna Styan to fortify its market strategy and operational excellence.

Summing It All Up

- Explore the 48 names from our European High Growth Tech and AI Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal