3 European Penny Stocks With Market Caps Up To €1B

As the pan-European STOXX Europe 600 Index edges closer to record highs, optimism about future earnings and economic prospects is creating a favorable backdrop for investors. Penny stocks, although an outdated term, continue to capture attention as they represent smaller or emerging companies with potential for significant growth. By focusing on those with strong financials and clear growth paths, investors can find opportunities in these often-overlooked segments of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.518 | €1.56B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.75 | €84.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.00 | €14.86M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.10 | €65.75M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.00 | SEK182.52M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.37 | €386.24M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.78 | €26.12M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 294 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Pharming Group (ENXTAM:PHARM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pharming Group N.V. is a biopharmaceutical company that develops and commercializes protein replacement therapies and precision medicines for rare diseases globally, with a market cap of approximately €986.61 million.

Operations: Pharming Group's revenue is primarily derived from its product Ruconest®, which accounts for $310.84 million, followed by Joenja® at $51.46 million.

Market Cap: €986.61M

Pharming Group has shown significant progress in its financial performance, becoming profitable recently and reducing its debt-to-equity ratio from 89.4% to 37.2% over five years. Its revenue is primarily driven by Ruconest® and Joenja®, with a revised revenue guidance for 2025 between US$365 million and US$375 million, indicating strong sales momentum. The company has also implemented organizational restructuring to optimize costs, targeting a 15% reduction in general expenses annually. Recent executive changes include the appointment of Leverne Marsh as Chief Commercial Officer, expected to bolster Pharming's commercial strategy in rare diseases globally.

- Jump into the full analysis health report here for a deeper understanding of Pharming Group.

- Evaluate Pharming Group's prospects by accessing our earnings growth report.

Freelance.com (ENXTPA:ALFRE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Freelance.com SA facilitates intermediation between companies and intellectual service providers across several countries including France, Germany, Morocco, Luxembourg, Switzerland, and Singapore with a market cap of €124.31 million.

Operations: The company's revenue primarily comes from its Business Services segment, generating €1.06 billion.

Market Cap: €124.31M

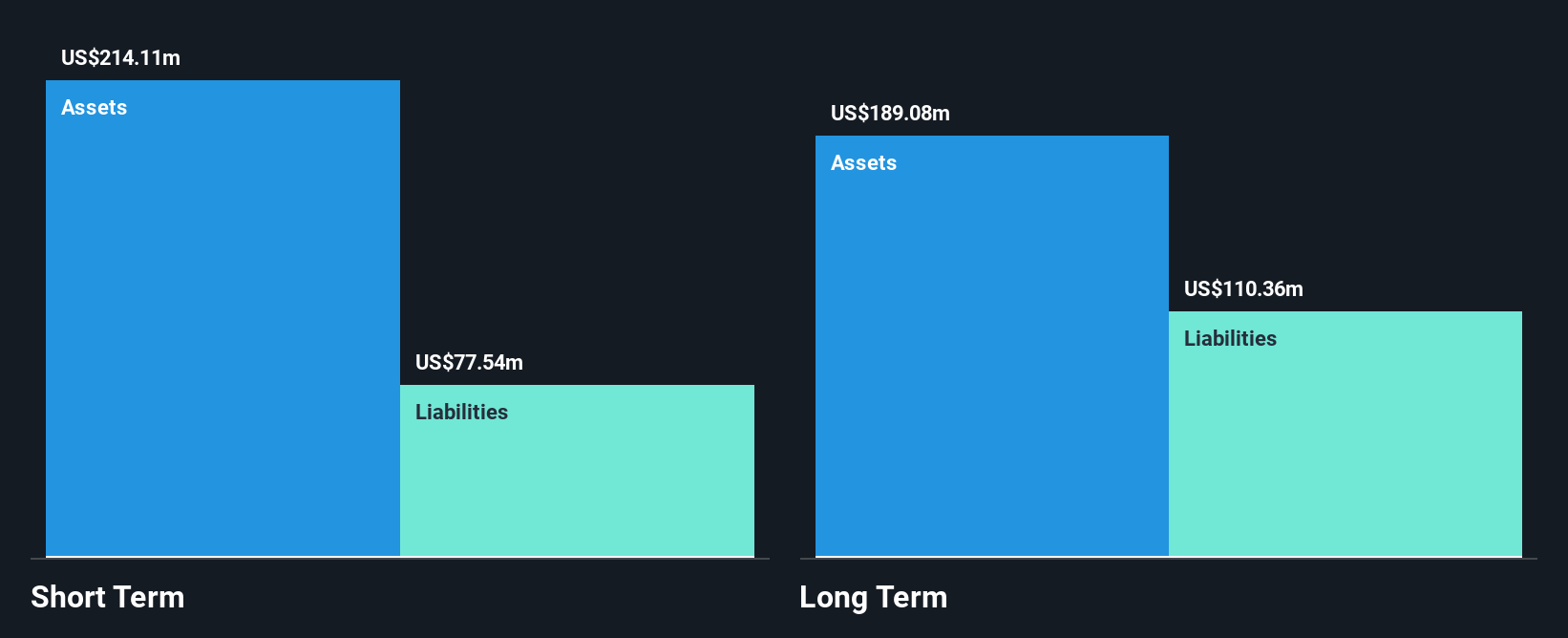

Freelance.com SA has demonstrated robust earnings growth, with a 53.4% increase over the past year, surpassing its five-year average. The company's short-term assets exceed both its short and long-term liabilities, indicating solid financial stability. Despite a satisfactory net debt to equity ratio of 11%, operating cash flow does not sufficiently cover debt obligations. Recent earnings reports show improved net profit margins at 2.2% and sales of €530.1 million for the first half of 2025, up from €517 million the previous year. However, future earnings are forecasted to decline by an average of 8.5% annually over three years.

- Get an in-depth perspective on Freelance.com's performance by reading our balance sheet health report here.

- Gain insights into Freelance.com's outlook and expected performance with our report on the company's earnings estimates.

Nykode Therapeutics (OB:NYKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nykode Therapeutics AS is a clinical-stage biopharmaceutical company focused on discovering and developing novel immunotherapies for cancer and autoimmune diseases, with a market cap of NOK764.12 million.

Operations: The company generates revenue from its Pharmaceuticals segment, amounting to $7.35 million.

Market Cap: NOK764.12M

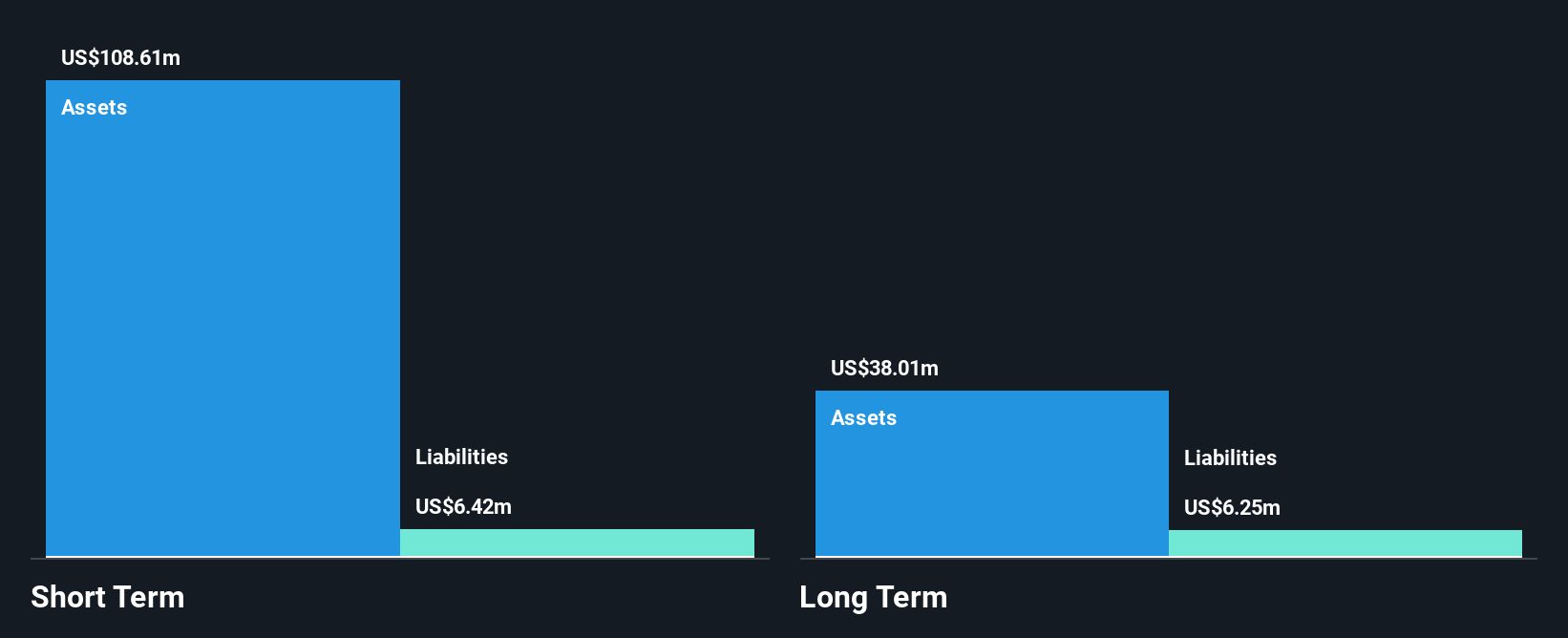

Nykode Therapeutics, a clinical-stage biopharmaceutical firm, remains pre-revenue with recent quarterly earnings showing revenue of US$0.118 million and a net loss of US$3.66 million. Despite its unprofitability, Nykode is debt-free and has substantial short-term assets (US$66.9 million) exceeding both short-term (US$3.9 million) and long-term liabilities (US$2.5 million), ensuring financial stability for more than three years based on current cash flow trends. The company’s innovative AI-powered NeoSELECT™ platform shows promise in cancer immunotherapy trials but faces challenges with high share price volatility and declining earnings forecasts over the next three years.

- Click to explore a detailed breakdown of our findings in Nykode Therapeutics' financial health report.

- Learn about Nykode Therapeutics' future growth trajectory here.

Seize The Opportunity

- Gain an insight into the universe of 294 European Penny Stocks by clicking here.

- Interested In Other Possibilities? These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal