Exploring Europe's Undiscovered Gems For December 2025

As the pan-European STOXX Europe 600 Index edges closer to record highs amid positive economic sentiment, investors are keenly observing shifts within the small-cap segment, which often harbors potential for growth and innovation. In this dynamic environment, discovering stocks with robust fundamentals and unique market positions can offer intriguing opportunities for those looking to navigate Europe's evolving financial landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intellego Technologies | 5.42% | 70.25% | 79.14% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Envirotainer | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

CNTEE Transelectrica (BVB:TEL)

Simply Wall St Value Rating: ★★★★★★

Overview: CNTEE Transelectrica SA operates as the transmission and system operator for the national power system, with a market capitalization of RON5.26 billion.

Operations: Transelectrica generates revenue primarily from its transmission and dispatch services, totaling RON5.95 billion. The company's financial performance is influenced by its ability to manage costs associated with these operations effectively.

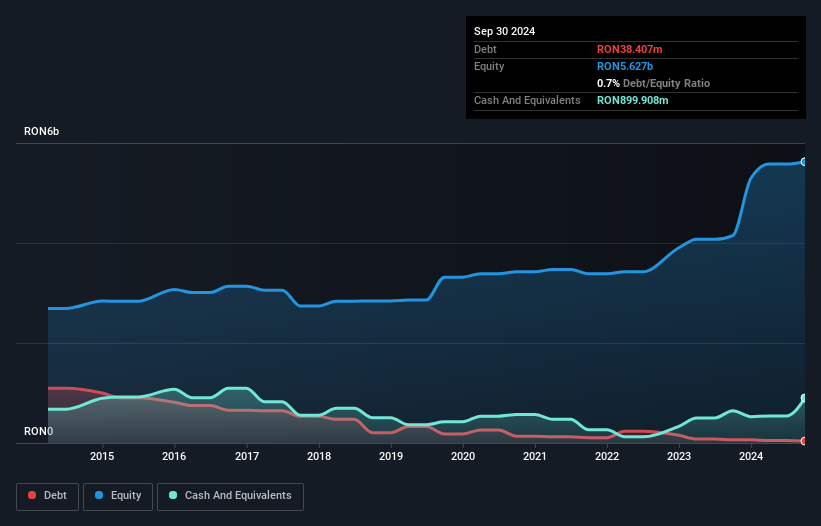

Transelectrica, a notable player in the European energy sector, has been navigating financial challenges with its recent earnings report showing a net income of RON 243.88 million for the first nine months of 2025, down from RON 417.82 million the previous year. Despite this dip, it remains profitable and maintains high-quality earnings while trading at an attractive valuation—2.7% below its estimated fair value. The company's debt-to-equity ratio has impressively decreased from 3.9% to 0.5% over five years, signaling prudent financial management amidst industry headwinds like negative earnings growth of -5.3%.

- Delve into the full analysis health report here for a deeper understanding of CNTEE Transelectrica.

Evaluate CNTEE Transelectrica's historical performance by accessing our past performance report.

Voxel (WSE:VOX)

Simply Wall St Value Rating: ★★★★★★

Overview: Voxel S.A. operates in the healthcare sector, offering medical services in Poland, with a market capitalization of PLN 1.27 billion.

Operations: Voxel S.A. generates revenue primarily from Diagnostics, contributing PLN 418.70 million, and IT & Infrastructure, with PLN 166.89 million. Therapy services add PLN 14.48 million to the total revenue stream.

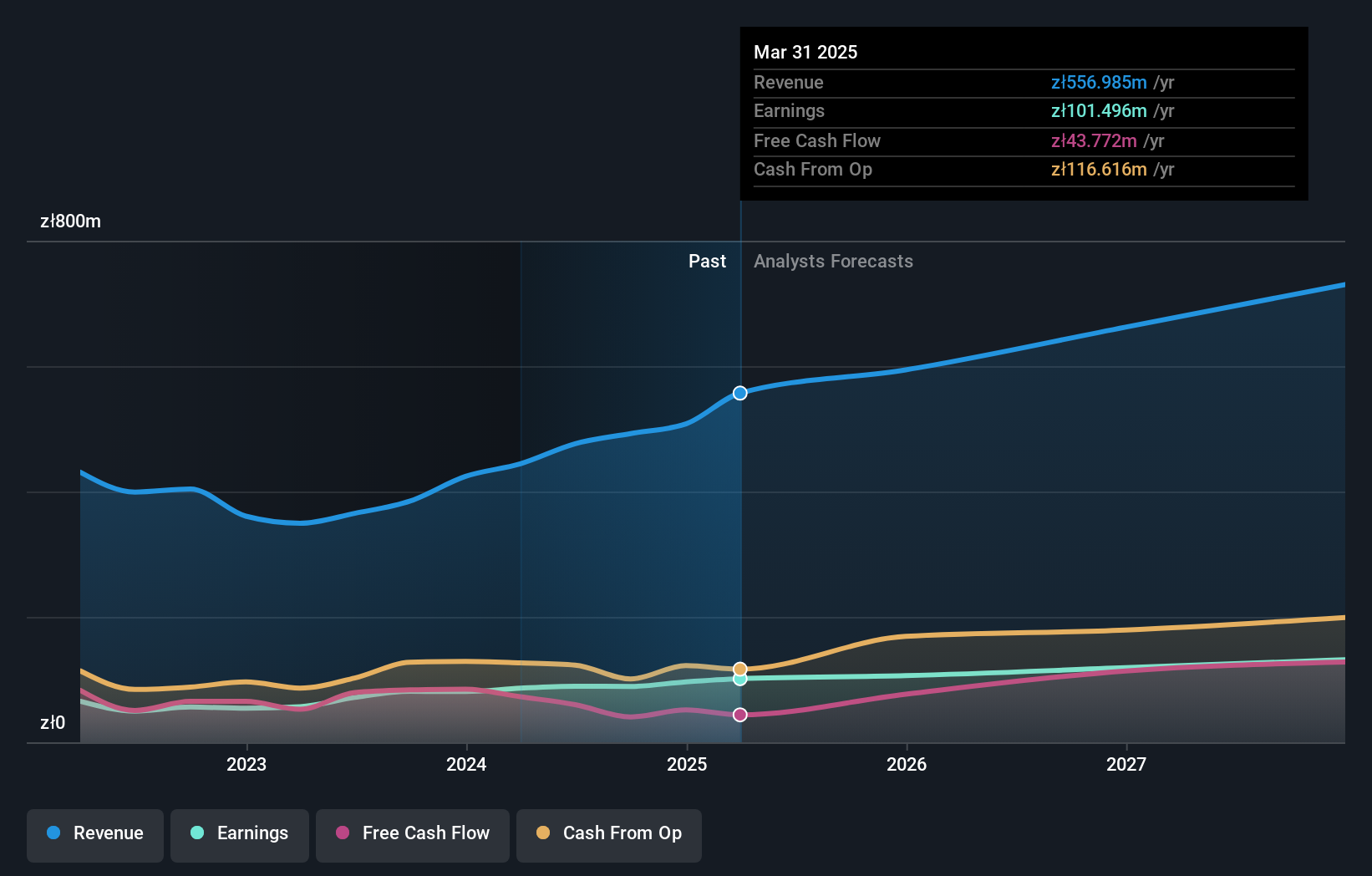

Voxel stands out with its high-quality earnings and a notable reduction in debt to equity ratio from 64.8% to 0.6% over five years, signaling strong financial health. The company is trading at 59% below its estimated fair value, offering good relative value compared to peers. Recent earnings growth of 15.7%, which surpasses the broader healthcare industry’s -4.7%, highlights its competitive edge and potential for future expansion, with forecasts suggesting an annual growth rate of 11%. Voxel's third-quarter sales hit PLN142.97 million, up from PLN134.52 million last year, while net income rose to PLN27.57 million from PLN25.4 million, reflecting solid operational performance and strategic positioning within the market landscape.

MBB (XTRA:MBB)

Simply Wall St Value Rating: ★★★★★★

Overview: MBB SE is involved in acquiring and managing medium-sized companies, primarily within the technology and engineering sectors both in Germany and internationally, with a market cap of approximately €1.08 billion.

Operations: MBB generates revenue primarily from Service & Infrastructure (€781.36 million) and Technological Applications (€299.66 million), with additional contributions from Consumer Goods (€85.49 million).

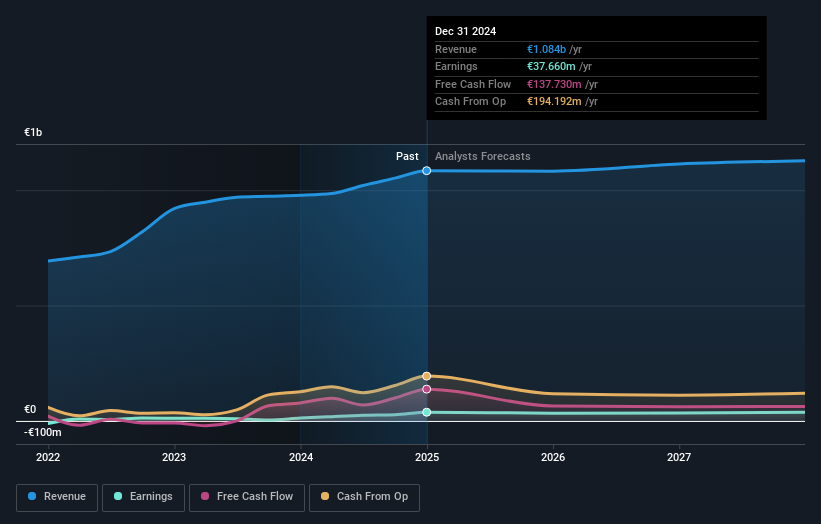

MBB's recent performance showcases a strong financial position, with earnings growing by 101% over the past year, significantly outpacing the Industrials sector's 8.5%. The company has reduced its debt to equity ratio from 13.7% to 4.5% in five years and holds more cash than total debt, underscoring financial prudence. MBB trades at a substantial discount of 43% below its estimated fair value, suggesting potential investment appeal despite forecasts of a 34% annual decline in earnings over three years. Strategic focus on automation and software sectors supports growth prospects but faces challenges from automotive sector reliance and competitive M&A pressures.

Seize The Opportunity

- Get an in-depth perspective on all 303 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal