3 European Dividend Stocks Offering Up To 5.4% Yield

As the pan-European STOXX Europe 600 Index edges closer to a record high amid optimism about future earnings and economic conditions, investors are increasingly eyeing dividend stocks as a potential source of steady income. In this context, selecting stocks with reliable dividend yields can offer stability and potential returns in an environment where market sentiment remains cautiously optimistic.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.07% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.51% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.37% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.00% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| Evolution (OM:EVO) | 4.85% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.14% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 4.91% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.30% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.22% | ★★★★★★ |

Click here to see the full list of 195 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Aena S.M.E (BME:AENA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aena S.M.E., S.A. manages airports across Spain, Brazil, the United Kingdom, Mexico, and Colombia and has a market cap of €35.79 billion.

Operations: Aena S.M.E., S.A.'s revenue is primarily derived from its Airports - Aeronautical segment at €3.27 billion and Airports - Commercial (including Car Park Network) at €1.90 billion, with additional income from Real Estate Services totaling €126 million.

Dividend Yield: 4.1%

Aena S.M.E. offers a dividend yield of 4.09%, below the top quartile of Spanish dividend payers, and has exhibited volatility over the past decade. Despite this, its dividends are currently covered by earnings and cash flows with payout ratios around 72%. The company faces high debt levels but reported a recent earnings growth of 6.3% and confirmed traffic guidance for 2025 at a 3.4% increase year-on-year, indicating operational stability amidst financial challenges.

- Take a closer look at Aena S.M.E's potential here in our dividend report.

- The valuation report we've compiled suggests that Aena S.M.E's current price could be inflated.

Eolus Aktiebolag (OM:EOLU B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Eolus Aktiebolag (publ) focuses on the development, construction, and operation of renewable energy assets across Sweden, Finland, the United States, Poland, Spain, and the Baltic states with a market cap of approximately SEK1.02 billion.

Operations: Eolus Aktiebolag generates revenue primarily through its Project Development segment, which accounted for SEK3.23 billion.

Dividend Yield: 5.5%

Eolus Aktiebolag's dividend yield of 5.47% ranks in the top 25% of Swedish dividend payers, although its dividends have been historically volatile. The company's low payout ratio of 20.5% and cash payout ratio of 10% indicate dividends are well-covered by earnings and cash flows, despite a high debt level. Recent earnings results show significant revenue growth, but net losses persist, suggesting financial challenges that could impact future dividend stability.

- Click here to discover the nuances of Eolus Aktiebolag with our detailed analytical dividend report.

- Our valuation report unveils the possibility Eolus Aktiebolag's shares may be trading at a discount.

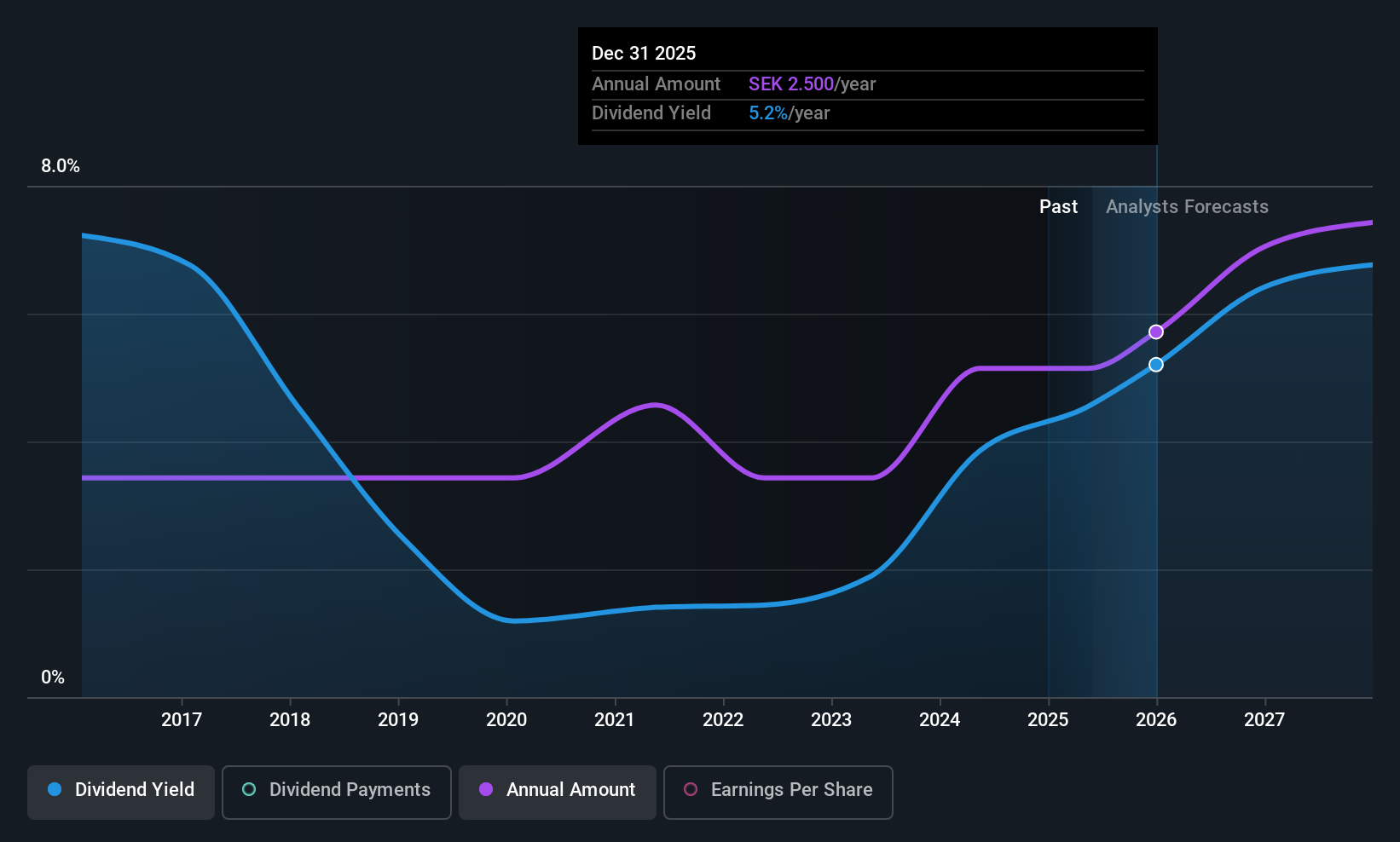

NCC (OM:NCC B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NCC AB (publ) is a construction company operating in Sweden, Norway, Denmark, and Finland with a market cap of SEK21.09 billion.

Operations: NCC AB (publ) generates its revenue from several segments, including NCC Industry at SEK12.62 billion, NCC Infrastructure at SEK18.41 billion, NCC Building Sweden at SEK13.10 billion, NCC Building Nordics at SEK13.53 billion, and NCC Property Development at SEK4.28 billion.

Dividend Yield: 4.2%

NCC's dividend yield of 4.17% places it among the top 25% of Swedish dividend payers, with dividends covered by both earnings and cash flows due to a payout ratio of 55.5% and a cash payout ratio of 21.6%. However, its dividend history is marked by volatility over the past decade, raising concerns about reliability. Recent substantial project wins in Denmark and Sweden totaling billions could support future earnings growth, potentially stabilizing dividends long-term.

- Unlock comprehensive insights into our analysis of NCC stock in this dividend report.

- The analysis detailed in our NCC valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Delve into our full catalog of 195 Top European Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal