3 Asian Stocks Possibly Undervalued By Up To 48.3%

As global markets continue to navigate a complex landscape, Asian stocks have shown resilience, with indices like Japan's Nikkei 225 and China's CSI 300 posting gains amid optimism around artificial intelligence and economic growth prospects. In this environment, identifying potentially undervalued stocks can be crucial for investors seeking opportunities in Asia's diverse market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | CN¥16.77 | CN¥32.50 | 48.4% |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥156.00 | CN¥302.88 | 48.5% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥82.61 | CN¥162.16 | 49.1% |

| Takara Bio (TSE:4974) | ¥791.00 | ¥1576.22 | 49.8% |

| PharmaEssentia (TWSE:6446) | NT$489.00 | NT$946.94 | 48.4% |

| Kuraray (TSE:3405) | ¥1603.50 | ¥3165.42 | 49.3% |

| JINS HOLDINGS (TSE:3046) | ¥5660.00 | ¥11008.83 | 48.6% |

| Forth Corporation (SET:FORTH) | THB5.60 | THB11.07 | 49.4% |

| CURVES HOLDINGS (TSE:7085) | ¥804.00 | ¥1581.02 | 49.1% |

| Cowell e Holdings (SEHK:1415) | HK$27.98 | HK$55.41 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

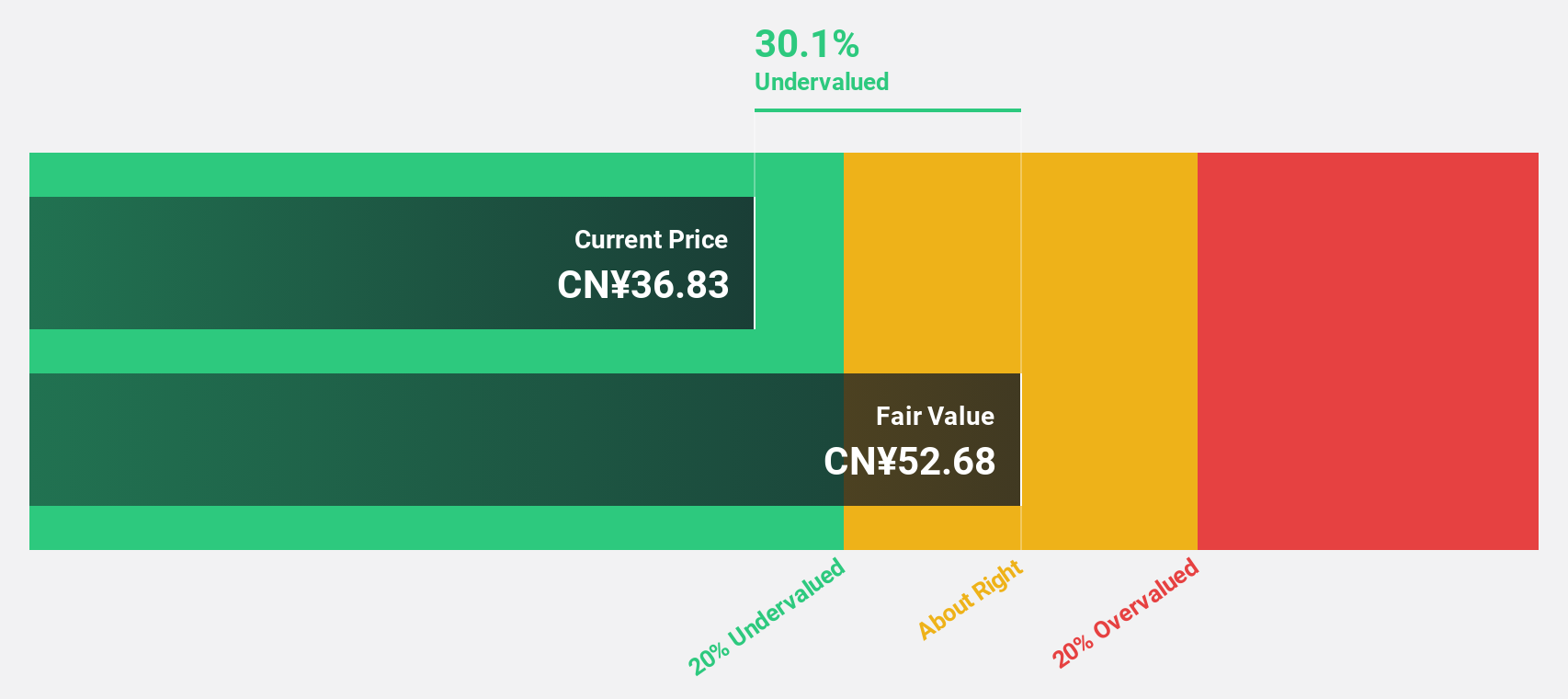

Guangdong Naruida Technology (SHSE:688522)

Overview: Guangdong Naruida Technology Co., Ltd. specializes in the manufacturing and sale of polarized multifunctional active phased array radars in China, with a market capitalization of CN¥11.80 billion.

Operations: The company generates revenue of CN¥463.09 million from its Scientific & Technical Instruments segment.

Estimated Discount To Fair Value: 25.2%

Guangdong Naruida Technology's stock appears undervalued, trading at CN¥38.98, below its estimated fair value of CN¥52.1. The company's earnings have grown significantly, with a 120.7% increase over the past year and forecasts suggesting continued robust growth at 58.3% annually, outpacing the broader Chinese market. Recent earnings reports show strong performance with net income rising to CN¥73.16 million from CN¥26.01 million year-on-year, supporting its potential as an undervalued opportunity based on cash flows.

- Our earnings growth report unveils the potential for significant increases in Guangdong Naruida Technology's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Guangdong Naruida Technology.

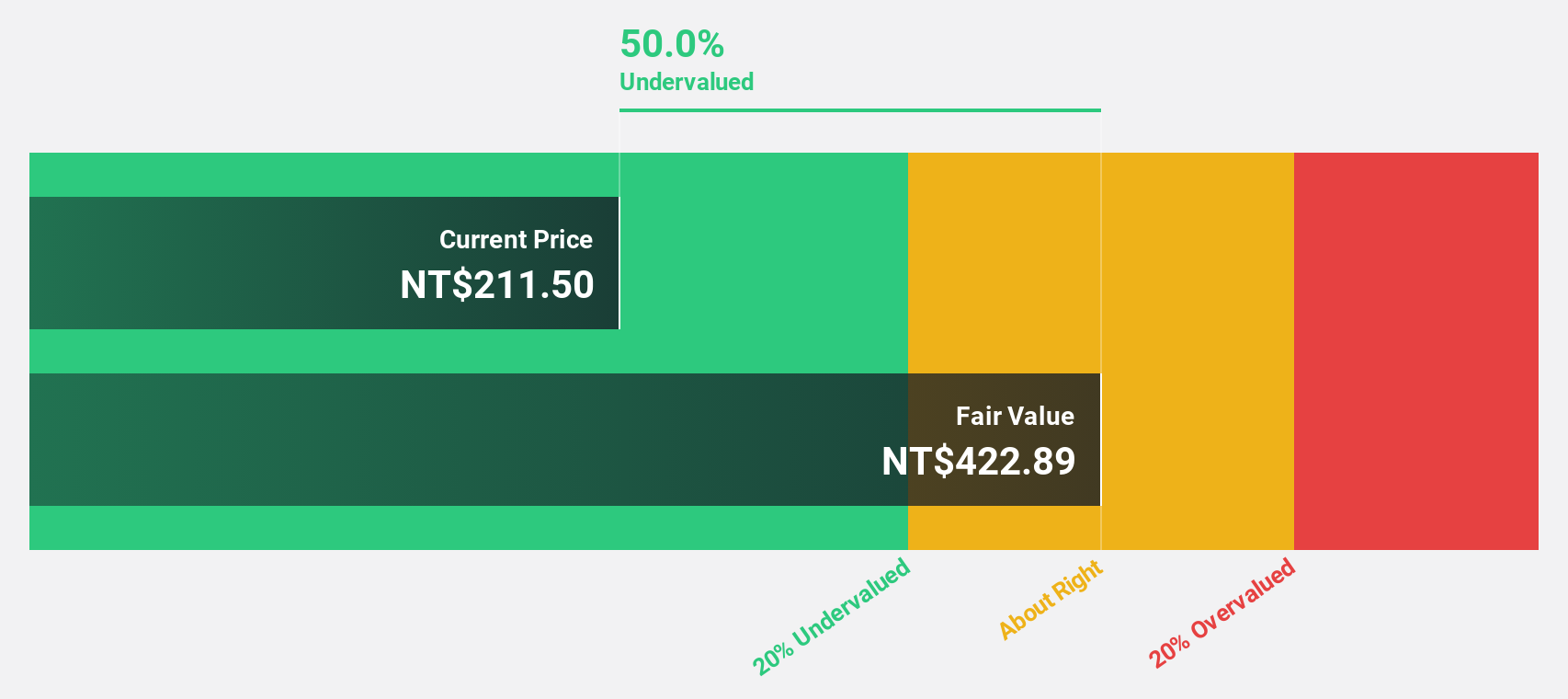

Taiwan Union Technology (TPEX:6274)

Overview: Taiwan Union Technology Corporation manufactures and sells copper clad laminates in Asia and internationally, with a market cap of NT$140.78 billion.

Operations: The company's revenue segments consist of NT$16.49 billion from foreign sales and manufacturing, and NT$11.03 billion from domestic sales and manufacturing.

Estimated Discount To Fair Value: 42.7%

Taiwan Union Technology is trading at NT$498, significantly below its fair value estimate of NT$869.08, making it a strong candidate for undervaluation based on cash flows. The company reported robust earnings growth of 32.3% over the past year and forecasts suggest annual revenue growth of 24.7%, surpassing the Taiwanese market's average. Despite recent executive changes, its earnings are expected to grow significantly by 37.3% annually over the next three years, highlighting its potential as an undervalued investment opportunity in Asia.

- Insights from our recent growth report point to a promising forecast for Taiwan Union Technology's business outlook.

- Navigate through the intricacies of Taiwan Union Technology with our comprehensive financial health report here.

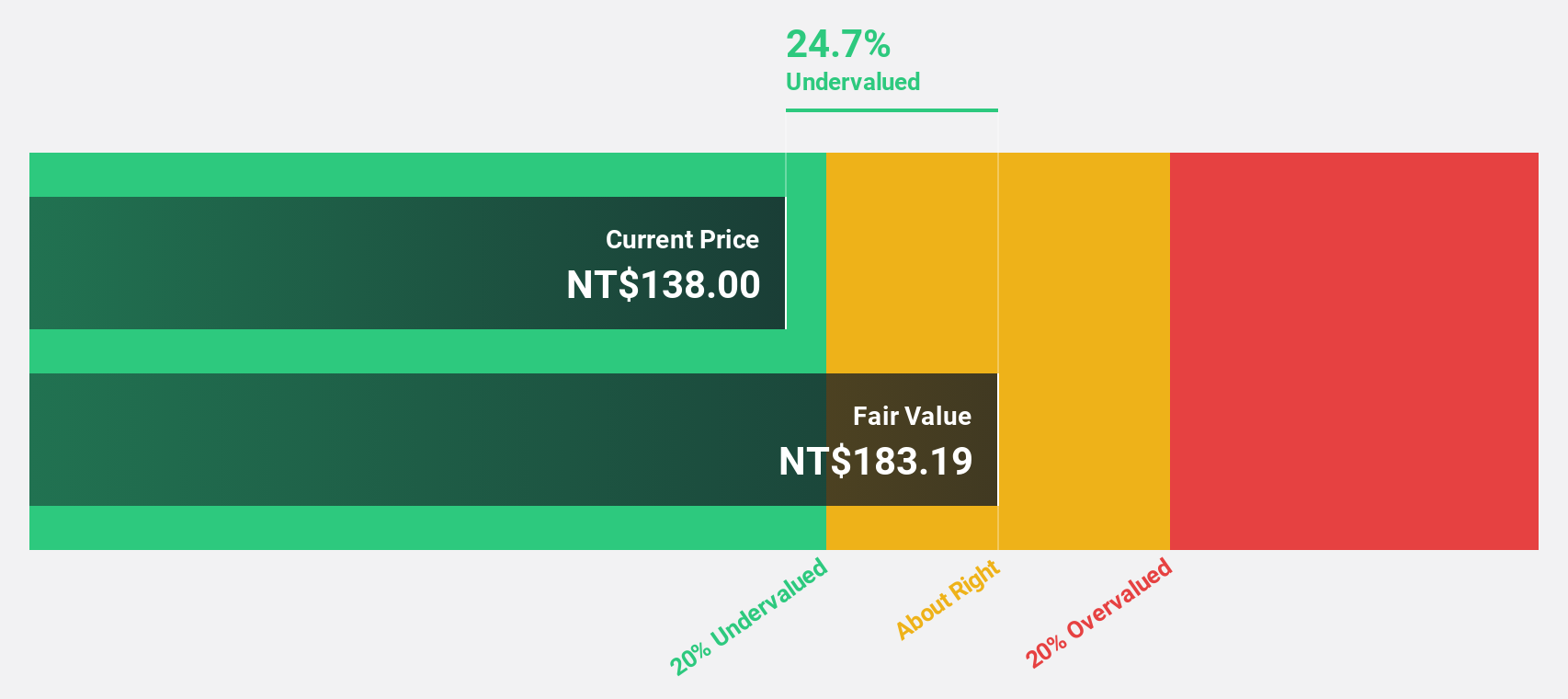

HD Renewable Energy (TWSE:6873)

Overview: HD Renewable Energy Co., Ltd. focuses on developing solar power generation systems, engineering construction, and maintenance services in Taiwan with a market cap of NT$15.68 billion.

Operations: The company generates revenue primarily from its heavy construction segment, amounting to NT$9.53 billion.

Estimated Discount To Fair Value: 48.3%

HD Renewable Energy is trading at NT$111, well below its fair value of NT$214.64, presenting a significant undervaluation based on cash flows. Despite recent declines in sales and net income, analysts forecast robust earnings growth of 76.4% annually, outpacing the Taiwanese market's average. However, profit margins have decreased from last year and operating cash flow inadequately covers debt and dividends, highlighting potential financial challenges despite the stock's discounted valuation.

- The analysis detailed in our HD Renewable Energy growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of HD Renewable Energy.

Make It Happen

- Investigate our full lineup of 270 Undervalued Asian Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal