High Growth Tech Stocks To Watch In Asia December 2025

As global markets continue to experience varied performances, with the U.S. economy growing at its fastest pace in two years and Asian indices like Japan's Nikkei 225 and China's CSI 300 showing positive momentum, investors are keeping a close watch on high-growth tech stocks in Asia. In such dynamic environments, identifying promising stocks often involves looking for companies that demonstrate robust innovation potential and adaptability to technological advancements like artificial intelligence.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 36.73% | 37.89% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Venustech Group (SZSE:002439)

Simply Wall St Growth Rating: ★★★★★☆

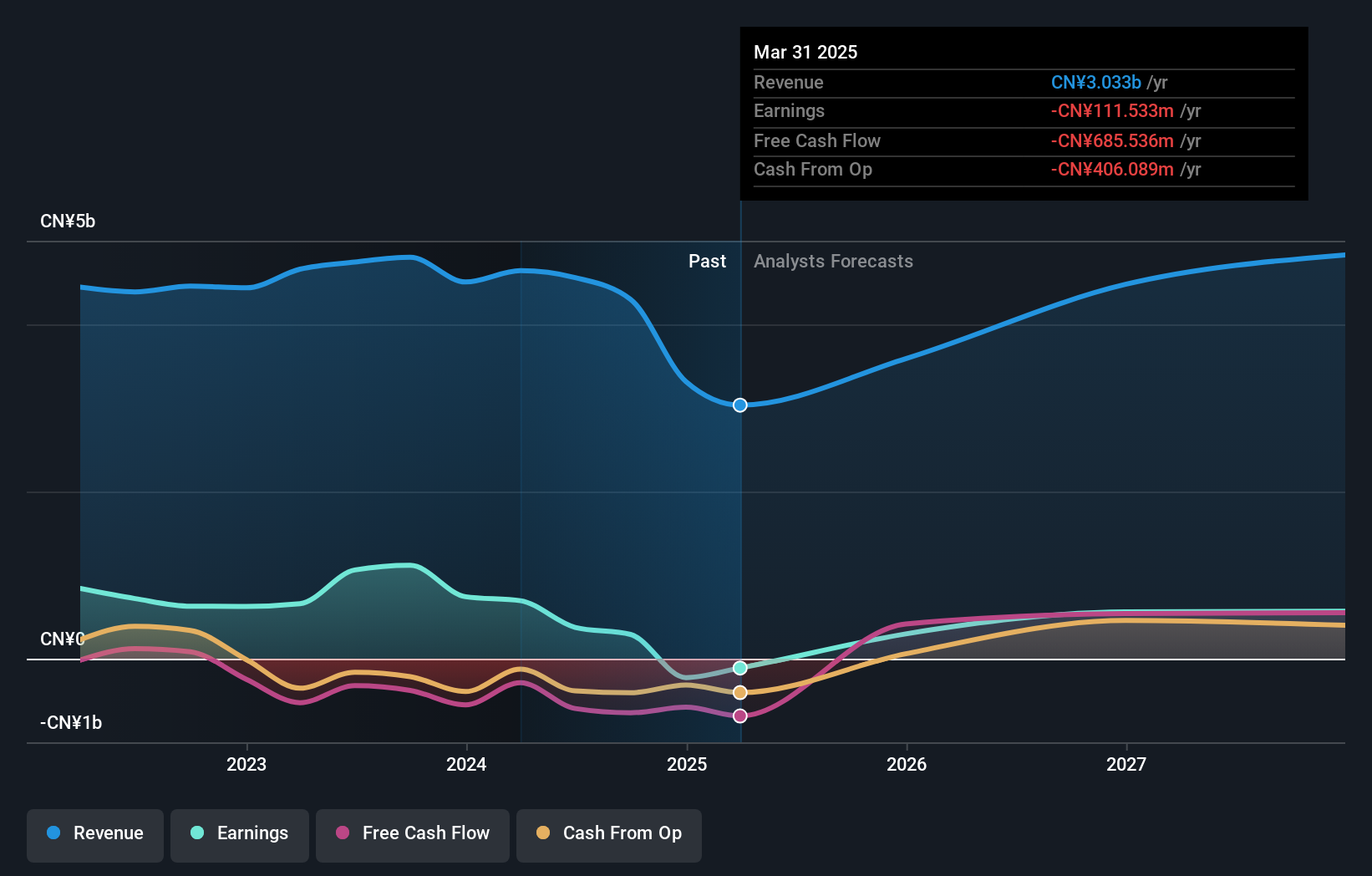

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services and solutions globally, with a market cap of CN¥17.13 billion.

Operations: The company generates revenue primarily from its Information Network Security segment, amounting to CN¥2.51 billion.

Despite its current unprofitability, Venustech Group is positioned for significant growth with projected annual revenue increases of 20.7%, outpacing the Chinese market average of 14.6%. The company's earnings are also expected to surge by 57.1% annually, signaling a robust turnaround within the next three years. Recent strategic amendments in corporate governance and management systems underscore a proactive approach to scaling operations and enhancing shareholder value. However, with a forecasted return on equity of just 3.5% in three years, investors may need to temper expectations regarding profitability metrics against broader industry benchmarks.

- Take a closer look at Venustech Group's potential here in our health report.

Understand Venustech Group's track record by examining our Past report.

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

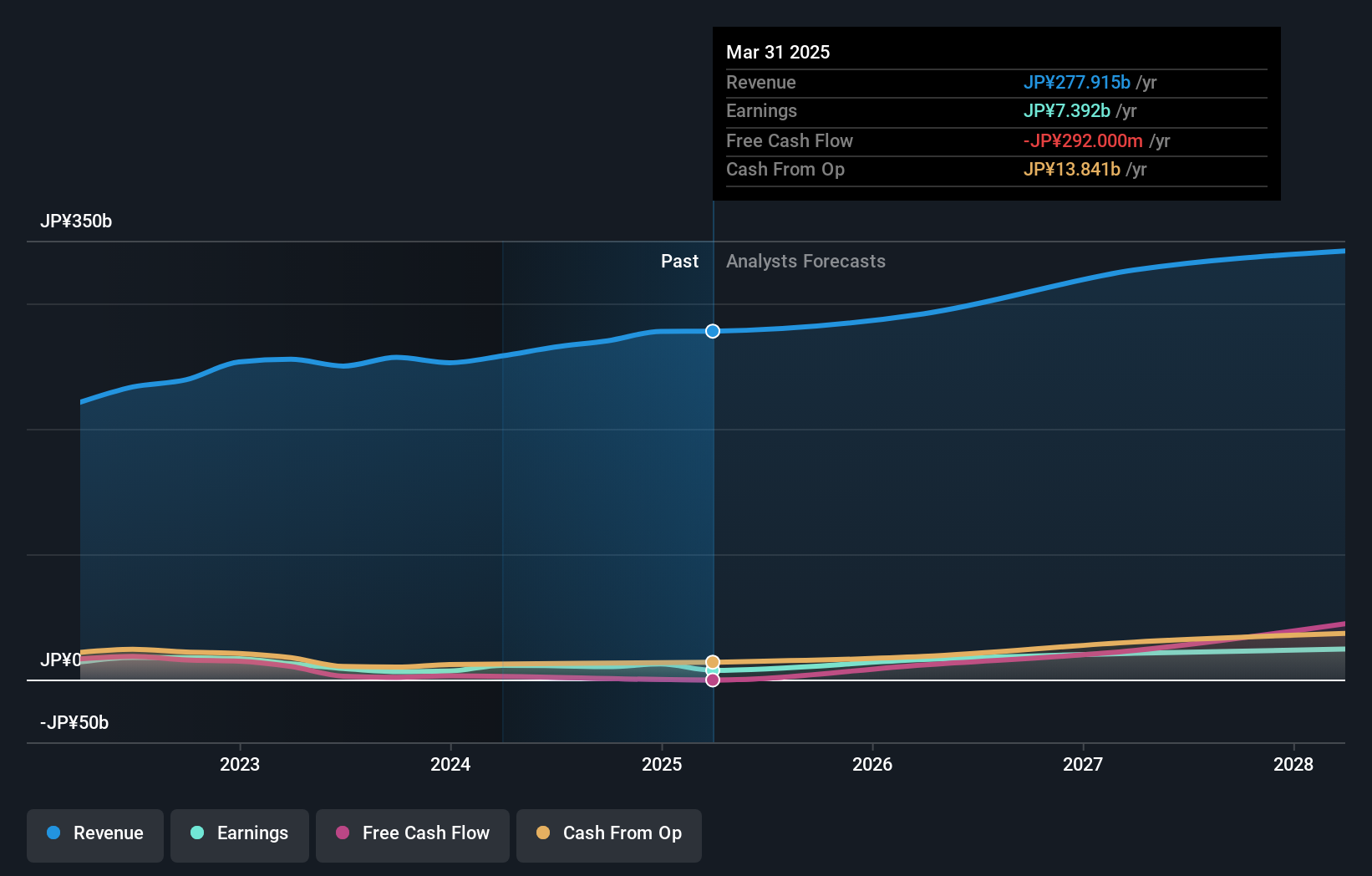

Overview: Kadokawa Corporation is an entertainment company in Japan with a market capitalization of ¥466.20 billion.

Operations: Kadokawa Corporation generates revenue primarily through its Publication/IP Creation and Animation/Film segments, contributing ¥151.21 billion and ¥45.69 billion respectively. The company also earns from Gaming, Web Service, and Education/Edtech sectors, with Gaming bringing in ¥32.04 billion.

Kadokawa Corporation, despite a recent downward revision in earnings guidance for FY 2026, with net sales now expected at JPY 278.2 billion and operating profit at JPY 10.3 billion, continues to innovate in the high-growth tech sector of Asia. The company's strategic pivot includes collaborations like the one with iQIYI for global distribution of animated series, tapping into international markets and broadening its revenue streams. With an annual revenue growth forecasted at 6.7% and earnings projected to grow by a substantial 31.8% annually, Kadokawa is navigating through its challenges by leveraging its creative IP and expanding its digital footprint in entertainment technology, despite current profitability pressures indicated by a recent profit margin decrease from last year's 3.8% to this year's 2.1%.

- Unlock comprehensive insights into our analysis of Kadokawa stock in this health report.

Review our historical performance report to gain insights into Kadokawa's's past performance.

ASROCK Incorporation (TWSE:3515)

Simply Wall St Growth Rating: ★★★★★★

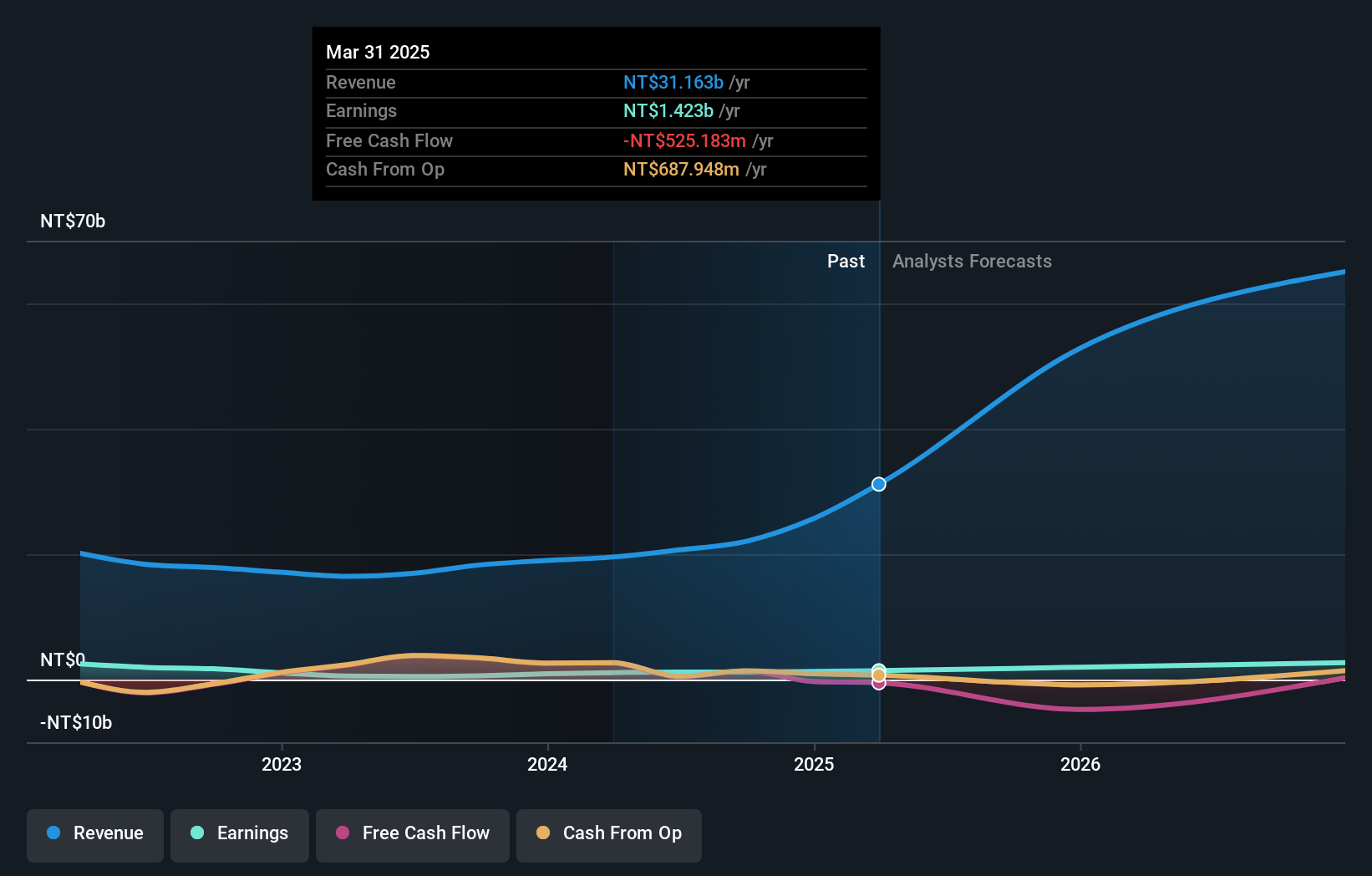

Overview: ASROCK Incorporation designs, develops, and sells motherboards across Asia, Europe, America, and internationally with a market capitalization of approximately NT$31.07 billion.

Operations: The company generates revenue primarily from the sale of motherboards, with reported sales amounting to NT$43.34 billion.

ASROCK Incorporation has demonstrated a robust performance with its recent earnings report showing a significant uptick in sales, nearly doubling from TWD 6,266.03 million to TWD 11,644.79 million year-over-year for the third quarter. This surge aligns with an annual revenue growth rate of 29.2%, outpacing the Taiwan market's average of 13.9%. The company's strategic focus on innovation is further evidenced by its R&D investments which have been pivotal in driving these financial gains and supporting a projected earnings growth of 28% annually, considerably higher than the market forecast of 20.5%. With this momentum, ASROCK is not only expanding its market share but also enhancing its technological offerings, positioning itself as a competitive player in Asia’s high-growth tech landscape despite the highly volatile share price observed over the past three months.

- Get an in-depth perspective on ASROCK Incorporation's performance by reading our health report here.

Explore historical data to track ASROCK Incorporation's performance over time in our Past section.

Next Steps

- Get an in-depth perspective on all 185 Asian High Growth Tech and AI Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal