High Growth Tech Stocks in Asia with Promising Potential

As Asia's technology sector continues to capture investor interest, recent market dynamics have shown a mix of optimism and caution, with indices like the CSI 300 and Shanghai Composite seeing gains amid broader economic uncertainties. In this environment, identifying high growth tech stocks involves looking for companies that not only innovate but also demonstrate resilience in navigating fluctuating market conditions and evolving consumer demands.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 36.73% | 37.89% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 35.50% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Zhuzhou Hongda ElectronicsLtd (SZSE:300726)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhuzhou Hongda Electronics Corp., Ltd. focuses on the R&D, manufacturing, sale, and servicing of electronic components and circuit modules in China with a market cap of CN¥22.20 billion.

Operations: The company generates revenue through the development and sale of electronic components and circuit modules, primarily serving the Chinese market. It engages in R&D, manufacturing, sales, and servicing activities to support its product offerings.

Zhuzhou Hongda Electronics has demonstrated robust financial performance with a 19.3% annual revenue growth and an even more impressive 28.6% increase in earnings per year, surpassing the broader Chinese market's averages of 14.6% and 27.6%, respectively. Recent strategic amendments to their corporate bylaws suggest a forward-looking approach to governance, aligning with their substantial R&D commitment which is evident from recent expenditures that bolster their competitive edge in the electronics sector. This focus on innovation, coupled with a strong earnings outlook, positions them well amidst Asia's dynamic tech landscape despite some industry challenges like slower overall tech growth rates.

Appier Group (TSE:4180)

Simply Wall St Growth Rating: ★★★★☆☆

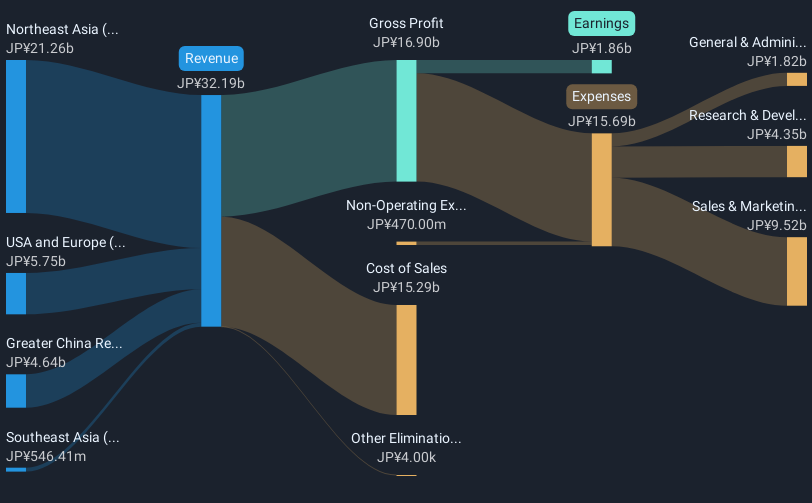

Overview: Appier Group, Inc. is an AI-native SaaS company that operates in Japan and internationally with a market capitalization of approximately ¥112.94 billion.

Operations: Appier Group generates revenue primarily from its AI SaaS business, which reported ¥40.52 billion. The company leverages artificial intelligence to deliver software solutions across various markets globally.

Appier Group, with a 19.6% annual revenue growth, outpaces the Japanese market's 4.6%, showcasing its robust position in the tech sector. This momentum is mirrored in its earnings, which have surged by 80.2% over the past year, significantly outperforming the software industry's growth of 22.5%. Despite a highly volatile share price recently and challenges like negative free cash flow, Appier's strategic focus on innovation through substantial R&D investments positions it for continued relevance in Asia’s competitive tech landscape. The recent board decision to issue stock options underscores a commitment to leveraging human capital for future growth, aligning with its impressive forecast of 31.5% annual earnings growth over the next three years.

- Dive into the specifics of Appier Group here with our thorough health report.

Review our historical performance report to gain insights into Appier Group's's past performance.

Chenming Electronic Tech (TWSE:3013)

Simply Wall St Growth Rating: ★★★★★☆

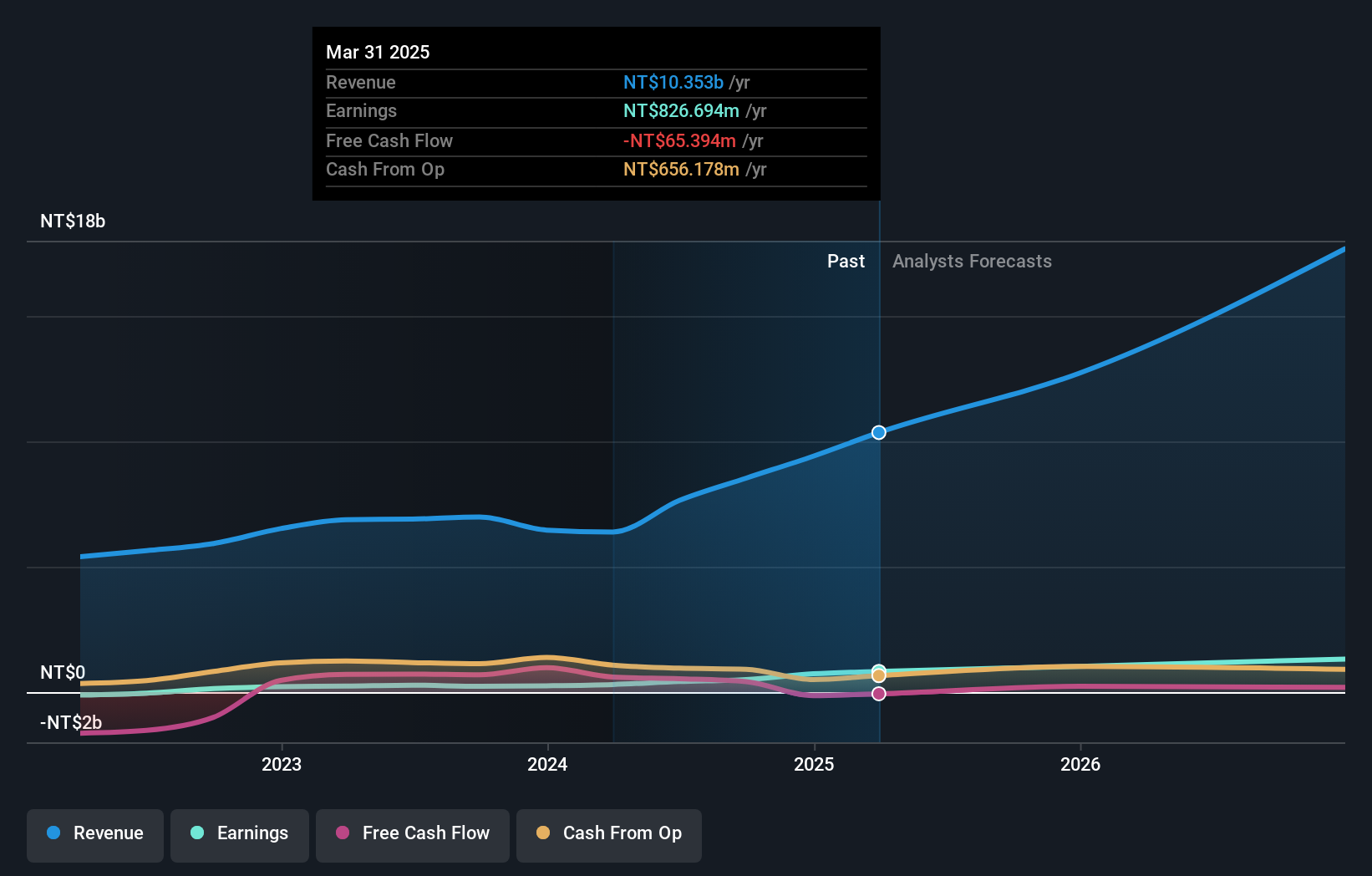

Overview: Chenming Electronic Tech. Corp., with a market cap of NT$26.46 billion, operates as an OEM/ODM manufacturer involved in the R&D, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and internationally.

Operations: The company generates revenue primarily from the production and sales of computer and mobile device components, amounting to NT$10.18 billion.

Chenming Electronic Tech has demonstrated robust growth, with its third-quarter earnings rising to TWD 217.27 million from TWD 164.48 million year-over-year, reflecting a strategic emphasis on expanding market share in the competitive tech sector of Asia. The company's commitment to R&D is evident as it aligns with an impressive forecasted annual revenue growth of 47.1% and earnings growth of 76.8%, significantly outpacing the Taiwanese market projections of 13.9% and 20.5%, respectively. This performance is underpinned by a surge in sales to TWD 7,499.63 million over nine months, up from TWD 6,727.29 million in the previous period, showcasing Chenming's ability to innovate and capture new opportunities despite a volatile share price recently.

- Navigate through the intricacies of Chenming Electronic Tech with our comprehensive health report here.

Evaluate Chenming Electronic Tech's historical performance by accessing our past performance report.

Make It Happen

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 182 more companies for you to explore.Click here to unveil our expertly curated list of 185 Asian High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal