Asian Penny Stocks Under US$2B Market Cap: 3 Promising Picks

As global markets continue to experience varied performances, Asian stock markets have shown resilience amid economic uncertainties. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.103 | SGD53.92M | ✅ 2 ⚠️ 4 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.92 | THB876M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.45 | SGD13.58B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.78 | HK$2.08B | ✅ 3 ⚠️ 2 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.71 | HK$20.83B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.60 | HK$53.4B | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.84 | NZ$238.83M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 966 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Food Empire Holdings (SGX:F03)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Food Empire Holdings Limited is a food and beverage manufacturing and distribution company operating in Russia, Ukraine, Kazakhstan and CIS markets, South-East Asia, South Asia, and internationally with a market cap of SGD1.31 billion.

Operations: The company's revenue is primarily derived from South-East Asia at $225.94 million, followed by Russia with $163.81 million, Ukraine, Kazakhstan and CIS contributing $135.79 million, and South Asia generating $93.69 million.

Market Cap: SGD1.31B

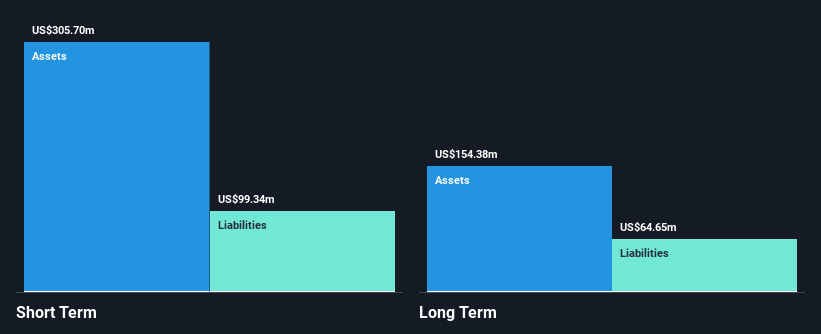

Food Empire Holdings has demonstrated financial resilience with strong liquidity, as its short-term assets of $333.6 million comfortably cover both short-term and long-term liabilities. Despite a challenging year with negative earnings growth of -48.7%, the company has maintained high-quality earnings and stable profit margins, although these have decreased from 11.8% to 5.2%. Recent revenue growth is notable, with a 23.9% increase for the nine months ending September 2025 compared to the previous year, reaching US$426.7 million. The company also initiated a share buyback program, indicating management's confidence in its value proposition despite ongoing challenges.

- Dive into the specifics of Food Empire Holdings here with our thorough balance sheet health report.

- Explore Food Empire Holdings' analyst forecasts in our growth report.

Routon Electronic (SHSE:600355)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Routon Electronic Co., Ltd. offers intelligent control and commercial terminal products in China, with a market cap of CN¥1.09 billion.

Operations: The company generates revenue of CN¥267.39 million from its operations in China.

Market Cap: CN¥1.09B

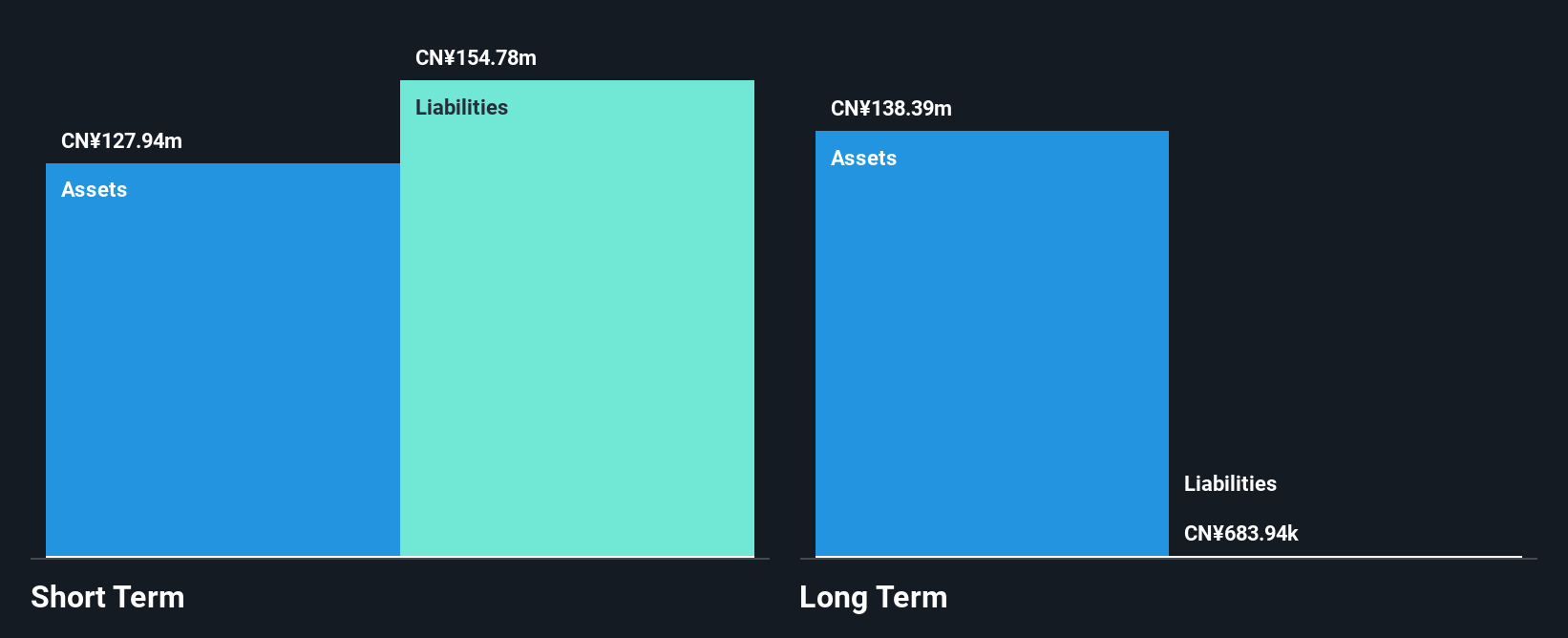

Routon Electronic Co., Ltd. has shown significant revenue growth, reporting CN¥228.89 million for the nine months ending September 2025, up from CN¥104 million a year earlier, despite remaining unprofitable with a net loss of CN¥27.12 million. The company maintains a satisfactory net debt to equity ratio of 23.1%, and its short-term assets exceed long-term liabilities but fall short in covering short-term obligations. While volatility has been stable and no shareholder dilution occurred over the past year, Routon's board lacks experience with an average tenure of just 1.1 years, which may impact strategic direction amidst ongoing financial challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Routon Electronic.

- Gain insights into Routon Electronic's historical outcomes by reviewing our past performance report.

Global Top E-Commerce (SZSE:002640)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Global Top E-Commerce Co., Ltd. is a cross-border e-commerce company operating in China and internationally, with a market cap of CN¥7.17 billion.

Operations: Global Top E-Commerce Co., Ltd. does not report specific revenue segments, but it operates in the cross-border e-commerce sector both within China and internationally.

Market Cap: CN¥7.17B

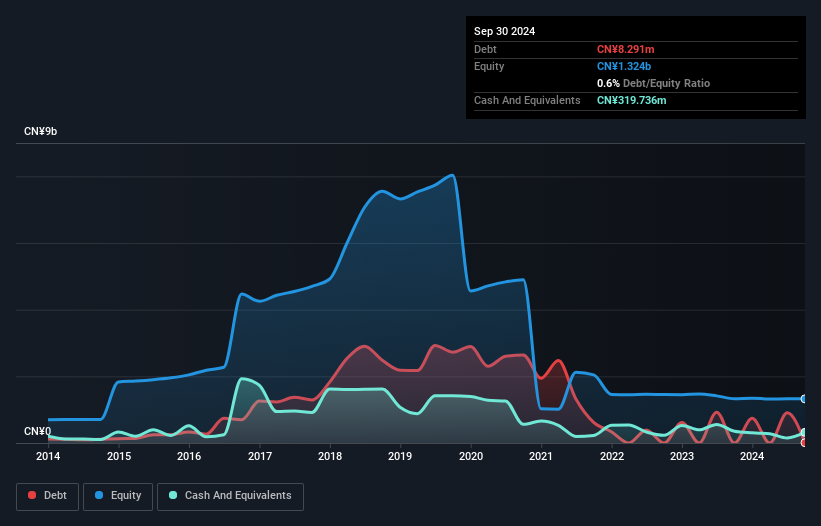

Global Top E-Commerce Co., Ltd. operates with a market cap of CN¥7.17 billion and reported sales of CN¥4.02 billion for the first nine months of 2025, though it remains unprofitable with a net loss of CN¥16.83 million. The company has eliminated its debt, improving financial stability, and possesses short-term assets worth CN¥2 billion, which do not fully cover its short-term liabilities of CN¥2.1 billion but exceed long-term obligations significantly. Recent amendments to company bylaws reflect governance changes that may affect strategic direction as the management team is relatively new with an average tenure of one year.

- Take a closer look at Global Top E-Commerce's potential here in our financial health report.

- Understand Global Top E-Commerce's track record by examining our performance history report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 966 Asian Penny Stocks by clicking here.

- Want To Explore Some Alternatives? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal