Undiscovered Gems In Australia To Watch This December 2025

As the Australian market winds down for the holiday season with a slight dip, largely due to profit-taking and in anticipation of Wall Street's highs, investors are turning their attention to commodities like gold and copper which have recently seen notable gains. In this environment, identifying promising small-cap stocks requires a keen eye for companies that can capitalize on these sector trends while navigating broader market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Spheria Emerging Companies | NA | -1.31% | 0.28% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Argosy Minerals | NA | -12.81% | -19.89% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Carlton Investments (ASX:CIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Carlton Investments Limited is a publicly owned asset management holding company with a market capitalization of A$911.96 million.

Operations: Carlton Investments generates revenue primarily through the acquisition and long-term holding of shares and units, amounting to A$41.60 million.

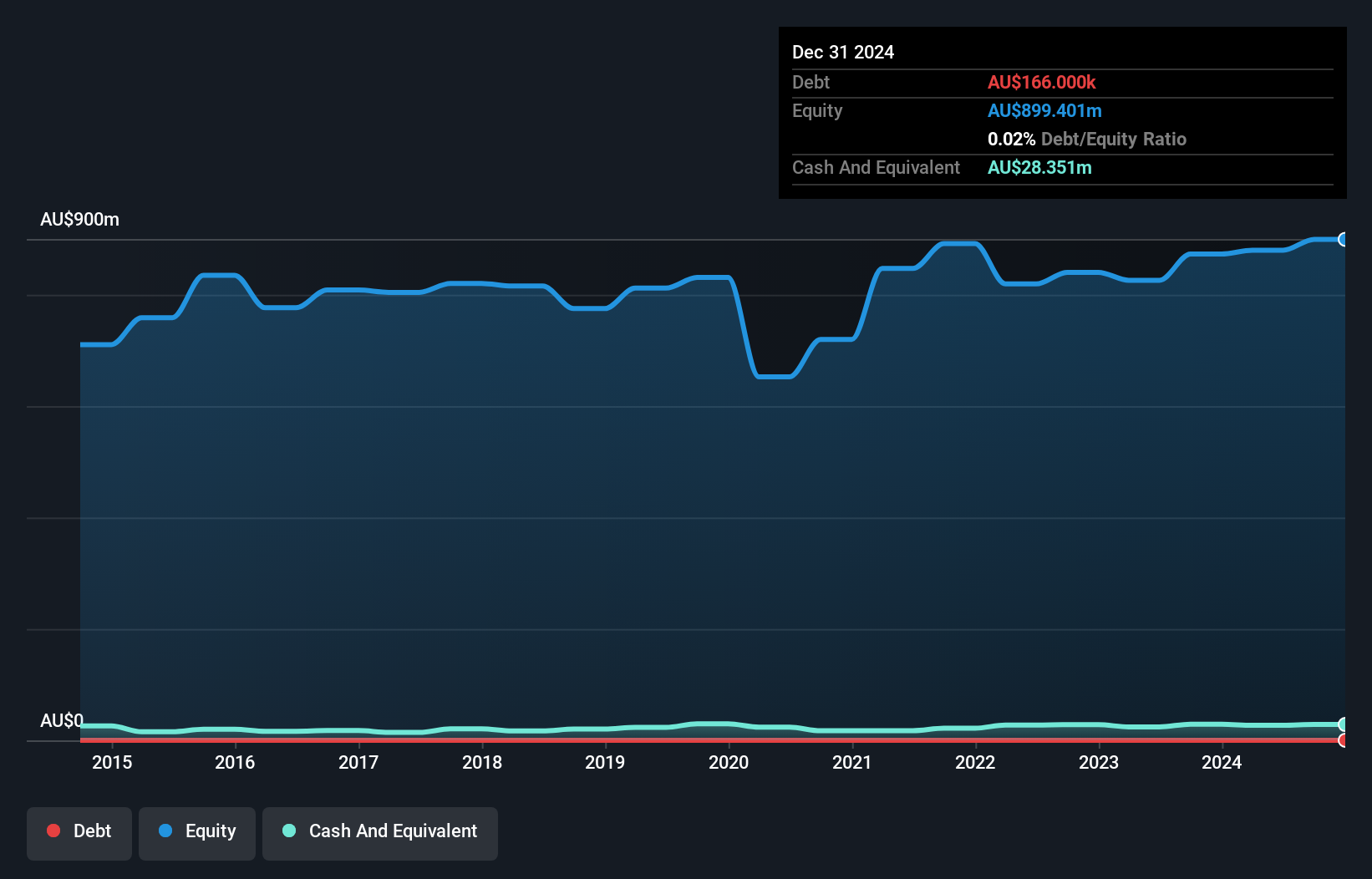

Carlton Investments, a relatively small player in the market, has shown a steady earnings growth of 8.7% annually over the past five years. Despite its modest size, it boasts high-quality earnings and maintains an impressive interest coverage ratio of 3390 times through EBIT. The company has effectively managed its debt levels, reducing the debt-to-equity ratio from 0.03% to 0.02% over five years, indicating prudent financial management. While recent earnings growth at 0.09% lagged behind industry standards of 6%, Carlton remains free cash flow positive with A$39 million recorded recently, suggesting solid operational health and potential for future stability.

- Click here to discover the nuances of Carlton Investments with our detailed analytical health report.

Evaluate Carlton Investments' historical performance by accessing our past performance report.

Metals X (ASX:MLX)

Simply Wall St Value Rating: ★★★★★★

Overview: Metals X Limited is an Australian company focused on tin production, with a market capitalization of A$975.03 million.

Operations: The primary revenue stream for Metals X Limited is its 50% stake in the Renison Tin Operation, generating A$271.38 million. The company focuses on tin production in Australia.

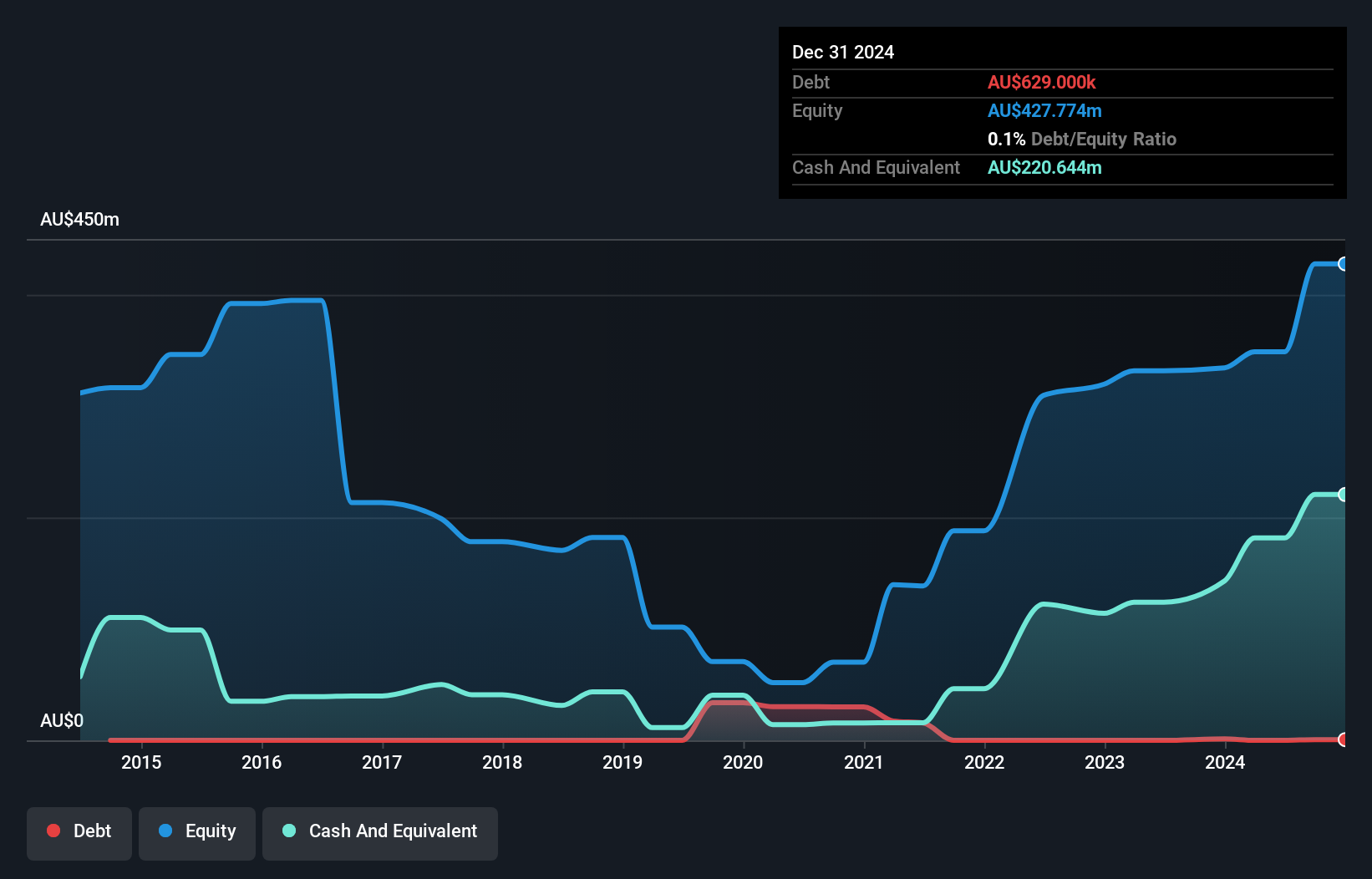

Metals X, a nimble player in the mining sector, boasts a remarkable earnings growth of 708% over the past year, outpacing the industry average of 10%. This performance is bolstered by its debt-free status, contrasting with a debt-to-equity ratio of 58% five years ago. With a price-to-earnings ratio at just 6.9x, it offers compelling value against the broader Australian market's 21.7x. However, recent financials include a significant A$38M one-off gain that might skew perceptions of ongoing profitability. Despite these fluctuations and forecasts suggesting declining earnings ahead, Metals X remains financially sound with positive free cash flow and no debt concerns.

- Take a closer look at Metals X's potential here in our health report.

Explore historical data to track Metals X's performance over time in our Past section.

Wagners Holding (ASX:WGN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wagners Holding Company Limited is involved in the production and sale of construction and related building materials across several countries, including Australia, the United States, and New Zealand, with a market capitalization of A$703.03 million.

Operations: Wagners generates revenue primarily from Construction Materials (A$257.69 million), Project Services (A$105.71 million), and Composite Fibre Technology (A$68.45 million). The company's net profit margin reflects its financial performance, influenced by its diverse revenue streams across multiple regions.

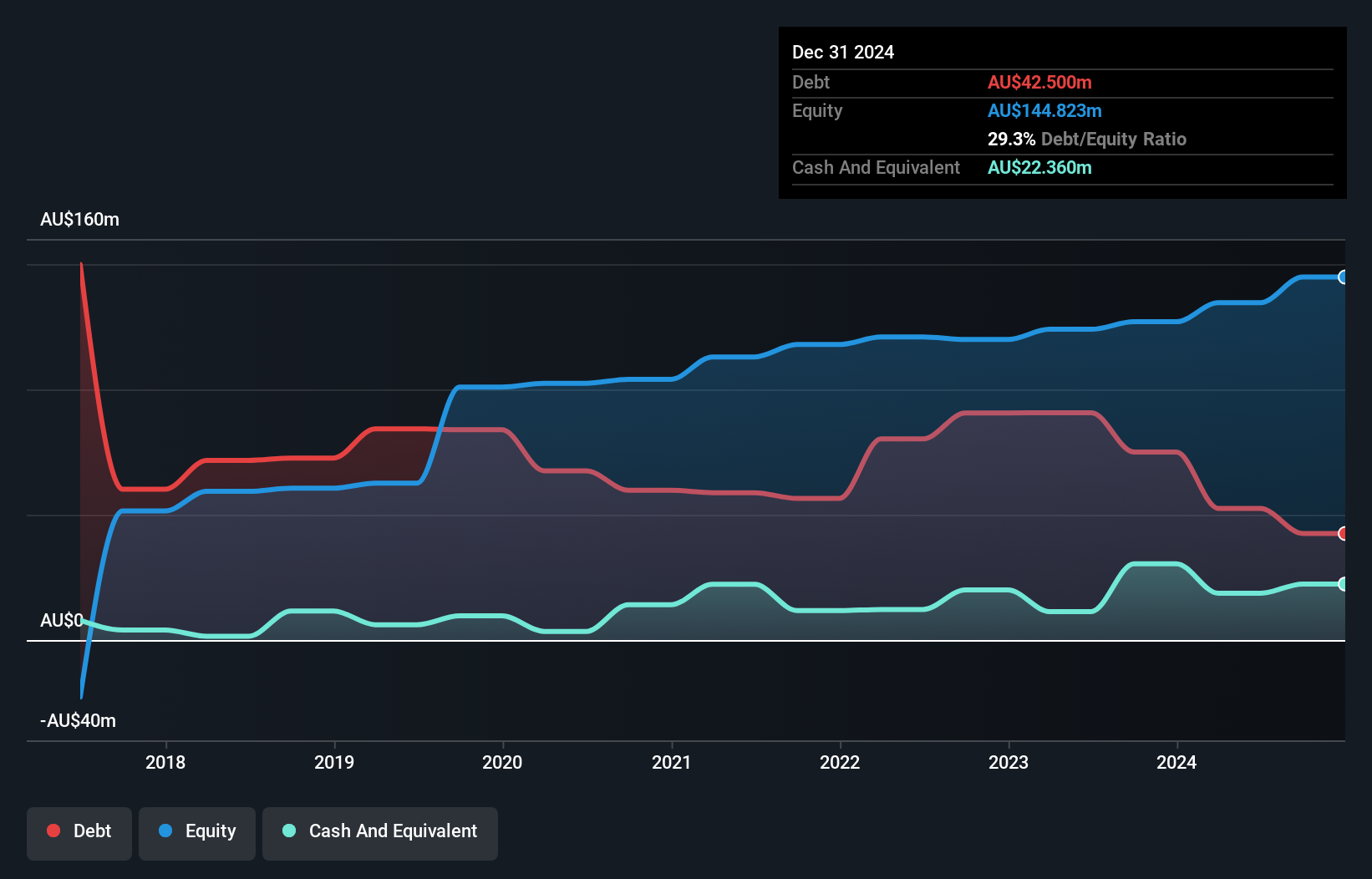

Wagners Holding, a small Australian player in the construction sector, is making waves with its focus on sustainable materials and infrastructure. Over the past year, earnings surged by 121%, outpacing industry growth of 3%. The company has reduced its debt to equity ratio from 66% to 28% over five years, showcasing financial prudence. With a net debt to equity ratio at a satisfactory 13%, Wagners seems well-positioned for future expansion. Analysts forecast an annual revenue growth of 6% for the next three years, although capital expenditure and raw material costs could impact earnings stability. Current share price sits at A$2.57 with an anticipated target of A$2.75.

Make It Happen

- Reveal the 59 hidden gems among our ASX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal