Slammed 28% CleanSpark, Inc. (NASDAQ:CLSK) Screens Well Here But There Might Be A Catch

CleanSpark, Inc. (NASDAQ:CLSK) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 12%.

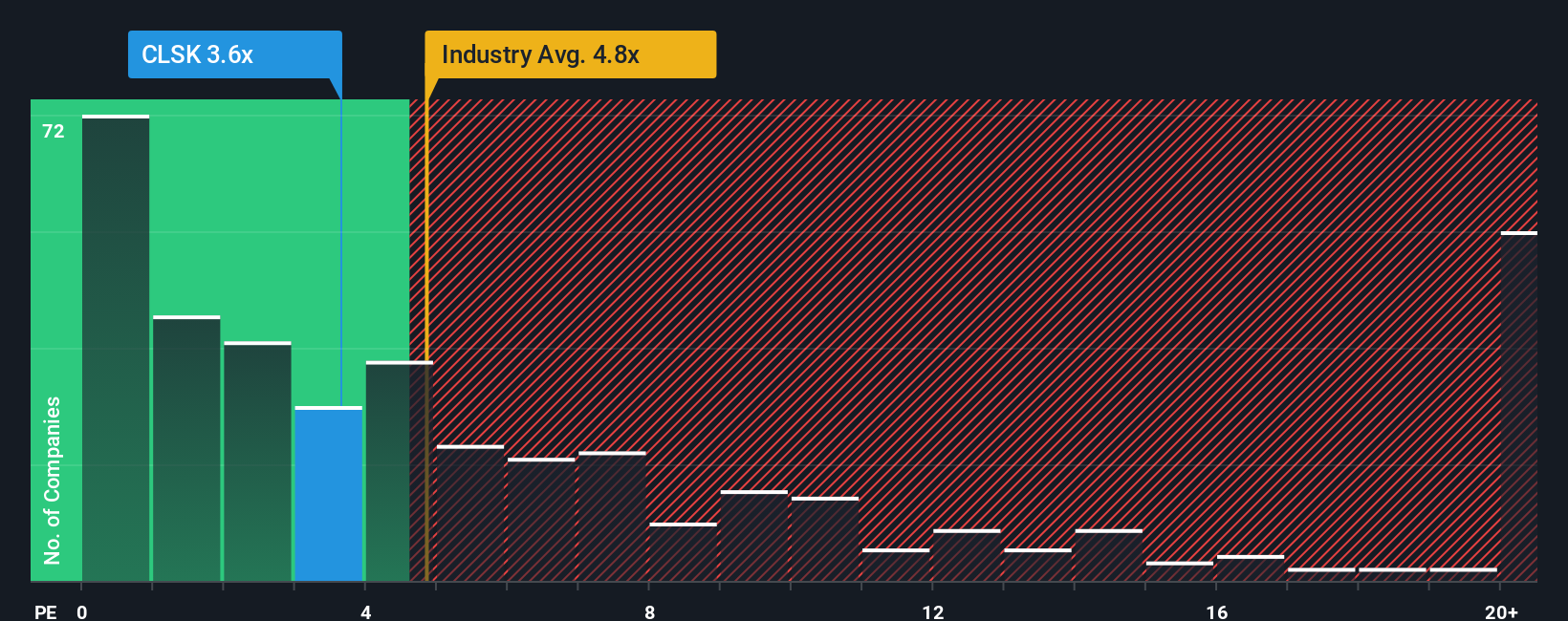

Following the heavy fall in price, CleanSpark's price-to-sales (or "P/S") ratio of 3.6x might make it look like a buy right now compared to the Software industry in the United States, where around half of the companies have P/S ratios above 4.8x and even P/S above 11x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for CleanSpark

How Has CleanSpark Performed Recently?

Recent times have been advantageous for CleanSpark as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CleanSpark.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, CleanSpark would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 102%. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 29% each year during the coming three years according to the ten analysts following the company. That's shaping up to be similar to the 30% each year growth forecast for the broader industry.

With this information, we find it odd that CleanSpark is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does CleanSpark's P/S Mean For Investors?

CleanSpark's recently weak share price has pulled its P/S back below other Software companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It looks to us like the P/S figures for CleanSpark remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with CleanSpark (at least 2 which can't be ignored), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal