abc Co., Ltd. (TSE:8783) May Have Run Too Fast Too Soon With Recent 25% Price Plummet

The abc Co., Ltd. (TSE:8783) share price has fared very poorly over the last month, falling by a substantial 25%. For any long-term shareholders, the last month ends a year to forget by locking in a 51% share price decline.

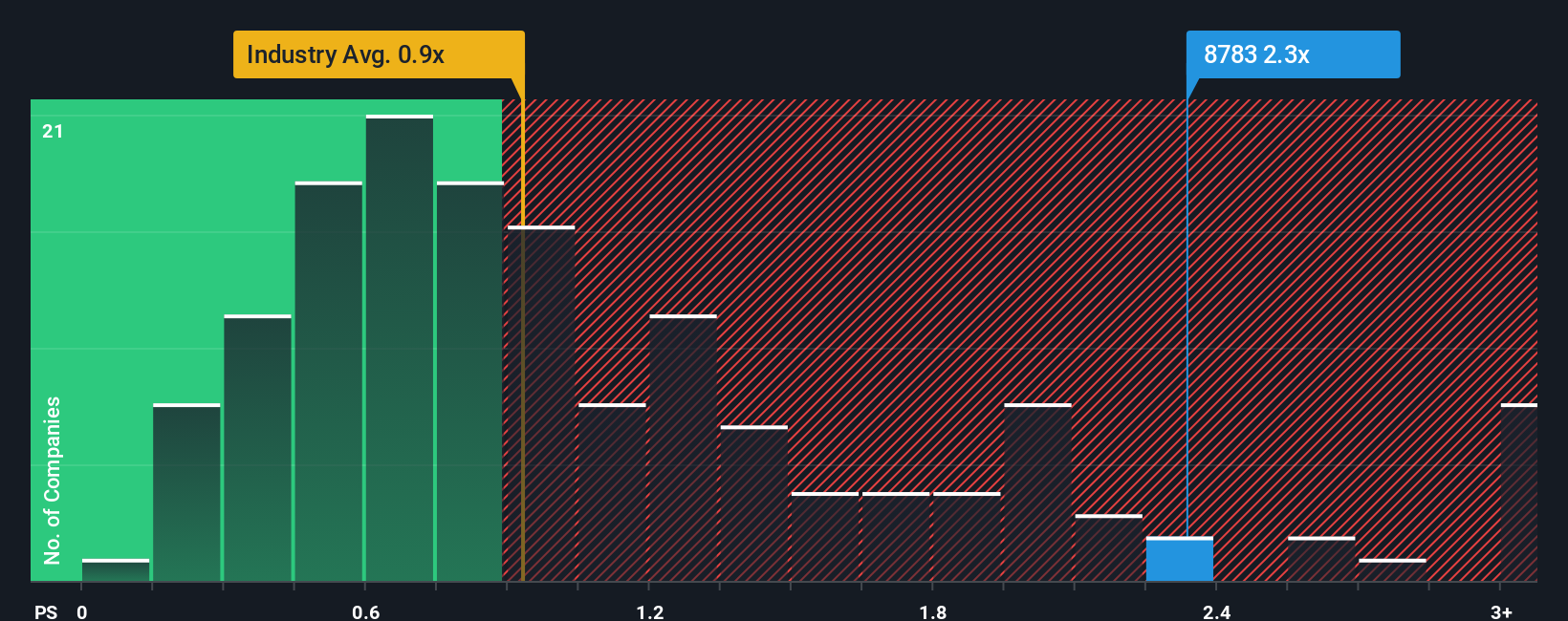

In spite of the heavy fall in price, when almost half of the companies in Japan's Hospitality industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider abc as a stock probably not worth researching with its 2.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for abc

How Has abc Performed Recently?

For example, consider that abc's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for abc, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is abc's Revenue Growth Trending?

In order to justify its P/S ratio, abc would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 36%. Still, the latest three year period has seen an excellent 74% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 32% shows it's noticeably less attractive.

In light of this, it's alarming that abc's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From abc's P/S?

There's still some elevation in abc's P/S, even if the same can't be said for its share price recently. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of abc revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

There are also other vital risk factors to consider and we've discovered 4 warning signs for abc (3 are significant!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal