Kratos Defense (KTOS) and Wayfair (W) lead the Bull Strangle Watch List this week

Dual Edge Research publishes two powerful newsletters that work great individually — and even better together. The Bull Strangle Newsletter focuses on stocks and options, combining stock ownership with premium-selling strategies to generate consistent income and market-beating returns. The Smart Spreads Newsletter specializes in seasonal commodity futures spreads, offering a diversified approach with low correlation to equities. Together, they deliver a complete investment perspective — one focused on income, the other on diversification — all under one simple subscription.

The Bull Strangle Newsletter, released weekly, shares a trading strategy that has achieved a documented 73%-win rate and outperformed the S&P 500 by 240% since inception. The strategy combines buying stock and simultaneously selling out-of-the-money covered calls and cash-secured puts to generate option premiums and manage risk.

Watch List Favorites

This week the Newsletter contains 19 stocks and ETFs across 8 sectors. 2 of the stocks on the Watch List are detailed below:

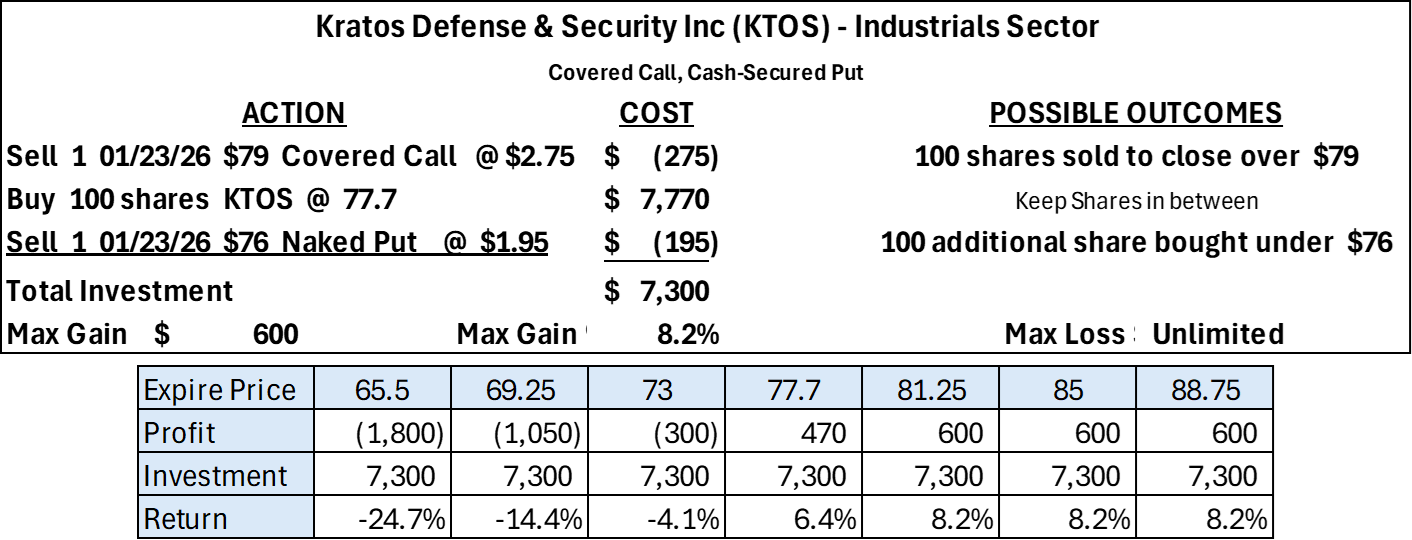

Kratos Defense & Security Solutions, Inc., (KTOS)

- Kratos Defense & Security Solutions, Inc., a technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Over the past several weeks, KTOS has been stabilizing after a sharp pullback from its peak, shifting from downside momentum into a choppier, constructive consolidation. Price has held above the rising longer-term trendline while reclaiming the 20-day moving average, suggesting buyers are defending support rather than exiting. The action reflects repair and base-building, with volatility compressing as the stock works to establish a firmer footing after the prior surge and correction.

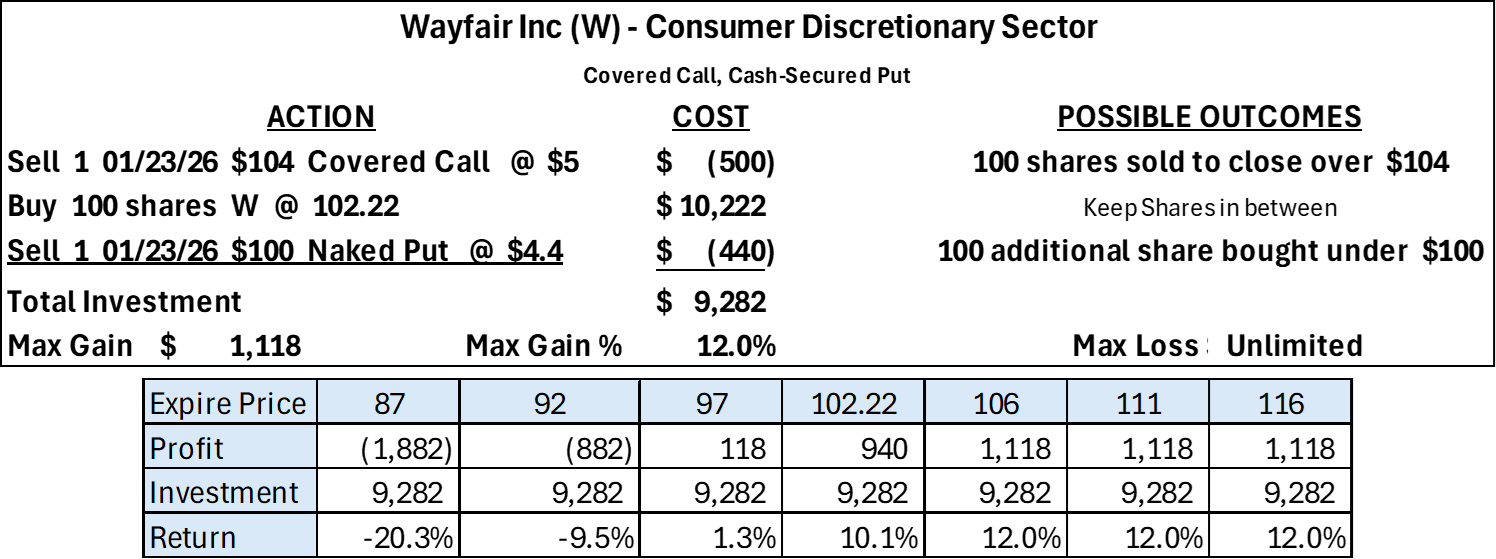

Wayfair Inc. (W)

- Wayfair Inc. engages in the e-commerce business in the United States and internationally. It offers online selections of furniture, decor, housewares, and home improvement products through its sites comprising Wayfair, Joss & Main, AllModern, Birch Lane, Perigold, and Wayfair Professional.

Over the past several weeks, Wayfair has been digesting a strong prior advance, trading sideways to slightly higher after pulling back from recent highs. W has held above its rising trendline and key moving averages, with buyers stepping in on dips and preventing deeper follow-through to the downside. The action suggests consolidation within an ongoing uptrend, as momentum cools but underlying support remains intact.

Past Performance

Each week the Newsletter contains around 20 stocks / ETF's on the Watch List to be opened the following Monday for expiration 4 Fridays later. Since the expiration cycle on May 23, the average stock gain on the Watch List has outperformed the S&P 500 25 of 31 weeks.

More Information

Now you can get two powerful newsletters — for one simple price!

- For stocks and options, the Bull Strangle Newsletter shows you how to combine stock ownership with dual option selling — a disciplined strategy that has consistently outperformed the S&P 500.

- For commodity futures, the Smart Spreads Newsletter focuses on seasonal commodity spreads — a proven, low-correlation approach that thrives in all types of markets.

Each newsletter is designed to deliver consistent income on its own — but when used together, they create a complete, diversified trading approach that works in any market environment.

Visit BullStrangle.com to subscribe for just $1 for the first month.

For a video overview of the Bull Strangle Newsletter

For a video overview of the Smart Spreads Newsletter

Darren Carlat

Dual Edge Research

(214) 636-3133

DualEdgeResearch@gamil.com

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal