The Power of Time Decay: How Weekly Cycles Can Boost Income

Dual Edge Research publishes two powerful newsletters that work great individually — and even better together. The Bull Strangle Newsletter focuses on stocks and options, combining stock ownership with premium-selling strategies to generate consistent income and market-beating returns. The Smart Spreads Newsletter specializes in seasonal commodity futures spreads, offering a diversified approach with low correlation to equities. Together, they deliver a complete investment perspective — one focused on income, the other on diversification — all under one simple subscription.

Introduction

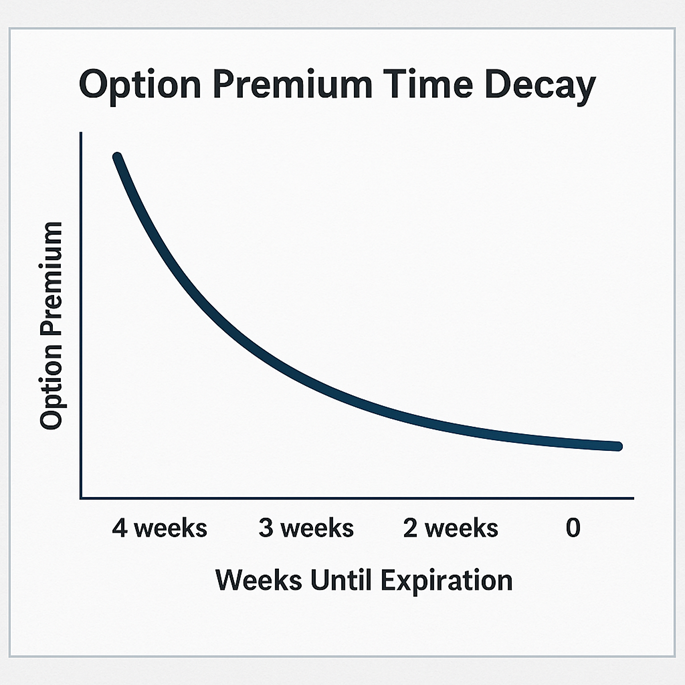

Most traders think of options in terms of direction—where a stock or commodity might move next. But buried beneath the constant motion of the markets is a force that behaves with unusual reliability: time decay. While prices can rise or fall unpredictably, time decay (theta) moves in one direction only. Every day, a portion of an option’s value melts away, and that decay accelerates as expiration approaches. For traders who build their strategies around this phenomenon—particularly those using structured, rules-based weekly cycles—time becomes a powerful ally.

But “weekly cycles” often leads to a misunderstanding. It does not mean holding options for only one week. Instead, it refers to using weekly-expiring options and entering new trades every Monday that are set to expire four Fridays later. In other words, weekly expirations provide flexibility, but the duration of each position is a full four-week hold, designed to maximize the steepest part of the time-decay curve.

Why Weekly Expirations Matter

Before weekly options were widely available, traders had only monthly expirations. That meant long gaps between cycles and no precise way to maintain a constant four-week rhythm. Weekly options changed that. They now allow traders to do something very specific:

- every Monday, choose options that expire four Fridays out, ~ 25 days to expiration.

This precision matters for three reasons:

- It allows consistent cycle construction. You always know that each new position has roughly the same time horizon, regardless of how the calendar month is arranged.

- It creates smooth weekly progressions. Each Friday one cycle matures; each Monday a new one takes its place. The ladder rolls forward automatically.

- It supports clean risk management. Very short-dated options (one week or less) are too sensitive to individual headlines and intraday events, while long-dated options dilute the rate of premium capture. Four weeks sit in the middle—long enough to let normal market noise resolve, short enough to keep time decay meaningful.

Why Time Decay Provides a Predictable Foundation

Every option has a fixed life, and the time value embedded in its price erodes steadily as expiration draws closer. This erosion becomes more pronounced in the final third of an option’s lifespan—precisely the period targeted by a four-week approach that uses weekly expirations. Unlike price direction or volatility spikes, time decay is:

- Stable

- Predictable

- Unaffected by headlines

- Mathematically unavoidable

A strategy built on time decay doesn’t require perfect forecasting. It requires consistency.

Volatility Interacts With Time Decay—But Doesn’t Replace It

Implied volatility influences option pricing dramatically. A sharp rise in volatility can inflate option premiums, temporarily slowing the appearance of time decay. But volatility is unstable; it expands and contracts in cycles. Time, on the other hand, never reverses.

This means that when volatility eventually normalizes, inflated premium collapses—and decay accelerates even more steeply. Weekly-expiring options with four-week durations benefit from this dynamic because they align with a window where volatility mean reversion and time decay often intersect.

Closing Thoughts — Putting Time Decay to Work in a Rules-Based Framework

Time decay is one of the most reliable forces in options trading, and weekly-expiring options—used with four-week holding periods—allow traders to harness the most favorable section of the decay curve repeatedly. When combined with structured entry timing, disciplined strike selection, and thoughtful risk management, this approach can turn the passage of time into a consistent income engine. For traders who want to see how these principles work in a fully executed, rules-based system, the Bull Strangle Newsletter demonstrates the four-week weekly cycle in real market conditions, applying every rule discussed in this article in a transparent, systematic way.

More Information

Now you can get two powerful newsletters — for one simple price!

- For stocks and options, the Bull Strangle Newsletter shows you how to combine stock ownership with dual option selling — a disciplined strategy that has consistently outperformed the S&P 500.

- For commodity futures, the Smart Spreads Newsletter focuses on seasonal commodity spreads — a proven, low-correlation approach that thrives in all types of markets.

Each newsletter is designed to deliver consistent income on its own — but when used together, they create a complete, diversified trading approach that works in any market environment.

Visit BullStrangle.com to subscribe for just $1 for the first month.

For a video overview of the Bull Strangle Newsletter

For a video overview of the Smart Spreads Newsletter

Darren Carlat

Dual Edge Research

(214) 636-3133

DualEdgeResearch@gamil.com

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal