Bursa’s quiet year sets stage for comeback

IF 2025 was a marathon, Bursa Malaysia struggled to keep pace.

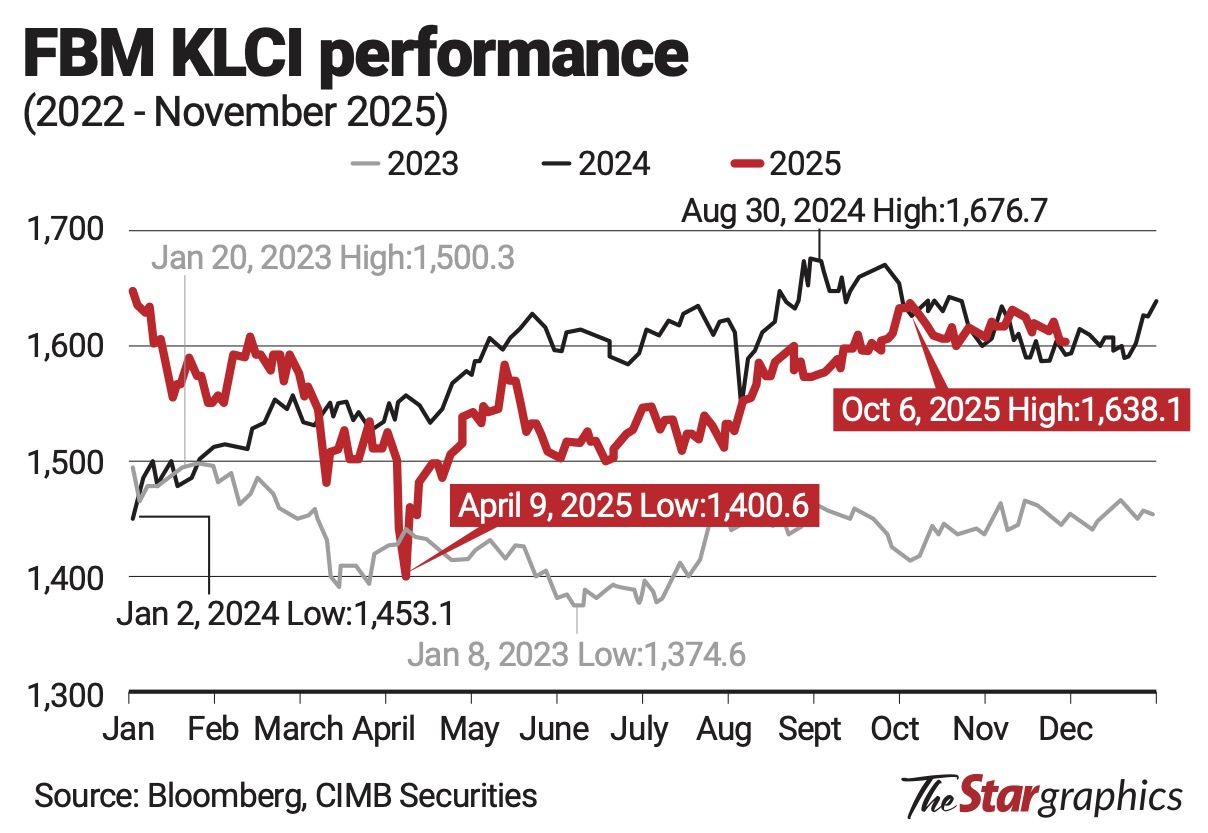

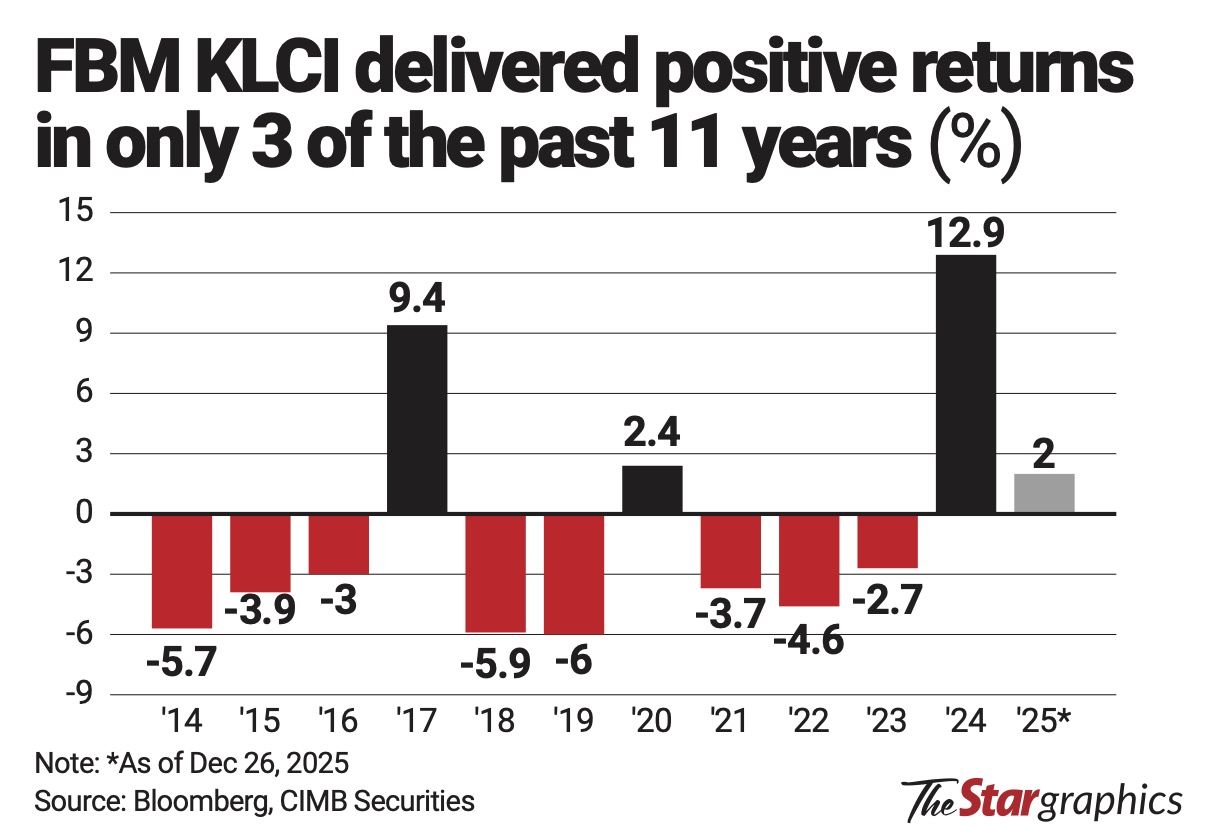

With three trading days to go in 2025, the local benchmark FBM KLCI is attempting to cross the tape with a one-year gain of 2% helped by late buying in liquidity-thin market conditions.

This is well below the double-digit gains seen on regional exchanges such as Singapore (20.67%), Indonesia (21.7%), Vietnam (32.38%), South Korea (66.47%), Taiwan (19%) and Hong Kong (27%).

Analysts warn it may be the same story in 2026 for Bursa Malaysia unless there is a collective effort to improve corporate performance and the market’s overall attractiveness.

Given its modest 1% weightage in the MSCI Emerging Markets index, the message to the government and regulators is to learn from what some regional exchanges have done to attract and retain capital.

Listed companies need to do some heavy lifting to translate Malaysia’s sustainable economic growth into stronger financial performances to attract both local and foreign investors.

As it stands, Manulife Investment Management (M) Bhd remains “neutral” on Malaysia heading into 2026, noting that the government faces little pressure to introduce additional stimulus as it is on track to meet deficit targets, while Bank Negara Malaysia is leaning towards tighter monetary policy given domestic growth dynamics.

“While Malaysia emerged as the fastest-growing data centre hub in 2025, capacity constraints suggest construction will slow in 2026,” it stated in a recent statement.

“Valuations are broadly neutral relative to other emerging markets, with consensus earnings growth of about 7% versus 16% for broader Asia.”

The tale at the tape in 2025In 2026, global markets will likely build on developments from 2025. President Donald Trump’s “Liberation Day” tariff announcement in early April initially sparked a global sell-off.

However, amid the volatility and uncertainty, economies and markets showed resilience, with many recovering to post historic highs.

A weaker US dollar triggered increased allocation to risk assets, gold rallied and the so-called “taco trade” became a mainstream strategy, while the artificial intelligence (AI) rally saw Nvidia of the Magnificent 7 stocks turn into US$5 trillion capitalised behemoth.

The cryptocurrency market also hit a fresh high before pulling back.

The initial tariff announcement saw the benchmark FBM KLCI hit a low of 1,386 points on April 9 before a tariff pause triggered gradual buying support that lifted the index.

This resilience was largely underpinned by local institutional support and explains why some believe Bursa Malaysia can add to its gains in 2026.

“We believe the FBM KLCI has been resilient, given that it managed to recover from its year low and turn positive year-to-date (y-t-d) with a strong push in December.

“This was despite various headwinds, notably uncertainties stemming from US trade policy (including tariffs) and earlier AI diffusion chip rule.

“Nevertheless, the FBM KLCI is still lagging behind other regional markets (except for Thailand and the Philippines). However, we believe this may be an opportunity for the market to carry its December momentum into 2026,” says Imran Yassin Yusof, director and head of research at MBSB Research.

Measured from its April low, the local benchmark is up about 21%. On a y-t-d basis, however, the local market failed to match regional peers such as Singapore and Taiwan in 2025, despite Malaysia’s real gross domestic product (GDP) growth forecast by the International Monetary Fund to expand by 4.6% in 2025 and moderate slightly to 4.3% in 2026.

How much of a gain or pullback Bursa Malaysia sees in 2026 may depend on how well local corporates align with the mega trends currently unfolding.

Market action in 2026From the macro perspective, 2026 is set to take the baton from how 2025 closes – marked by the US Federal Reserve and other central banks’ rate cuts that inject more liquidity into markets, Trump’s tariffs being challenged in US courts, and the AI theme successfully deflecting fears over concentration risk.

Ashley Lester, chief research and development (R&D) officer at MSCI, said the four mega trends that dominated 2025 will continue to shape investment flows in 2026.

The first is the interplay between geopolitics and institutional resilience. This year showed how quickly markets can reprice geopolitical shifts, such as the US tariff shocks.

“US ‘exceptionalism’ remains intact but carries higher institutional risk sensitivity. Investors may continue reallocating toward regions with strengthening fiscal or security regimes, particularly Europe and select emerging markets (EMs),” he tells StarBiz 7.

This could partly explain the RM22bil or more inflows into Malaysian Goverment Securities (MGS) debt in 2025.

Another major trend is the scale and evolution of AI-driven capital spending. Lester believes the AI value chain remains the gravitational centre of global investment, accounting for about 40% of global R&D spending, according to MSCI’s estimates.

This investment wave is broadening from chips to power, utilities, grid infrastructure and renewable energy systems.

“We expect this to remain a dominant force shaping cross-border flows, especially towards markets supporting stable, low-cost electrification,” he added.

Lester expects investor interest to broaden both horizontally across sectors and vertically across regions as the AI buildout becomes increasingly infrastructure and energy-intensive.

This creates natural diversification pathways – not an unwind of AI, but an expansion of the AI investment universe.

“AI remains the core engine of earnings growth. Our fundamental data shows that earnings growth in 2026 is projected to exceed 20% for stocks in our AI value chain basket, far outpacing other equities.

“The structural advantage is deep: AI-linked firms spend nearly four times more on R&D and twice as much on capital expenditure as global peers. This suggests AI momentum is unlikely to fade in 2026. However, the ‘AI trade’ is broadening across sectors and geographies,” he explained.

This could complicate the fund-flow dynamics for Bursa Malaysia, which saw RM21bil in outflows this year, partly due to AI-driven thematic allocation. By comparison, the FBM KLCI’s projected earnings growth of 7% to 8% in 2026 may appear less compelling to global investors.

The year 2025 already showed a widening set of beneficiaries – from semiconductors in 2024 to data centres, utilities, and renewable energy in 2025.

This diffusion may lower concentration risk not because investors are stepping away from AI, but because AI’s economic footprint now spans infrastructure, energy, industrials, and software adoption, Lester adds.

The third mega trend is energy system transformation as a market driver. Lester says as data centres are projected to account for a significant share of electricity-demand growth, clean energy infrastructure significantly outperformed fossil energy in 2025.

Hence, markets with competitive energy economics and predictable regulation may attract more capital, potentially shifting parts of the AI-infrastructure ecosystem beyond markets like the United States.

This could boost foreign direct investment (FDI) into Malaysia, which attracted some 32% of Asean’s AI investments.

The fourth mega trend is the expansion and fragility of private credit. Lester warns that private credit is now central to financing AI-related buildouts, with the share of semi-liquid structures growing significantly.

However, 2026 could test the asset class due to concerns over rising write-downs and mismatches between redemption expectations and illiquid assets.

Key to 2026

The AI thematic played a major role in capital allocation in 2025, as reflected in the strong performance of East Asian equity markets. Fund outflows from Asean markets (excluding Singapore) were partly a result of this trend, including the RM21bil outflow from Bursa Malaysia.

A stronger ringgit, cheap valuations, high levels of FDI, and reforms by the federal government failed to lure return-seeking foreign investors back to the Malaysian market in 2025.

This pushed cumulative net foreign outflows since 2010 to an all-time high of RM59bil (see chart).

To plug the leakage, listed companies need to translate the strong and sustainable growth in the real economy into better returns for shareholders and investors.

This could be key in 2026, as the exchange remains heavily weighted towards old-economy sectors such as banking, energy, and commodities.

With assets under management of about RM364bil, the bulk of it invested in Malaysian equities, Permodalan Nasional Bhd president and group chief executive Datuk Abdul Rahman Ahmad understands this challenge too well.

“Local corporates need to continue improving their performance – in terms of return on equity, earnings growth, and board focus on doing things that make sense to create shareholder value, whether by paying out more dividends, undertaking share buybacks, or pursuing mergers and acquisitions.

“These are the kinds of initiatives we will continue to push through our shareholder engagement with corporate Malaysia,” he said recently at a media briefing.

Abdul Rahman emphasised that building a viable and competitive market requires a shared commitment, adding that regulators, corporates, investors and other stakeholders must work together to strengthen Malaysia’s capital market and contribute to the nation’s long-term economic success.

As such, the 7% consensus earnings growth forecast for Bursa Malaysia-listed companies in 2026 should be viewed as the bare minimum benchmark for corporate leaders.

From the regulatory and government standpoint, initiatives such as progressive investment policy reforms and measures to enhance market accessibility are critical.

Malaysia has been rolling out policies to reduce transaction frictions – such as stamp duty reforms – and improve capital market efficiency, which could enhance cost competitiveness and attract both domestic and international capital flows.

Isaac Lim, chief market strategist for South-East Asia at online broker Moomoo, says that strengthening capital raising frameworks, improving market liquidity, and facilitating institutional investor participation will help maintain the local exchange’s relevance amid rising competition from exchanges across the region.

The Securities Commission is reviewing rules for the Main and ACE Markets to foster a more competitive and vibrant listing environment, including making it easier for high-potential, growth-stage firms to access public capital.

Lim says the reforms will help expand sector representation beyond traditional industries, making Bursa Malaysia more attractive relative to regional peers.

He adds that changing the narrative from commodities to a green energy hub could help Bursa Malaysia attract more investors and FDIs.

“By changing the narrative, utility stocks become proxy tech stocks, given that power is required to drive and support the demand of AI and tech through data centres,” he tells StarBiz 7.

Fostering stronger tech and growth narratives would help the local market better align with global mega trends and attract both local and international investors.

Clouds make way for sunshine

Much of Malaysia AI investments, such as Google’s US$2bil data centre, will be played out through proxies.

“As approved investments in digital infrastructure, chips and data centres are translated into actual projects on the ground, the beneficiaries on Bursa Malaysia are likely to be utilities, selected tech and electronics names, construction players, industrial real estate investment trusts and developers linked to these hubs.

“If execution stays on track, these segments could enjoy multi-year earnings tailwinds even if global AI valuations become more volatile at the headline level,” says Lim.

He adds that steady domestic growth, combined with a more benign global interest-rate environment, can help attract foreign flows back into reasonably valued markets with real-economy exposure to themes such as AI infrastructure, semiconductors and energy transition.

The key, however, is to recognise that these tailwinds don’t remove risk – they simply make the runway a bit smoother.

“For 2026, I think the real story will be in the earnings transmission from the investment pipeline we saw approved in 2025.

“Next year could be a year where Malaysia performs better – provided investors stay selective, continue to participate in the markets, and remain focused on structural winners rather than just the index level,” he says.

In the near term, foreign selling could persist. As foreign participation makes up about 40% of turnover, net selling may continue, given that the tech and AI theme remains in favour.

If the White House imposes another round of fresh tariffs, a pick-up in geopolitical tension will add further drag on the Malaysian markets, Lim warns.

Like Indonesia, if Malaysian equities see an increase in local participation, this could provide the boost the market needs.

However, the downside could be limited, as foreign investors’ light positioning leaves ample room for reallocation, with Malaysia’s banking sector expected to be the first to benefit, he says.

Banking stocks offer scale that foreign funds require – something many other local stocks lack. Moomoo believes the FBM KLCI could end 2026 in the range of 1,730 to 1,800 points, with technology, energy and financials driving growth.

Manulife notes that when considering opportunities in Malaysia, a key factor is the management team’s ability to navigate global risks, which requires ongoing monitoring and evaluation of their track record.

It says the impact of global uncertainties can be mitigated by prioritising companies with robust cash flows and healthy balance sheets, ensuring resilience in challenging environments.

MBSB Research says sustained GDP growth, data centre investments and Visit Malaysia 2026 could propel the FBM KLCI to hit 1,750 points next year, backed by 7.7% growth in earnings.

Its top picks include Malayan Banking Bhd, Public Bank Bhd, RHB Bank Bhd, Gamuda Bhd, Tenaga Nasional Bhd, Sunway-REIT, and YTL Power International Bhd.

Phillip Research also expects the FBM KLCI to edge higher to 1,710 point in 2026, helped by easing trade tensions and a more accommodative global monetary policy.

A firm ringgit, attractive market valuations, and continued support from government-linked companies for large-cap stocks should improve risk-reward dynamics and enhance liquidity ahead of the general election.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal