3 Stocks Estimated To Be Undervalued In December 2025

As we approach the end of 2025, the U.S. stock market is experiencing a period of notable strength, with major indices like the S&P 500 reaching fresh all-time highs amid a backdrop of rising precious metal prices and stable Treasury yields. In this environment, identifying undervalued stocks becomes crucial for investors looking to capitalize on opportunities that may not be immediately apparent in a thriving market.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zymeworks (ZYME) | $26.86 | $52.57 | 48.9% |

| UMB Financial (UMBF) | $118.90 | $233.12 | 49% |

| Sportradar Group (SRAD) | $23.11 | $45.56 | 49.3% |

| SmartStop Self Storage REIT (SMA) | $31.57 | $61.45 | 48.6% |

| Perfect (PERF) | $1.75 | $3.42 | 48.9% |

| Nicolet Bankshares (NIC) | $124.56 | $242.21 | 48.6% |

| Community West Bancshares (CWBC) | $22.74 | $44.11 | 48.4% |

| Columbia Banking System (COLB) | $28.62 | $56.93 | 49.7% |

| Clearfield (CLFD) | $29.43 | $58.37 | 49.6% |

| BioLife Solutions (BLFS) | $25.41 | $49.94 | 49.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Pinnacle Financial Partners (PNFP)

Overview: Pinnacle Financial Partners, Inc. operates as the bank holding company for Pinnacle Bank, offering a range of banking products and services to individuals, businesses, and professional entities in the United States, with a market cap of $7.79 billion.

Operations: The company generates revenue of $1.89 billion from its banking segment, providing a variety of financial products and services across the United States.

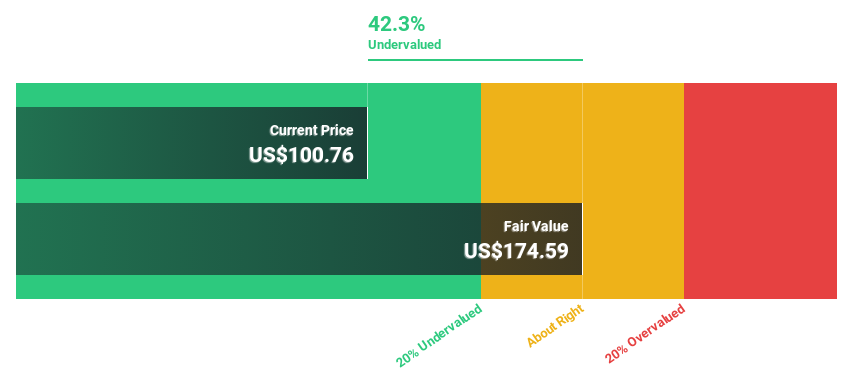

Estimated Discount To Fair Value: 32.3%

Pinnacle Financial Partners is trading at US$101.3, significantly below its estimated fair value of US$149.58, suggesting it might be undervalued based on cash flows. The company's earnings and revenue are expected to grow substantially faster than the market over the next three years, despite a forecasted low return on equity of 11.3%. Recent regulatory approvals for a merger with Synovus Financial Corp could influence future performance and integration efforts are underway for completion by 2027.

- The analysis detailed in our Pinnacle Financial Partners growth report hints at robust future financial performance.

- Take a closer look at Pinnacle Financial Partners' balance sheet health here in our report.

Seacoast Banking Corporation of Florida (SBCF)

Overview: Seacoast Banking Corporation of Florida, with a market cap of $3.14 billion, operates as the bank holding company for Seacoast National Bank, offering integrated financial services to retail and commercial customers in Florida.

Operations: The company's revenue primarily comes from providing integrated financial services, amounting to $556.54 million.

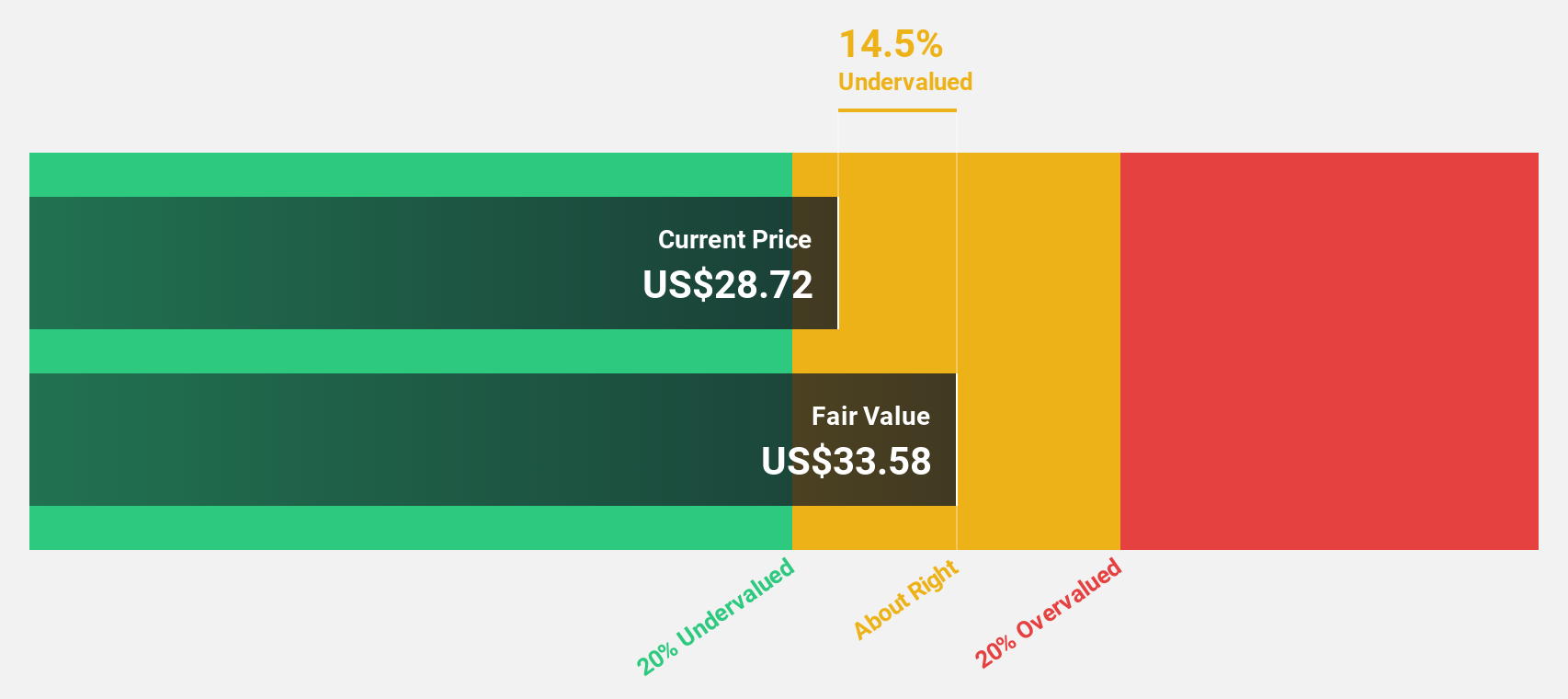

Estimated Discount To Fair Value: 15%

Seacoast Banking Corporation of Florida is trading at US$32.49, below its fair value estimate of US$38.2, indicating potential undervaluation based on cash flows. Despite a low forecasted return on equity of 9.2%, earnings are expected to grow significantly faster than the market at 38.4% annually over the next three years. Recent developments include a share repurchase program for up to $150 million and an increase in dividends, reflecting strong financial health and shareholder returns focus.

- Our earnings growth report unveils the potential for significant increases in Seacoast Banking Corporation of Florida's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Seacoast Banking Corporation of Florida.

Schrödinger (SDGR)

Overview: Schrödinger, Inc. develops a physics-based computational platform for discovering novel molecules used in drug development and materials applications, with a market cap of approximately $1.35 billion.

Operations: The company's revenue is derived from two main segments: Software, contributing $209.88 million, and Drug Discovery, accounting for $47.07 million.

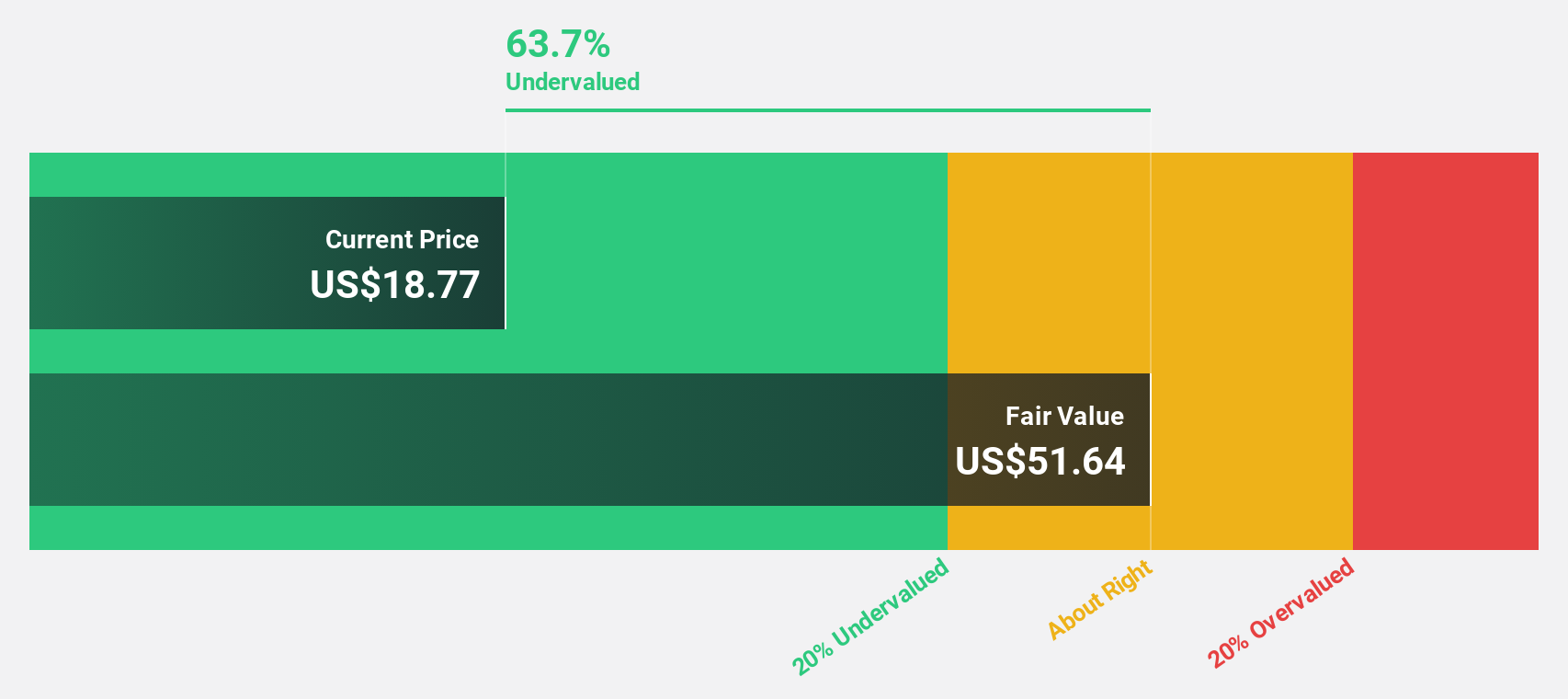

Estimated Discount To Fair Value: 48.1%

Schrödinger, Inc. is trading at US$18.38, significantly below its estimated fair value of US$35.45, suggesting it may be undervalued based on cash flows. The company reported strong revenue growth for Q3 2025 at US$54.32 million compared to the previous year's US$35.29 million and reduced net losses from the prior year. Strategic collaborations like the Neptune catalyst project with Copernic Catalysts could enhance future profitability and operational efficiency in ammonia production and other chemical processes.

- Upon reviewing our latest growth report, Schrödinger's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Schrödinger with our comprehensive financial health report here.

Make It Happen

- Dive into all 208 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal