2025 Tech Circle: Oracle (ORCL.US) Ellison overtakes Musk

The Zhitong Finance App notes that at the beginning of 2025, it seems that a billionaire with a close relationship with the White House will definitely become the most watched tech giant of the year. However, after 12 months of turbulence, Larry Ellison, not Elon Musk, had every reason to take this title.

The 81-year-old co-founder and chairman of Oracle (ORCL.US) has been ubiquitous — from the crazy artificial intelligence boom (or bubble) to the huge deals that stirred up Hollywood, he played a role in almost every major business news this year. Oracle is even planning to take a stake in TikTok as part of a tortuous plan to help Trump meddle in the popular video app. In the process, Ellison's wealth fluctuated along with Oracle's stock price—this became a “heat curve” in this turbulent era.

The year began with Stargate, probably the most ambitious of all data center projects. On January 21, the second day of Trump's inauguration, the President appeared at the White House with Ellison, OpenAI's Sam Ultrman, and SoftBank Group CEO Sun Zhengyi to announce a $500 billion artificial intelligence infrastructure construction plan. That day was full of exaggerations — “100,000 jobs!” ——And some skeptics think this huge sum is more like a lofty vision.

Since then, Oracle has begun a historic large-scale expansion of data centers optimized for artificial intelligence, and the progress has exceeded the expectations of some people. This attempt led to the company's cash flow turning negative for the first time since the early 1990s. However, Ellison, who was famous for missing out on the cloud computing revolution 15 years ago, suddenly became an AI fanatic.

In the summer, OpenAI signed an agreement worth around $300 billion to rent a large amount of computing power from Oracle, making this leading artificial intelligence lab Oracle's biggest customer.

Investors rejoiced in September when Oracle revealed the full scale of its OpenAI business. Ellison's net worth surged $89 billion to $388 billion in a single day, the biggest single-day increase recorded by the Billionaires Index. This enabled him to surpass Musk at one point and become the richest man in the world for a short time.

His rapidly growing wealth fits perfectly with his son David's ambition to become a Hollywood mogul. In August, David Ellison's Skydance Media finally closed a deal to gain control of Paramount, which was mainly funded by Ellison Ellison the Elder.

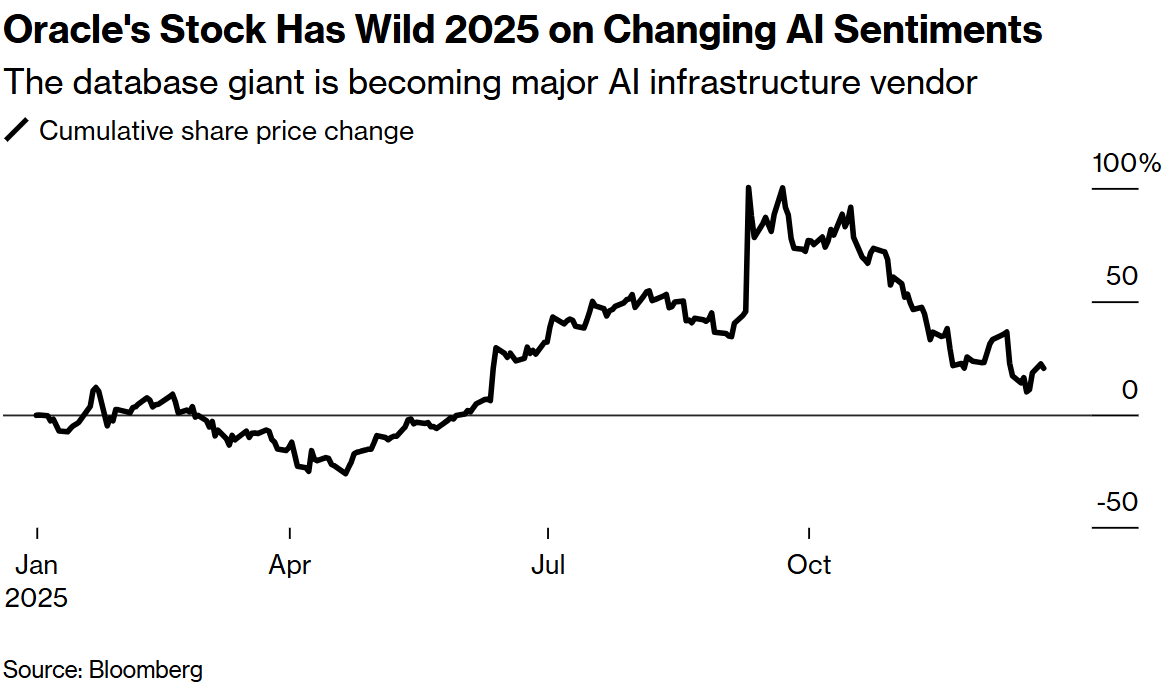

Affected by changes in artificial intelligence market sentiment, Oracle stock fluctuated sharply in 2025

A few weeks after completing the Paramount deal, David Ellison set his sights on Warner Bros. Discovery and proposed to take over the company that owns the rights to Batman, Harry Potter, and Bugs Bunny. His father offered to help finance the deal and personally lobbied Warner Bros. executives.

However, in the end, this was in vain. Warner Brothers rejected the Paramount Sky Dance (PSKY.US) bid and instead accepted Netflix's (NFLX.US) offer. Ellison Jr. then initiated a hostile takeover — a method his father used when he bought software company PeopleSoft in the early 21st century.

Paramount's second offer was rejected again, and Warner Bros. expressed doubts that the company could fulfill the equity portion of the offer. In response, Larry Ellison agreed to provide personal guarantees for the $40.4 billion financing.

It's a lot of money, even for him. Ellison's wealth has shrunk in recent months, stemming from the fall in Oracle's stock price. Many investors are skeptical about overall AI spending and believe that compared to its peers, Oracle is particularly vulnerable because it has accumulated huge debts to fund the data center construction boom, and a large portion of its future business is counting on OpenAI.

Ellison is currently the fifth richest person in the world, with a net worth of just under $250 billion. As a result, he has sufficient assets to fulfill this guarantee multiple times. However, since his assets are highly concentrated in Oracle shares, it is currently unclear how much cash he can immediately use if required to provide full $40.4 billion in financial support, which increases the possibility that he may have to resort to selling shares or pledging more shares.

Until 2025, Ellison mainly used his money to collect “loot” — including airplanes, sailboats, real estate in Malibu, and much of the land in Lanai, Hawaii. He has ventured into Hollywood by supporting his children's movies. His wealth is now tightly tied to the competitive artificial intelligence market and a Hollywood company headed by his son.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal