Undiscovered Gems In Global Featuring 3 Promising Small Caps

As global markets navigate a complex landscape marked by mixed performances across key indices and shifting economic indicators, small-cap stocks present intriguing opportunities for investors. In this environment, identifying promising small-cap companies requires a keen eye for those with strong fundamentals and the potential to thrive amid broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Suzhou Sepax Technologies | 1.11% | 20.70% | 32.08% | ★★★★★★ |

| KinjiroLtd | 19.52% | 9.13% | 29.10% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Aurora OptoelectronicsLtd | 4.19% | -12.12% | 20.63% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Jiangsu Dingsheng New Materials Ltd (SHSE:603876)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Dingsheng New Materials Ltd focuses on the research, development, production, and sale of aluminum plates and foils with a market cap of CN¥12.74 billion.

Operations: With a market cap of CN¥12.74 billion, the company generates revenue primarily from the research and development, design, and sales of aluminum sheets, strips, and foils amounting to CN¥26.01 billion.

Jiangsu Dingsheng New Materials, a company in the metals and mining sector, has shown promising financial performance with earnings growth of 31.6% over the past year, outpacing the industry average of 8.4%. The firm reported net income of CNY 306.73 million for the first nine months of 2025, up from CNY 224.54 million in the previous year. Its price-to-earnings ratio stands at a competitive 34.7x compared to the CN market's average of 45x, suggesting potential value for investors. Despite recent share price volatility, its debt profile is strong with a satisfactory net debt to equity ratio at 22.4%.

Pan Asian Microvent Tech (Jiangsu) (SHSE:688386)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pan Asian Microvent Tech (Jiangsu) Corporation specializes in the R&D, design, production, and sale of e-PTFE micro-permeable membranes and aerogels globally, with a market cap of CN¥6.89 billion.

Operations: The company generates revenue primarily from the sale of e-PTFE micro-permeable membranes and aerogels. A notable aspect of its financial performance is the net profit margin, which has shown variability across different reporting periods.

Pan Asian Microvent Tech (Jiangsu) has shown a solid financial performance, with earnings growing 30.7% over the past year, surpassing the Chemicals industry average of 6.8%. The company reported sales of CNY 500.46 million for the first nine months of 2025, up from CNY 352.35 million in the previous year, while net income rose to CNY 90.71 million from CNY 66.61 million a year ago. Although its debt to equity ratio increased to 45.8% over five years, it remains satisfactory at a net debt to equity ratio of 35.4%. A recent private placement aims to raise approximately CNY 671 million by issuing shares below market price, indicating strategic capital raising efforts amidst robust revenue growth projections of over 40% annually.

- Unlock comprehensive insights into our analysis of Pan Asian Microvent Tech (Jiangsu) stock in this health report.

Learn about Pan Asian Microvent Tech (Jiangsu)'s historical performance.

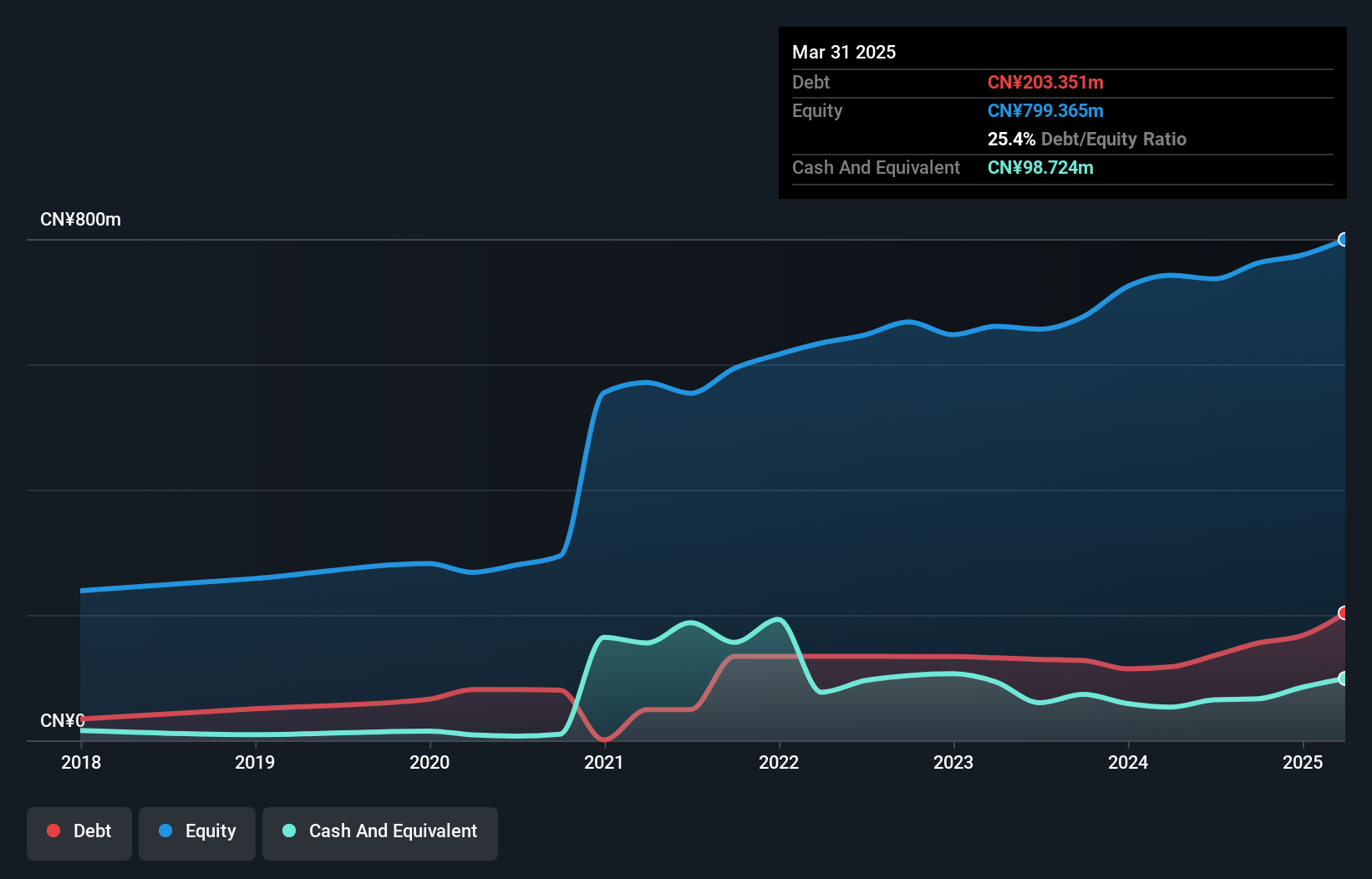

Goldenmax International Group (SZSE:002636)

Simply Wall St Value Rating: ★★★★★★

Overview: Goldenmax International Group Ltd. manufactures and distributes copper clad laminates for the electronics industry both in China and internationally, with a market cap of CN¥11.91 billion.

Operations: Goldenmax International Group generates revenue primarily from the production and sale of copper clad laminates. The company has a market capitalization of CN¥11.91 billion.

Goldenmax International Group, a nimble player in the market, has seen its earnings grow by 532% over the past year, outpacing the electronic industry’s growth rate of 9%. Despite a highly volatile share price recently, this debt-free company reported net income of CNY 172.93 million for the first nine months of 2025, up from CNY 99.44 million last year. The recent private placement aims to raise CNY 1.3 billion from select investors, indicating strategic moves to enhance capital structure and possibly fuel future expansion plans amidst ongoing changes in their governance framework.

Turning Ideas Into Actions

- Reveal the 2997 hidden gems among our Global Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal