Knafaim Holdings Ltd.'s (TLV:KNFM) CEO Looks Like They Deserve Their Pay Packet

Key Insights

- Knafaim Holdings' Annual General Meeting to take place on 1st of January

- Salary of US$318.1k is part of CEO Eran Ben-Menahem's total remuneration

- Total compensation is similar to the industry average

- Knafaim Holdings' total shareholder return over the past three years was 172% while its EPS grew by 61% over the past three years

We have been pretty impressed with the performance at Knafaim Holdings Ltd. (TLV:KNFM) recently and CEO Eran Ben-Menahem deserves a mention for their role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 1st of January. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is not extravagant.

See our latest analysis for Knafaim Holdings

Comparing Knafaim Holdings Ltd.'s CEO Compensation With The Industry

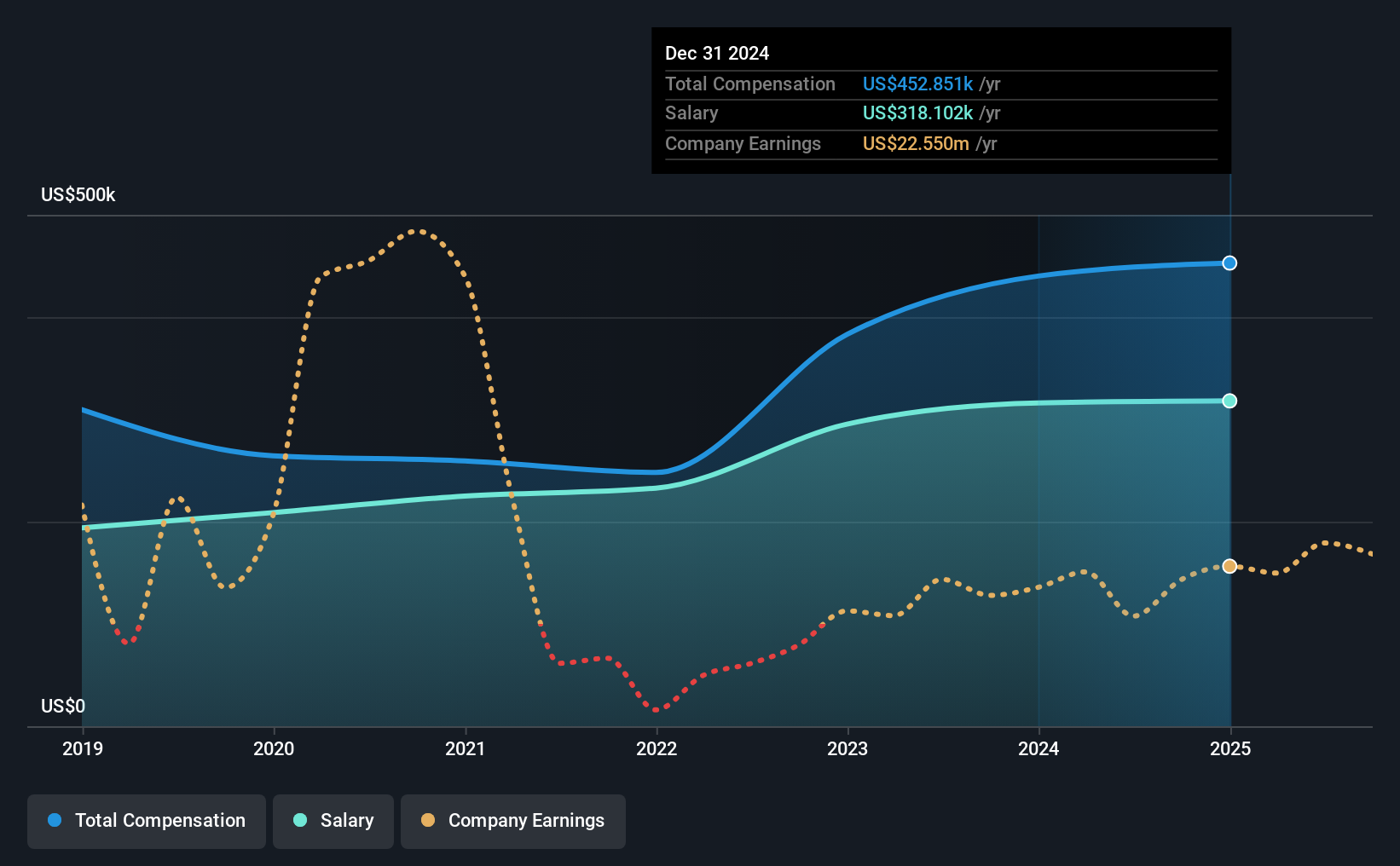

According to our data, Knafaim Holdings Ltd. has a market capitalization of ₪274m, and paid its CEO total annual compensation worth US$453k over the year to December 2024. That is, the compensation was roughly the same as last year. Notably, the salary which is US$318.1k, represents most of the total compensation being paid.

For comparison, other companies in the Israel Airlines industry with market capitalizations below ₪637m, reported a median total CEO compensation of US$428k. From this we gather that Eran Ben-Menahem is paid around the median for CEOs in the industry.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$318k | US$316k | 70% |

| Other | US$135k | US$124k | 30% |

| Total Compensation | US$453k | US$440k | 100% |

Speaking on an industry level, nearly 68% of total compensation represents salary, while the remainder of 32% is other remuneration. Knafaim Holdings is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Knafaim Holdings Ltd.'s Growth Numbers

Over the past three years, Knafaim Holdings Ltd. has seen its earnings per share (EPS) grow by 61% per year. It achieved revenue growth of 2.1% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Knafaim Holdings Ltd. Been A Good Investment?

Most shareholders would probably be pleased with Knafaim Holdings Ltd. for providing a total return of 172% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 4 warning signs for Knafaim Holdings (of which 2 make us uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal