Middle Eastern Penny Stocks To Watch In December 2025

As the year draws to a close, Middle Eastern stock markets have faced challenges, with most Gulf indices declining due to lower oil prices impacting investor sentiment. Despite these broader market pressures, penny stocks remain an intriguing area for investors seeking opportunities in smaller or newer companies. Although the term "penny stocks" may seem outdated, these investments can still offer value and growth potential when backed by strong financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.30 | SAR1.32B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.503 | ₪179.5M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.05 | AED2.14B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.79 | SAR956M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.25 | AED386.93M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.68 | AED15.6B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.826 | AED502.42M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.577 | ₪202.29M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 82 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

HAYAH Insurance Company P.J.S.C (ADX:HAYAH)

Simply Wall St Financial Health Rating: ★★★★★★

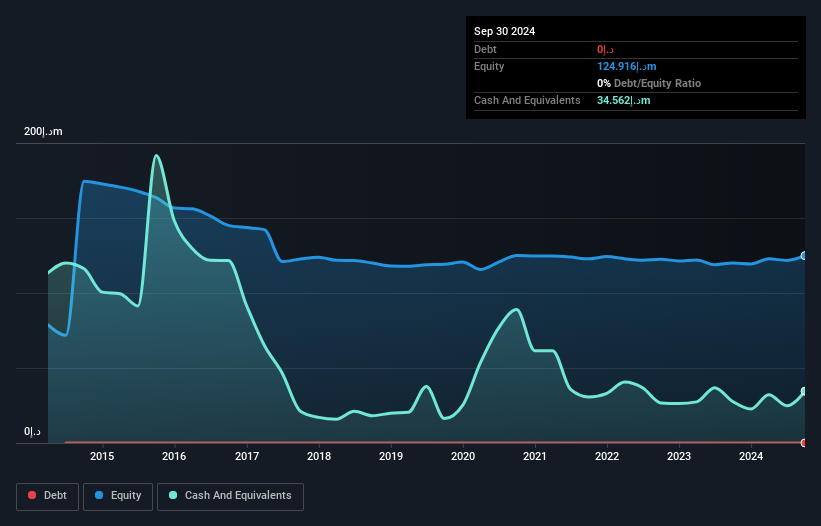

Overview: HAYAH Insurance Company P.J.S.C. offers health and life insurance solutions in the United Arab Emirates and internationally, with a market cap of AED298 million.

Operations: The company generates revenue from its Life segment, contributing AED79.05 million, and its Medical segment, adding AED31.67 million.

Market Cap: AED298M

HAYAH Insurance Company P.J.S.C., with a market cap of AED298 million, operates in the health and life insurance sectors. Despite being debt-free, the company is currently unprofitable with a negative Return on Equity of -1.7%. Its short-term assets significantly exceed liabilities, providing financial stability despite recent earnings challenges. The company's cash runway extends over three years even as free cash flow shrinks by 16.2% annually. Recent earnings reports indicate a net loss for the first nine months of 2025, contrasting with prior profits, highlighting volatility typical of penny stocks in this region's market landscape.

- Jump into the full analysis health report here for a deeper understanding of HAYAH Insurance Company P.J.S.C.

- Gain insights into HAYAH Insurance Company P.J.S.C's historical outcomes by reviewing our past performance report.

Big Tech 50 R&D-Limited Partnership (TASE:BIGT)

Simply Wall St Financial Health Rating: ★★★★★★

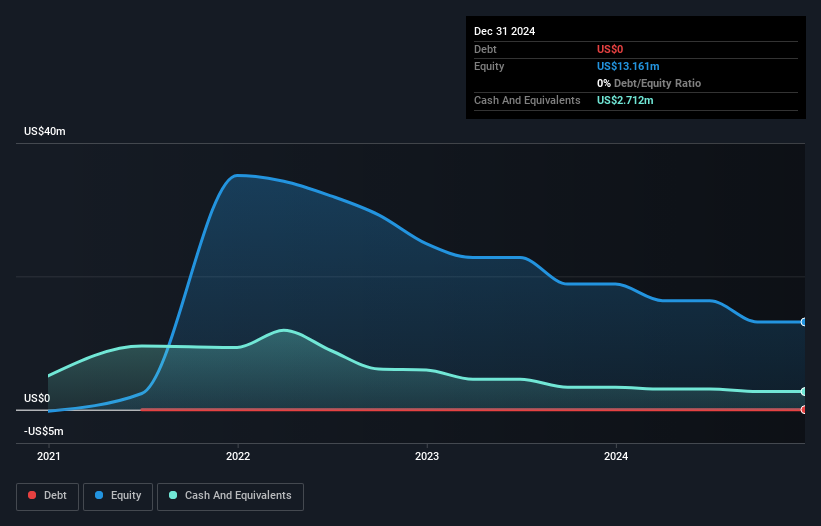

Overview: Big Tech 50 R&D-Limited Partnership focuses on investing in technology companies in Israel and has a market cap of ₪16.77 million.

Operations: Big Tech 50 R&D-Limited Partnership reported a revenue segment of Blank Checks amounting to -$2.08 million.

Market Cap: ₪16.77M

Big Tech 50 R&D-Limited Partnership, with a market cap of ₪16.77 million, is pre-revenue and operates debt-free with no significant liabilities. Despite this financial stability, the company remains unprofitable and has seen its losses increase by 35.8% annually over the past five years. The firm maintains a cash runway exceeding three years based on current free cash flow trends, yet its dividend yield of 28.07% is unsustainable given earnings constraints. While volatility has decreased from 10% to 4%, the lack of revenue growth and negative Return on Equity (-19.13%) underscore challenges typical in penny stocks within this sector.

- Dive into the specifics of Big Tech 50 R&D-Limited Partnership here with our thorough balance sheet health report.

- Assess Big Tech 50 R&D-Limited Partnership's previous results with our detailed historical performance reports.

SavorEat (TASE:SVRT-M)

Simply Wall St Financial Health Rating: ★★★★☆☆

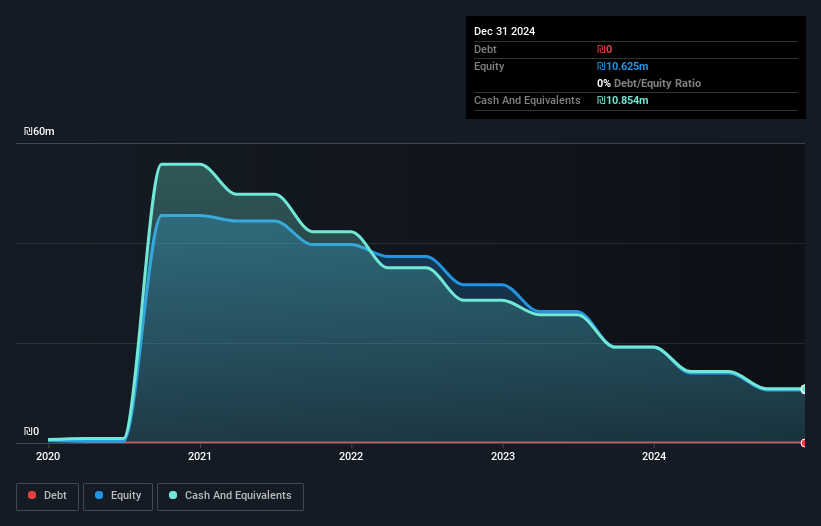

Overview: SavorEat Ltd. is a company that produces cellulose-based meat substitutes designed to mimic the eating experience of real meat, with a market cap of ₪4.81 million.

Operations: SavorEat Ltd. has not reported any revenue segments.

Market Cap: ₪4.81M

SavorEat Ltd., with a market cap of ₪4.81 million, is pre-revenue and currently unprofitable, facing increased losses at 2.5% annually over the past five years. The company operates without debt and has no long-term liabilities, but its cash runway is less than a year based on current free cash flow trends. Short-term assets of ₪6.2 million cover short-term liabilities of ₪840,000, yet the lack of significant revenue streams presents challenges typical for penny stocks in this sector. The board's average tenure is 5.9 years, providing some stability amidst financial uncertainties.

- Click to explore a detailed breakdown of our findings in SavorEat's financial health report.

- Evaluate SavorEat's historical performance by accessing our past performance report.

Taking Advantage

- Click here to access our complete index of 82 Middle Eastern Penny Stocks.

- Contemplating Other Strategies? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal