Trane Technologies (TT): Assessing Valuation After New Focus on Electrified, High-Efficiency Decarbonization Solutions

Trane Technologies (TT) is back in focus as fresh coverage spotlighted its leadership in electrified thermal management and high efficiency HVAC, tying the story tightly to decarbonization, industrial electrification, and long term earnings power.

See our latest analysis for Trane Technologies.

That backdrop helps explain why, even after a recent pullback with a 30 day share price return of negative 6.31 percent, Trane’s year to date share price return of 5.17 percent sits alongside a striking three year total shareholder return of 142.32 percent. This suggests momentum is cooling in the short term, but the longer term trend remains firmly positive.

If Trane’s decarbonization story has your attention, it could be worth seeing what else fits that quality plus growth profile by exploring fast growing stocks with high insider ownership.

With the shares now trading around 393 dollars versus an average analyst target near 480 dollars, investors have to ask: is Trane quietly undervalued here, or is the market already banking on years of decarbonization driven growth?

Most Popular Narrative Narrative: 18.5% Undervalued

Compared with the last close at 393.18 dollars, the most followed narrative implies fair value near 482 dollars, framing Trane as materially mispriced.

The strategic emphasis on innovation and a direct sales force enables Trane Technologies to consistently outgrow its end markets. This approach supports long term revenue expansion and potential margin improvement due to enhanced market positioning and customer engagement.

Want to see what kind of growth path and profit profile need to materialize to support that higher fair value, including a premium earnings multiple and rising margins? Explore the full narrative to examine the revenue runway, margin build, and share count assumptions that sit behind this price target.

Result: Fair Value of $482.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained weakness in transport refrigeration, or a downturn in data center and healthcare projects, could quickly challenge the upbeat margin and growth narrative.

Find out about the key risks to this Trane Technologies narrative.

Another Lens on Value

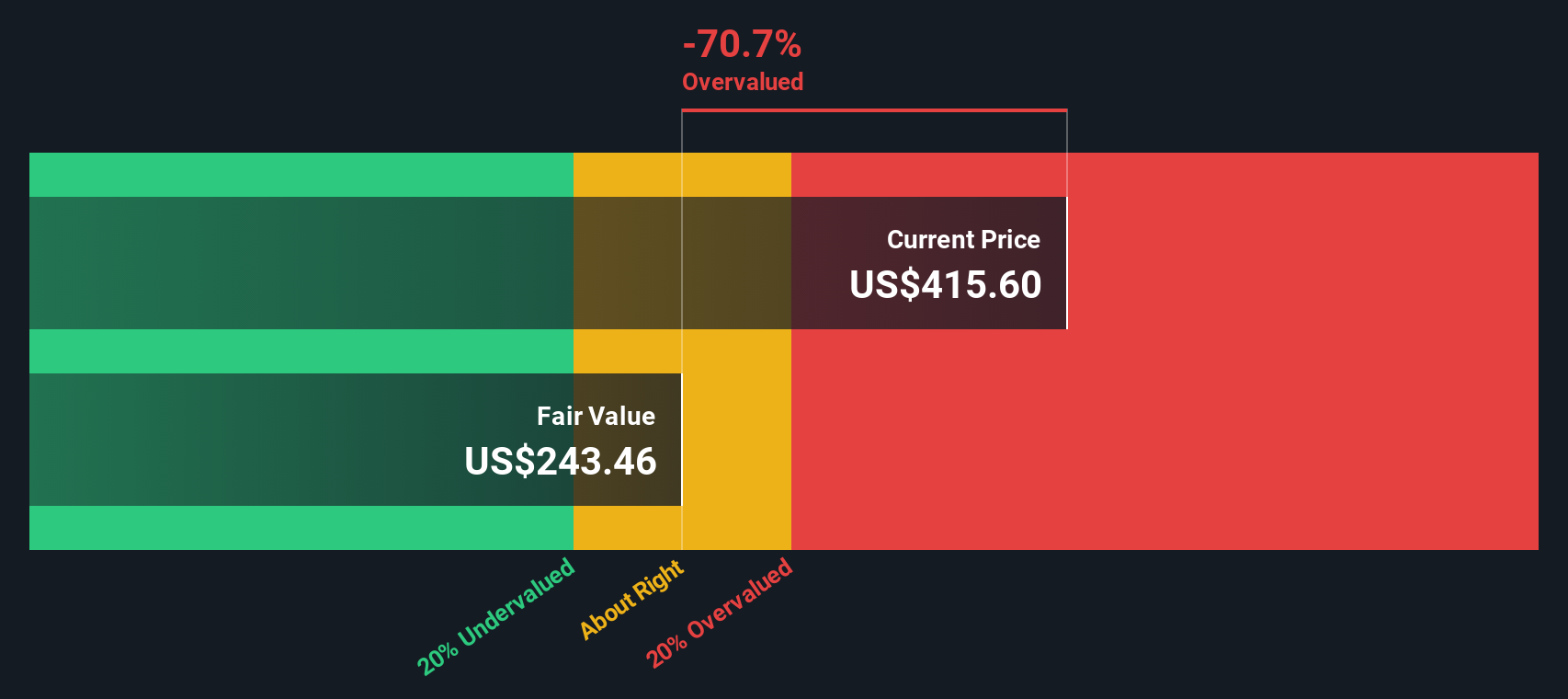

While the narrative driven fair value points to upside, our SWS DCF model tells a different story, putting Trane’s value closer to 304.60 dollars. At today’s 393.18 dollar price, the shares screen as overvalued. Is the market paying too far in advance for decarbonization growth?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Trane Technologies Narrative

If you see things differently, or simply want to dig into the numbers yourself, you can quickly build a personalized view in under three minutes: Do it your way.

A great starting point for your Trane Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your edge by using the Simply Wall St Screener to uncover targeted opportunities that most investors are still overlooking.

- Capture potential mispricings by scanning these 901 undervalued stocks based on cash flows that look attractively priced based on future cash flows rather than headline hype.

- Supercharge your growth hunt by targeting these 24 AI penny stocks positioned at the forefront of machine learning, automation, and intelligent infrastructure.

- Strengthen your income stream with these 10 dividend stocks with yields > 3% that combine solid yields with underlying business quality and staying power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal