ASX Penny Stocks To Watch In December 2025

As the Australian market approaches the end of 2025, it seems to be winding down for the holiday season with a slight dip, largely due to profit-taking and early closures. Despite this quiet period, investors continue to seek opportunities in niche areas like penny stocks, which remain relevant despite their somewhat outdated name. These stocks often represent smaller or newer companies that can offer significant growth potential when supported by strong financial foundations.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.405 | A$116.07M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.39 | A$65.57M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.78 | A$48.57M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.00 | A$461.07M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.14 | A$231.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$39.99M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.14 | A$3.59B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.26 | A$1.38B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.825 | A$118.74M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.26 | A$125.53M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 427 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Judo Capital Holdings (ASX:JDO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Judo Capital Holdings Limited, with a market cap of A$1.95 billion, provides a range of banking products and services specifically tailored for small and medium businesses in Australia through its subsidiaries.

Operations: The company generates revenue of A$347.4 million from its lending activities to small and medium enterprises in Australia.

Market Cap: A$1.95B

Judo Capital Holdings, with a market cap of A$1.95 billion, has demonstrated robust growth in earnings over the past five years, averaging 50.5% annually. The company maintains high-quality earnings and an appropriate loans-to-deposits ratio of 125%. Despite a low return on equity at 5.1%, Judo's net profit margins have improved to 24.9% from last year’s 21.4%. Analysts forecast continued earnings growth at 22.8% per year and see the stock trading below its estimated fair value by 29%. However, Judo faces challenges with a high level of bad loans at 3.4%, requiring careful monitoring moving forward.

- Take a closer look at Judo Capital Holdings' potential here in our financial health report.

- Examine Judo Capital Holdings' earnings growth report to understand how analysts expect it to perform.

Macmahon Holdings (ASX:MAH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Macmahon Holdings Limited operates in the mining sector, offering surface and underground mining, mining support, and civil infrastructure services to clients in Australia and Southeast Asia, with a market cap of A$1.42 billion.

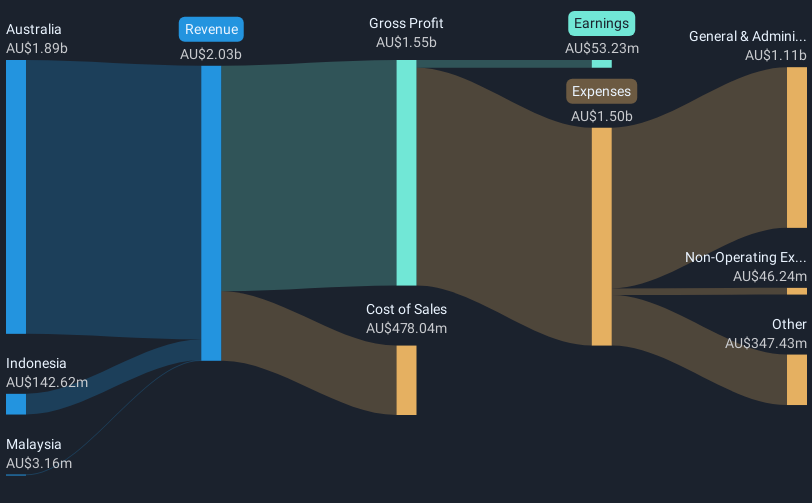

Operations: The company's revenue is primarily derived from its mining segment, which generated A$1.97 billion, complemented by A$436.97 million from civil infrastructure services.

Market Cap: A$1.42B

Macmahon Holdings, with a market cap of A$1.42 billion, has shown significant earnings growth of 38.9% over the past year, outpacing the industry average. The company operates with high-quality earnings and maintains satisfactory debt levels, with a net debt to equity ratio at 5.7%. Its interest payments are well covered by EBIT at 4.4 times coverage. Despite these strengths, Macmahon's return on equity is low at 10.7%, and its board lacks experience with an average tenure of 1.8 years. Recent board changes include appointing Ms Suzan Pervan as an Independent Non-Executive Director to strengthen governance.

- Dive into the specifics of Macmahon Holdings here with our thorough balance sheet health report.

- Gain insights into Macmahon Holdings' future direction by reviewing our growth report.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Southern Cross Electrical Engineering Limited, along with its subsidiaries, offers a range of services and products including electrical, instrumentation, communications, security, fire protection, and maintenance across Australia with a market cap of A$670.25 million.

Operations: The company generates revenue of A$801.45 million from its electrical services segment.

Market Cap: A$670.25M

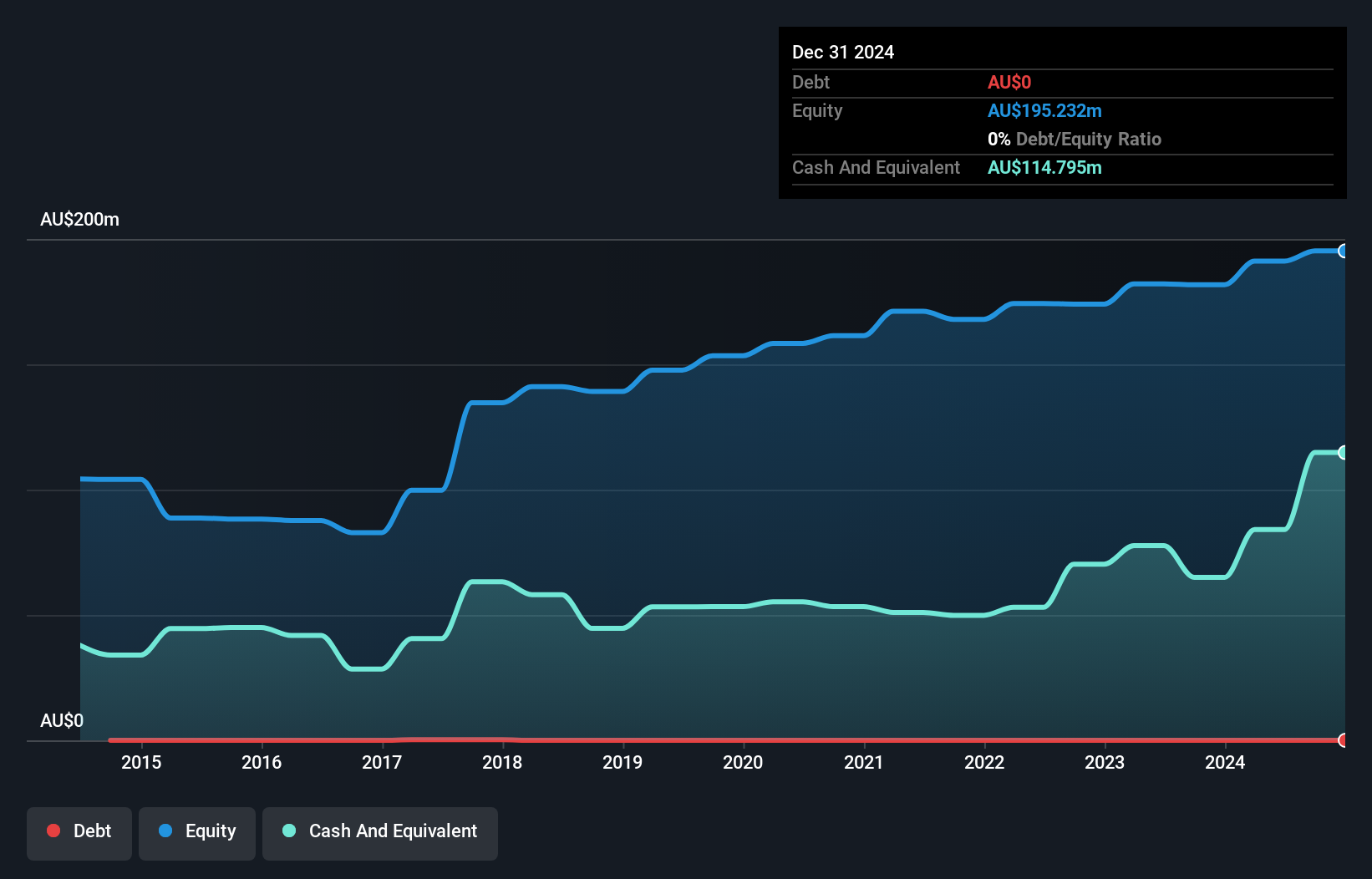

Southern Cross Electrical Engineering, with a market cap of A$670.25 million, has demonstrated robust earnings growth of 44.5% over the past year, surpassing its five-year average and the construction industry benchmark. The company operates debt-free, enhancing financial stability and reducing risk exposure. Its short-term assets comfortably cover both short and long-term liabilities, indicating strong liquidity management. Despite trading below estimated fair value by 13.5%, concerns include significant insider selling recently and an unstable dividend track record. The management team is experienced with an average tenure of 13.2 years, contributing to operational consistency amidst these challenges.

- Jump into the full analysis health report here for a deeper understanding of Southern Cross Electrical Engineering.

- Learn about Southern Cross Electrical Engineering's future growth trajectory here.

Summing It All Up

- Click this link to deep-dive into the 427 companies within our ASX Penny Stocks screener.

- Interested In Other Possibilities? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal