Baldwin Insurance Group (BWIN): Reassessing Valuation After Q3 Revenue Beat and Stable Organic Growth

Baldwin Insurance Group (BWIN) just posted Q3 results that cleared Wall Street’s revenue bar, with sales up roughly 8% and organic growth holding at a steady 5%, keeping year-to-date expansion near 9%.

See our latest analysis for Baldwin Insurance Group.

The Q3 beat has sparked a short burst of optimism, with a 1 day share price return of 4.4 percent lifting Baldwin Insurance Group to 25.15 dollars. However, this comes against a much weaker year to date share price return of minus 32.5 percent and a similarly soft 1 year total shareholder return. This suggests sentiment is stabilizing rather than fully turning around just yet.

If this earnings reaction has you rethinking your portfolio, it could be a good moment to explore fast growing stocks with high insider ownership for other compelling growth stories with skin in the game.

With the stock still trading at roughly a one third discount to analyst targets, despite double digit revenue growth and improving profitability, investors now face a key question: is this a genuine buying opportunity or is future growth already priced in?

Most Popular Narrative: 26% Undervalued

With the narrative fair value pegged at 33.88 dollars versus a last close of 25.15 dollars, the valuation case leans heavily on future growth and margin recovery.

The demographic shift toward an aging U.S. population, paired with government confirmed growth in Medicare Advantage funding, positions Baldwin's Medicare and health related offerings for a return to double digit organic revenue growth and margin recovery beyond current temporary headwinds.

Want to see the math behind that optimism? The narrative leans on accelerating revenue, sharply rising earnings, and a rich future earnings multiple. Curious which assumptions really move the needle here? Dive in to unpack the full valuation story.

Result: Fair Value of $33.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated leverage and persistent pricing pressure in key lines could quickly undermine the margin recovery and growth assumptions embedded in this narrative.

Find out about the key risks to this Baldwin Insurance Group narrative.

Another View: Market Ratios Tell a Different Story

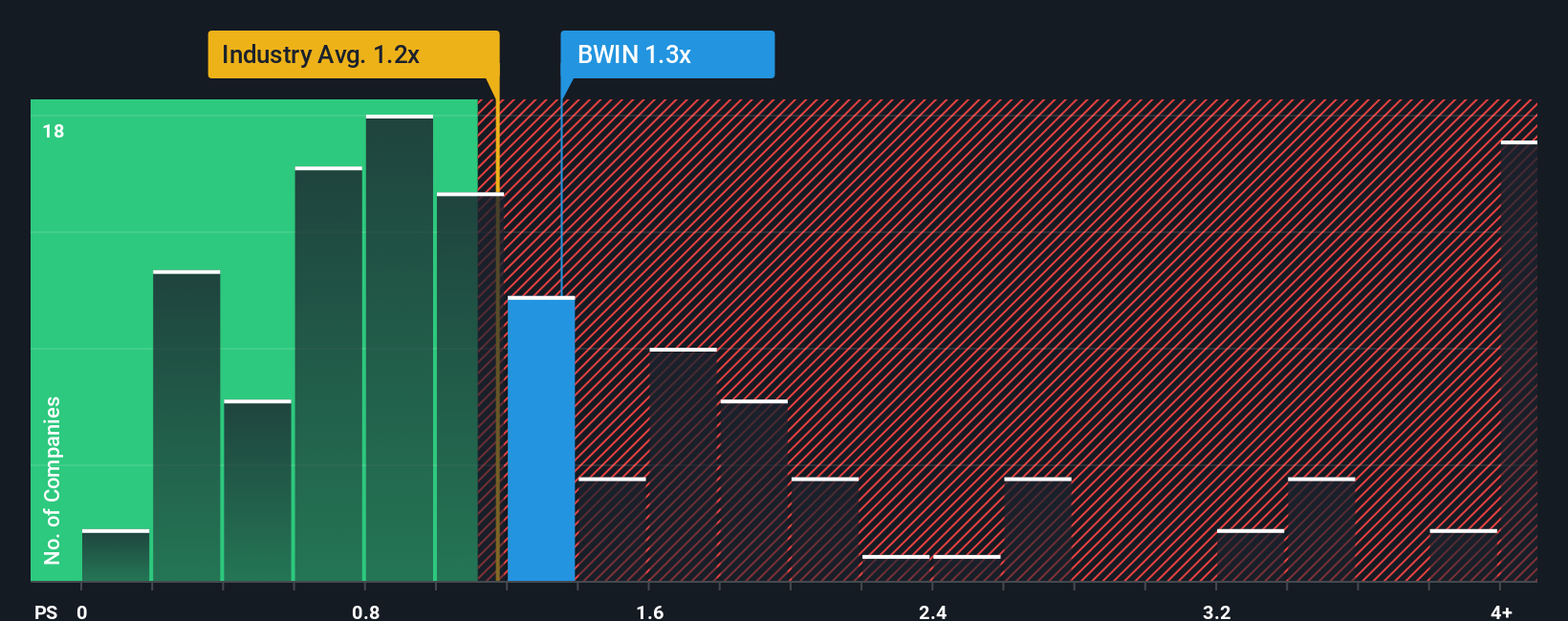

While the narrative model points to upside, the simple sales based lens looks more cautious. Baldwin trades at about 1.2 times sales, slightly richer than the US insurance industry at 1.1 times and above its own fair ratio of 1.1 times. This hints at limited margin for error if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Baldwin Insurance Group Narrative

If you see the story differently or simply want to stress test the assumptions with your own inputs, build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Baldwin Insurance Group.

Looking for more investment ideas?

Before you move on, strengthen your watchlist by scanning focused stock ideas built from real fundamentals, so you are not relying on headlines alone.

- Identify potential multi baggers early by reviewing these 3622 penny stocks with strong financials that pair tiny market caps with comparatively solid financial footprints.

- Position your portfolio in the center of intelligent automation by checking out these 24 AI penny stocks that are transforming industries with scalable AI solutions.

- Seek a margin of safety with these 901 undervalued stocks based on cash flows that trade below their estimated cash flow value yet still offer credible long term growth runways.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal