Reassessing Entegris (ENTG) Valuation After Goldman Sachs’ Downgrade and Margin Concerns

Entegris (ENTG) is back in the spotlight after Goldman Sachs cut the stock to Sell, arguing margins and sector positioning look challenged even as management leans into a more upbeat long term growth story.

See our latest analysis for Entegris.

The downgrade comes after a choppy stretch for Entegris, with a 1 month share price return of 13.87 percent but a negative year to date share price return and a 1 year total shareholder return of minus 15.62 percent. This suggests momentum is still fragile despite management’s upbeat growth narrative.

If this mix of optimism and skepticism around Entegris has you rethinking your exposure to chip suppliers, it could be worth scanning high growth tech and AI stocks for other potential semiconductor and tech names that appear to be riding stronger momentum.

So with shares down double digits this year but still trading at a premium to some chip peers, is Entegris quietly setting up as a contrarian value play, or is the market already baking in its next leg of growth?

Most Popular Narrative: 14.9% Undervalued

With Entegris last closing at $85.49 against an implied fair value near $100.50, the most followed narrative sees meaningful upside if its growth roadmap holds.

Investments and leadership in advanced materials for next-generation nodes, including CMP slurries, selective etch, and deposition materials, position Entegris to capitalize on upcoming node transitions (e.g., advanced logic, 3D NAND, HBM) and increasing semiconductor complexity, supporting higher ASPs and improved gross margins.

Curious what kind of revenue climb, margin lift, and future earnings multiple are baked into that fair value, and how long the runway really is? The narrative lays out a precise earnings path, a firm view on profitability, and a punchy valuation multiple that only makes sense if those milestones are hit, but the exact assumptions might surprise you.

Result: Fair Value of $100.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained trade uncertainty and ongoing fabs running below full utilization could easily derail the margin and multiple assumptions that investors are leaning on.

Find out about the key risks to this Entegris narrative.

Another View: Rich on Earnings

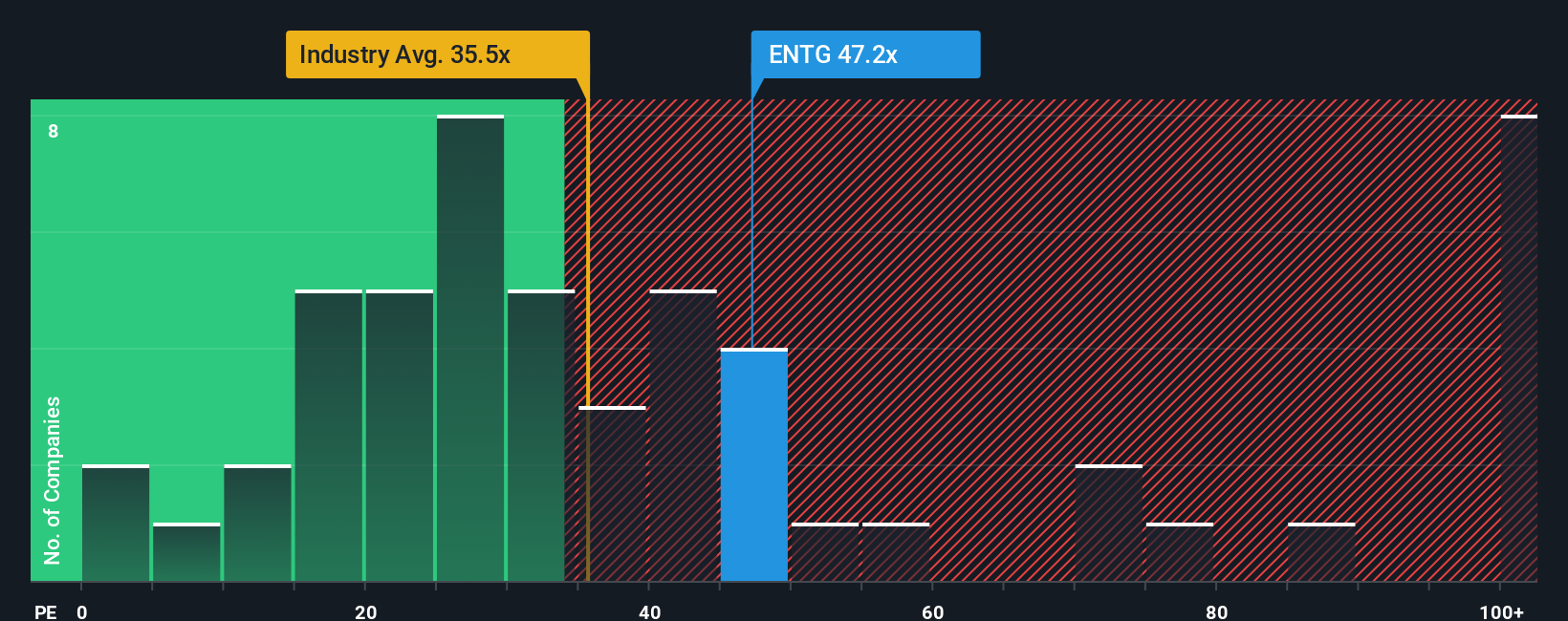

That 14.9 percent upside case runs into a tougher message from the earnings multiple picture, where Entegris trades on about 44.9 times earnings versus 36.6 times for the US semiconductor group and a fair ratio of roughly 35 times, pointing to meaningful valuation risk if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Entegris Narrative

If you are not fully aligned with these views or prefer stress testing the numbers yourself, you can quickly craft a personalized thesis in minutes using Do it your way.

A great starting point for your Entegris research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single stock. Use the Simply Wall St Screener to surface focused opportunities that match your strategy before the market catches on.

- Capture potential bargains early by scanning these 901 undervalued stocks based on cash flows that trade below their estimated cash flow value yet still show solid business fundamentals.

- Position yourself for the next wave of innovation by targeting these 24 AI penny stocks that are pushing real world adoption of artificial intelligence across industries.

- Lock in reliable portfolio income by narrowing in on these 10 dividend stocks with yields > 3% that pair attractive yields with balance sheets built to sustain payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal