Wall Street is singing in unison about 2026 US stocks! With AI and interest rate cuts in resonance, it is expected to rise for four consecutive years, but the high level of consensus may become a concern

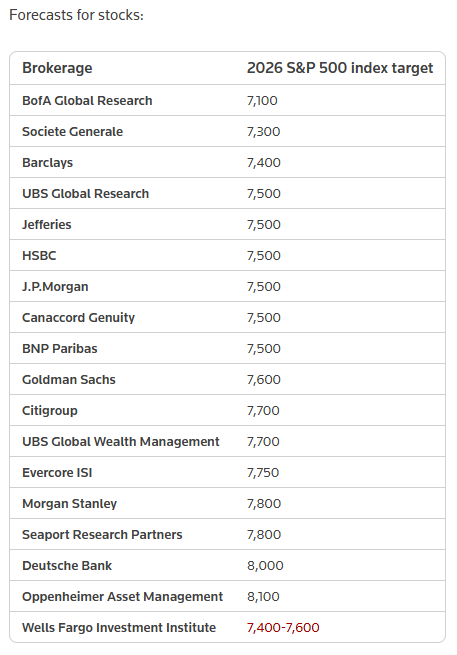

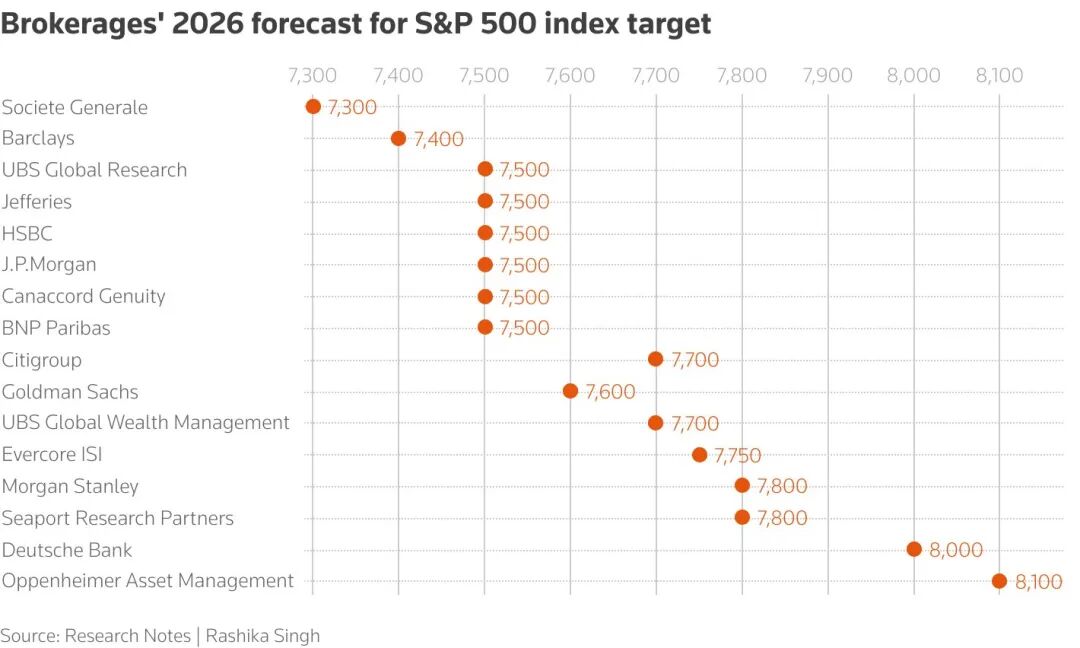

The Zhitong Finance App learned that near the end of the year, the agency's forecast for the 2026 US stock market has basically been released. Wall Street's forecast for the 2026 S&P 500 index is in the 7100-8100 point range, with an average target point of 7,490 points, with room for an increase of about 8% from Wednesday's closing point. With US stocks likely to close higher this year, if the trend of US stocks in 2026 matches the forecast, it will be the fourth year in a row that US stocks will rise.

Wall Street generally expects that the artificial intelligence (AI) boom and the Federal Reserve's interest rate cuts will drive the S&P 500 index to continue to rise, and that corporate profit growth will also support higher US stocks, but it also warns that inflation, high valuations, and tariff tension may still trigger a market correction.

Furthermore, Wall Street also expects global economic growth to be resilient in 2026. According to estimates by various agencies, the global GDP growth rate should be between 2.4% and 3.3%, while the US GDP growth rate should be between 1.7% and 2.4%.

Wall Street is generally optimistic about 2026 US stocks

A number of top Wall Street investment banks have already released their forecasts for the 2026 S&P 500 index. Despite differences in target points, the general consensus is that US stocks are expected to continue to rise as the wave of AI investment continues, monetary policy shifts to easing, and profit growth spreads.

J.P. Morgan Chase and Deutsche Bank called out the current highest point on Wall Street. The Xiaomo Stock Strategy Team, led by Dubravko Lakos-Bujas, set a target of 7,500 points for the S&P 500 index at the end of 2026. At the same time, it was pointed out that if the Federal Reserve continues to implement interest rate cuts, this benchmark index is expected to exceed 8,000 points in the next year. Komo proposed a forecast that the S&P 500 index will reach 7,500 points in 2026, mainly based on an expected profit growth rate of 13% to 15% over the next two years. Under the benchmark scenario, Komo expects the Federal Reserve to cut interest rates two more times, then enter a long period of suspension. The bank believes that continued improvement in the inflation situation will prompt the Federal Reserve to step up its efforts to cut interest rates. This factor will push the S&P 500 index to 8,000 points and above.

“Despite concerns about the AI bubble and valuation pressure in the market, we believe that the current high price-earnings ratio reflects the expectations of super-trend profit growth, the AI capital expenditure boom, increased shareholder returns, and loose fiscal policies (the “Big and Beautiful Act”),” Komo said in a customer report. “More importantly, the profit benefits brought about by deregulation and the expansion of the scope of AI-related productivity gains have yet to be fully recognized by the market.”

Deutsche Bank has set an S&P 500 target of 8,000 points at the end of 2026, and the bank's confidence stems from expectations that profit growth will “spread.” Deutsche Bank stock strategists predict that earnings per share of the S&P 500 will rise sharply by 14% to $320 next year. The bank believes that the growth momentum brought by AI will break through the category of the “Big Seven US stocks” and spread to a wider range of market sectors such as financial stocks and cyclical sectors, thus driving a round of bullish market coverage with wider coverage.

Morgan Stanley strategist Michael Wilson is also optimistic and expects the S&P 500 to climb to 7,800 points over the next year. Michael Wilson believes that the recent wave of market sell-offs is nearing its end, and any short-term weakness is a good opportunity to lay out long positions in 2026. He expects that the Federal Reserve's interest rate cuts will support the stock market, while AI technology will drive corporate efficiency improvements. Its strategy team is particularly optimistic about non-essential consumer goods, healthcare, finance, industrial sectors, and small-cap stocks.

In its 2026 US Stock Strategy Outlook Report, Citi predicts that 2026 will be a “continuous but volatile bull market.” Based on core logic such as broadening corporate profit growth and deepening AI themes, the bank set a benchmark target of 7700 points for the S&P 500 index at the end of the year, based on an index earnings per share (EPS) forecast of $320, and a target of 8,300 points under an optimistic scenario, reflecting more aggressive profit growth and slightly higher valuation levels; in a pessimistic scenario, the target was 5,700 points, corresponding to situations where fundamentals fell short of expectations and valuation compression. Citi believes that investment in the field of artificial intelligence will continue smoothly, but the differentiation in performance within the groups of enablers and users of this technology will still be a long-term dynamic. Expanding growth beyond this group will be the core main line, including the full participation of all sectors within the S&P 500 index, as well as the rise of small and medium capitalization stocks in the US.

UBS Global Research released a report saying that the AI-driven rise in US stocks will continue until 2026. The bank has set a target of 7,500 points for the S&P 500 by the end of next year. The core logic is that corporate profits are expected to maintain strong growth, and the highly concentrated but resilient technology sector will continue to contribute to the increase. The report also pointed out that although there are still market concerns about bubble risks and AI-related individual stock valuations, it is expected that the actual impact of such concerns on the market will be limited.

HSBC also set a target point of 7,500 points for the S&P 500 by the end of 2026. Driven by the AI investment boom, the index is expected to achieve a second consecutive year of double-digit growth. Nicole Inui, head of equity strategy in the Americas at HSBC, said that with the support of “macroeconomic stability, easing of policy uncertainty, and a boom in AI investment,” the earnings per share of S&P 500 companies are expected to increase by 12%.

Barclays expects 7,400 points for the S&P 500 at the end of 2026, and said that despite weak macroeconomic growth, large technology stocks have performed strongly, and the monetary and fiscal environment continues to improve. According to the bank's stock strategy team, the latest target is 5.7% higher than the 7,000 points previously set, while raising the S&P 500 earnings forecast for 2026 from $295 to $305 per share. They believe that in an environment of low macroeconomic growth, large technology stocks continue to operate steadily, and competition in the AI field shows no sign of cooling down, so the profit growth rate of the technology industry will exceed Wall Street's general expectations.

In contrast, the target point for the 2026 S&P 500 index at the end of the year given by Bank of America is only 7,100 points. Bank of America strategists expect earnings per share of the S&P 500 index to increase by about 14% in 2026, but the index itself is expected to increase by less than 3%. This combination (strong profits and moderate exponential growth) indicates that the economy is working well, but the valuation is high enough that it cannot be expected to drive returns through a large price-earnings expansion. Regarding the AI bubble, which is widely feared in the market, Bank of America pointed out that AI investment has begun to make a substantial contribution to US GDP and will continue to grow in 2026. According to an analysis of the historical bubble cycle, the US technology sector is currently still in a relatively healthy valuation range, and there are no signs of speculative overheating during the typical bubble period.

However, it is worth mentioning that Steve Sosnick (Steve Sosnick), chief strategist at Yingtou Securities, set a year-end target of 6,500 points for the 2026 S&P 500 index. This forecast means that the stock index will fall about 6% from current levels, which is much more cautious than the bullish predictions of other major Wall Street banks. The strategist explained his views on reverse investing and justified his conservative strategy by citing historical trends.

Sosnick pointed out that “there have only been two bear years in history, both of which occurred during the second year of the presidential term,” and he used the “end of volatility” incident in February 2018 as an example to illustrate market turbulence in such a cycle. At the same time, he expressed concern that the new chairman of the Federal Reserve often faces tests at the beginning of his term, citing historical cases such as Alan Greenspan (who experienced the 1987 stock crash soon after taking office) and Ben Bernanke (facing a financial crisis at the beginning of his term), saying “new Federal Reserve presidents usually experience market tests around the first time in office.” In response to the current boom in artificial intelligence, Sosnick believes its sustainability is questionable. He warned that if there is a correction in the leading industry leading the recent rise, it will be difficult to make up for losses due to sector rotation alone. “These companies drive the market to a rapid upward trend, but if they experience any decline, even if they only stagnate, they will require huge capital rotation to offset the impact.”

At the same time, while Wall Street institutions are bullish, they also suggest many risks. The first is the downside risk of the US economy. The rise in inflation and unemployment may drag down overall economic activity and consumption; second, the impact of the US midterm elections, which historically tend to weaken stock market returns; third, the valuation bubble controversy. The current stock market's expected price-earnings ratio is close to 22 times, far higher than the five-year average. The key depends on whether the productivity increase brought about by artificial intelligence can be transmitted to non-technology companies.

Is it dangerous when Wall Street is bullish on US stocks?

Although Wall Street analysts have always been known for their bullish stance, their current optimistic expectations for US stocks in 2026 are causing concern among some market observers. According to compiled data, the concentration of year-end target points given by sell-side strategists of major institutions for the S&P 500 index reached the highest level in nearly a decade. Oppenheimer gave the highest prediction of 8,100 points, while Stifel Nicolaus & Co. A minimum of 7,000 points was given, but the expected difference between the two was only 16%.

This highly consistent view is often viewed as an inverse indicator in the market — when all market participants are betting in the same direction, this state of imbalance often corrects itself. Moreover, the current risks in the market are already obvious: the inflation rate is still higher than the target level of the Federal Reserve, and the market's expectations of monetary policy easing may fall short at any time; the unemployment rate has continued to rise in recent months; huge investment in artificial intelligence has yet to bring real profits.

Optimists believe that the core of this bullish logic is that economic growth will drive corporate profits upward. They pointed out that tax cuts and deregulation policies will boost economic vitality. Coupled with the expectation that the Federal Reserve is expected to cut interest rates by 25 basis points twice, the market has upward support. Pessimists, on the other hand, interpret this general optimism as a reflection of market complacency.

Sosnick, chief strategist at Yingtou Securities, warned: “This high degree of consistency and concentration of predictions worries me. If everyone's expectations are the same, then those expectations are bound to be reflected in current stock prices — especially when most of the logic behind the consensus is based on similar logic such as interest rate cuts, tax cuts, and the continued dominance of AI.”

Greg Boutle, head of US stock and derivatives strategy at BNP Paribas, also said, “The risk that the current market is generally optimistic is that this sentiment is based on the inertia of the index continuing to rise. In my opinion, the market movement is the most likely outcome, but it is also because of this, once an external shock occurs, its impact will be further amplified.”

Michael Kantrowitz, chief investment strategist at Piper Sandler, tried to mitigate this concern. He said, “Market consensus targets are not so much the leading indicators of market trends as market trends are leading indicators of consensus target adjustments. In my opinion, the target points given by strategists are just a simple way for them to express their bullish or bearish positions.”

Publishing S&P 500 point predictions is a long-standing Wall Street tradition. Every year at the end of the year, analysts from all walks of life, from large investment banks to niche investment institutions, reveal their predictions. However, these predictions have always been famous for being “tested and mistaken.” According to Piper Sandler's data, the target point of the S&P 500 index often lags behind the actual performance of the index by about two months, and the prediction of individual stock target prices also has the same lag problem.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal