Assessing TechnipFMC (FTI) Valuation After the Coral North FLNG Contract Win Boosts Growth Visibility

TechnipFMC (FTI) just landed a substantial EPCI contract from Eni for the Coral North FLNG project offshore Mozambique, a material win that adds visibility to future revenue and helps explain the recent strength in the stock.

See our latest analysis for TechnipFMC.

That Coral North award caps a run of positive catalysts for TechnipFMC, including the recent Gorgon Stage 3 Subsea 2.0 contract and ongoing high profile investor engagement. The stock has responded with a strong year to date share price return of around 51 percent and a powerful multi year total shareholder return trend that suggests momentum is still building.

If this kind of contract driven rerating interests you, it is worth exploring aerospace and defense stocks for other project based businesses that could surprise on execution and growth.

With shares up more than 50 percent year to date yet still trading at a notable intrinsic discount, is TechnipFMC merely catching up to fundamentals, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 2.3% Undervalued

With TechnipFMC closing at $44.68 against a narrative fair value of $45.75, the story leans modestly positive and hinges on long term cash generation.

Continued investment and leadership in subsea innovation (e.g., all-electric subsea systems, hybrid flexible pipe, and CO2 capture technology) position TechnipFMC to capture value from both conventional oil & gas projects and the rising demand for energy transition infrastructure such as CCS and hydrogen, fostering top-line diversification and future margin upside.

Curious how steady revenue growth, rising margins, and shrinking share count combine to justify this valuation? The full narrative reveals the math behind that confidence.

Result: Fair Value of $45.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on oil and gas spending, along with exposure to geopolitically sensitive regions, could quickly undermine the margin and free cash flow story.

Find out about the key risks to this TechnipFMC narrative.

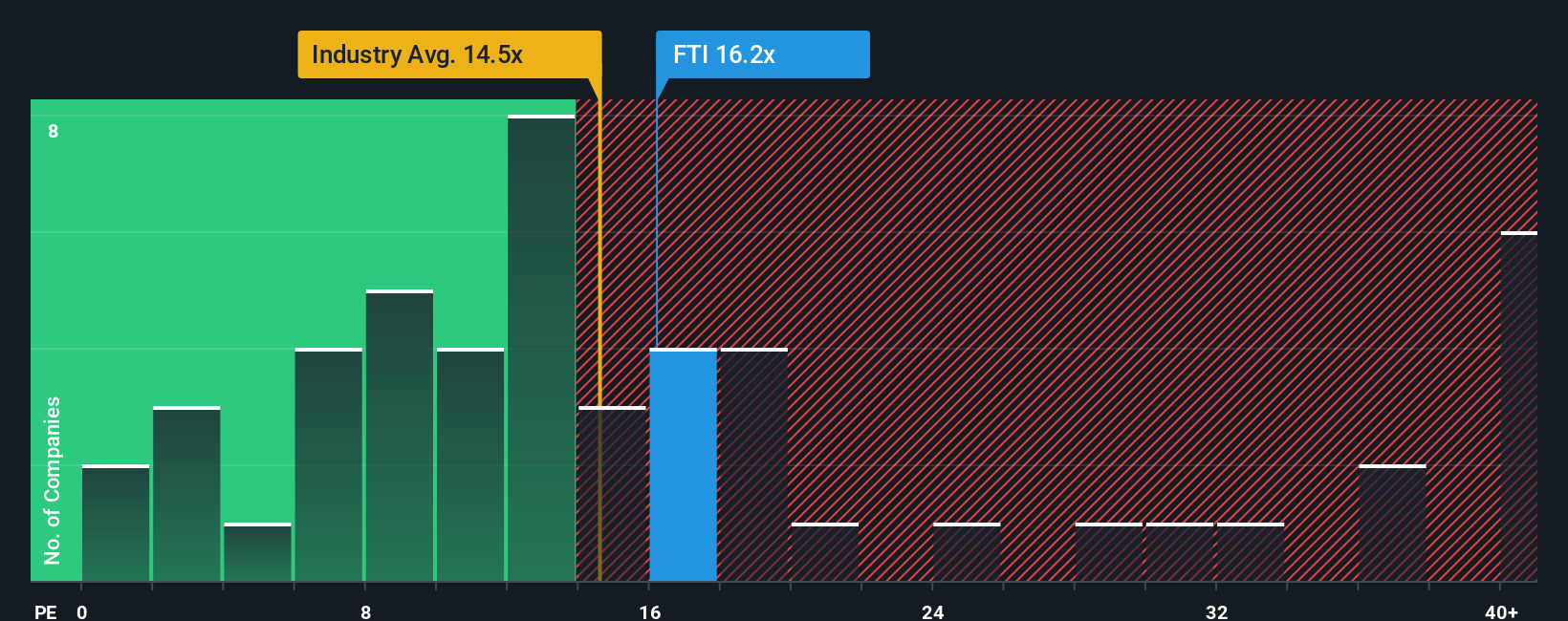

Another Valuation Lens: Earnings Multiple Risk

While the narrative fair value paints TechnipFMC as modestly undervalued, the earnings multiple tells a more demanding story. The shares trade on a P/E of 18.6 times, richer than the Energy Services industry at 18.1 times, peers at 16 times, and even above a 17.9 times fair ratio that the market could drift back toward.

In practice, that premium means there is less room for error if growth or margins disappoint. It also shifts more of the upside case onto flawless execution and continued contract wins. Is that a margin of safety you are comfortable paying for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TechnipFMC Narrative

If you would rather review the numbers yourself and draw your own conclusions, you can build a personalized narrative in just minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TechnipFMC.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St Screener to quickly surface fresh ideas that match your strategy before everyone else notices them.

- Capitalize on early stage momentum by reviewing these 3622 penny stocks with strong financials that already show stronger financial foundations than most tiny names in the market.

- Position your portfolio for the next wave of automation by targeting these 24 AI penny stocks that are shaping how data, software, and intelligent systems transform entire industries.

- Seek better entry points by focusing on these 901 undervalued stocks based on cash flows that trade below their cash flow potential yet already demonstrate solid execution and financial discipline.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal