Assessing AEON Financial Service (TSE:8570)’s Valuation After Profit Surge, Cleaner Credit Book and Digital Investment

AEON Financial Service (TSE:8570) is drawing fresh attention after its AEON Credit Service (Asia) unit reported a 28% jump in nine month profit, alongside cleaner credit books and sustained digital investment.

See our latest analysis for AEON Financial Service.

The market seems to be catching on to this story, with a 7 day share price return of 10.42 percent and a 1 year total shareholder return of 43.57 percent, which signals that momentum is building rather than fading.

If this kind of improving credit story has your attention, it could be a good moment to see what else is working and explore fast growing stocks with high insider ownership

Yet with earnings accelerating, credit costs improving, and the share price already well ahead of the market, is AEON Financial Service still trading below its real value, or is the market already pricing in its next leg of growth?

Price-to-Earnings of 20.9x: Is it justified?

AEON Financial Service trades on a 20.9x price-to-earnings multiple at ¥1748, which screens as expensive against both its peers and its own fair ratio.

The price-to-earnings ratio compares what investors pay today with the company’s current earnings, a key lens for diversified financials where profitability can be cyclical.

In this case, the stock’s 20.9x multiple sits well above the estimated fair price-to-earnings ratio of 17.2x. This implies investors are paying a premium to the level our model suggests the market could eventually gravitate toward.

That premium looks even starker beside the Asian Consumer Finance industry average of 14.2x and a peer group average of 12.5x. This indicates AEON Financial Service is priced more like a growth standout than a turnaround still rebuilding margins and returns.

Explore the SWS fair ratio for AEON Financial Service

Result: Price-to-earnings of 20.9x (OVERVALUED).

However, the stock already trades above analyst targets, and any setback in credit quality or regional growth could quickly compress these premium multiples.

Find out about the key risks to this AEON Financial Service narrative.

Another View: Our DCF Suggests Upside

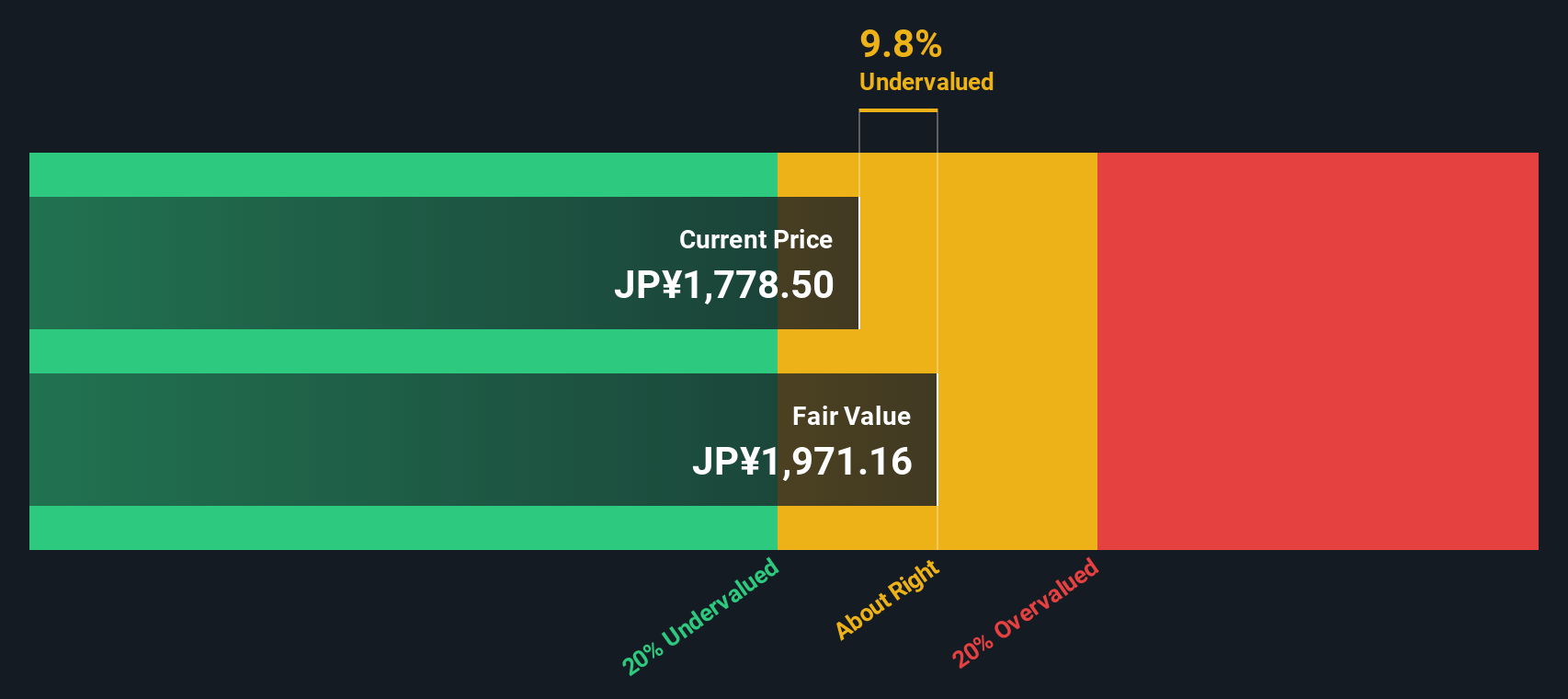

While the price-to-earnings ratio flags AEON Financial Service as expensive, our DCF model presents a different picture and indicates the shares trade about 11.3 percent below an estimated fair value of ¥1971.16. Is the market underestimating the earnings recovery, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AEON Financial Service for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AEON Financial Service Narrative

If you want to stress test these assumptions or dig into the numbers yourself, you can build a tailored view of AEON Financial Service in minutes. All you need to do is Do it your way

A great starting point for your AEON Financial Service research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential winner by using our screener to uncover focused sets of stocks that match your exact strategy.

- Capture potential multi baggers early by scanning these 3622 penny stocks with strong financials that already back up their story with solid balance sheets and improving fundamentals.

- Ride structural growth in automation and machine learning by targeting these 24 AI penny stocks positioned at the crossroads of software innovation and real world adoption.

- Target mispriced quality by filtering for these 901 undervalued stocks based on cash flows that generate strong cash flows yet still trade at compelling valuation discounts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal