Grand Canyon Education (LOPE): Evaluating Valuation After Soft EPS Guidance and Weak Peer Performance

Grand Canyon Education (LOPE) just posted revenue growth of about 10% in line with expectations, but its softer full year earnings guidance and lag versus peers quickly turned the spotlight to profitability.

See our latest analysis for Grand Canyon Education.

That cautious EPS outlook helps explain why, even with a solid 30 day share price return of 8.35 percent, Grand Canyon Education is still working off a 21.51 percent 90 day share price pullback. This leaves long term total shareholder returns looking stronger than recent momentum.

If this update has you rethinking where education fits in your portfolio, it could be a good moment to explore other resilient service and consumer names via fast growing stocks with high insider ownership.

With shares still trading at a sizable discount to analyst targets despite years of strong total returns, the key question now is whether Grand Canyon Education is quietly undervalued or if the market already sees slower growth ahead.

Most Popular Narrative: 24.5% Undervalued

With Grand Canyon Education last closing at $168.21 versus a narrative fair value near $223, the current gap hinges on steady, compounding earnings power.

Analysts expect earnings to reach $306.2 million (and earnings per share of $11.16) by about September 2028, up from $236.5 million today. The analysts are largely in agreement about this estimate.

Want to see how modest revenue growth, firmer margins, and shrinking share count combine into that earnings jump and valuation multiple reset? The narrative explains the full playbook in detail.

Result: Fair Value of $222.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent enrollment headwinds and mounting legal or regulatory costs could pressure margins and challenge the steady earnings and buyback driven valuation thesis.

Find out about the key risks to this Grand Canyon Education narrative.

Another Lens On Valuation

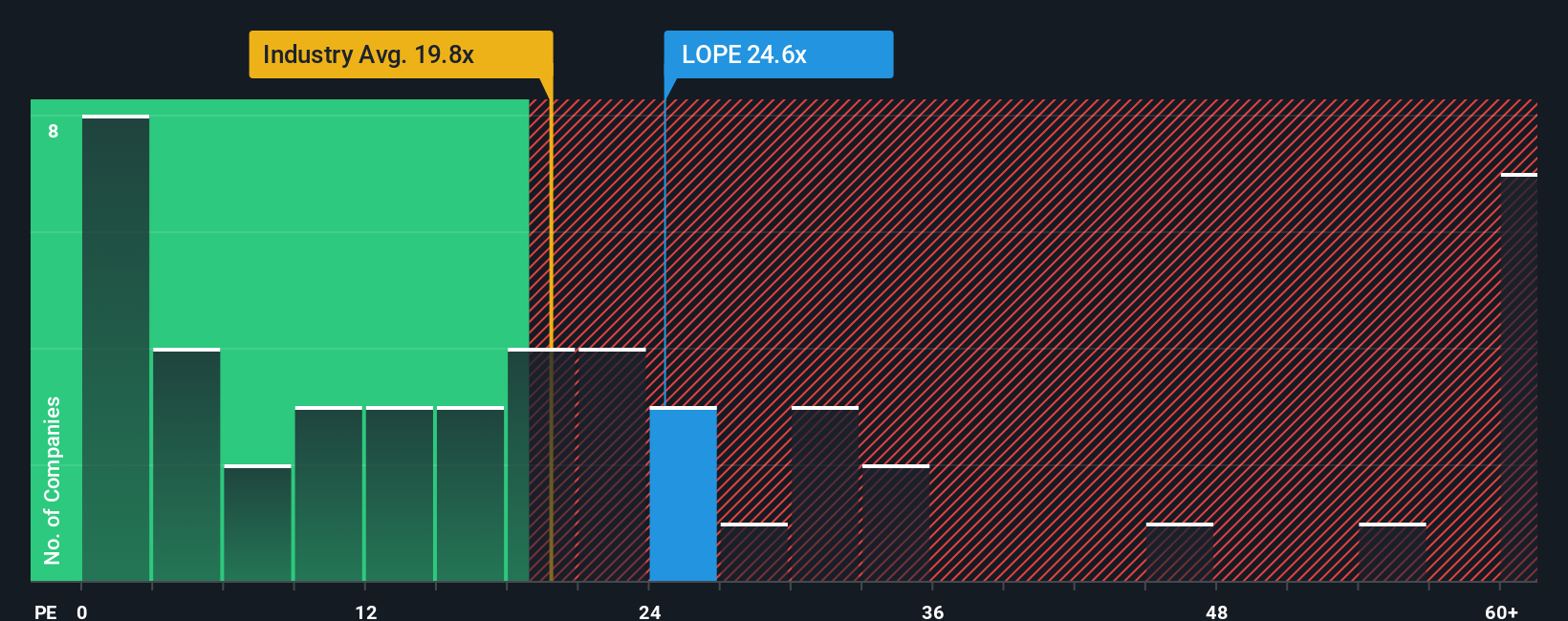

On earnings based metrics, Grand Canyon Education looks far less like a bargain. Its 22 times P E sits well above both the Consumer Services industry at 16.6 times and peers at 18.7 times, even though our fair ratio sits at 23.4 times. Is the premium justified, or just extra risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grand Canyon Education Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Grand Canyon Education.

Looking for more investment ideas?

Do not stop at one opportunity when a wide field of potential winners is waiting. Use the Simply Wall St Screener now so you are not left behind.

- Capture income focused opportunities by scanning these 10 dividend stocks with yields > 3% that aim to balance reliable payouts with solid business strength.

- Position yourself for structural growth trends by targeting these 29 healthcare AI stocks harnessing data to transform patient outcomes and operational efficiency.

- Harness volatility to your advantage by reviewing these 80 cryptocurrency and blockchain stocks riding long term adoption of blockchain infrastructure and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal