Rezolute (RZLT) Valuation Revisited After Phase 3 sunRIZE Trial Misses Primary and Key Secondary Endpoints

Rezolute (RZLT) just released topline data from its pivotal Phase 3 sunRIZE trial in congenital hyperinsulinism, and the drug missed both primary and key secondary endpoints, forcing investors to quickly reassess the story.

See our latest analysis for Rezolute.

The setback helps explain why Rezolute’s 30 day share price return sits at around negative 72 percent even after a sharp short term rebound. The share price closed at 2.74 dollars, and while the three year total shareholder return is still positive, long term momentum now looks fragile as investors reassess pipeline risk.

If Rezolute’s volatility has you rethinking concentration risk, it might be worth exploring other healthcare names using our screener for healthcare stocks as potential alternatives.

With the stock now trading at a steep discount to analyst targets after the trial failure, the key question is whether pessimism has swung too far and created a speculative entry point, or if markets are correctly pricing in weaker future growth.

Price to Book of 1.7 times, is it justified?

On a price to book basis, Rezolute’s last close at 2.74 dollars screens as notably cheap versus both its own fair value estimate and biotech peers.

The price to book ratio compares the company’s market value to its net assets, a common yardstick for early stage biotechs that lack meaningful revenue or profits. For Rezolute, the multiple sits at 1.7 times, which is flagged as good value relative to similar companies and stands well below the peer average.

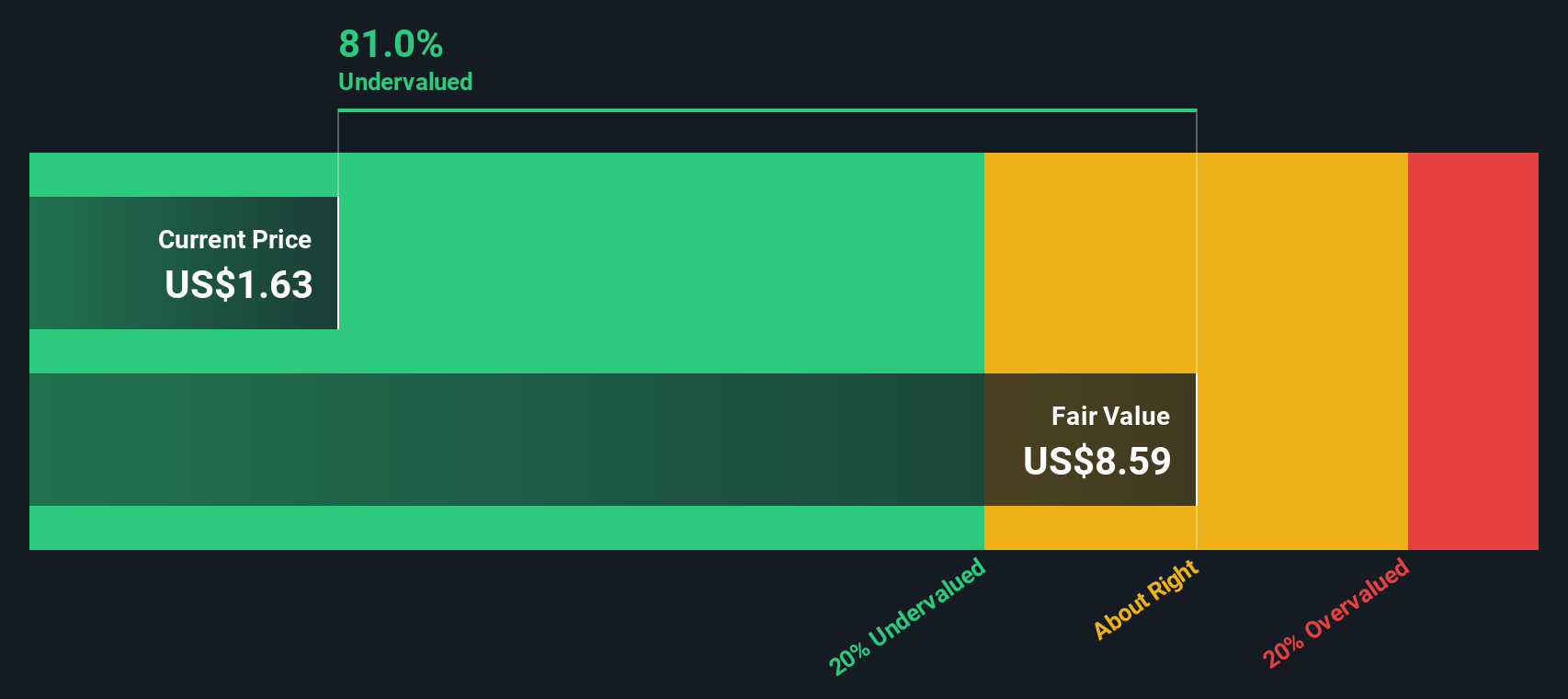

Relative to the broader US Biotechs industry, where the average price to book multiple is 2.7 times and some peers trade at far richer levels around 33.8 times, Rezolute’s valuation looks materially compressed. When set against our DCF based fair value estimate of 8.68 dollars per share, which implies the stock is trading roughly 68.4 percent below that level, the current market price suggests investors are heavily discounting the company’s future growth potential and execution risk.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 1.7 times (UNDERVALUED)

However, the failed Phase 3 trial and ongoing operating losses with no current revenue mean any recovery still hinges on successful pipeline readouts and fresh funding.

Find out about the key risks to this Rezolute narrative.

Another View, our DCF model

Our DCF model paints an even starker picture, suggesting fair value near 8.68 dollars per share, around 68 percent above where Rezolute trades today. That kind of gap hints at deep pessimism baked into the price, but is it justified after a major trial failure?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rezolute for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rezolute Narrative

If you would rather challenge these assumptions or examine the numbers yourself, you can quickly develop a personalized view of Rezolute, Do it your way.

A great starting point for your Rezolute research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with a single biotech setback. Use the Simply Wall St Screener to uncover fresh opportunities that match your strategy before the market moves on.

- Capture potential mispricings early by targeting companies trading below intrinsic value through these 901 undervalued stocks based on cash flows with solid cash flow support.

- Position yourself at the frontier of innovation by focusing on transformative automation and next generation models using these 24 AI penny stocks.

- Strengthen your income stream by zeroing in on established businesses with attractive payouts via these 10 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal