Undiscovered Gems in Asia to Explore This December 2025

As we approach December 2025, the Asian markets are navigating a complex landscape shaped by Japan's highest interest rates in three decades and China's signals of restrained economic stimulus, which have influenced broader market sentiment. In this environment, identifying promising stocks requires a keen eye for companies that can thrive amid shifting economic policies and demonstrate resilience against global headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NS United Kaiun Kaisha | 44.97% | 10.62% | 10.49% | ★★★★★★ |

| Asian Terminals | 25.82% | 12.05% | 17.00% | ★★★★★★ |

| Ohashi Technica | NA | 6.82% | -2.11% | ★★★★★★ |

| AOKI Holdings | 21.00% | 6.54% | 55.73% | ★★★★★★ |

| Chuo WarehouseLtd | 12.82% | 2.30% | 6.14% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 2.72% | 37.80% | ★★★★★★ |

| Jiangsu Lianfa TextileLtd | 16.06% | 0.19% | -13.07% | ★★★★★☆ |

| House of Investments | 18.23% | 14.46% | 47.47% | ★★★★★☆ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 4.59% | 17.51% | 3.97% | ★★★★★☆ |

| Akatsuki | 238.26% | 10.43% | 16.51% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Center International GroupLtd (SHSE:603098)

Simply Wall St Value Rating: ★★★★★★

Overview: Center International Group Co., Ltd. offers building metal enclosure systems solutions in China, with a market cap of CN¥7.70 billion.

Operations: Center International Group Co., Ltd. generates revenue primarily through its building metal enclosure systems solutions in China. The company's financial performance is highlighted by a market cap of CN¥7.70 billion, reflecting its scale in the industry.

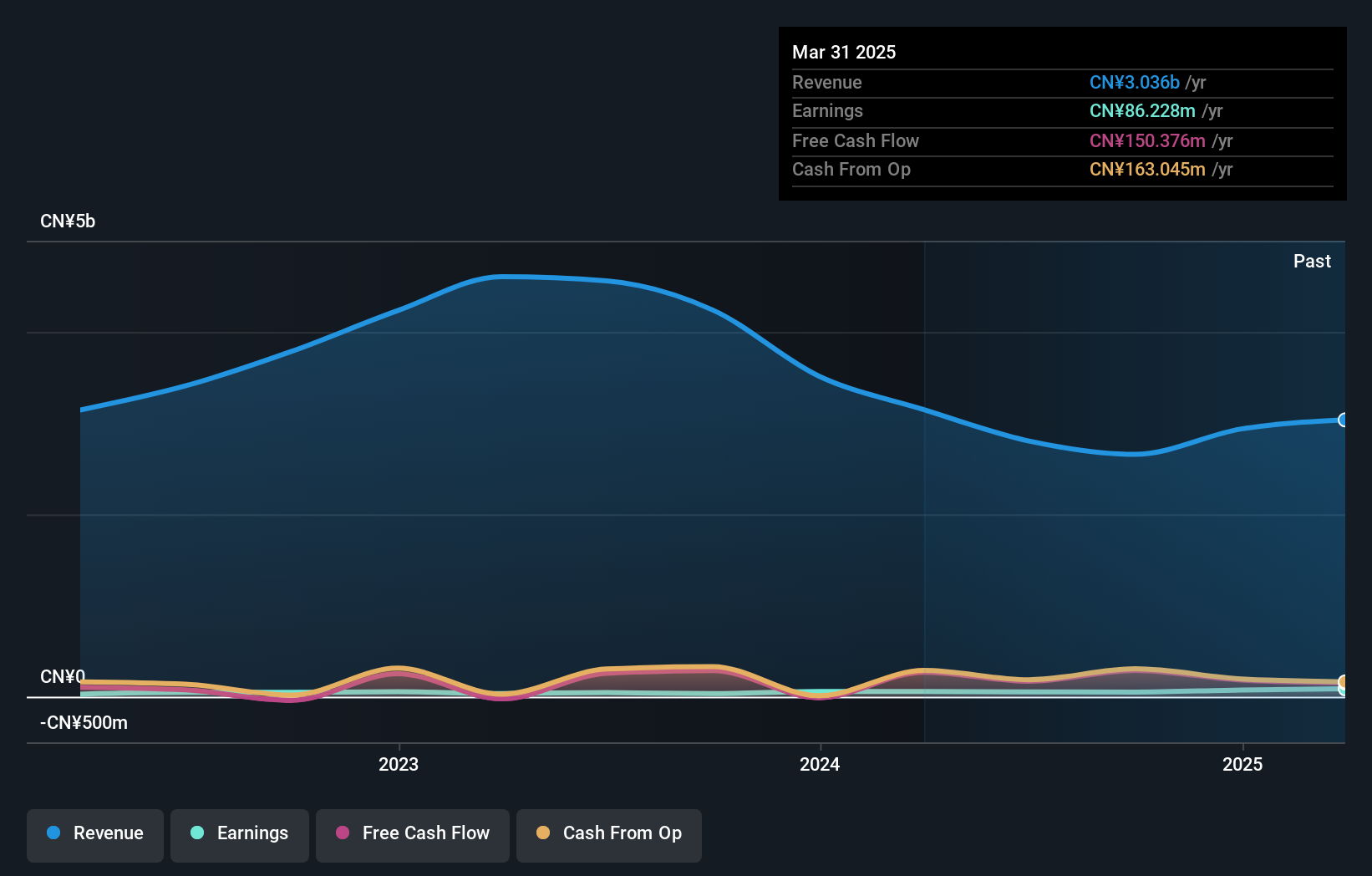

Center International Group Ltd. has been making waves with its solid financial footing, boasting more cash than total debt and a reduced debt-to-equity ratio from 54.6% to 13.2% over five years. Recent earnings growth of 88.9% outpaces the construction industry's -7.3%, highlighting its robust performance despite a challenging sector backdrop. The company reported sales of CNY 2,244 million for the first nine months of 2025, up from CNY 1,885 million last year, while net income rose to CNY 96 million from CNY 74 million previously. With free cash flow in positive territory and interest payments well-covered by EBIT at a multiple of 15x, Center International seems poised for continued stability in its operations.

- Get an in-depth perspective on Center International GroupLtd's performance by reading our health report here.

Learn about Center International GroupLtd's historical performance.

Zhangjiagang Furui Special Equipment (SZSE:300228)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhangjiagang Furui Special Equipment Co., Ltd. is a company with a market cap of CN¥6.22 billion, specializing in the design and manufacture of specialized equipment for various industrial applications.

Operations: Furui Special Equipment's revenue is primarily derived from its industrial equipment manufacturing operations. The company's net profit margin has shown variability, reflecting fluctuations in operational efficiency and cost management.

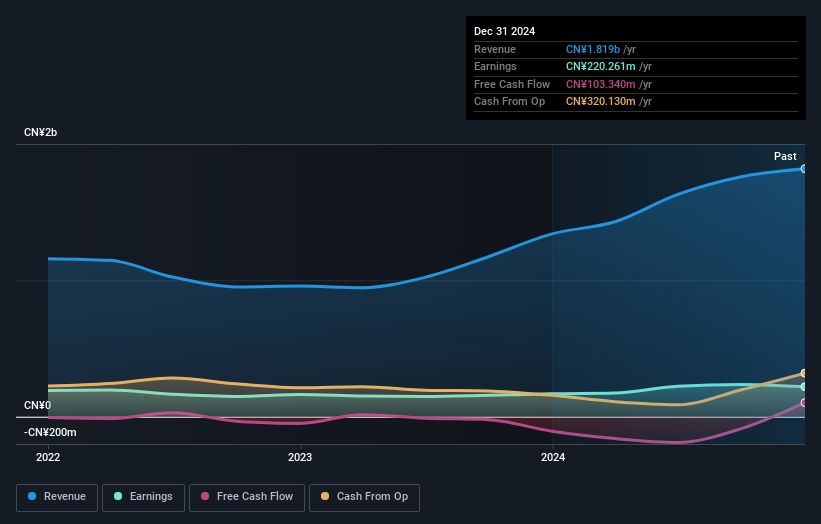

Zhangjiagang Furui Special Equipment showcases robust financial health with its debt to equity ratio plummeting from 53.7% to 5.5% over five years, indicating strong capital management. Its earnings growth of 13.5% outpaces the Machinery industry average of 6.1%, reflecting competitive performance in a challenging sector. Despite a dip in sales to CNY 2,363 million for the first nine months of 2025, net income rose to CNY 173 million from CNY 126 million last year, highlighting operational efficiency improvements. The company’s P/E ratio at 23.4x remains attractive against the broader CN market's average of 44.5x, suggesting potential value for investors seeking opportunities in smaller companies within Asia's industrial landscape.

Xiamen Voke Mold & Plastic Engineering (SZSE:301196)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xiamen Voke Mold & Plastic Engineering Co., Ltd. is a company specializing in the production and sale of high-precision molds, injection products, and health products, with a market capitalization of CN¥9.89 billion.

Operations: Xiamen Voke Mold & Plastic Engineering generates revenue primarily from the production and sale of high-precision molds, injection products, and health products, amounting to CN¥2.16 billion. The company's financial performance can be analyzed through its net profit margin trends over recent periods.

Xiamen Voke Mold & Plastic Engineering, a relatively small player in the machinery sector, has shown promising performance with earnings growth of 12% over the past year, outpacing the industry average of 6%. The company reported sales of CN¥1.68 billion for nine months ending September 2025, up from CN¥1.34 billion a year prior. Net income rose to CN¥222 million from CN¥177 million. Despite an increased debt-to-equity ratio from 0.4% to 1.5% over five years, interest coverage remains strong and their P/E ratio at 37x suggests potential value compared to the market's average of 44x.

Where To Now?

- Reveal the 2497 hidden gems among our Asian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal