Taking a Fresh Look at Construction Partners (ROAD) Valuation After Upbeat Analyst Revenue Projections

Fresh analyst projections pointing to higher revenue have put Construction Partners (ROAD) back on investors radar, pairing upbeat expectations with a strong history of earnings growth and steadily improving free cash flow margins.

See our latest analysis for Construction Partners.

The share price has climbed to around $112, with a robust year to date share price return of roughly 28% and a standout three year total shareholder return above 300%, signaling momentum that investors clearly still trust.

If this kind of compounding story has your attention, it might be worth exploring fast growing stocks with high insider ownership as a way to spot other under the radar growth names backed by committed insiders.

Yet with the stock near record highs, a premium valuation, and a roughly 14% gap to analyst targets, investors now face a crucial question: is ROAD still an attractive opportunity, or has future growth already been fully priced in?

Most Popular Narrative Narrative: 12.5% Undervalued

With the narrative fair value sitting at $128 against the last close of $112.01, the story frames current pricing as leaving notable upside on the table.

Ongoing vertical integration through investment in owned asphalt plants and material sourcing, combined with increasing scale, is already enhancing operational efficiencies and margin expansion, as shown by record adjusted EBITDA margins despite weather disruptions. This should drive higher net margins and improved earnings resilience going forward.

Want to see what kind of revenue climb and margin reset need to unfold to support that valuation path? The growth milestones behind this forecast might surprise you.

Result: Fair Value of $128 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, localized project softness and potential cost inflation could quickly challenge the margin expansion story and force investors to reassess ROAD's premium valuation.

Find out about the key risks to this Construction Partners narrative.

Another Angle on Valuation

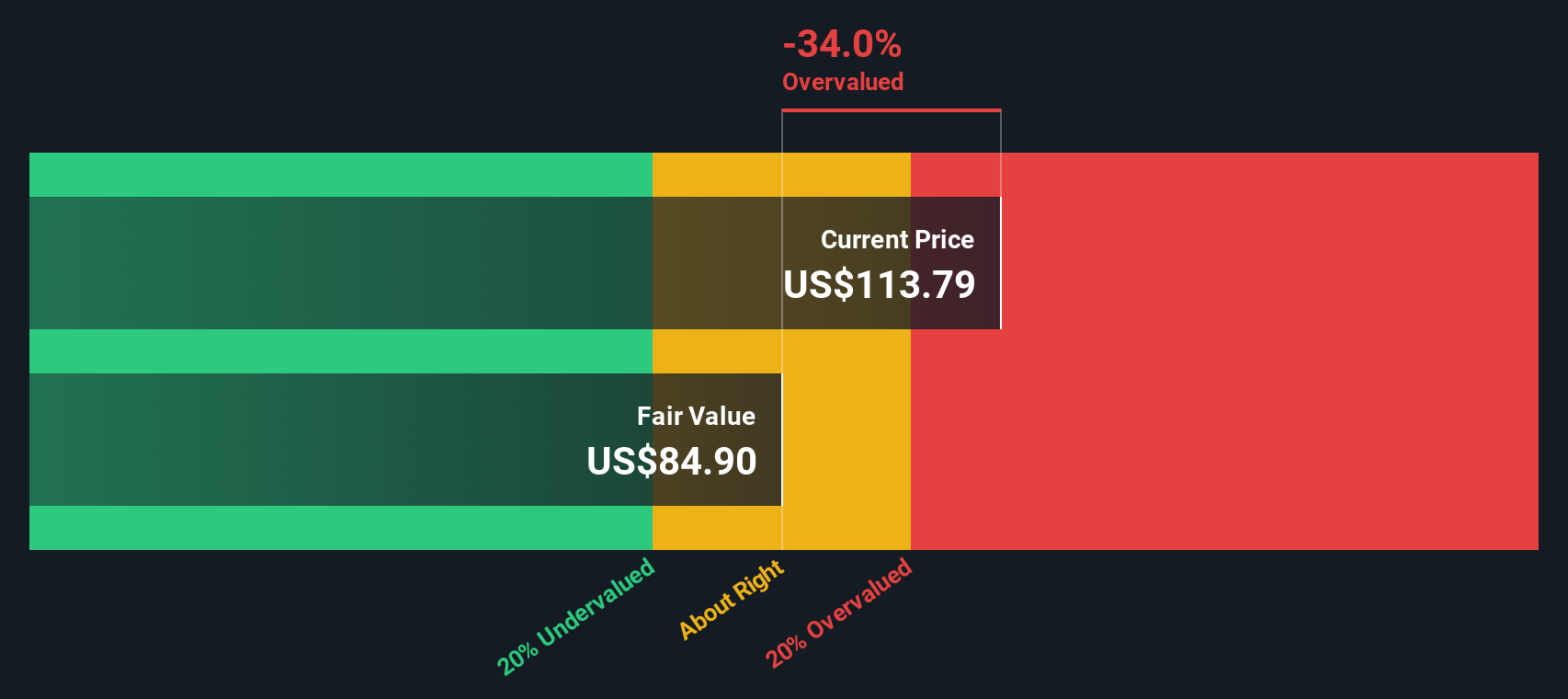

While the narrative points to upside, our SWS DCF model paints a different picture, with ROAD trading above an estimated fair value of $85.62. That implies the shares are overvalued on a cash flow basis and raises the question of which story ultimately wins out: sentiment or cash flows.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Construction Partners Narrative

If this perspective does not quite align with your own view, dig into the numbers yourself and craft a custom narrative in minutes: Do it your way

A great starting point for your Construction Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at just one opportunity. Use the Simply Wall St Screener to uncover fresh stock ideas before the crowd and keep your portfolio evolving intelligently.

- Capitalize on potentially mispriced quality by reviewing these 901 undervalued stocks based on cash flows that combine solid fundamentals with attractive valuations grounded in future cash flows.

- Ride powerful technological shifts by targeting these 24 AI penny stocks that are building real businesses around artificial intelligence rather than hype alone.

- Strengthen your income stream by focusing on these 10 dividend stocks with yields > 3% that can help support reliable cash returns alongside capital growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal