CBRE Group (CBRE) Valuation Revisited After Strategic Global Leadership Reshuffle

CBRE Group (CBRE) just reshuffled its senior leadership across Real Estate Investments, Advisory Services, and Trammell Crow Company, a move clearly designed to tighten execution and support its next phase of global growth.

See our latest analysis for CBRE Group.

Those leadership promotions land against a backdrop of solid momentum, with the share price returning nearly 27 percent year to date and a strong three year total shareholder return signaling investor confidence in CBRE’s long term growth story.

If CBRE’s reshuffle has you thinking about where else management quality and growth might align, it could be worth exploring fast growing stocks with high insider ownership as your next idea source.

With shares already up strongly and trading only modestly below analyst targets, the real question now is whether CBRE still trades at a discount, or if the market has fully priced in its future growth.

Most Popular Narrative Narrative: 9.7% Undervalued

With CBRE Group last closing at $164.94 against a narrative fair value near $182.58, the story frames the shares as still offering upside from here.

The analysts have a consensus price target of $169.727 for CBRE Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $197.0, and the most bearish reporting a price target of just $115.0.

Want to see what kind of earnings breakout and margin reset could justify that richer future multiple, and why buybacks quietly amplify it all? Read on.

Result: Fair Value of $182.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if higher-for-longer rates further cool leasing or capital markets volatility reopens, today’s valuation cushion could evaporate faster than expected.

Find out about the key risks to this CBRE Group narrative.

Another Lens on Valuation

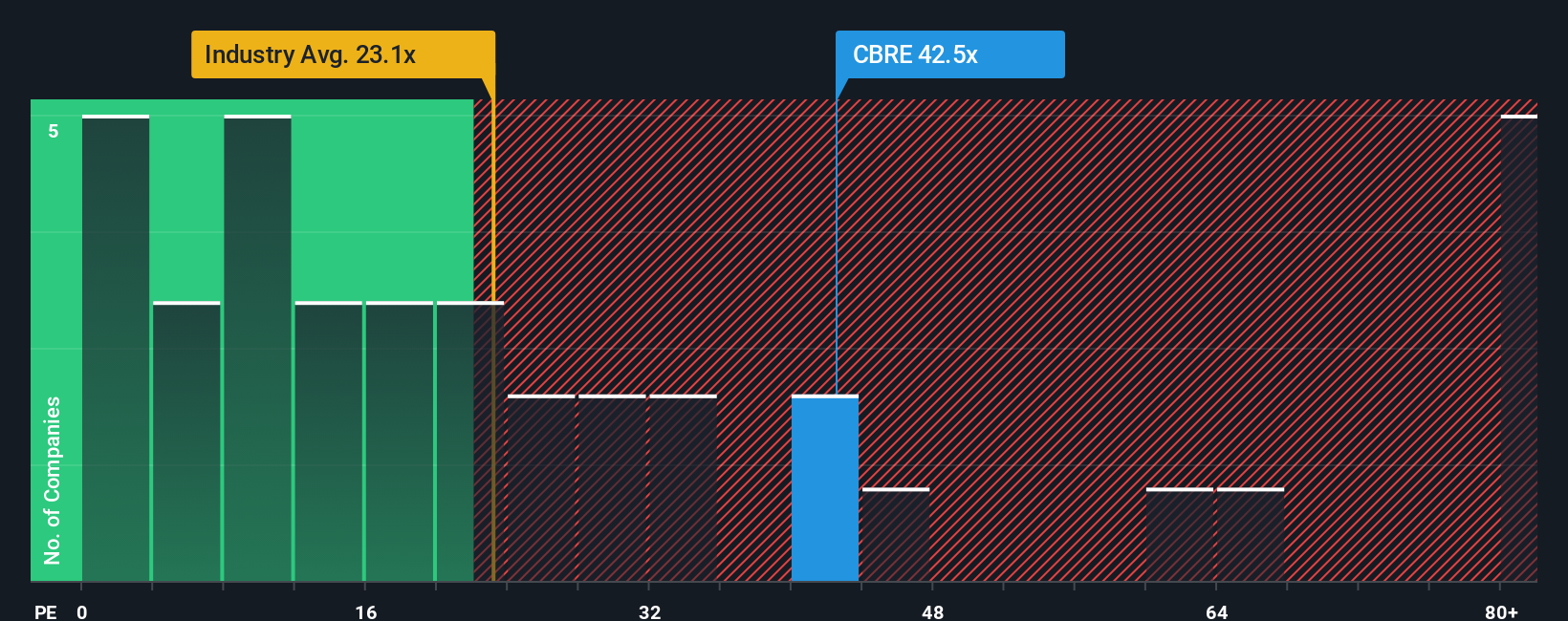

On earnings based multiples, the picture is less forgiving. CBRE trades on about 39.4 times earnings, well above the US real estate sector at 30.7 times and our fair ratio of 28.3 times. That premium narrows the margin of safety if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CBRE Group Narrative

If you see the story differently or want to follow your own research trail, you can build a custom view in just minutes: Do it your way.

A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before the next move in CBRE plays out, lock in an edge by lining up your watchlist with fresh opportunities using the Simply Wall St Screener.

- Capitalize on mispriced quality by targeting companies that appear undervalued on cash flows through these 901 undervalued stocks based on cash flows, before the market wakes up to them.

- Catch the next wave of innovation early by focusing on these 24 AI penny stocks that are building real revenue momentum from artificial intelligence.

- Enhance your income strategy by zeroing in on these 10 dividend stocks with yields > 3% that can strengthen your portfolio’s cash returns while others wait on price gains alone.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal