Does Ecolab’s Soaring 90.7% Three Year Gain Still Match Its Fundamentals in 2025?

- If you are wondering whether Ecolab’s current share price really reflects its quality and growth story, you are not alone. This article is designed to unpack exactly that question in plain English.

- The stock now trades around $265.58, up 1.4% over the last week but slightly down 1.2% over the past month, while still sitting on a gain of 15.0% year to date and 90.7% over three years.

- Those moves come as investors focus on Ecolab’s role in long term themes such as water scarcity, industrial hygiene and sustainability linked services. These are areas where the company has been expanding its solutions and customer partnerships. At the same time, the broader market has been rewarding resilient, recurring revenue businesses, which adds more attention and sometimes more volatility to a name like Ecolab.

- Despite that backdrop, Ecolab scores just 0 out of 6 on our undervaluation checks. Next we will walk through different valuation approaches, then finish by exploring a more complete way to think about what this stock might be worth beyond the usual metrics.

Ecolab scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ecolab Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes estimates of how much cash a company will generate in the future, then discounts those cash flows back into today’s dollars to arrive at an intrinsic value per share.

For Ecolab, the latest twelve month free cash flow is about $1.7 billion. Based on analyst estimates for the next few years, and then extrapolations beyond that, free cash flow is projected to grow to roughly $3.6 billion by 2035. These projections are built in two stages, with near term numbers guided by analysts and later years extended by Simply Wall St using gradually slowing growth assumptions.

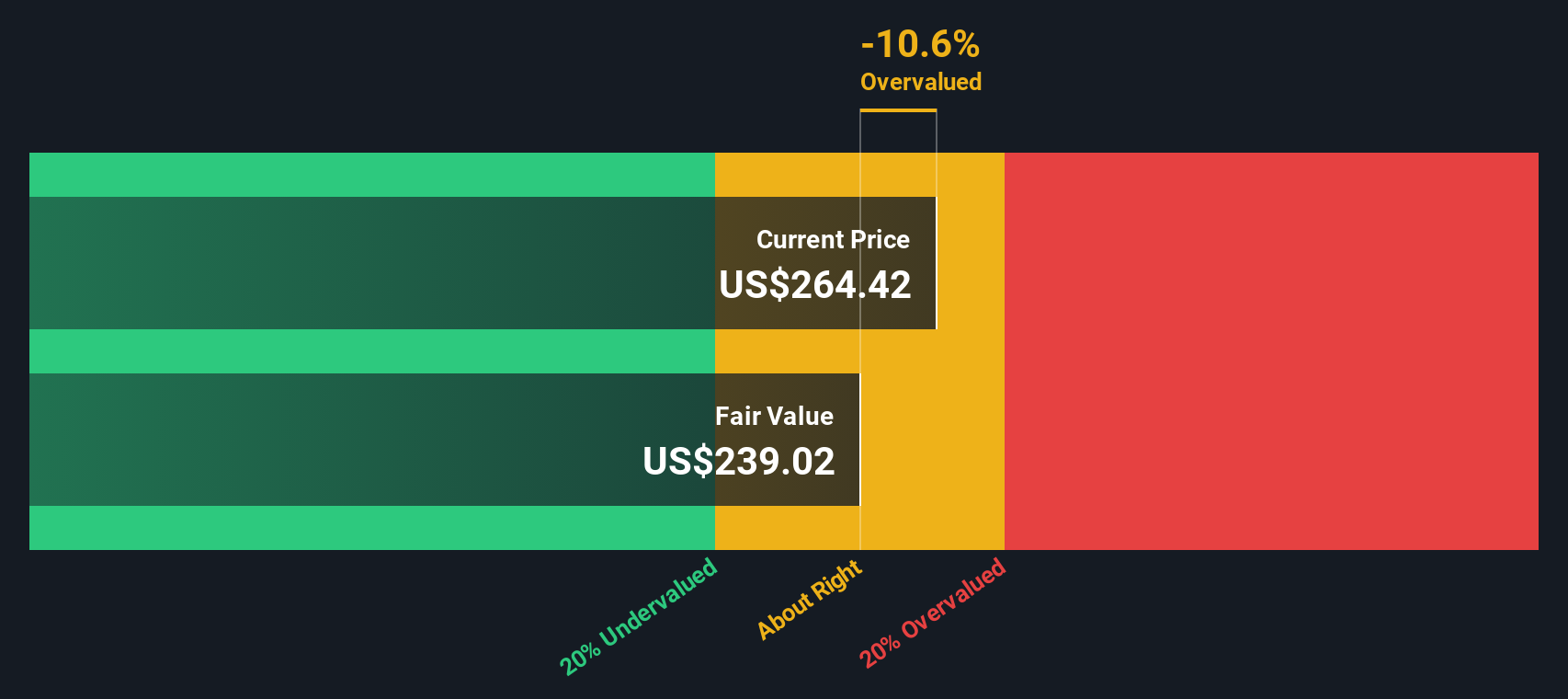

When all those future cash flows are discounted back, the model arrives at an intrinsic value of about $218.64 per share. Compared with the recent share price around $265.58, the DCF suggests Ecolab is roughly 21.5% overvalued on this basis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ecolab may be overvalued by 21.5%. Discover 901 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ecolab Price vs Earnings

For profitable, established businesses like Ecolab, the price to earnings, or PE, ratio is often the go to valuation yardstick because it links what investors pay directly to the profits the company generates today.

In general, faster growing, more resilient companies with lower perceived risk deserve a higher PE ratio. Slower growing or riskier firms tend to trade on lower multiples. The question is what counts as a normal or fair PE for Ecolab given its growth profile and risk.

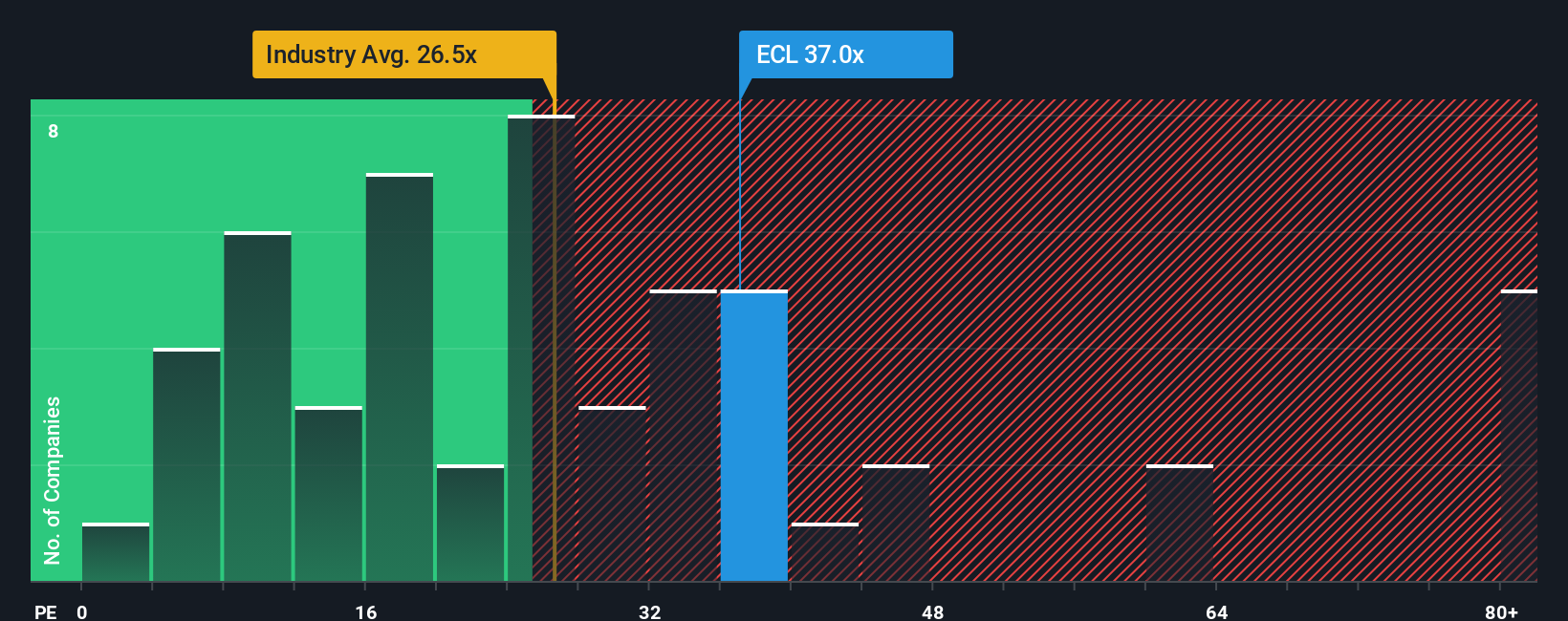

Ecolab currently trades on a PE of about 37.9x, which is well above both the Chemicals industry average of roughly 23.8x and the peer group average of about 23.2x. To move beyond those simple comparisons, Simply Wall St calculates a proprietary Fair Ratio. This is the PE multiple Ecolab might reasonably trade at after accounting for its earnings growth outlook, profitability, industry, market cap and company specific risks.

On this basis, Ecolab’s Fair Ratio is 25.3x. This means the shares are trading materially above what would be expected from those fundamentals, suggesting the stock still looks expensive on an earnings multiple view.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ecolab Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, a simple way for you to connect your view of Ecolab’s story with a concrete forecast for its future revenue, earnings and margins, and then translate that into a Fair Value you can compare with today’s share price to decide whether to buy, hold or sell. On Simply Wall St’s Community page, used by millions of investors, Narratives let you articulate your assumptions, automatically tie them to a dynamic financial model, and keep that view up to date as new information like earnings reports, margin guidance or product announcements flows in. For Ecolab, one investor might build a bullish Narrative around faster digital and Life Sciences growth and improving margins that supports a Fair Value closer to $325 per share, while a more cautious investor might stress test softer demand and higher input costs to arrive at a Fair Value nearer $243, and both perspectives are continuously refreshed as the facts change.

Do you think there's more to the story for Ecolab? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal