Is Nokia Still Attractive After a 34% Rally and Strong 5G Contract Momentum?

- If you are wondering whether Nokia Oyj is still a value play after its long turnaround story, or if the easy money has already been made, this article will walk through the numbers in plain language so you can judge for yourself.

- The stock has quietly climbed 1.6% over the last week, 5.5% over the past month, and is now up 27.7% year to date and 34.4% over the last year, with a 96.0% gain over five years that has started to change how the market sees its risk and reward profile.

- Behind these moves, investors have been reacting to ongoing contract wins in mobile networks and cloud infrastructure, alongside renewed interest in companies tied to 5G and digital infrastructure spending. At the same time, debate continues over whether Nokia can sustain margin improvements and cash generation as competition in telecom equipment remains intense.

- On our framework, Nokia currently scores 1 out of 6 on undervaluation checks. In the sections ahead we will unpack what that means across discounted cash flow, multiples, and other lenses, before finishing with a more holistic way to think about what the stock is really worth.

Nokia Oyj scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nokia Oyj Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes Nokia Oyj’s expected future cash flows and discounts them back into today’s euros, aiming to estimate what the entire business is worth right now.

Nokia generated roughly €1.33 billion in free cash flow over the last twelve months, a solid base that analysts expect to rise in the near term before tapering off. For example, free cash flow is projected to peak at about €2.24 billion in 2027, then gradually decline, with extrapolated estimates falling to around €0.43 billion by 2035 as growth normalizes.

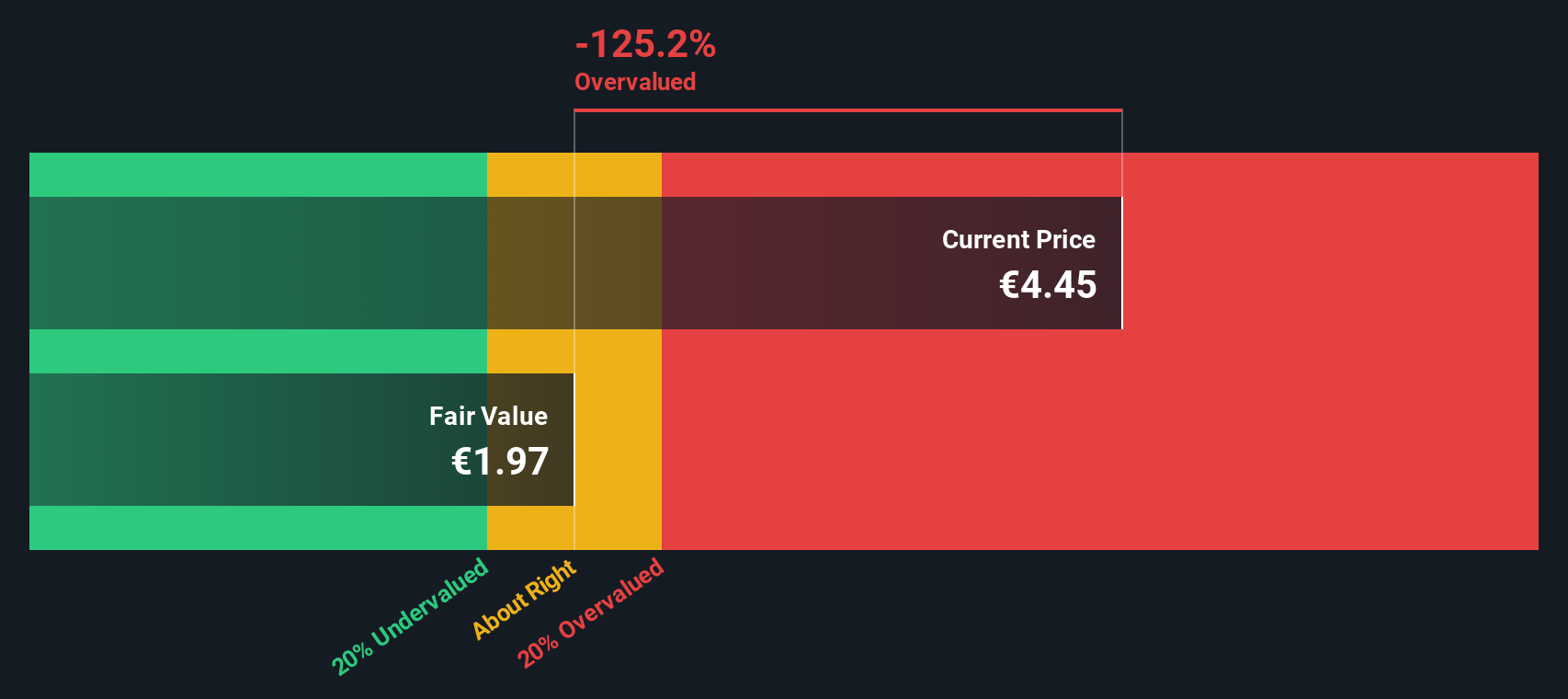

Simply Wall St’s 2 Stage Free Cash Flow to Equity model combines these analyst forecasts for the next few years with longer term extrapolations to arrive at an intrinsic value of about €1.99 per share. Compared with the current share price, this implies the stock is roughly 177.9% overvalued on a DCF basis. This suggests the market is pricing in much rosier cash flow prospects than the model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nokia Oyj may be overvalued by 177.9%. Discover 901 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Nokia Oyj Price vs Earnings

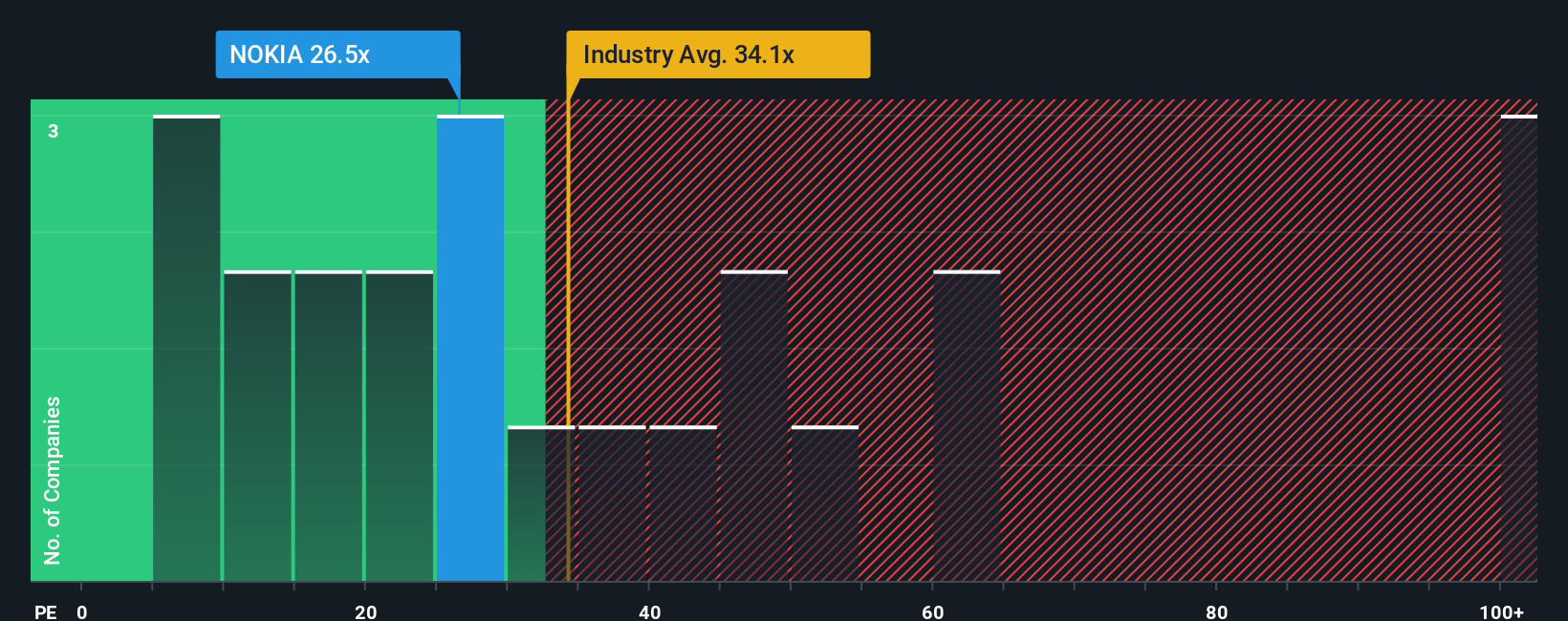

For a profitable business like Nokia, the price to earnings, or PE, ratio is a useful way to see how much investors are paying today for each euro of current earnings. In general, companies with stronger, more reliable growth prospects and lower perceived risk can justify a higher PE multiple, while slower growing or riskier firms usually deserve a lower one.

Nokia currently trades on a PE of about 36.4x, which is slightly above both the Communications industry average of roughly 34.8x and the peer group average of around 29.2x. Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE Nokia should trade on, given its specific mix of earnings growth, profitability, industry position, market cap and risk profile. On this measure, Nokia’s Fair Ratio is 33.8x, implying the stock is priced a bit richer than what those fundamentals alone would suggest.

Because the actual PE of 36.4x sits meaningfully above the Fair Ratio of 33.8x, Nokia looks somewhat expensive on an earnings basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nokia Oyj Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you turn your view of Nokia Oyj’s future into a clear story linked to a financial forecast and a Fair Value. It then compares that Fair Value to today’s price and automatically updates when new news or earnings arrive. A bullish investor might build a Narrative where AI driven network demand, U.S. expansion and stronger margins justify a Fair Value near the top of current community estimates around €5.75 per share. A more cautious investor might focus on capex headwinds, competition and execution risk to arrive at a much lower Fair Value closer to €3.00. Each Narrative shows in one place how assumptions about revenue, earnings and margins flow through to a forecast and a view of whether the stock might be considered a potential buy, hold or sell as the market price moves.

Do you think there's more to the story for Nokia Oyj? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal