Reassessing Electro Optic Systems (ASX:EOS) Valuation After Landmark South Korea and US Defense Contracts

EOS stock jumps on landmark defense contracts

Electro Optic Systems Holdings (ASX:EOS) is back on investor radars after securing an $80 million laser weapon deal with South Korea and a $22 million US Army contract, sharply improving revenue visibility.

See our latest analysis for Electro Optic Systems Holdings.

Those December defense wins cap an extraordinary run, with the share price delivering a year to date return of around 609 percent and a 1 year total shareholder return of about 677 percent, suggesting momentum has shifted decisively as investors reassess EOS’s growth and risk profile.

If contracts like these have you rethinking the defense theme, it could be worth exploring aerospace and defense stocks to see which other names are quietly building order books and market share.

With the share price having already rocketed and analysts now seeing limited upside versus their targets, is Electro Optic Systems still trading below its true earnings potential, or is the market already baking in years of future growth?

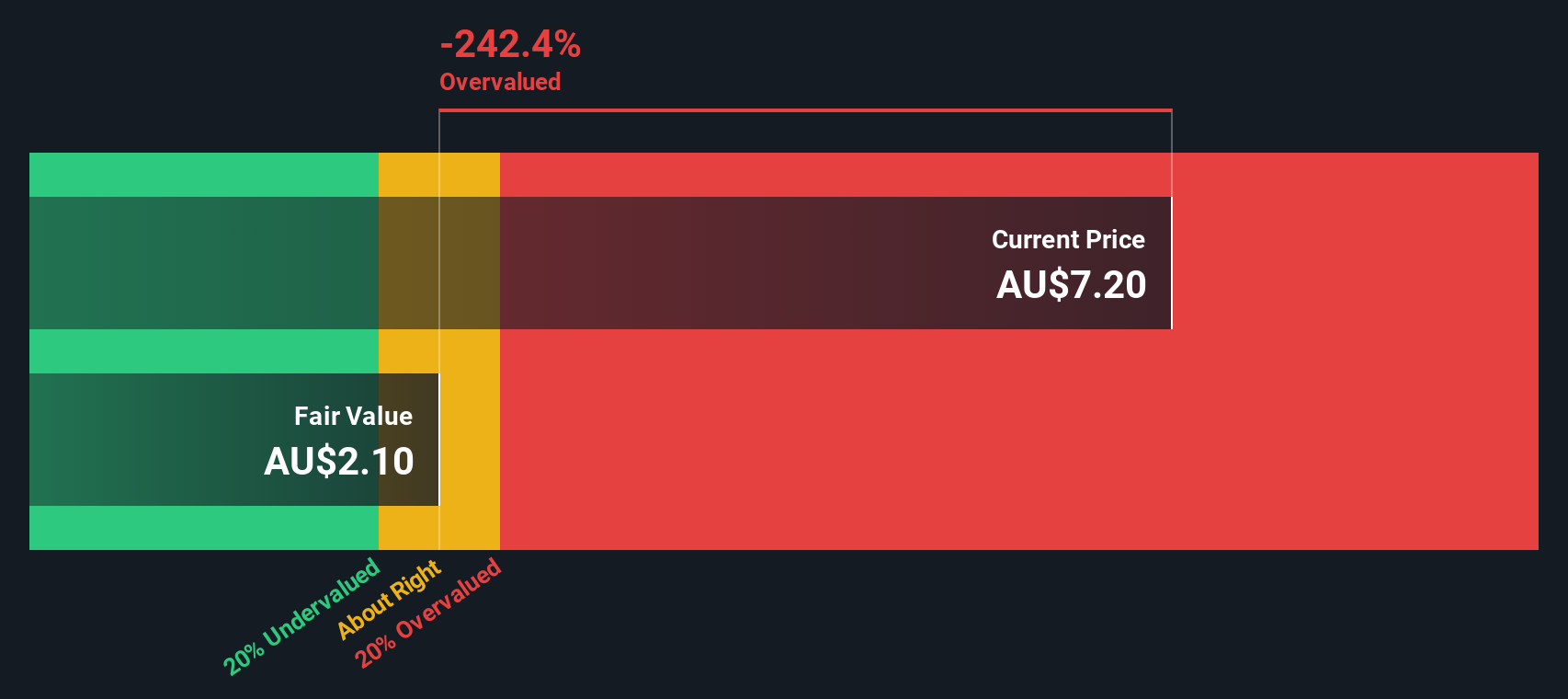

Most Popular Narrative Narrative: 19.9% Overvalued

With EOS last closing at A$9.25 against a narrative fair value of A$7.72, the story hinges on fast improving margins and aggressive growth assumptions.

The analysts have a consensus price target of A$4.358 for Electro Optic Systems Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$5.7, and the most bearish reporting a price target of just A$1.58.

Want to see what kind of revenue surge, margin jump, and future earnings multiple are being baked into that valuation gap? The narrative spells out surprisingly punchy assumptions.

Result: Fair Value of $7.72 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained global defense spending and EOS’s growing leadership in laser and counter drone systems could keep revenue and margins surprising to the upside.

Find out about the key risks to this Electro Optic Systems Holdings narrative.

Another Lens On Value

Our SWS DCF model paints a very different picture, suggesting EOS is actually undervalued, with a fair value estimate of about A$13.53 versus the current A$9.25 share price. If the cash flow story plays out, the question is whether the market is still underestimating the potential scale of this turnaround.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Electro Optic Systems Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Electro Optic Systems Holdings Narrative

If you see the story differently or want to stress test the assumptions with your own numbers, you can build a fresh view in just a few minutes: Do it your way

A great starting point for your Electro Optic Systems Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready to act on your next investment move?

Do not stop at a single story, use the Simply Wall St Screener now to uncover new opportunities before the crowd spots them and prices them in.

- Capture potential mispricings early by using these 901 undervalued stocks based on cash flows that the market may be overlooking today.

- Fuel your growth strategy with these 24 AI penny stocks harnessing cutting edge artificial intelligence trends.

- Strengthen your income stream through these 10 dividend stocks with yields > 3% offering yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal