Is It Too Late To Consider 3M After Earplug Settlement Progress And 2025 Rally?

- If you are wondering whether 3M is still a bargain or if the easy money has already been made, especially after all the headlines and legal noise, you are not alone in trying to figure out what this stock is really worth today.

- Despite slipping 1.1% over the last week and 5.4% over the past month, 3M is still up 23.6% year to date and 25.3% over the last year, suggesting that sentiment has turned more constructive after a tough few years.

- Recent moves have been shaped by ongoing updates around 3M's earplug litigation settlements and its broader restructuring efforts, which have helped investors reassess long term legal and operational risks. At the same time, coverage around portfolio streamlining and a sharper focus on higher margin segments has added a quietly optimistic tone to the story.

- On our framework, 3M scores a 3 out of 6 valuation score, reflecting that it screens as undervalued on half of the key checks we run. Next, we will walk through those different valuation angles before finishing with an even more powerful way to think about what this business is truly worth.

Approach 1: 3M Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by forecasting the cash it can generate in the future and then discounting those flows back to their value in todays dollars.

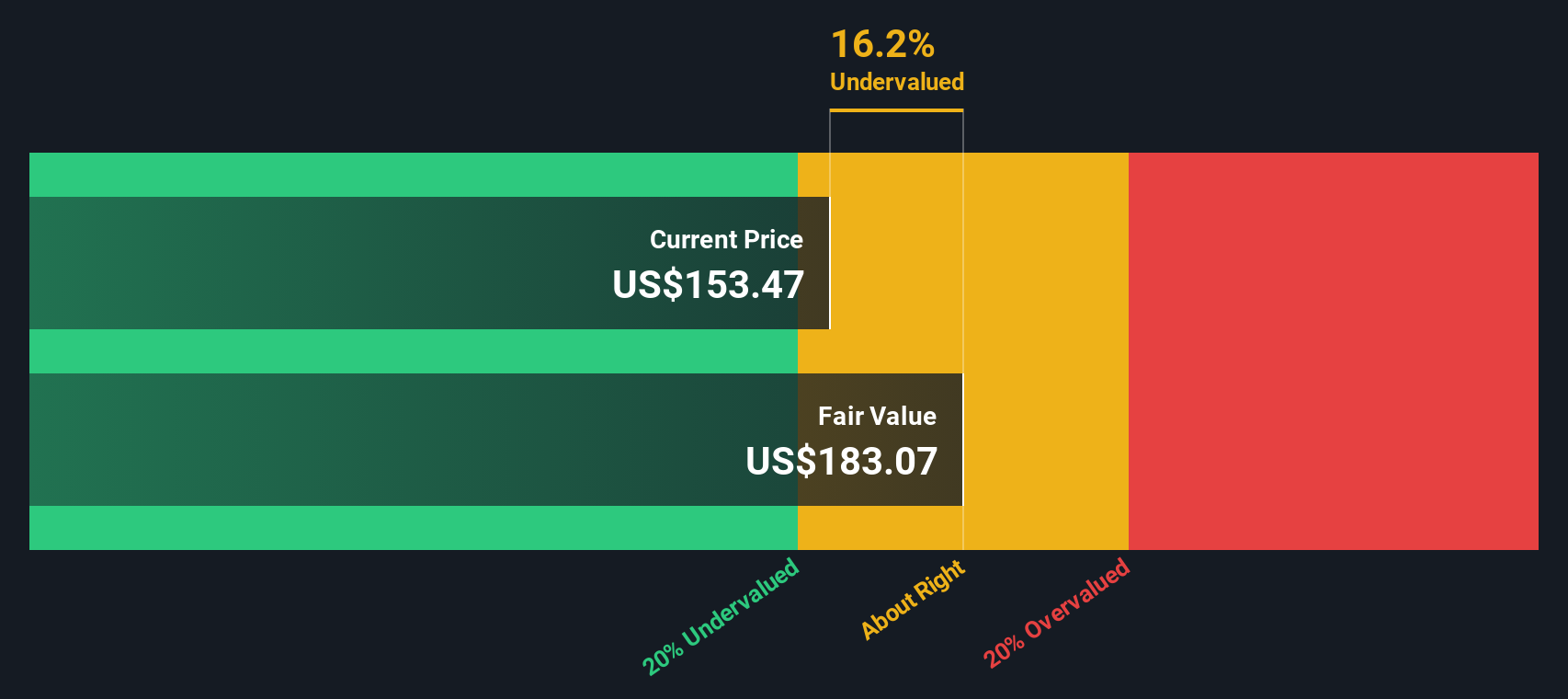

For 3M, the latest twelve month Free Cash Flow is about $1.25 billion, and analysts expect this to rise meaningfully over the next few years as legal and restructuring headwinds ease. On Simply Wall Sts 2 Stage Free Cash Flow to Equity model, those analyst forecasts are extended beyond the formal estimate horizon, with projected Free Cash Flow reaching roughly $6.3 billion by 2035 as growth gradually normalizes.

When all of those projected cash flows are discounted back, the intrinsic value implied by the model is $197.16 per share. Compared to the current share price, this suggests 3M trades at an 18.7% discount. This indicates that investors are still pricing in a fair amount of caution around its long term outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests 3M is undervalued by 18.7%. Track this in your watchlist or portfolio, or discover 901 more undervalued stocks based on cash flows.

Approach 2: 3M Price vs Earnings

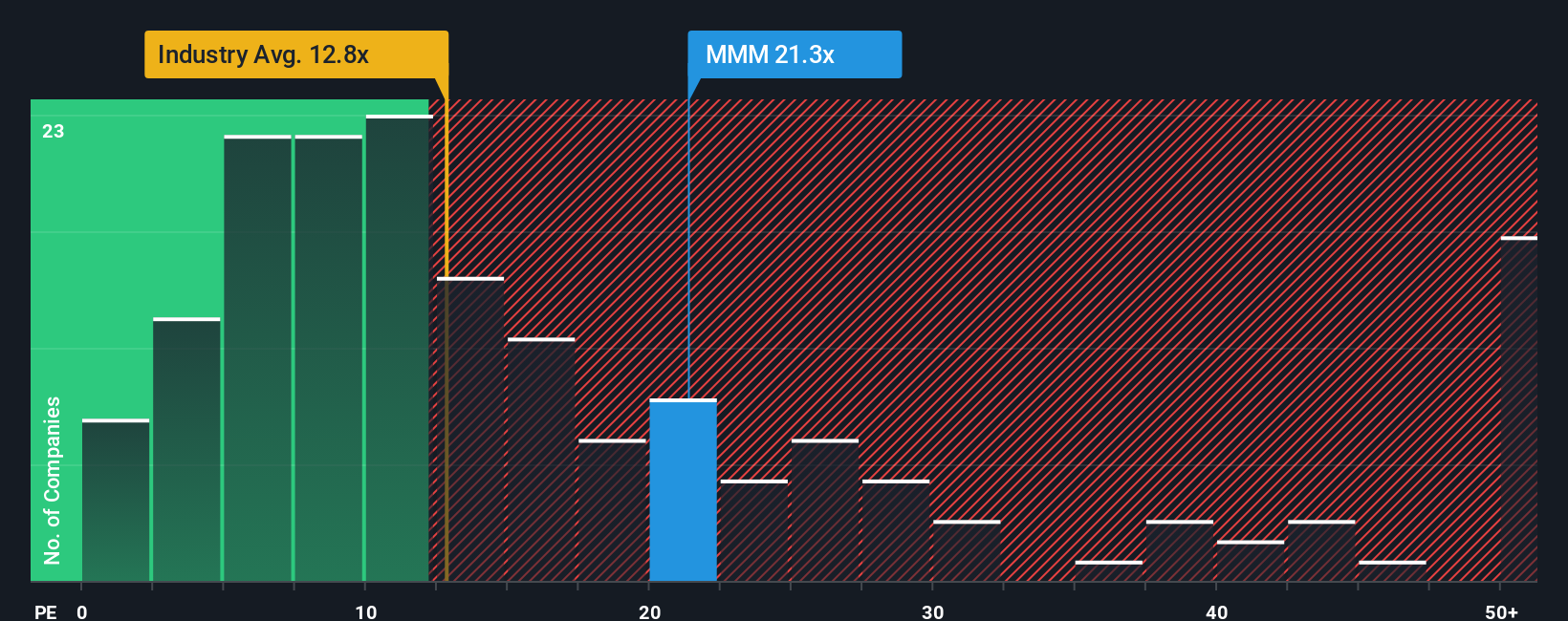

For a mature, profitable business like 3M, the Price to Earnings (PE) ratio is a practical way to gauge value because it links what you pay for the stock directly to the profits the company is generating today. In general, faster growth and lower risk justify a higher PE, while slower growth and higher uncertainty point to a lower, more conservative multiple.

3M currently trades on a PE of about 25x, which is meaningfully higher than the broader Industrials sector average of roughly 12x but slightly below the 27x average of its closer peer group. To refine this further, Simply Wall St uses a proprietary Fair Ratio, which estimates what PE investors might reasonably pay given 3M's earnings growth profile, margins, industry, size and risk factors.

This Fair Ratio for 3M is 32.37x, well above the current 25x multiple. Because it explicitly incorporates growth prospects and risk rather than simply mirroring where peers or the industry trade, it can be a more useful anchor for long term value. On this basis, 3M screens as undervalued relative to what its fundamentals would typically warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your 3M Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St where you connect your view of a companys story to a set of financial forecasts and a resulting fair value estimate. You can then track in real time whether that fair value suggests you should buy, hold or sell as new news and earnings arrive.

In practice, a Narrative lets you spell out how you think 3M will navigate PFAS litigation, portfolio reshaping and innovation driven growth. You then translate that story into assumptions for future revenue, earnings and margins, and compare the fair value that falls out of those numbers with todays share price on the Community page that millions of investors use.

For example, one 3M Narrative on the platform currently implies a fair value of about $187 per share, while a more cautious view sits closer to $101. This shows how two investors can look at the same facts and reach very different, but clearly quantified, buy and sell decisions.

Do you think there's more to the story for 3M? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal