Assessing KULR Technology Group (KULR)’s Valuation After Its AI Data Center Battery Collaboration and Equity Offering Pause

KULR Technology Group (KULR) just hit pause on its stock issuance while doubling down on a new battery backup partnership for AI scale data centers. This move tightly links liquidity, focus, and future demand.

See our latest analysis for KULR Technology Group.

The latest BBU collaboration and ATM pause land after a sharp swing in sentiment, with a 48.13 percent 1 month share price return to 3.57 following an 85.32 percent year to date share price decline and deeply negative multi year total shareholder returns. This suggests traders are betting on an early AI infrastructure inflection rather than a fully de risked turnaround.

If this AI energy pivot has your attention, it might be worth scanning other high growth tech names and comparing business quality using high growth tech and AI stocks.

With shares still down sharply this year despite a recent surge and a price target nearly triple the current quote, investors face a key question: Is KULR now an overlooked AI energy play, or is future growth already priced in?

Most Popular Narrative Narrative: 64.3% Undervalued

With KULR closing at 3.57 against a most popular narrative fair value of 10 dollars, this view leans heavily into aggressive future scaling.

The company is rapidly expanding its core KULR ONE product platform with new launches for high-demand applications, such as aerospace (KULR ONE Space), military (Guardian), unmanned vehicles (Air), and industrial battery backup, aligning with global trends in e-mobility, electrification, and large-scale energy storage. These innovations and vertical expansions are expected to materially increase revenue and support gross margin improvement as premium, specialized products capture higher pricing.

Curious how this story moves from rapid revenue expansion and margin uplift to a rich future earnings multiple and double digit discount rate assumptions? The full narrative explains the path from these operating assumptions to the implied valuation.

Result: Fair Value of $10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering dependence on equity funding and Bitcoin linked balance sheet volatility could quickly undermine confidence in KULR’s long term AI energy thesis.

Find out about the key risks to this KULR Technology Group narrative.

Another Take on Valuation

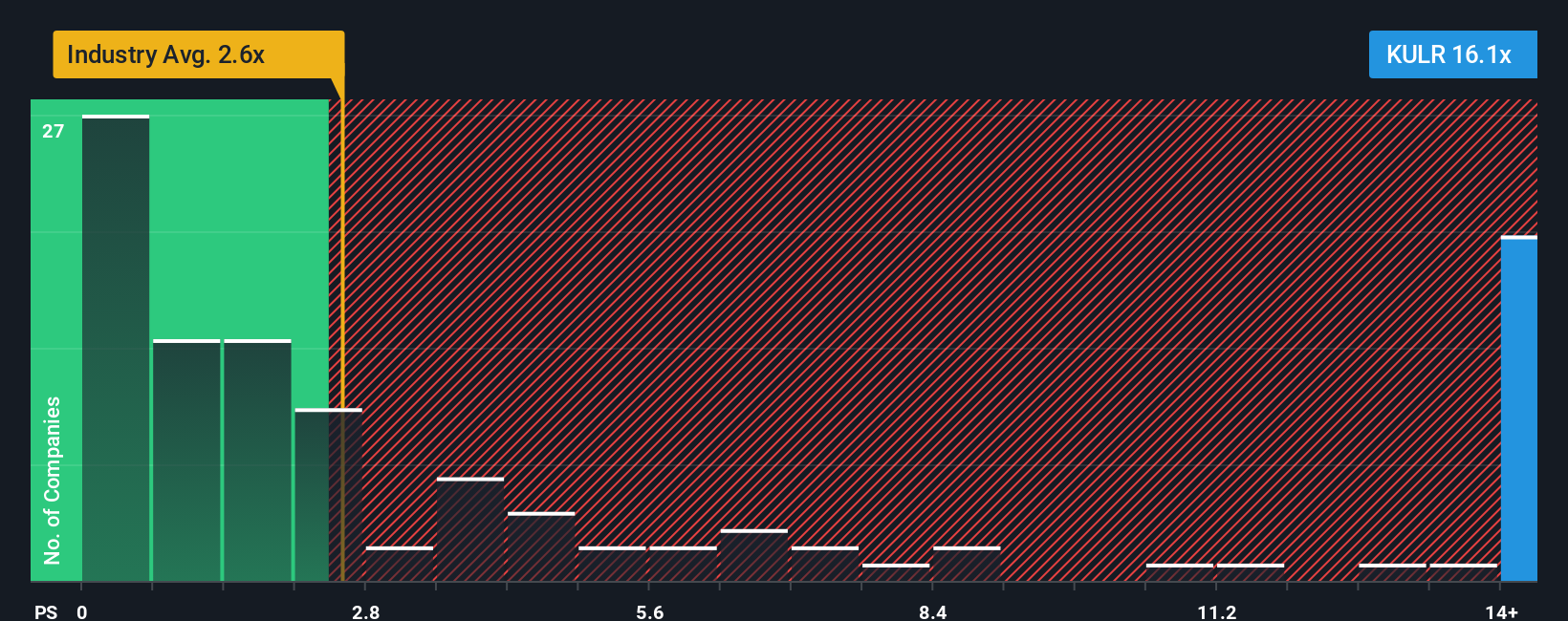

While the popular narrative flags KULR as 64.3 percent undervalued, a simple price to sales lens paints a riskier picture. At 9.8 times sales versus 2.2 times for the US Electrical industry, 3.1 times for peers, and a 3.6 times fair ratio, today’s price already bakes in a lot of future success. Which story do you trust more, the growth dream or the current math?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KULR Technology Group Narrative

If you see KULR’s setup differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your KULR Technology Group research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before sentiment shifts again, start building your next watchlist upgrades with a few targeted screens on Simply Wall St that surface focused, high conviction opportunities efficiently.

- Identify potential multibaggers early by scanning these 3623 penny stocks with strong financials where smaller companies show real financial strength instead of just hype.

- Prepare for the next automation trend by finding targeted AI opportunities through these 24 AI penny stocks with clear growth narratives.

- Strengthen your core portfolio with rational, cash flow supported opportunities using these 901 undervalued stocks based on cash flows before the market potentially closes any pricing gaps.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal