Has the Market Fully Recognized Deluxe’s Value After Its Recent 12.7% Share Price Jump?

- Wondering if Deluxe is quietly trading below what it is really worth? Let us walk through the numbers to see whether the recent price still offers value or if most of the upside has already been priced in.

- Over the last month the stock has climbed 12.7%, building on a 5.4% gain over the past year and a strong 63.3% return over three years, even though it is slightly down 0.7% year to date and off 3.0% this week.

- Those moves come as investors refocus on Deluxe as a diversified payments and business technology provider, rather than just a legacy check-printing company. That shift in narrative has helped put a spotlight on the company’s balance between mature cash-generating segments and more growth oriented services.

- At the same time, Deluxe currently scores a 6/6 valuation check rating, suggesting it screens as undervalued on every metric we track. We will unpack what that actually means using multiple valuation approaches, before finishing with a more holistic way to think about what Deluxe is really worth.

Approach 1: Deluxe Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today in $ terms.

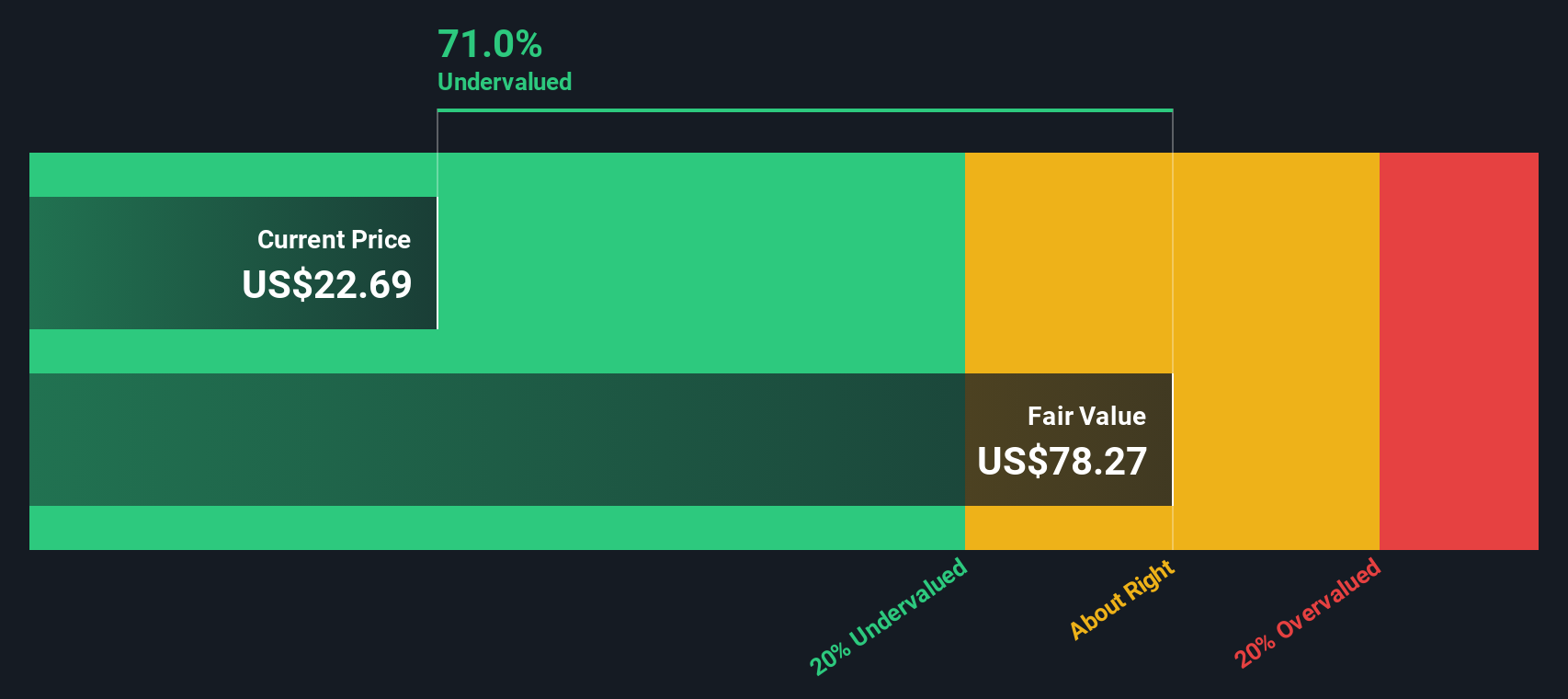

For Deluxe, the model starts from last twelve months free cash flow of about $130.9 million and uses a 2 Stage Free Cash Flow to Equity approach. Analyst forecasts call for free cash flow to rise to roughly $148.3 million in 2026 and $184.9 million in 2027, with Simply Wall St extrapolating further growth to around $306.5 million by 2035 as the business scales its payments and technology offerings.

When all of those projected cash flows are discounted back to today, the estimated intrinsic value comes out at about $78.27 per share. That implies the stock is trading at roughly a 71.5% discount to its calculated fair value, suggesting the market is pricing Deluxe well below the cash flows it is expected to generate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Deluxe is undervalued by 71.5%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: Deluxe Price vs Earnings

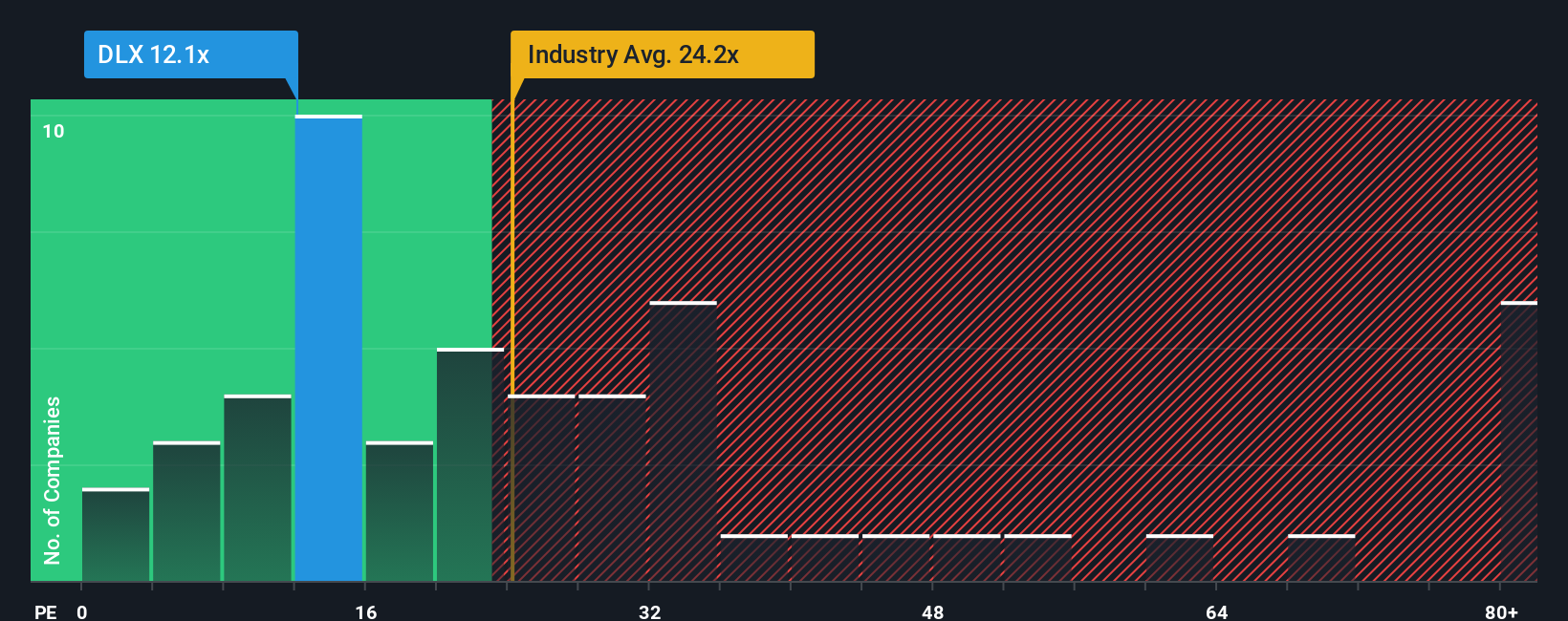

For profitable, mature businesses like Deluxe, the price to earnings ratio is a useful way to gauge value because it directly links what investors pay today to the company’s current earning power. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or higher uncertainty usually warrant a lower, more conservative multiple.

Deluxe currently trades on a PE of about 12.1x. That is meaningfully below both the Commercial Services industry average of roughly 24.0x and the broader peer group average of around 23.9x. At first glance, this suggests the market is assigning Deluxe a sizable discount. However, raw comparisons like these do not fully account for Deluxe’s specific growth profile, risk factors, profitability, or size.

Simply Wall St’s Fair Ratio attempts to solve this by estimating what a more tailored PE should be, given Deluxe’s earnings growth outlook, margins, risk characteristics, industry, and market capitalization. For Deluxe, that Fair Ratio is around 15.3x, which still sits well above the current 12.1x multiple. This indicates that investors are paying less than what would be expected on a risk and growth adjusted basis, and it points to further potential upside if sentiment normalizes.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Deluxe Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Deluxe’s story to a concrete forecast and fair value by choosing assumptions for its future revenue, earnings and margins, then comparing that Fair Value to today’s Price to consider whether you would buy, hold, or sell.

On Simply Wall St’s Community page, Narratives are an easy, accessible tool used by many investors to turn their perspective into numbers. They update dynamically whenever new information like news or earnings arrives, so your thesis is always linked to the latest data rather than a static snapshot.

For Deluxe, one investor might build a bullish Narrative around accelerating digital payments and data solutions, landing near the higher fair value estimate of about 30.00 dollars per share. A more cautious investor, focused on risks such as print decline and competition, could land closer to the lower 24.00 dollar view. Seeing where your own Narrative sits in that range can help you act with more clarity and conviction when the market price moves.

Do you think there's more to the story for Deluxe? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal