How Investors Are Reacting To Westlake (WLK) Shutting Key Chlorovinyl And Styrene Plants To Boost Profitability

- Westlake Corporation has approved and begun implementing a plan to cease operations at several North American chlorovinyl and styrene production facilities by December 2025, incurring about US$415 million in pre-tax closure-related costs and reducing its workforce by roughly 295 employees.

- The company will discuss these closures on a special call as part of a broader effort to improve profitability in its Performance & Essential Materials segment while consolidating production across its remaining chlorovinyl footprint.

- We’ll now examine how this major capacity rationalization, including the shutdown of Aberdeen’s billion-pound PVC facility, reshapes Westlake’s investment narrative.

This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

Westlake Investment Narrative Recap

To own Westlake, you need to believe the company can turn an unprofitable, cyclical chemicals portfolio into a steadier earnings engine while maintaining balance sheet discipline and its dividend. The newly announced chlorovinyl and styrene closures look material for near term earnings optics, given the US$415 million in mostly non cash charges, but the bigger immediate swing factor remains how quickly pricing and utilization in the Performance & Essential Materials segment stabilize.

Among recent developments, the tender offer for a portion of Westlake’s US$750 million 3.600% Senior Notes due 2026 stands out alongside the plant closures, because both speak to how the company is reshaping its cost base and capital structure around lower profitability in Performance & Essential Materials. For investors focused on catalysts, this combination puts more weight on upcoming profitability updates and on how far capacity rationalization can go if chemical overcapacity lingers.

Yet investors should also weigh how prolonged global oversupply in key chlorovinyl chains could keep pressuring margins just as these closures start to...

Read the full narrative on Westlake (it's free!)

Westlake's narrative projects $13.0 billion revenue and $893.8 million earnings by 2028. This requires 3.5% yearly revenue growth and a $960.8 million earnings increase from $-67.0 million today.

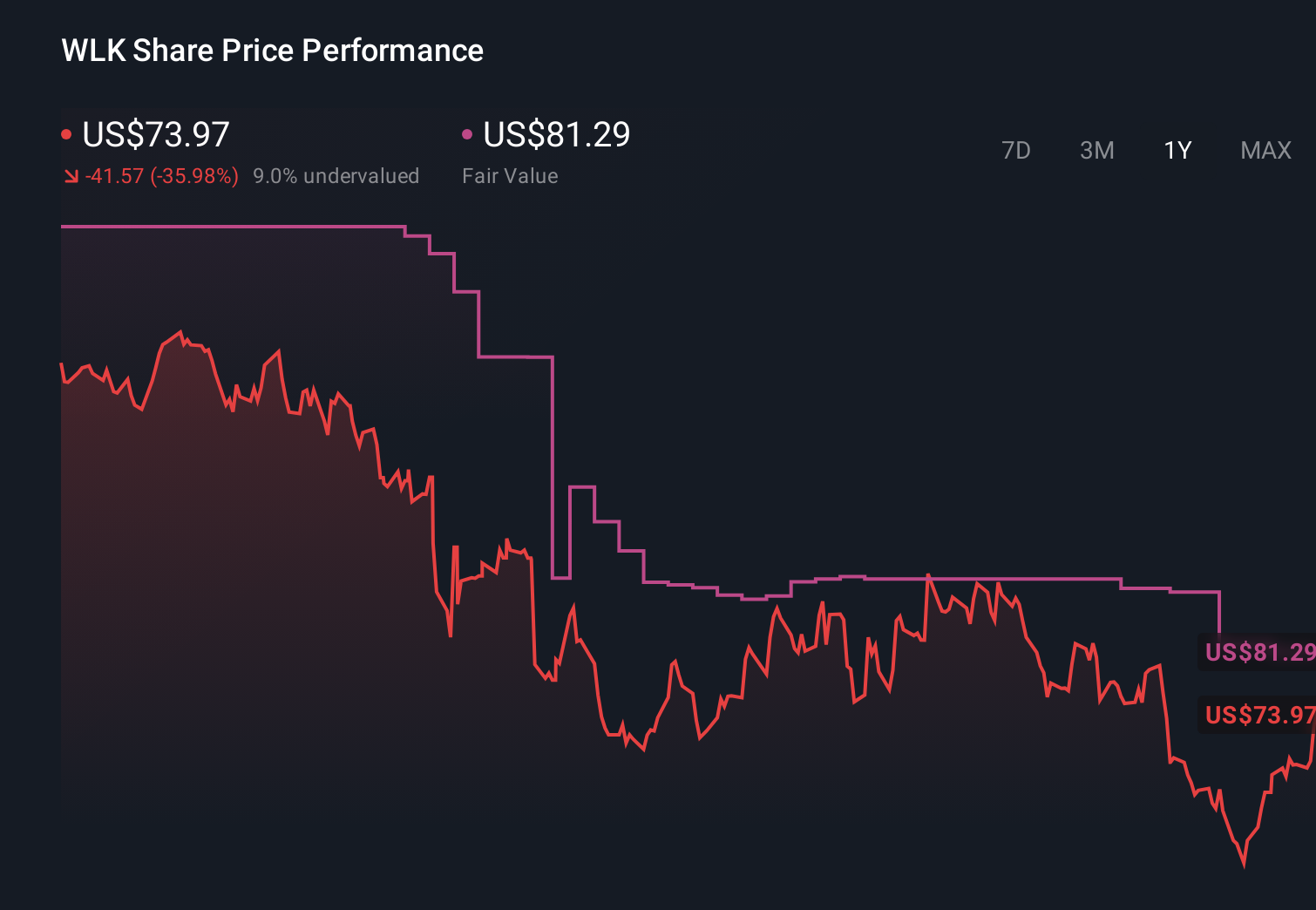

Uncover how Westlake's forecasts yield a $81.29 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$55 to US$81, showing how far apart individual views on Westlake run. When you set those against the risk that persistent global oversupply and weak pricing could hold back any earnings recovery, it underlines why exploring several alternative viewpoints on the stock’s prospects can be so important.

Explore 2 other fair value estimates on Westlake - why the stock might be worth as much as 10% more than the current price!

Build Your Own Westlake Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westlake research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Westlake research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westlake's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal