Expedia Group (EXPE): Revisiting Valuation After a Strong 3-Month and One-Year Share Price Rally

Expedia Group (EXPE) has been quietly climbing, with shares gaining around 15% over the past month and more than 50% over the past year, as investors reassess its travel recovery story.

See our latest analysis for Expedia Group.

The latest leg of Expedia Group's rally, with a roughly 33% 3 month share price return, has come as investors grow more confident in its steady post pandemic travel recovery and improving profitability, while a 52% one year total shareholder return signals that momentum is still building rather than fading.

If Expedia's run has you thinking about what else could surprise on the upside, this is a good moment to explore fast growing stocks with high insider ownership for other high conviction growth ideas.

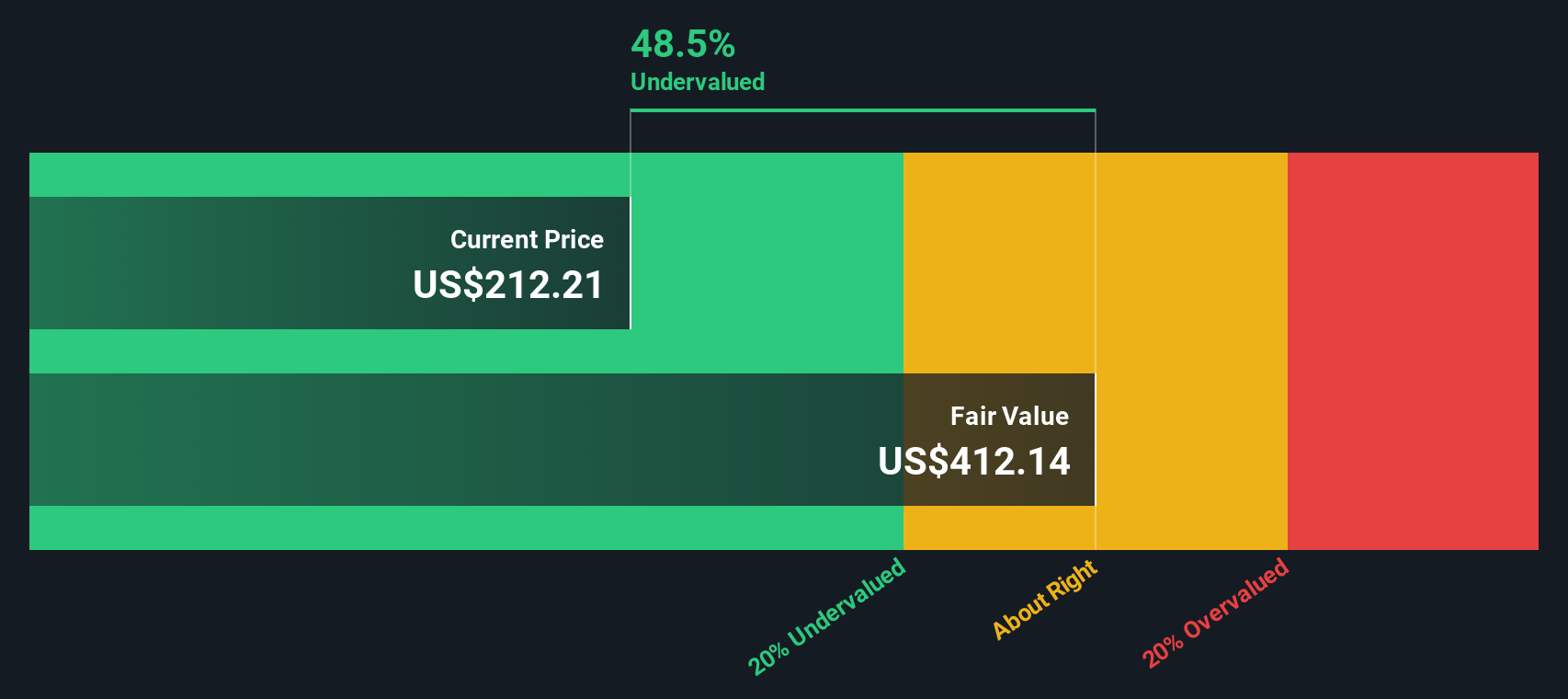

Yet despite rapid earnings growth and a strong share price run, Expedia still trades at a steep discount to some intrinsic value estimates. This raises the key question: is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative Narrative: 6% Overvalued

Compared to Expedia Group's last close near $286, the most widely followed narrative points to a fair value in the low $270s, framing the recent surge as slightly ahead of intrinsic value.

Ongoing shift in consumer preference toward digital and mobile channels, paired with increased adoption of AI powered search and personalization on Expedia's platforms, is driving higher conversion rates and improved retention, which should support sustained revenue growth and margin expansion. Unified global technology platform and greater automation (including AI powered developer tools and personalized insurance products) are already producing faster feature delivery, improved customer experience, and reduced operating costs, which are expected to further expand EBITDA margins and benefit earnings over the next several years.

Curious how modest growth assumptions, rising margins, and a disciplined earnings multiple still justify a premium valuation tag on Expedia Group's future? The narrative leans on a specific revenue trajectory, a step change in profitability, and a lower forward multiple than many peers. Want to see exactly how those moving parts combine to support that fair value line in the sand?

Result: Fair Value of $270.24 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering pressure on U.S. consumer travel and rising AI enabled competition could still squeeze take rates, margins, and Expedia's longer term growth trajectory.

Find out about the key risks to this Expedia Group narrative.

Another Lens On Value

Our DCF model paints a very different picture. On those long term cash flow assumptions, Expedia Group's shares look deeply undervalued, trading more than 40% below an intrinsic value estimate that sits well above $500. This raises the question of which narrative investors should trust.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Expedia Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Expedia Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in just a few minutes: Do it your way.

A great starting point for your Expedia Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall St, where curated screeners spotlight stocks most investors overlook.

- Capitalize on mispriced opportunities by running through these 903 undervalued stocks based on cash flows, which aligns strong fundamentals with attractive entry points.

- Ride the next wave of innovation by targeting these 24 AI penny stocks, shaping automation, data intelligence, and productivity across multiple industries.

- Strengthen your income stream by checking out these 10 dividend stocks with yields > 3%, built to highlight sustainable payouts and resilient cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal