Is Pfizer a Quiet Opportunity After a 41% Three Year Share Price Slide?

- If you are wondering whether Pfizer at around $25 a share is a value trap or a quiet opportunity, you are not alone. This article will walk through the case step by step.

- Despite a modest 0.4% gain over the last year, the stock is still down 41.4% over three years and 13.1% over five years. That tells us the market has drastically reset its expectations and may be mispricing the long term story.

- That reset has been driven by fading Covid related optimism and a tougher backdrop for big pharma pipelines, alongside ongoing headlines about drug pricing reforms in the US and strategic moves to refocus portfolios and cut costs. Taken together, those forces help explain why the share price has struggled even as investors start to look past the pandemic era.

- On our framework, Pfizer scores a 5 out of 6 valuation checks, suggesting the stock looks undervalued on most metrics we track. The more interesting question is how those traditional valuation methods stack up against a more holistic view of value that we will get to by the end of this article.

Find out why Pfizer's 0.4% return over the last year is lagging behind its peers.

Approach 1: Pfizer Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those cash flows back to the present.

For Pfizer, the model uses a 2 Stage Free Cash Flow to Equity approach based on cash flow projections. The company generated about $9.9 billion in free cash flow over the last twelve months, and analyst forecasts plus longer term extrapolations indicate free cash flow rising to roughly $16.3 billion by 2029. Beyond the explicit analyst horizon, Simply Wall St extends the projections with gradually moderating growth assumptions through 2035, all in dollar terms.

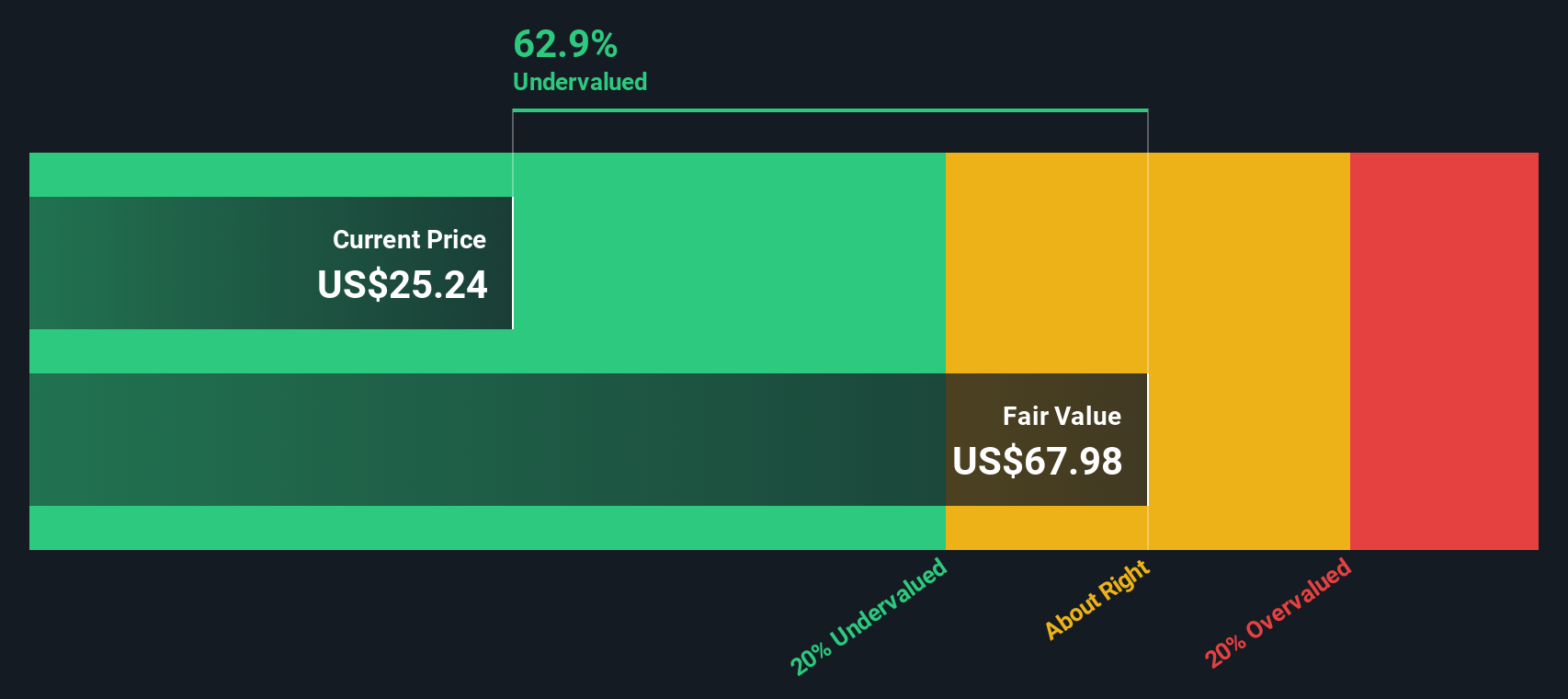

When all those future cash flows are discounted back, the model produces an intrinsic value estimate for Pfizer of about $63.65 per share. Compared with the current share price around $25, the DCF output suggests the stock is trading at roughly a 60.7% discount to this estimated fair value.

Result: UNDERVALUED (model-based estimate)

Our Discounted Cash Flow (DCF) analysis suggests Pfizer is undervalued by 60.7%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: Pfizer Price vs Earnings

For profitable companies like Pfizer, the price to earnings ratio is a practical way to gauge how much investors are willing to pay for each dollar of current earnings. It links directly to what shareholders ultimately care about, cash flows and profits, without getting lost in more complex modeling assumptions.

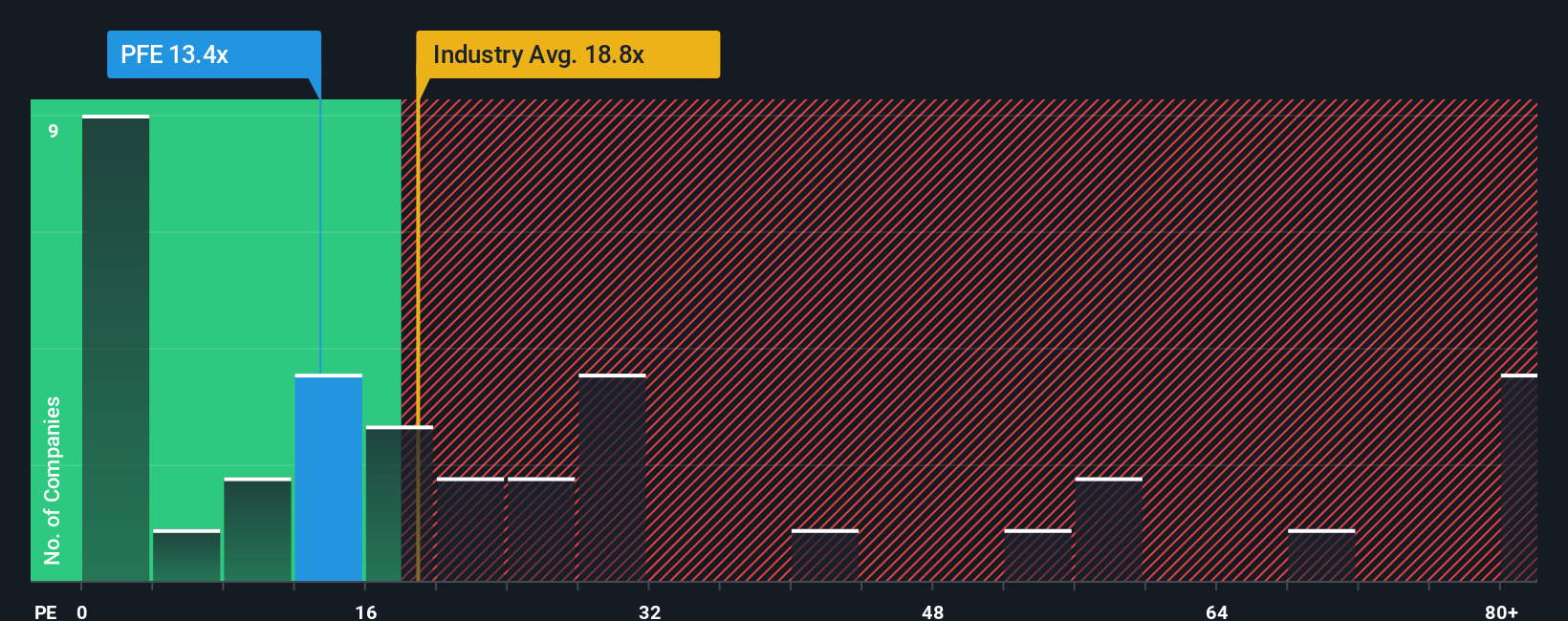

A company with faster, more reliable earnings growth and lower perceived risk typically has a higher PE ratio, while slower growth or greater uncertainty is often reflected in a lower, more cautious multiple. Today, Pfizer trades on about 14.5x earnings, which sits below both the Pharmaceuticals industry average of roughly 19.9x and a peer group average of about 18.3x. This suggests the market is pricing Pfizer more conservatively than many of its rivals.

Simply Wall St’s Fair Ratio for Pfizer is 26.0x, a proprietary estimate of what a reasonable PE could be once its earnings growth profile, industry positioning, profit margins, market cap and key risks are taken into account. Because this approach is tailored to Pfizer’s own fundamentals, it can be more informative than a simple comparison with peers or broad industry averages. With the current PE at 14.5x versus a Fair Ratio of 26.0x, the shares appear meaningfully undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pfizer Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you attach a clear story to your numbers by linking your view of Pfizer’s future revenue, earnings and margins to a financial forecast and then to your own Fair Value estimate. You can compare this with today’s share price to decide whether it looks like a buy, hold or sell. Your view automatically refreshes as new news or earnings land so it stays current. For example, one Pfizer Narrative might assume oncology growth, margin expansion and low double digit long term returns with a Fair Value near 30 dollars per share. Another, more bullish view focused on obesity drugs, emerging markets and higher margins might justify a Fair Value closer to 36 dollars. A more cautious Narrative that leans into tougher pricing and slower growth might sit nearer 24 dollars. All of these can coexist on the platform so you can see how different assumptions create different, but fully quantified, investment stories.

For Pfizer however we will make it really easy for you with previews of two leading Pfizer Narratives:

Fair value in this Narrative: $29.08 per share

Implied undervaluation versus the latest close of $25.03: 13.9%

Revenue growth assumption: minus 2.9% a year

- Views Pfizer as a long term winner from expanding obesity, oncology and rare disease pipelines, supported by next generation biologics and vaccines.

- Expects emerging markets, digitalization and targeted deals to lift efficiency and margins, helping offset patent expiries and pricing pressure.

- Anchors upside on analysts consensus forecasts, modest multiple expansion and a still cautious top line outlook that leaves room for positive surprise.

Fair value in this Narrative: $24.00 per share

Implied overvaluation versus the latest close of $25.03: 4.3%

Revenue growth assumption: minus 4.2% a year

- Emphasises drug pricing reforms, tougher reimbursement and a steep patent cliff as sustained headwinds for revenue and margin resilience.

- Argues that late stage assets and recent acquisitions may not fully or quickly replace lost Covid and legacy blockbuster sales.

- Sees the current share price as broadly fair to slightly rich if revenue erosion persists and investors demand a lower PE multiple for execution risk.

Whichever side you lean toward, Narratives let you adjust these building blocks yourself, see the impact on Pfizer’s fair value in real time and decide whether you think the market is still too pessimistic or not pessimistic enough.

Do you think there's more to the story for Pfizer? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal