Globalstar (GSAT): Reassessing Valuation After a Strong Year-Long Share Price Surge

Globalstar (GSAT) has quietly delivered a strong run, almost doubling year to date and more than doubling over the past year. This performance is prompting investors to reconsider how the satellite operator is being valued.

See our latest analysis for Globalstar.

That surge has been driven less by a single headline and more by steadily improving sentiment, with an 82.54 percent 3 month share price return and a standout 1 year total shareholder return of 114.04 percent, signaling strong momentum.

If Globalstar’s run has you thinking more broadly about satellite and communications names, it could be worth exploring fast growing stocks with high insider ownership as your next hunting ground for potential opportunities.

With revenue and earnings growth accelerating but the share price now sitting just shy of analyst targets, the key question is whether Globalstar still trades below its true potential, or if markets are already pricing in future gains.

Most Popular Narrative Narrative: 6.3% Undervalued

With Globalstar last closing at $63.25 versus a narrative fair value of $67.50, the most followed valuation view still sees modest upside ahead.

The global rollout of the RM200 2-way module with over 50 partners in advanced testing signals accelerating adoption across industrial, defense, and commercial IoT markets as more assets require always-on connectivity. This increases subscriber numbers and raises ARPU, ultimately benefiting future revenue and margin expansion.

Want to know what kind of revenue path and margin reset could back this premium valuation? The projections lean on aggressive earnings growth and richer profitability. Curious which assumptions really move the dial and how a relatively low discount rate helps support that price tag? Read on to see the full financial story behind this fair value.

Result: Fair Value of $67.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this optimism faces real tests, including long sales cycles in key government and enterprise deals, as well as heavy capital needs that could pressure cash flow.

Find out about the key risks to this Globalstar narrative.

Another Lens on Valuation

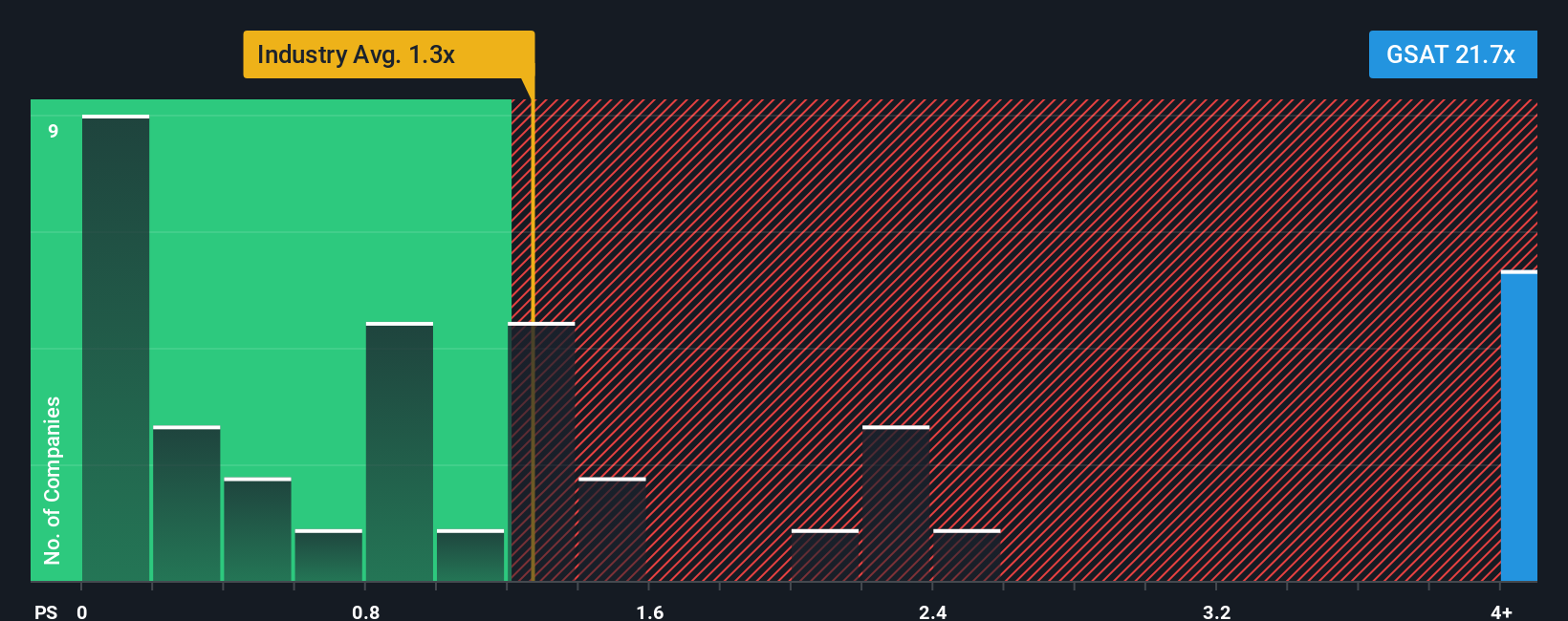

Strip out the narrative model and Globalstar looks far less forgiving, trading on a 30.6 times sales multiple versus roughly 1.2 times for both the US Telecom industry and peers, against a fair ratio of just 2.9 times. Is the market rewarding future growth or simply overreaching?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Globalstar Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Globalstar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Globalstar may be on your radar, but the smartest investors always keep a pipeline of fresh ideas, so do not let these opportunities pass you by.

- Target income potential by reviewing these 10 dividend stocks with yields > 3% that could strengthen your portfolio with consistent cash returns and resilient business models.

- Capitalize on innovation by scanning these 24 AI penny stocks positioned at the forefront of machine learning, automation, and data driven disruption.

- Amplify your upside by focusing on these 903 undervalued stocks based on cash flows, where current prices may not yet reflect the underlying cash flow power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal