Kroger (KR) Valuation Check as Board Approves Another $2 Billion Share Repurchase Authorization

Kroger (KR) just gave investors a clear signal on how it sees its future by expanding its share repurchase authorization by another $2 billion, lifting the total program to $9.5 billion.

See our latest analysis for Kroger.

At a share price of $62.93, Kroger’s modest year to date share price gain contrasts with a much stronger three year total shareholder return above 50 percent, suggesting longer term momentum remains intact even as investors digest regulatory headlines and this larger buyback.

If Kroger’s capital return plans have your attention, this could be a good moment to see what else is out there and discover fast growing stocks with high insider ownership

With the stock trading at a mid single digit discount to analyst targets and enjoying robust multi year returns, the key question now is whether Kroger is still mispriced or if markets already reflect its future growth.

Most Popular Narrative Narrative: 14.4% Undervalued

With Kroger shares at $62.93 versus a most popular narrative fair value near $73.52, the gap hinges on how convincingly future earnings can scale.

The rapid growth in Kroger's e commerce business highlighted by a 15% YoY increase and strong improvements in delivery suggests significant upside potential as more consumers shift to online grocery shopping, ongoing investment in unified digital platforms and fulfillment operations is expected to drive future revenue growth and accelerate profit improvement as the business scales.

Curious how mid single digit top line growth can still support a double digit upside case, even with a lower future earnings multiple baked in? The full narrative unpacks the margin path, capital discipline, and share count assumptions that make that math work.

Result: Fair Value of $73.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent e commerce losses and rising labor costs could squeeze margins and delay the earnings ramp that underpins this double digit upside case.

Find out about the key risks to this Kroger narrative.

Another Lens On Valuation

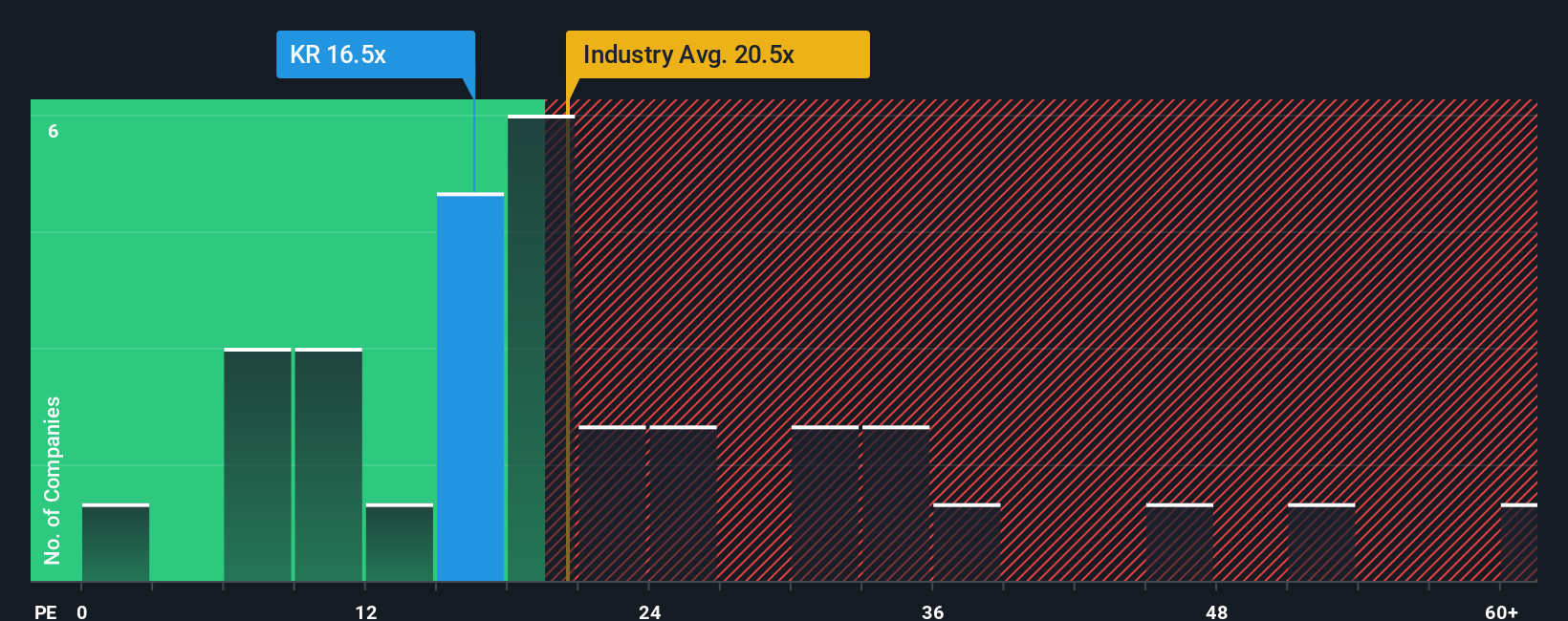

Our fair value work suggests Kroger is about 15.9 percent undervalued, but its 51 times earnings ratio versus a 38.1 times fair ratio and roughly 21 to 22 times for peers and the industry paints a far richer picture. Is the upside really worth that valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kroger Narrative

If these assumptions do not quite fit your view, or you would rather lean on your own research, you can build a personalized thesis in just a few minutes: Do it your way

A great starting point for your Kroger research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single supermarket champion. Use the Simply Wall Street Screener to line up your next opportunities before the market catches on.

- Capture potential long term bargains by reviewing these 901 undervalued stocks based on cash flows, built on detailed cash flow forecasts rather than headline hype.

- Ride powerful technology trends by targeting innovators in automation and machine learning through these 24 AI penny stocks, shaping tomorrow’s economy.

- Boost your income strategy by focusing on dependable payouts with these 10 dividend stocks with yields > 3%, featuring yields that can strengthen total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal