Discover Hongli Group And Two More Promising Penny Stocks

As the U.S. stock market continues to set new records, with the Dow Jones and S&P 500 reaching all-time highs, investors are exploring diverse opportunities beyond blue-chip stocks. Penny stocks, a term that has evolved from its speculative roots, still present intriguing possibilities for those willing to explore smaller or newer companies offering potential growth. In this article, we will discuss three penny stocks that stand out due to their financial resilience and potential for long-term success in today's market conditions.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.72 | $582.91M | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.83 | $661.84M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8702 | $148.8M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.40 | $572.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.21 | $1.33B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.40 | $571.19M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.46 | $360.73M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.905 | $6.57M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.83 | $86.77M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 341 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Hongli Group (HLP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hongli Group Inc. manufactures and sells customized metal profiles in China and internationally, with a market cap of $91.06 million.

Operations: The company generates revenue from its Metal Processors and Fabrication segment, amounting to $16.73 million.

Market Cap: $91.06M

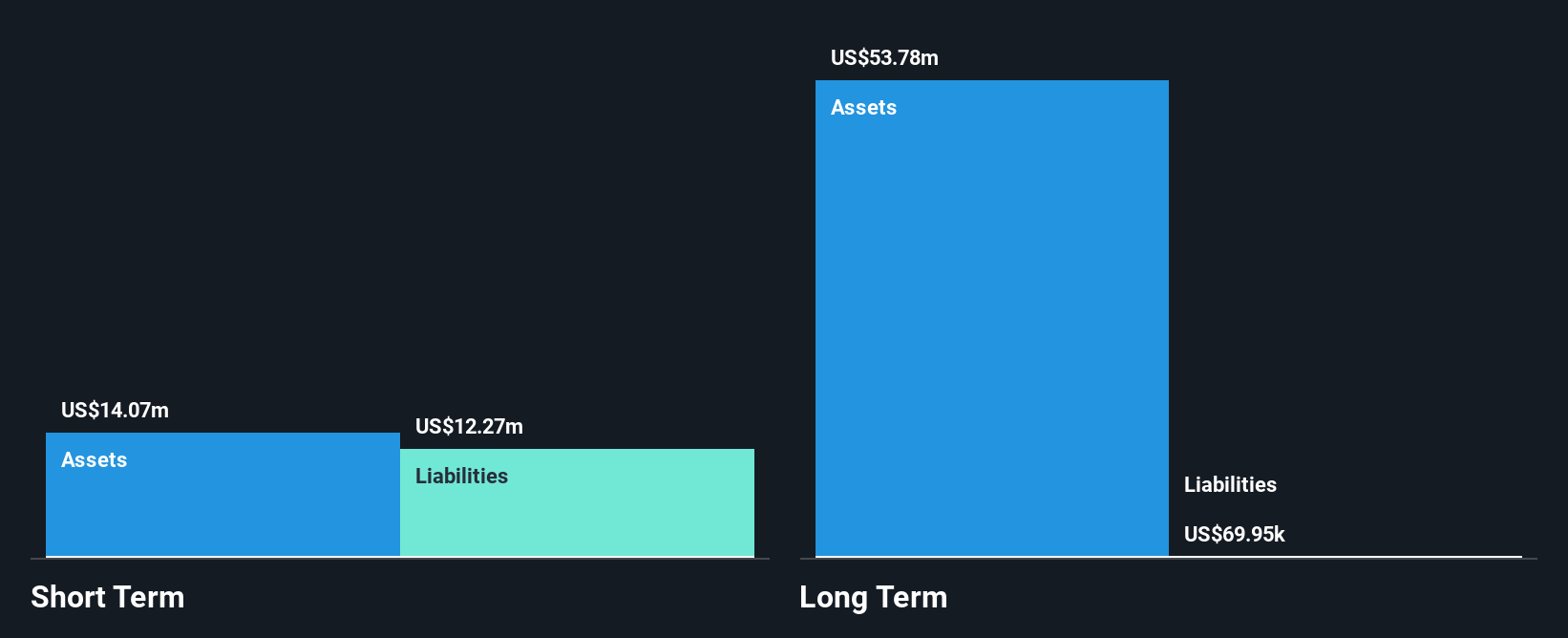

Hongli Group Inc. has shown improvement by becoming profitable this year, reporting a net income of US$0.99 million for the half-year ended June 30, 2025, compared to a loss previously. With sales increasing to US$9.59 million from US$6.96 million year-on-year, the company demonstrates growth potential despite its earnings volatility and low return on equity of 1.8%. The firm maintains satisfactory debt levels with short-term assets exceeding both short and long-term liabilities, though interest coverage remains below ideal thresholds at 2.1 times EBIT. Its share price remains highly volatile but undiluted over the past year.

- Dive into the specifics of Hongli Group here with our thorough balance sheet health report.

- Assess Hongli Group's previous results with our detailed historical performance reports.

Riskified (RSKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Riskified Ltd. develops an e-commerce risk intelligence platform that helps online merchants build trusted consumer relationships across various global regions, with a market cap of approximately $768.95 million.

Operations: Riskified's revenue is primarily generated from its Security Software & Services segment, totaling $338.84 million.

Market Cap: $768.95M

Riskified Ltd. continues to operate with a market cap of approximately US$768.95 million, generating revenue primarily from its Security Software & Services segment, totaling US$338.84 million annually. Despite being unprofitable with a negative return on equity of -11.83%, the company maintains financial stability by having no debt and short-term assets exceeding both short and long-term liabilities significantly. Riskified's cash runway is secure for over three years due to positive free cash flow growth, and it trades at 60% below estimated fair value. Recent buybacks indicate confidence in future performance despite ongoing net losses reported in recent earnings results.

- Take a closer look at Riskified's potential here in our financial health report.

- Learn about Riskified's future growth trajectory here.

Voip-Pal.com (VPLM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Voip-Pal.com Inc. focuses on acquiring and developing Voice-over-Internet Protocol processes in the United States, with a market cap of $39.76 million.

Operations: Voip-Pal.com Inc. has not reported any revenue segments.

Market Cap: $39.76M

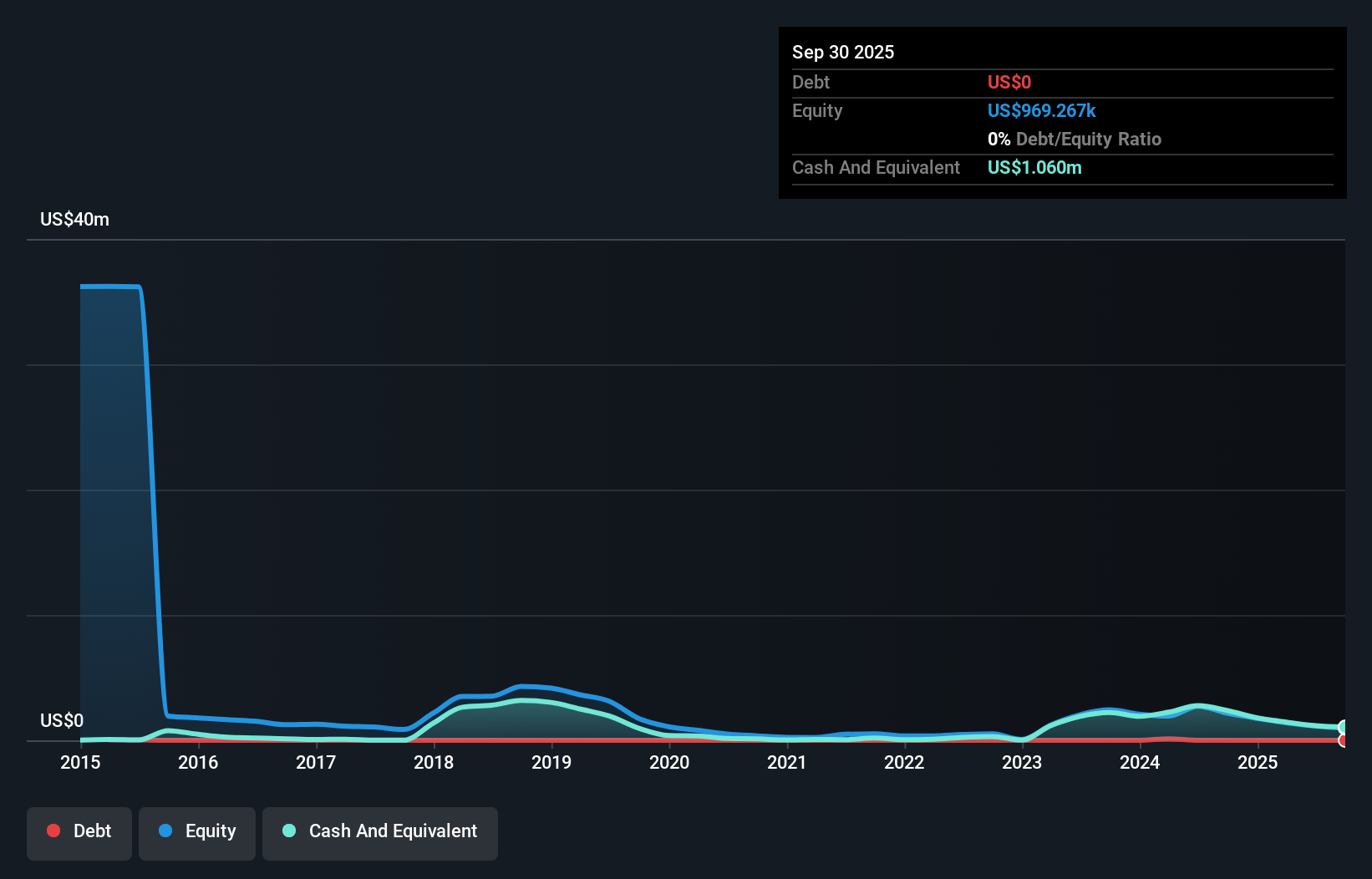

Voip-Pal.com Inc., with a market cap of US$39.76 million, is pre-revenue and currently unprofitable, reporting a net loss of US$6.23 million for the year ended September 30, 2025. Despite its lack of revenue streams and ongoing losses, the company benefits from being debt-free and having short-term assets (US$1.1 million) that exceed short-term liabilities (US$173.9K). Its management team is relatively new with an average tenure of 2.4 years, while its board's inexperience may pose challenges in strategic direction. The stock remains highly volatile but has not experienced significant shareholder dilution recently.

- Get an in-depth perspective on Voip-Pal.com's performance by reading our balance sheet health report here.

- Learn about Voip-Pal.com's historical performance here.

Key Takeaways

- Jump into our full catalog of 341 US Penny Stocks here.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal