December 2025's Top Insider-Owned Growth Stocks

As the U.S. stock market continues to hit new highs, with the S&P 500 setting an all-time record and major indices posting consistent gains, investors are keenly observing growth opportunities. In this thriving environment, companies with high insider ownership often attract attention due to the potential alignment of interests between management and shareholders, making them compelling considerations for those seeking robust growth prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 74% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

| AppLovin (APP) | 27.3% | 27.1% |

Let's explore several standout options from the results in the screener.

Coincheck Group (CNCK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Coincheck Group N.V. operates a cryptocurrency exchange platform in Japan with a market cap of approximately $400.29 million.

Operations: The company generates revenue primarily from its cryptocurrency exchange platform, with ¥454.78 million attributed to unclassified services.

Insider Ownership: 10.6%

Coincheck Group's earnings forecast indicates a significant annual profit growth of 167.42%, with expectations to become profitable within the next three years, outpacing average market growth. Revenue is projected to grow at 16.7% per year, faster than the US market but below high-growth benchmarks. Despite its volatile share price, Coincheck trades at a favorable value compared to peers and industry standards. Recent earnings show substantial revenue increases but mixed profitability results over six months ending September 2025.

- Click here to discover the nuances of Coincheck Group with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Coincheck Group is priced lower than what may be justified by its financials.

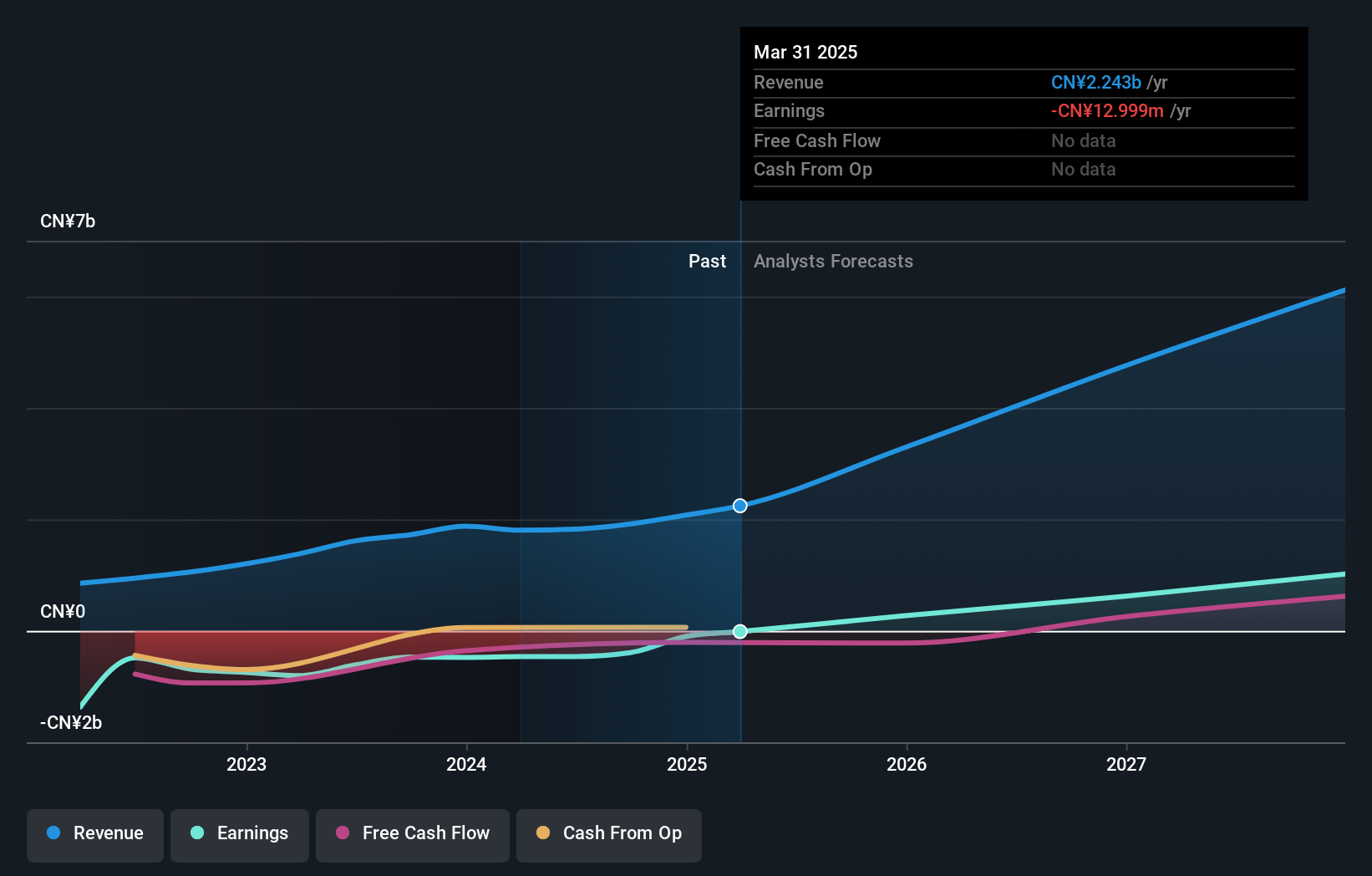

Hesai Group (HSAI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hesai Group develops, manufactures, and sells three-dimensional LiDAR solutions across Mainland China, Europe, North America, and internationally, with a market cap of $3.49 billion.

Operations: The company generates revenue of CN¥2.75 billion from its LiDAR products' development, manufacturing, and delivery across various regions including Mainland China, Europe, and North America.

Insider Ownership: 17.5%

Hesai Group is poised for significant growth, with earnings projected to increase 30.5% annually, surpassing US market averages. Recent strategic partnerships, such as with Keeta Drone and Li Auto, bolster its position in the lidar industry. Despite past shareholder dilution and share price volatility, Hesai trades below fair value estimates by 24.9%. The company has become profitable this year and raised its earnings guidance for 2025 to US$49-63 million.

- Delve into the full analysis future growth report here for a deeper understanding of Hesai Group.

- The analysis detailed in our Hesai Group valuation report hints at an deflated share price compared to its estimated value.

Youdao (DAO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Youdao, Inc. is an internet technology company offering online services in content, community, communication, and commerce in China with a market cap of approximately $1.10 billion.

Operations: The company's revenue is primarily derived from its Learning Services segment, which generated CN¥2.52 billion, followed by Online Marketing Services with CN¥2.36 billion and Smart Devices contributing CN¥803.54 million.

Insider Ownership: 20.4%

Youdao's earnings are forecast to grow significantly at 49.34% annually, outpacing the US market average. Despite recent revenue growth and a return to profitability, net income has decreased year-on-year for Q3. The company completed a share buyback of 6.19% for US$33.8 million but reported negative shareholders' equity, indicating financial challenges. Revenue is expected to grow at 12.6% per year, faster than the overall market yet below high-growth benchmarks.

- Unlock comprehensive insights into our analysis of Youdao stock in this growth report.

- The valuation report we've compiled suggests that Youdao's current price could be inflated.

Next Steps

- Click here to access our complete index of 208 Fast Growing US Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal