Capital One (COF): Assessing Valuation After Bullish Analyst Calls and Optimistic Earnings Expectations

Capital One Financial (COF) is back in the spotlight after a wave of upbeat brokerage calls tied to its upcoming January 22 earnings, where the market is primed for strong year over year profit growth.

See our latest analysis for Capital One Financial.

Those upbeat calls are landing after a powerful run, with Capital One’s 1 month share price return of 18.88 percent helping drive a 38.92 percent year to date gain and a hefty 3 year total shareholder return of 191.54 percent. This suggests momentum has been building as investors reprice both its growth prospects and perceived risk.

If the earnings story plays out as hoped, it is a good moment to see what else is gathering steam, from large banks to more focused lenders or diversified finance names. You can also scan the market for discovery style opportunities using fast growing stocks with high insider ownership.

Yet with the stock near record highs and trading only modestly below bullish analyst targets, the real debate now is whether Capital One still offers mispriced upside or if the market is already factoring in most of that future growth.

Most Popular Narrative: 5.8% Undervalued

The most widely followed narrative sees Capital One’s fair value around $263.5 per share, slightly above the recent $248.27 close, framing a modest upside gap.

The Discover acquisition enables expanded payments infrastructure, customer base, and cross-selling opportunities, supporting long-term revenue growth and higher fee income. Ongoing investments in technology, analytics, and premium offerings are expected to enhance efficiency, credit management, and market share while supporting future international expansion.

Curious how this story turns steady card spending and a new payments network into a richer valuation profile, with ambitious growth and margin assumptions baked in? Want to see how those moving pieces add up to that fair value and what has to go right to get there? Read on to unpack the full narrative behind these numbers.

Result: Fair Value of $263.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavier than expected technology and Discover integration costs, or sharper competition in premium cards, could quickly erode the optimistic margin and growth assumptions.

Find out about the key risks to this Capital One Financial narrative.

Another Angle on Valuation

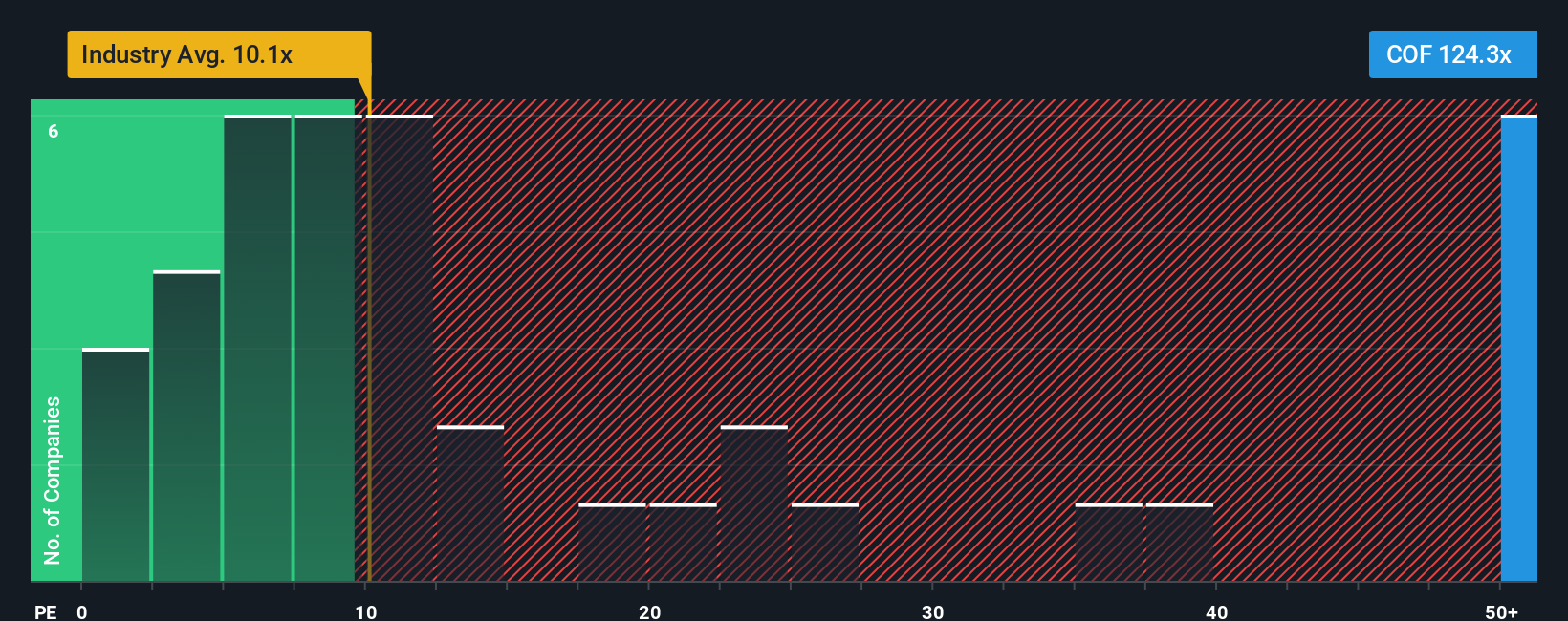

Step away from fair value models and Capital One suddenly looks stretched. Its price to earnings ratio of 137.1 times towers over both the industry average of 10 times and a fair ratio of 30.9 times, suggesting less margin for error if growth or credit trends wobble. Is the market getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capital One Financial Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in under three minutes: Do it your way.

A great starting point for your Capital One Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one opportunity. Use the Simply Wall St Screener to hunt for fresh ideas tailored to different strategies before the market spots them.

- Capture potential multi-baggers early by scanning these 3626 penny stocks with strong financials that already show solid balance sheets and improving fundamentals.

- Ride the next wave of innovation by targeting these 24 AI penny stocks that blend cutting edge technology with scalable business models.

- Focus on these 10 dividend stocks with yields > 3% that pair attractive yields with resilient cash flows and disciplined payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal